struggling on this part

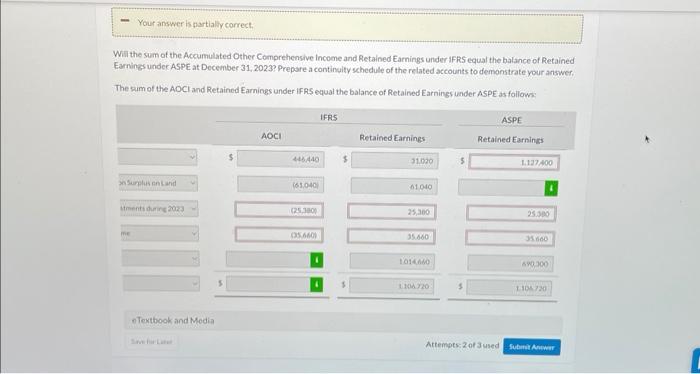

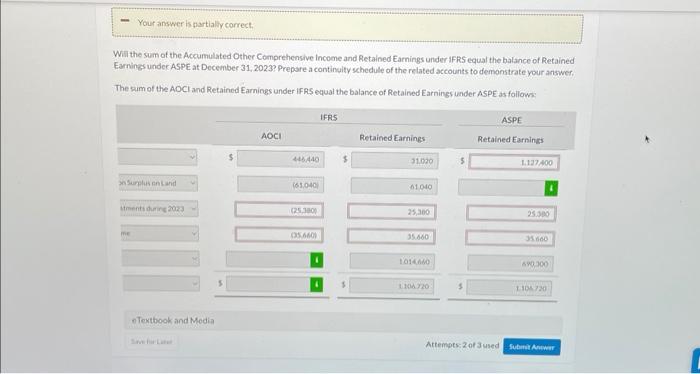

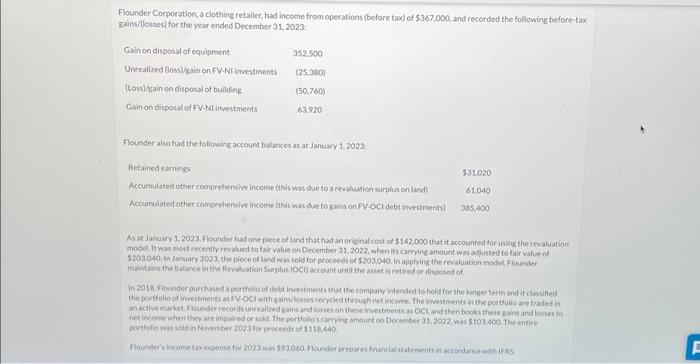

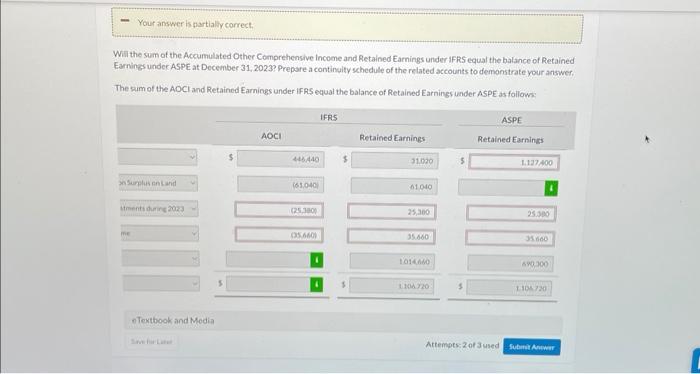

Wil the sum of the Accumulated Other Comprehensive income and Retained Earnings under IFRS equal the balance of Retained Earning under. ASPE at December 31, 2023? Prepare a continulty schedule of the related accounts to demonstrate your answer. The sum of the AOCI and Retained Earnings under IF RS equal the balance of Retained Earnings under ASPE as follows: Flounder Corporation, a clothing retailer, had income from operations (before tax) of $367,000, and recorded the followiag before-tax gainsi(losses) for the vear ended December 31, 2023: Flounder also tiad the followirg accoum balances as at January 1.2023 : As at January 1, 2023, flounder had one piece or land that had an original cost of $142,000 that it accounted for usicus the revaluation inodel. It was mostrecently revalued to fair value on December 31,2022 , when its carrving amount was adfusted to fair value of 5203040 , in invary 2023 , the piece of land was iold for proceeds ef 5203,040 . In applying the revaluation model. Flounder maintains the balance in the Revaluation Sumplus IOCD account until the autet is retired or disposed of pervolio wn sols in Nommber 2023 for aroceedi ce $113.440 Wil the sum of the Accumulated Other Comprehensive income and Retained Earnings under IFRS equal the balance of Retained Earning under. ASPE at December 31, 2023? Prepare a continulty schedule of the related accounts to demonstrate your answer. The sum of the AOCI and Retained Earnings under IF RS equal the balance of Retained Earnings under ASPE as follows: Flounder Corporation, a clothing retailer, had income from operations (before tax) of $367,000, and recorded the followiag before-tax gainsi(losses) for the vear ended December 31, 2023: Flounder also tiad the followirg accoum balances as at January 1.2023 : As at January 1, 2023, flounder had one piece or land that had an original cost of $142,000 that it accounted for usicus the revaluation inodel. It was mostrecently revalued to fair value on December 31,2022 , when its carrving amount was adfusted to fair value of 5203040 , in invary 2023 , the piece of land was iold for proceeds ef 5203,040 . In applying the revaluation model. Flounder maintains the balance in the Revaluation Sumplus IOCD account until the autet is retired or disposed of pervolio wn sols in Nommber 2023 for aroceedi ce $113.440