Answered step by step

Verified Expert Solution

Question

1 Approved Answer

struggling w this one. thank you. Schedule of Cash Payments for a Service Company EastGate Physical Therapy Inc. is planning its cash payments for operations

struggling w this one. thank you.

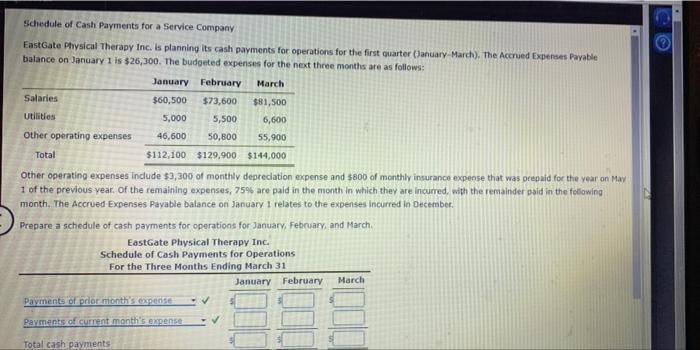

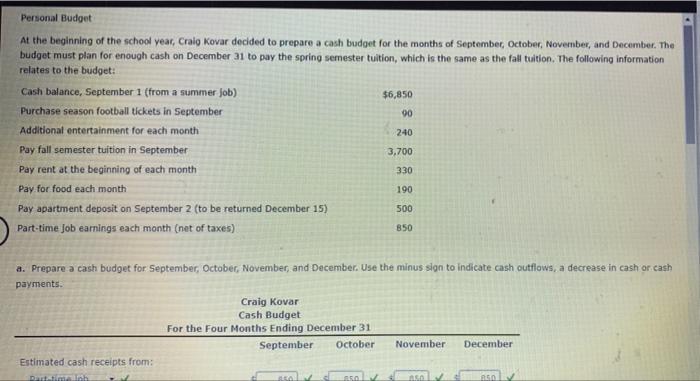

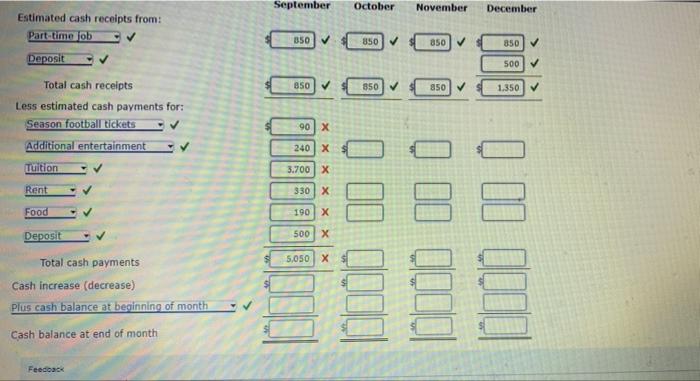

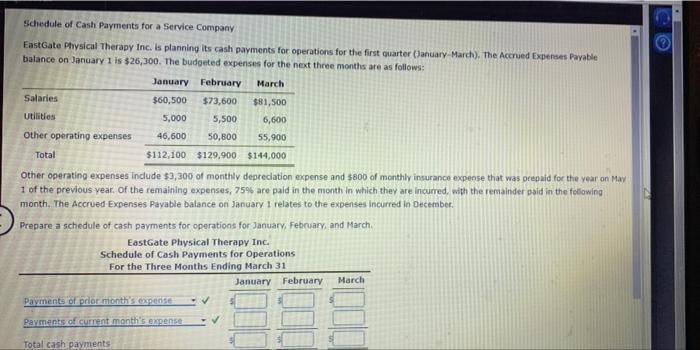

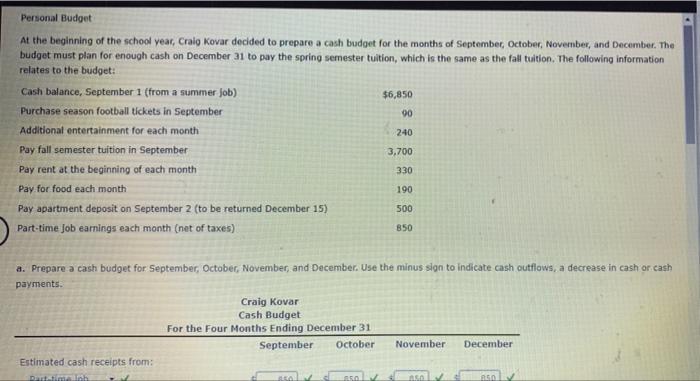

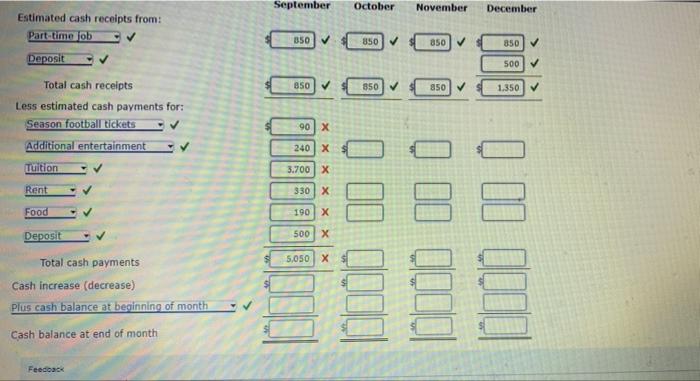

Schedule of Cash Payments for a Service Company EastGate Physical Therapy Inc. is planning its cash payments for operations for the first quarter (January-March). The Accrued Expenses Payable balance on January 1 is $26,300. The budgeted expenses for the next three months are as follows: January February March Salaries $60,500 $73,600 $81,500 Utilities 5,000 5,500 6,600 Other operating expenses 46,600 50,800 55,900 Total $112,100 $129,900 $144,000 Other operating expenses include $3,300 of monthly depreciation expense and $800 of monthly insurance expense that was prepaid for the year on May 1 of the previous year. Of the remaining expenses, 75% are paid in the month in which they are incurred, with the remainder paid in the following month. The Accrued Expenses Payable balance on January 1 relates to the expenses incurred in December. Prepare a schedule of cash payments for operations for January, February, and March. EastGate Physical Therapy Inc. Schedule of Cash Payments for Operations For the Three Months Ending March 31 January February March Payments of prior month's expense Payments of current month's expense Total cash payments Personal Budget At the beginning of the school year, Craig Kovar decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: $6,850 Cash balance, September 1 (from a summer job) Purchase season football tickets in September Additional entertainment for each month 90 240 Pay fall semester tuition in September 3,700 Pay rent at the beginning of each month 330 Pay for food each month 190 500 Pay apartment deposit on September 2 (to be returned December 15) Part-time job earnings each month (net of taxes) 850 a. Prepare a cash budget for September, October, November, and December. Use the minus sign to indicate cash outflows, a decrease in cash or cash payments. Craig Kovar Cash Budget For the Four Months Ending December 31 September October November December Estimated cash receipts from: Part-time oh aso 650 Aso 850 Estimated cash receipts from: Part-time job Deposit Total cash receipts Less estimated cash payments for: Season football tickets Additional entertainment Tuition Rent Food Deposit Total cash payments Cash increase (decrease) Plus cash balance at beginning of month Cash balance at end of month Feedback September 850 850 90 X 240 X 3.700 X 330 X 190 X 500 X 5,050 X October November December 850 850 850 850 0000000 OOO 850 500 1.350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started