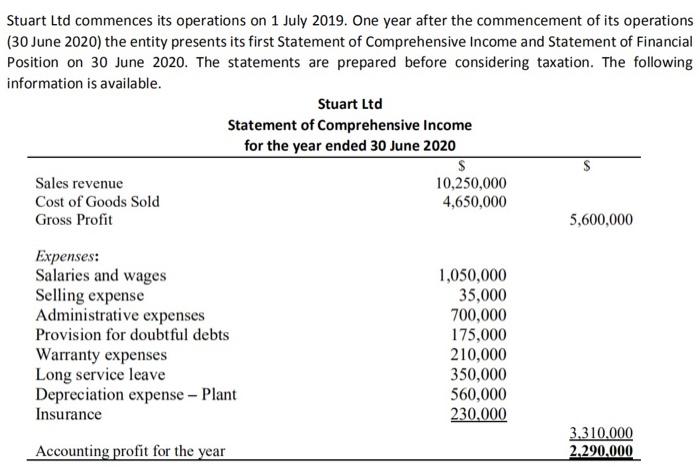

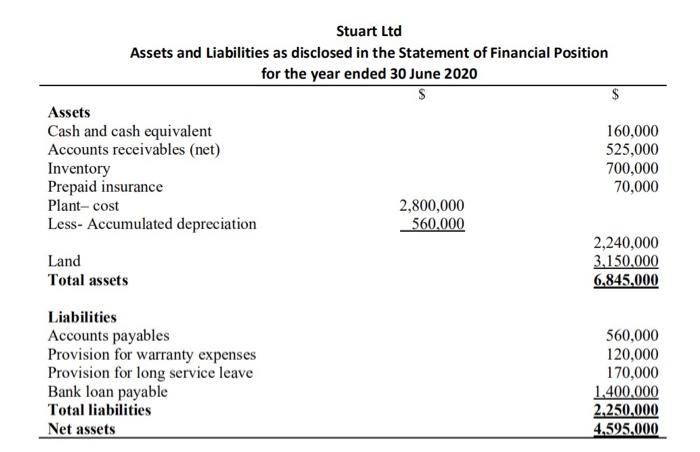

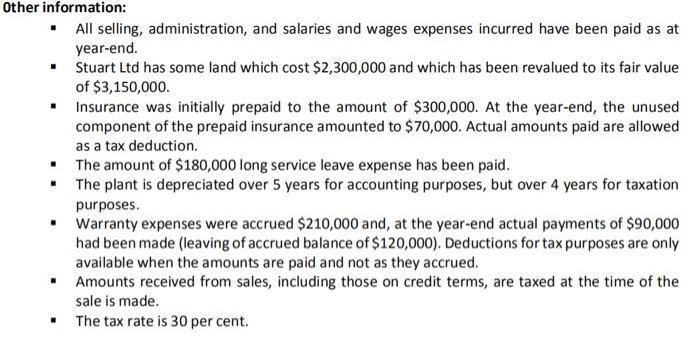

Stuart Ltd commences its operations on 1 July 2019. One year after the commencement of its operations (30 June 2020) the entity presents its first statement of Comprehensive Income and Statement of Financial Position on 30 June 2020. The statements are prepared before considering taxation. The following information is available. Stuart Ltd Statement of Comprehensive Income for the year ended 30 June 2020 $ Sales revenue 10,250,000 Cost of Goods Sold 4,650,000 Gross Profit 5,600,000 Expenses: Salaries and wages Selling expense Administrative expenses Provision for doubtful debts Warranty expenses Long service leave Depreciation expense - Plant Insurance 1,050,000 35,000 700,000 175,000 210,000 350,000 560,000 230,000 3.310,000 2.290.000 Accounting profit for the year Stuart Ltd Assets and Liabilities as disclosed in the Statement of Financial Position for the year ended 30 June 2020 S $ Assets Cash and cash equivalent 160,000 Accounts receivables (net) 525,000 Inventory 700,000 Prepaid insurance 70,000 Plant-cost 2,800,000 Less- Accumulated depreciation 560,000 2,240,000 Land 3,150,000 Total assets 6,845.000 Liabilities Accounts payables Provision for warranty expenses Provision for long service leave Bank loan payable Total liabilities Net assets 560,000 120,000 170,000 1,400,000 2.250,000 4.595,000 Other information: All selling, administration, and salaries and wages expenses incurred have been paid as at year-end. Stuart Ltd has some land which cost $2,300,000 and which has been revalued to its fair value of $3,150,000 Insurance was initially prepaid to the amount of $300,000. At the year-end, the unused component of the prepaid insurance amounted to $70,000. Actual amounts paid are allowed as a tax deduction. . The amount of $180,000 long service leave expense has been paid. The plant is depreciated over 5 years for accounting purposes, but over 4 years for taxation purposes. Warranty expenses were accrued $210,000 and, at the year-end actual payments of $90,000 had been made (leaving of accrued balance of $120,000). Deductions for tax purposes are only available when the amounts are paid and not as they accrued. . Amounts received from sales, including those on credit terms, are taxed at the time of the sale is made The tax rate is 30 per cent. Required: (0) Compute the taxable income or loss. (using excel spreadsheet). 5.5 Marks Complete the Taxation Worksheet on the next page in accordance with AASB 112 Income Taxes. (using excel spreadsheet). 21 Marks Prepare the applicable journal entries at 30 June 2020 to account for tax using the balance sheet method. 3.5 Marks Stuart Ltd Taxation Worksheet as at 30 June 2020 Item Carrying amount Tax Base Tax Expense Tax Payable Deductable Temporary Difference Taxable Temporary Difference S Revaluation Surplus S S S s Assets Cash Accounts receivables (net) Prepaid insurance Inventory Plant-net Land Liabilities Accounts payables Provision for long service leave Provision for warranty Bank loan payable Net assets Temporary difference for year Lass carried forward Movement for the priod Tax effected at 30 Tax on taxable income Income tax adjustment Stuart Ltd commences its operations on 1 July 2019. One year after the commencement of its operations (30 June 2020) the entity presents its first statement of Comprehensive Income and Statement of Financial Position on 30 June 2020. The statements are prepared before considering taxation. The following information is available. Stuart Ltd Statement of Comprehensive Income for the year ended 30 June 2020 $ Sales revenue 10,250,000 Cost of Goods Sold 4,650,000 Gross Profit 5,600,000 Expenses: Salaries and wages Selling expense Administrative expenses Provision for doubtful debts Warranty expenses Long service leave Depreciation expense - Plant Insurance 1,050,000 35,000 700,000 175,000 210,000 350,000 560,000 230,000 3.310,000 2.290.000 Accounting profit for the year Stuart Ltd Assets and Liabilities as disclosed in the Statement of Financial Position for the year ended 30 June 2020 S $ Assets Cash and cash equivalent 160,000 Accounts receivables (net) 525,000 Inventory 700,000 Prepaid insurance 70,000 Plant-cost 2,800,000 Less- Accumulated depreciation 560,000 2,240,000 Land 3,150,000 Total assets 6,845.000 Liabilities Accounts payables Provision for warranty expenses Provision for long service leave Bank loan payable Total liabilities Net assets 560,000 120,000 170,000 1,400,000 2.250,000 4.595,000 Other information: All selling, administration, and salaries and wages expenses incurred have been paid as at year-end. Stuart Ltd has some land which cost $2,300,000 and which has been revalued to its fair value of $3,150,000 Insurance was initially prepaid to the amount of $300,000. At the year-end, the unused component of the prepaid insurance amounted to $70,000. Actual amounts paid are allowed as a tax deduction. . The amount of $180,000 long service leave expense has been paid. The plant is depreciated over 5 years for accounting purposes, but over 4 years for taxation purposes. Warranty expenses were accrued $210,000 and, at the year-end actual payments of $90,000 had been made (leaving of accrued balance of $120,000). Deductions for tax purposes are only available when the amounts are paid and not as they accrued. . Amounts received from sales, including those on credit terms, are taxed at the time of the sale is made The tax rate is 30 per cent. Required: (0) Compute the taxable income or loss. (using excel spreadsheet). 5.5 Marks Complete the Taxation Worksheet on the next page in accordance with AASB 112 Income Taxes. (using excel spreadsheet). 21 Marks Prepare the applicable journal entries at 30 June 2020 to account for tax using the balance sheet method. 3.5 Marks Stuart Ltd Taxation Worksheet as at 30 June 2020 Item Carrying amount Tax Base Tax Expense Tax Payable Deductable Temporary Difference Taxable Temporary Difference S Revaluation Surplus S S S s Assets Cash Accounts receivables (net) Prepaid insurance Inventory Plant-net Land Liabilities Accounts payables Provision for long service leave Provision for warranty Bank loan payable Net assets Temporary difference for year Lass carried forward Movement for the priod Tax effected at 30 Tax on taxable income Income tax adjustment