stuck help to solve the question

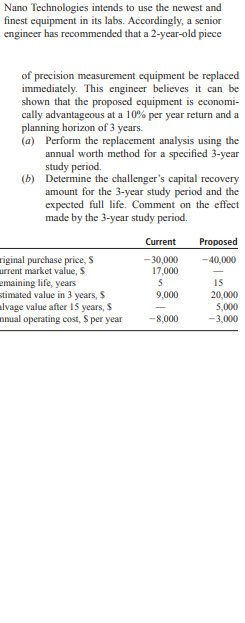

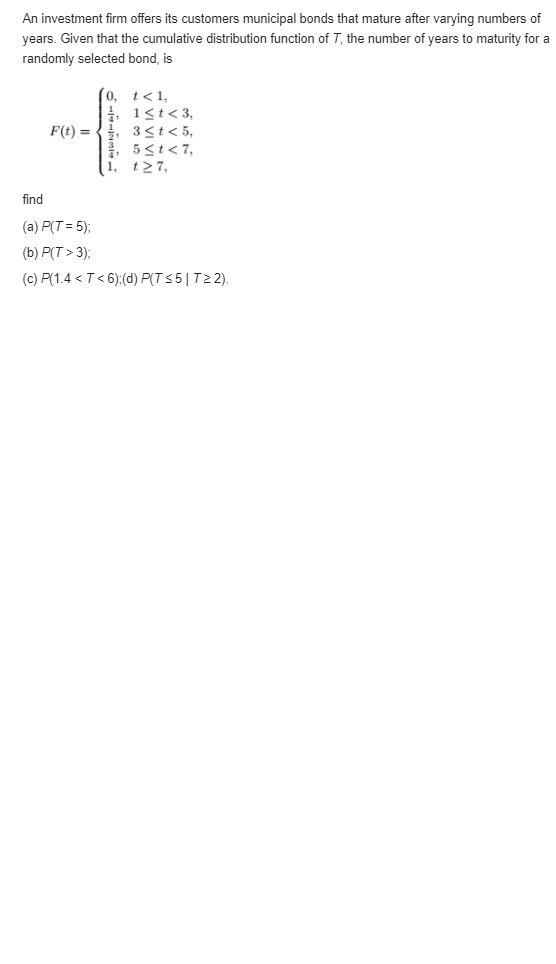

In a study conducted by the Department of Mechanical Engineering at Virginia Tech, the steel rods supplied by two different companies were compared. Ten sample springs were made out of the steel rods supplied by each company, and a measure of flexibility was recorded for each. The data are as follows: Company A: 9.3 8.8 6.8 8.7 8.5 6.7 8.0 6.5 9.2 7.0 Company B: 11.0 9.8 9.9 10.2 10.1 9.7 11.0 11.1 10.2 9.6 (a) Calculate the sample mean and median for the data for the two companies. (b) Plot the data for the two companies on the same line and give your impression regarding any apparent differences between the two companies. An overseas shipment of 5 foreign automobiles contains 2 that have slight paint blemishes. If an agency receives 3 of these automobiles at random, list the elements of the sample space S, using the letters Band / for blemished and nonblemished, respectively; then to each sample point assign a value x of the random variable X representing the number of automobiles with paint blemishes purchased by the agency.The following measurements were recorded for the drying time, in hours, of a certain brand of latex paint. 3.4 2.5 4.8 2.9 3.6 2.8 3.3 5.6 3.7 2.8 4.4 4.0 5.2 3.0 4.8 Assume that the measurements are a simple random sample. (a) What is the sample size for the above sample? (b) Calculate the sample mean for these data. (c) Calculate the sample median. (d) Plot the data by way of a dot plot. (e) Compute the 20% trimmed mean for the above data set. (f) Is the sample mean for these data more or less descriptive as a center of location than the trimmed mean?A public corporation in which you own common stock reported a WACC of 11.1% for the year in its report to stockholders. The common stock that you own has averaged a total return of 7% per year over the last 3 years. The annual report also men- tions that projects within the corporation are 75% funded by its own capital. Estimate the company's cost of debt capital. BASF will invest $14 million this year to upgrade its ethylene glycol processes. This chemical is used to produce polyester resins to manufacture products varying from construction materials to aircraft, and from luggage to home appliances. Eq- uity capital costs 14.5% per year and will supply 65% of the capital funds. Debt capital costs 10% per year before taxes. The effective tax rate for BASF is 36% (a) Determine the amount of annual revenue after taxes that is consumed in covering the interest on the project's initial cost. (b) If the corporation does not want to use 65% of its own funds, the financing plan may in- clude 75% debt capital. Determine the amount of annual revenue needed to cover the interest with this plan, and explain the ef- fect it may have on the corporation's ability to borrow in the future. A couple planning for their child's college educa- tion can fund part of or all the expected $100,000 tuition cost from their own funds (through an edu- cation IRA) or borrow all or part of it. The average return for their own funds is 7% per year, but the loan is expected to have a higher interest rate as the loan amount increases. Use a spreadsheet to generate a plot of the WACC curve with the esti- mated loan interest rates below and determine the best D-E mix for the couple.Nano Technologies intends to use the newest and finest equipment in its labs. Accordingly, a senior engineer has recommended that a 2-year-old piece of precision measurement equipment be replaced immediately. This engineer believes it can be shown that the proposed equipment is economi- cally advantageous at a 10% per year return and a planning horizon of 3 years. (a) Perform the replacement analysis using the annual worth method for a specified 3-year study period. (b) Determine the challenger's capital recovery amount for the 3-year study period and the expected full life. Comment on the effect made by the 3-year study period. Current Proposed riginal purchase price, $ -30,000 -40,000 irrent market value, $ 17,000 emaining life, years S 15 stimated value in 3 years, $ 9.000 20,00 0 Ivage value after 15 years, $ 5,000 unual operating cost, $ per year -8,000 -3,000An investment firm offers its customers municipal bonds that mature after varying numbers of years. Given that the cumulative distribution function of 7, the number of years to maturity for a randomly selected bond, is t 3); (c) P(1.4 2).An alternative with an infinite life has a B/C ratio of 1.5. The alternative has benefits of $50,000 per year and annual maintenance costs of $10,000 per year. The first cost of the alternative at an interest rate of 10% per year is closest to: (a) $23,300 (b) $85.400 (c) $146,100 (ad) $233,000 Cost-effectiveness analysis (CEA) differs from cost-benefit (B/C) analysis in that: (a) CEA cannot handle multiple alternatives. (b) CEA expresses outcomes in natural units rather than in currency units. (c) CEA cannot handle independent alternatives. (d) CEA is more time-consuming and resource- intensive. Several private colleges claim to have programs that are very effective at teaching enrollees how to become entrepreneurs. Two programs, identi- fied as program X and program Y, have produced 4 and 6 persons per year, respectively, who were recognized as entrepreneurs. If the total cost of the programs is $25,000 and $33,000, respec- tively, the incremental cost-effectiveness ratio is closest to: (a) 6250 (b) 5500 (c) 4000 (d) 1333\f