Stuck on this problem. Any help would be appreciated! Thanks!

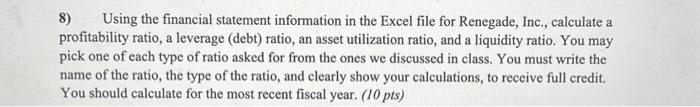

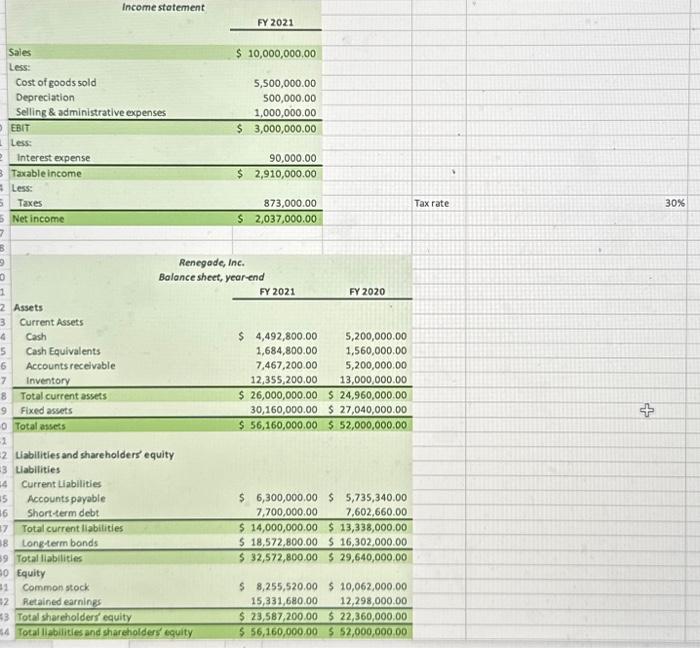

8) Using the financial statement information in the Excel file for Renegade, Inc., calculate a profitability ratio, a leverage (debt) ratio, an asset utilization ratio, and a liquidity ratio. You may pick one of each type of ratio asked for from the ones we discussed in class. You must write the name of the ratio, the type of the ratio, and clearly show your calculations, to receive full credit. You should calculate for the most recent fiscal year. (10pts) Income stotement FY 2021 Saies $10,000,000,00 Less: \begin{tabular}{lr} Cost of goods sold & 5,500,000.00 \\ Depreciation & 500,000.00 \\ Selling \& administrative expenses & 1,000,000.00 \\ \hline EBIT & $,000,000.00 \end{tabular} Less: Interest expense Taxable income Less: \begin{tabular}{lrr} Taxes & 873,000.00 \\ \hline Net income & $ & 2,037,000.00 \end{tabular} Renegade, Inc. Balance sheet, year-end FY 2021 FY 2020 2. Assets 3 Current Assets \begin{tabular}{llrr|} \hline Cash & $ & 4,492,800.00 & 5,200,000.00 \\ 5 & Cash Equivalents & 1,684,800.00 & 1,560,000.00 \\ 6 & Accounts recelvable & 7,467,200.00 & 5,200,000.00 \\ 7 & Inventory & 12,355,200,00 & 13,000,000.00 \\ \hline 8 & Total current assets & $26,000,000.00 & $24,960,000.00 \\ 9 & Fixed assets & 30,160,000.00 & $27,040,000.00 \\ \hline 0 & Total asses & $5,160,000,00 & $5,000,000.00 \\ \hline \end{tabular} Lablities and shareholders equity Labilities Current Libilities \begin{tabular}{l|lrrrr|} \hline & A & \multicolumn{1}{|c}{ B } & \multicolumn{1}{c}{ C } & \multicolumn{1}{c|}{ D } & \multicolumn{1}{c|}{ E } \\ \cline { 3 - 7 } & & & Renegade,Inc.SelectFinancialData & & \\ \hline 1 & & 2020 & 2021 & 2022 & 2023 \\ 2 & & & 3,000,000 & 3,500,000 & 3,750,000 \\ 4 & EBIT & & 500,000 & 550,000 & 575,000 \\ 5 & Dep & & 1,000,000 & 1,200,000 & 1,350,000 \\ 6 & Cap Ex & 24,960,000 & 26,000,000 & 27,000,000 & 28,000,000 \\ 7 & Current Assets & 13,338,000 & 14,000,000 & 14,500,000 & 15,000,000 \end{tabular} 8) Using the financial statement information in the Excel file for Renegade, Inc., calculate a profitability ratio, a leverage (debt) ratio, an asset utilization ratio, and a liquidity ratio. You may pick one of each type of ratio asked for from the ones we discussed in class. You must write the name of the ratio, the type of the ratio, and clearly show your calculations, to receive full credit. You should calculate for the most recent fiscal year. (10pts) Income stotement FY 2021 Saies $10,000,000,00 Less: \begin{tabular}{lr} Cost of goods sold & 5,500,000.00 \\ Depreciation & 500,000.00 \\ Selling \& administrative expenses & 1,000,000.00 \\ \hline EBIT & $,000,000.00 \end{tabular} Less: Interest expense Taxable income Less: \begin{tabular}{lrr} Taxes & 873,000.00 \\ \hline Net income & $ & 2,037,000.00 \end{tabular} Renegade, Inc. Balance sheet, year-end FY 2021 FY 2020 2. Assets 3 Current Assets \begin{tabular}{llrr|} \hline Cash & $ & 4,492,800.00 & 5,200,000.00 \\ 5 & Cash Equivalents & 1,684,800.00 & 1,560,000.00 \\ 6 & Accounts recelvable & 7,467,200.00 & 5,200,000.00 \\ 7 & Inventory & 12,355,200,00 & 13,000,000.00 \\ \hline 8 & Total current assets & $26,000,000.00 & $24,960,000.00 \\ 9 & Fixed assets & 30,160,000.00 & $27,040,000.00 \\ \hline 0 & Total asses & $5,160,000,00 & $5,000,000.00 \\ \hline \end{tabular} Lablities and shareholders equity Labilities Current Libilities \begin{tabular}{l|lrrrr|} \hline & A & \multicolumn{1}{|c}{ B } & \multicolumn{1}{c}{ C } & \multicolumn{1}{c|}{ D } & \multicolumn{1}{c|}{ E } \\ \cline { 3 - 7 } & & & Renegade,Inc.SelectFinancialData & & \\ \hline 1 & & 2020 & 2021 & 2022 & 2023 \\ 2 & & & 3,000,000 & 3,500,000 & 3,750,000 \\ 4 & EBIT & & 500,000 & 550,000 & 575,000 \\ 5 & Dep & & 1,000,000 & 1,200,000 & 1,350,000 \\ 6 & Cap Ex & 24,960,000 & 26,000,000 & 27,000,000 & 28,000,000 \\ 7 & Current Assets & 13,338,000 & 14,000,000 & 14,500,000 & 15,000,000 \end{tabular}