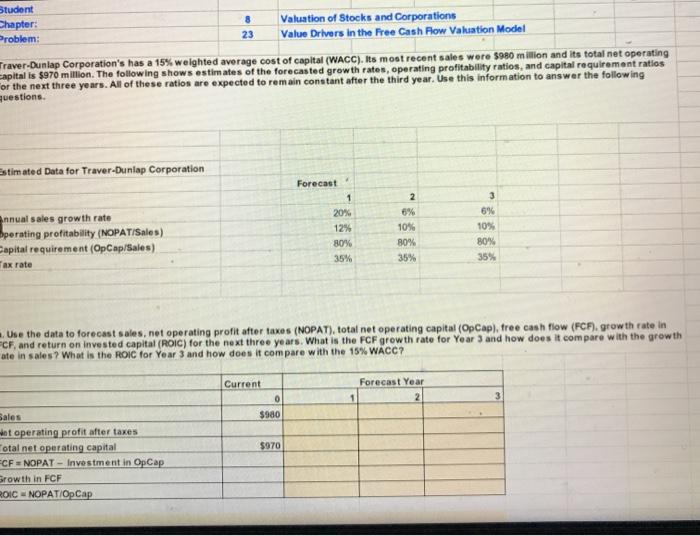

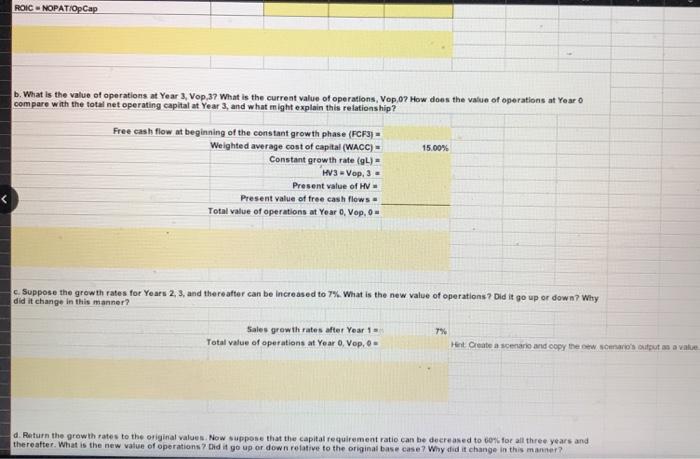

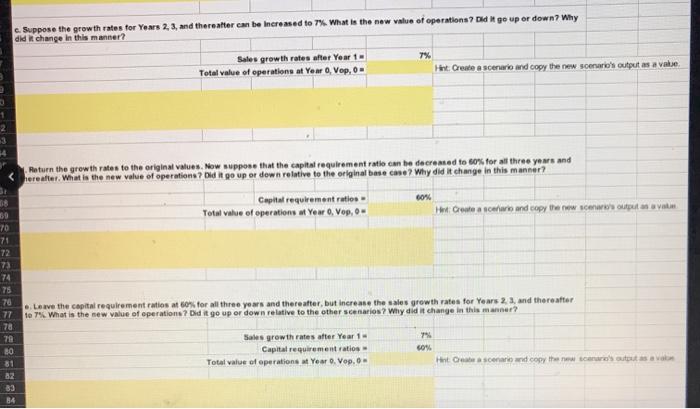

Student Chapter: 8 Valuation of Stocks and Corporations Problem: 23 Value Drivers in the Free Cash Flow Valuation Model Traver-Dunlap Corporation's has a 15% weighted average cost of capital (WACC). Its most recent sales were $980 million and its total net operating capital is $970 million. The following shows estimates of the forecasted growth rates, operating profitability ratios, and capital requirement ratios or the next three years. All of these ratios are expected to remain constant after the third year. Use this information to answer the following questions. Estimated Data for Traver-Duniap Corporation 2 3 Annual sales growth rate Operating profitability (NOPAT/Sales) Capital requirement (OpCap/Sales) Forecast 1 20% 12% 80% 35% 10% 80% 35% 6% 10% 80% 35% Tax rate Use the data to forecast sales, net operating profit after taxes (NOPAT), total net operating capital (OpCap), free cash flow (FCF), growth rate in ECF, and return on invested capital (ROIC) for the next three years. What is the FCF growth rate for Year 3 and how does it compare with the growth ate in sales ? What is the ROIC for Year 3 and how does it compare with the 15% WACC? Current Forecast Year 2 0 $980 $970 Sales Wet operating profit after taxes Total net operating capital CF = NOPAT - Investment in Op Cap Browth in FCF ROICNOPATIOp Cap ROICNOPATIOpCap b. What is the value of operations at Year 3, Vop,37 What is the current value of operations, Vop.07 How does the value of operations at Year o compare with the total net operating capital at Year 3, and what might explain this relationship? 15.00% Free cash flow at beginning of the constant growth phase (FCF3) - Weighted average cost of capital (WACC) = Constant growth rate (91) HV3 - Vop, 3 - Present value of HV Present value of free cash flows Total value of operations at Year 0. Vop, O Suppose the growth rates for Years 2, 3, and thereafter can be increased to 7%. What is the new value of operations? Did it go up or down? Why did it change in this manner? 7% Sales growth rates after Year 1 Total value of operations at Year 0 Vop, Het Create a scenario and copy the woman's outputs a value d. Return the growth rates to the original values. Now suppose that the capital requirement ratio can be decreased to 60% for all three years and thereafter. What is the new value of operations ? Did it go up or down relative to the original base case? Why did it change in this manner? . Suppose the growth rates for Yours 2, 3, and thereafter can be increased to 7%. What is the new value of operations? Did It go up or down? Why did it change in this manner? Sales growth rates after Year 1 Total value of operations at Year 0. Vop, 0 7% Hint Create a scenario and copy the new scenario's output as a vale Return the growth rates to the original values. Now suppose that the capital requirement ratio can be decreased to 50% for all three years and hereafter. What is the new value of operations? Did it go up or down relative to the original base cose? Why did it change in this manner? Capital requirement ratios 60% 30 Total value of operations of Year 0. Vop, 0- Hot Create a se and copy the new song An 70 71 72 73 74 75 78 Love the capital requirement ruties at 60% for all three years and thereafter, but increase the sales growth rates for Years 2. 3. and thereafter 77 7% What is the new value of operations? Did it go up or down relative to the other scenarios? Why did it change in this manner? 78 79 Sales growth rates after Year 1 80 Capital requirementation 60% Total value of operations M Year 0. Vop. Hint Ceea scenario and copy the car's tout av 82 B3 84 Student Chapter: 8 Valuation of Stocks and Corporations Problem: 23 Value Drivers in the Free Cash Flow Valuation Model Traver-Dunlap Corporation's has a 15% weighted average cost of capital (WACC). Its most recent sales were $980 million and its total net operating capital is $970 million. The following shows estimates of the forecasted growth rates, operating profitability ratios, and capital requirement ratios or the next three years. All of these ratios are expected to remain constant after the third year. Use this information to answer the following questions. Estimated Data for Traver-Duniap Corporation 2 3 Annual sales growth rate Operating profitability (NOPAT/Sales) Capital requirement (OpCap/Sales) Forecast 1 20% 12% 80% 35% 10% 80% 35% 6% 10% 80% 35% Tax rate Use the data to forecast sales, net operating profit after taxes (NOPAT), total net operating capital (OpCap), free cash flow (FCF), growth rate in ECF, and return on invested capital (ROIC) for the next three years. What is the FCF growth rate for Year 3 and how does it compare with the growth ate in sales ? What is the ROIC for Year 3 and how does it compare with the 15% WACC? Current Forecast Year 2 0 $980 $970 Sales Wet operating profit after taxes Total net operating capital CF = NOPAT - Investment in Op Cap Browth in FCF ROICNOPATIOp Cap ROICNOPATIOpCap b. What is the value of operations at Year 3, Vop,37 What is the current value of operations, Vop.07 How does the value of operations at Year o compare with the total net operating capital at Year 3, and what might explain this relationship? 15.00% Free cash flow at beginning of the constant growth phase (FCF3) - Weighted average cost of capital (WACC) = Constant growth rate (91) HV3 - Vop, 3 - Present value of HV Present value of free cash flows Total value of operations at Year 0. Vop, O Suppose the growth rates for Years 2, 3, and thereafter can be increased to 7%. What is the new value of operations? Did it go up or down? Why did it change in this manner? 7% Sales growth rates after Year 1 Total value of operations at Year 0 Vop, Het Create a scenario and copy the woman's outputs a value d. Return the growth rates to the original values. Now suppose that the capital requirement ratio can be decreased to 60% for all three years and thereafter. What is the new value of operations ? Did it go up or down relative to the original base case? Why did it change in this manner? . Suppose the growth rates for Yours 2, 3, and thereafter can be increased to 7%. What is the new value of operations? Did It go up or down? Why did it change in this manner? Sales growth rates after Year 1 Total value of operations at Year 0. Vop, 0 7% Hint Create a scenario and copy the new scenario's output as a vale Return the growth rates to the original values. Now suppose that the capital requirement ratio can be decreased to 50% for all three years and hereafter. What is the new value of operations? Did it go up or down relative to the original base cose? Why did it change in this manner? Capital requirement ratios 60% 30 Total value of operations of Year 0. Vop, 0- Hot Create a se and copy the new song An 70 71 72 73 74 75 78 Love the capital requirement ruties at 60% for all three years and thereafter, but increase the sales growth rates for Years 2. 3. and thereafter 77 7% What is the new value of operations? Did it go up or down relative to the other scenarios? Why did it change in this manner? 78 79 Sales growth rates after Year 1 80 Capital requirementation 60% Total value of operations M Year 0. Vop. Hint Ceea scenario and copy the car's tout av 82 B3 84