Answered step by step

Verified Expert Solution

Question

1 Approved Answer

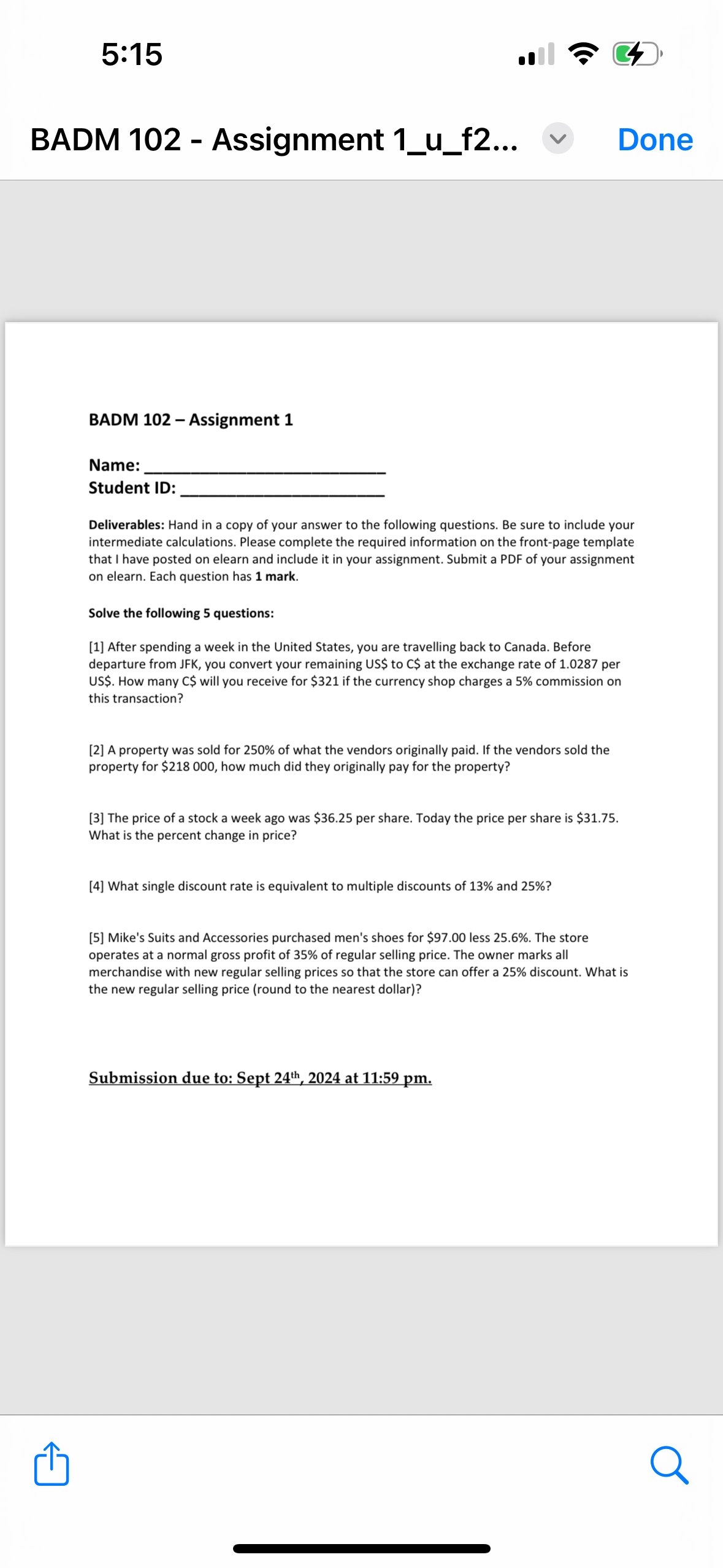

Student I Deliverables: Hand in a copy of your answer to the following questions. Be sure to include your intermediate calculations. Please complete the required

Student I

Deliverables: Hand in a copy of your answer to the following questions. Be sure to include your

intermediate calculations. Please complete the required information on the frontpage template

that I have posted on elearn and include it in your assignment. Submit a PDF of your assignment

on elearn. Each question has mark.

Solve the following questions:

After spending a week in the United States, you are travelling back to Canada. Before

departure from JFK you convert your remaining US$ to C$ at the exchange rate of per

US$ How many C$ will you receive for $ if the currency shop charges a commission on

this transaction?

A property was sold for of what the vendors originally paid. If the vendors sold the

property for $ how much did they originally pay for the property?

The price of a stock a week ago was $ per share. Today the price per share is $

What is the percent change in price?

What single discount rate is equivalent to multiple discounts of and

Mike's Suits and Accessories purchased men's shoes for $ less The store

operates at a normal gross profit of of regular selling price. The owner marks all

merchandise with new regular selling prices so that the store can offer a discount. What is

the new regular selling price round to the nearest dollar

Submission due to: Sept at : pm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started