Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Student loan debt in 2023 is the highest ever. There are more than 45 million borrowers who collectively owe $1.76 trillion in student loan

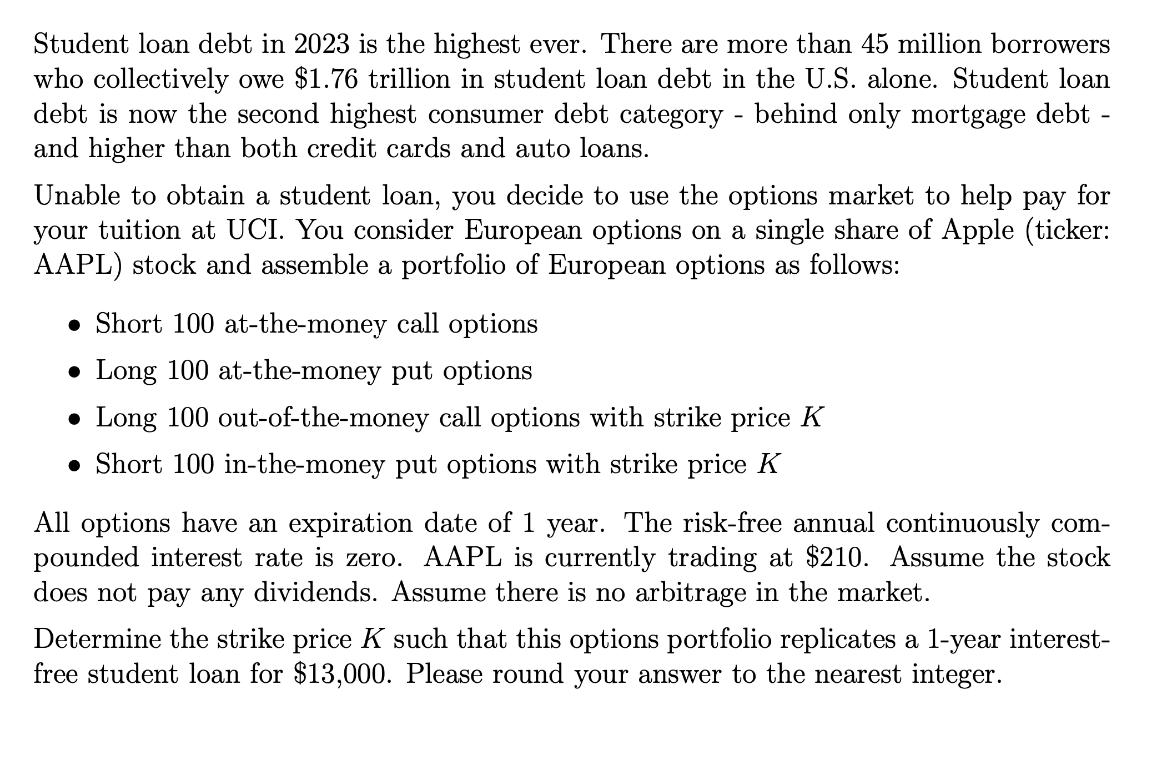

Student loan debt in 2023 is the highest ever. There are more than 45 million borrowers who collectively owe $1.76 trillion in student loan debt in the U.S. alone. Student loan debt is now the second highest consumer debt category - behind only mortgage debt and higher than both credit cards and auto loans. Unable to obtain a student loan, you decide to use the options market to help pay for your tuition at UCI. You consider European options on a single share of Apple (ticker: AAPL) stock and assemble a portfolio of European options as follows: Short 100 at-the-money call options Long 100 at-the-money put options Long 100 out-of-the-money call options with strike price K Short 100 in-the-money put options with strike price K All options have an expiration date of 1 year. The risk-free annual continuously com- pounded interest rate is zero. AAPL is currently trading at $210. Assume the stock does not pay any dividends. Assume there is no arbitrage in the market. Determine the strike price K such that this options portfolio replicates a 1-year interest- free student loan for $13,000. Please round your answer to the nearest integer.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To replicate a 1year interestfree student loan of 13000 we need to determine the strike price K that will make the portfolio worth 13000 at expiration ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started