Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Corporation manufactures widgets. Each widget goes through the machining and assembly departments. Recently, XYZ Corporation has been approached by Alpha Suppliers, an external

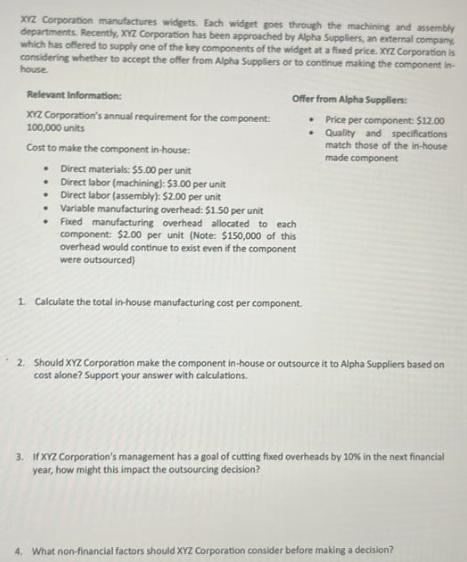

XYZ Corporation manufactures widgets. Each widget goes through the machining and assembly departments. Recently, XYZ Corporation has been approached by Alpha Suppliers, an external company which has offered to supply one of the key components of the widget at a fixed price. XYZ Corporation is considering whether to accept the offer from Alpha Suppliers or to continue making the component in- house. Relevant information: XYZ Corporation's annual requirement for the component: 100,000 units Cost to make the component in-house: Direct materials: $5.00 per unit Direct labor (machining): $3.00 per unit Direct labor (assembly): $2.00 per unit . Variable manufacturing overhead: $1.50 per unit Offer from Alpha Suppliers: Fixed manufacturing overhead allocated to each component: $2.00 per unit (Note: $150,000 of this overhead would continue to exist even if the component were outsourced) 1. Calculate the total in-house manufacturing cost per component. . Price per component: $12.00 Quality and specifications match those of the in-house made component 2. Should XYZ Corporation make the component in-house or outsource it to Alpha Suppliers based on cost alone? Support your answer with calculations. 3. If XYZ Corporation's management has a goal of cutting fixed overheads by 10% in the next financial year, how might this impact the outsourcing decision? 4. What non-financial factors should XYZ Corporation consider before making a decision?

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here is the analysis 1 Total inhouse cost per component Direct materials 500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started