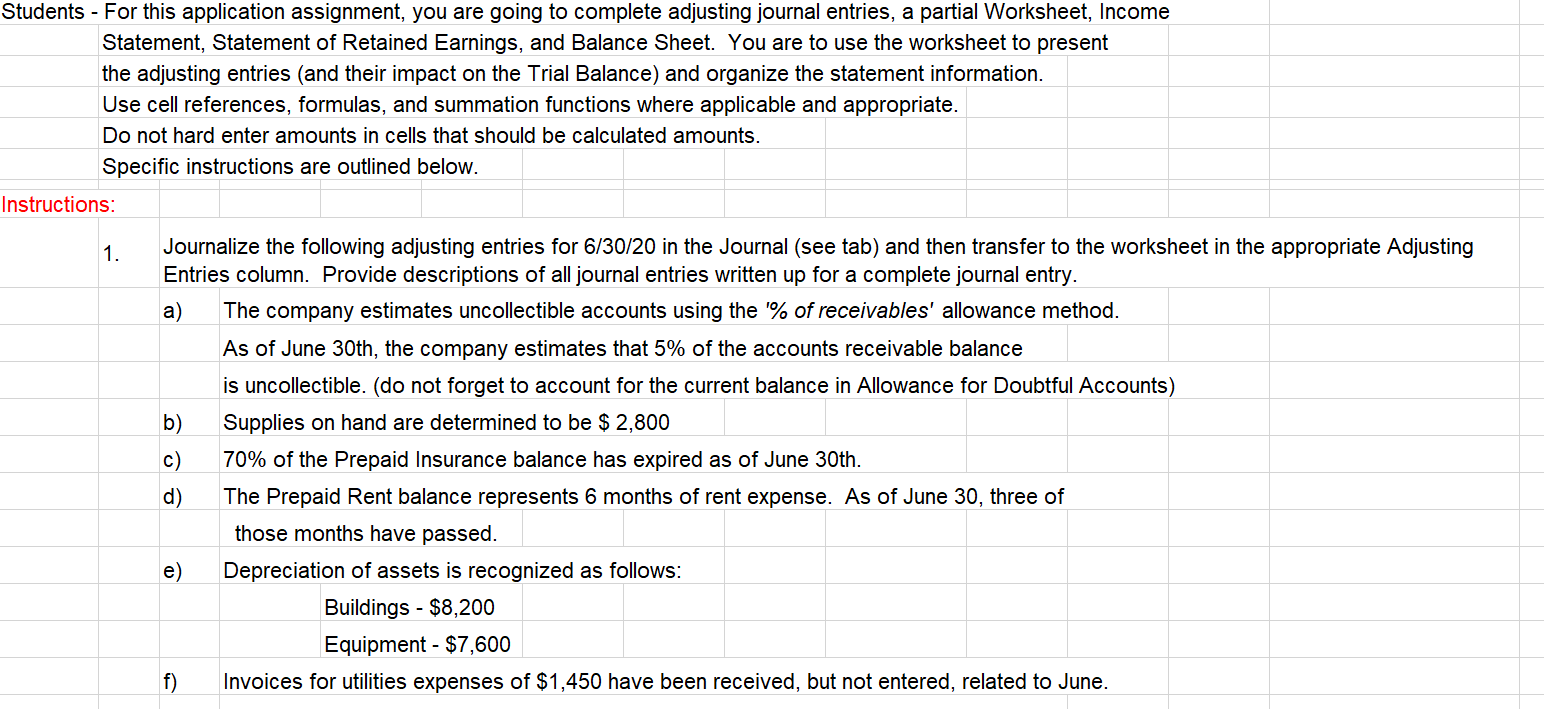

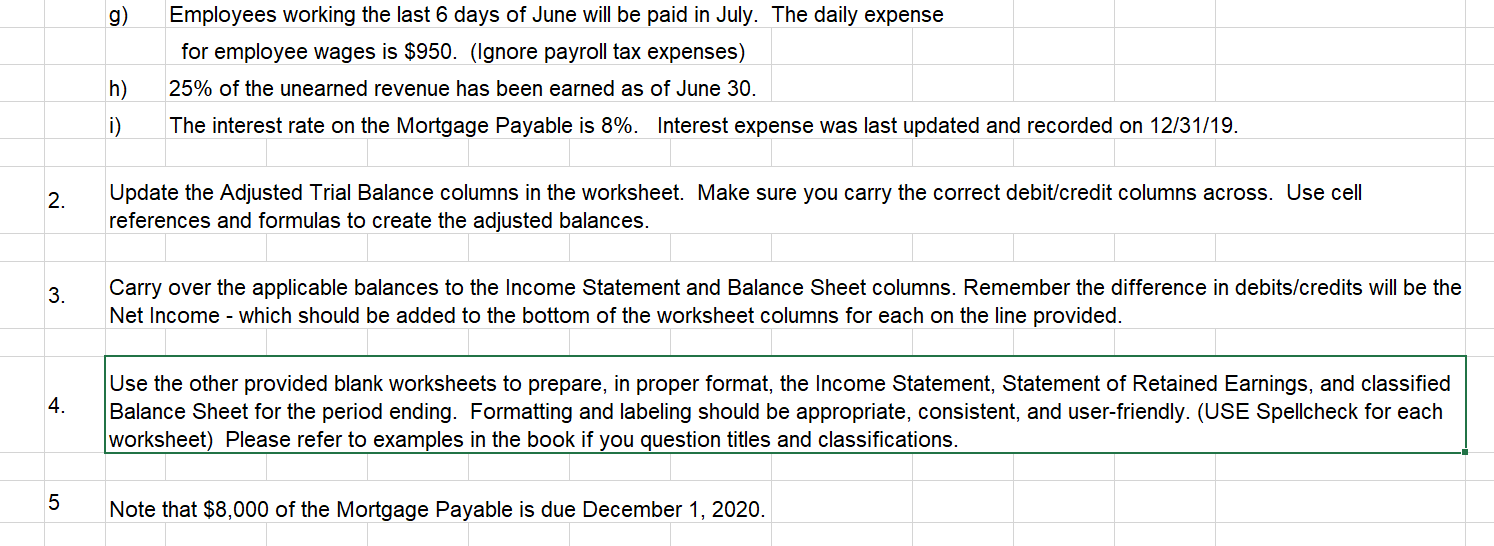

Students - For this application assignment, you are going to complete adjusting journal entries, a partial Worksheet, Income Statement, Statement of Retained Earnings, and Balance Sheet. You are to use the worksheet to present the adjusting entries (and their impact on the Trial Balance) and organize the statement information. Use cell references, formulas, and summation functions where applicable and appropriate. Do not hard enter amounts in cells that should be calculated amounts. Specific instructions are outlined below. Instructions: 1. Journalize the following adjusting entries for 6/30/20 in the Journal (see tab) and then transfer to the worksheet in the appropriate Adjusting Entries column. Provide descriptions of all journal entries written up for a complete journal entry. a) The company estimates uncollectible accounts using the '% of receivables' allowance method. As of June 30th, the company estimates that 5% of the accounts receivable balance is uncollectible. (do not forget to account for the current balance in Allowance for Doubtful Accounts) b) Supplies on hand are determined to be $ 2,800 70% of the Prepaid Insurance balance has expired as of June 30th. d) The Prepaid Rent balance represents 6 months of rent expense. As of June 30, three of those months have passed. Depreciation of assets is recognized as follows: Buildings - $8,200 Equipment - $7,600 f) Invoices for utilities expenses of $1,450 have been received, but not entered, related to June. e) g) Employees working the last 6 days of June will be paid in July. The daily expense for employee wages is $950. (Ignore payroll tax expenses) 25% of the unearned revenue has been earned as of June 30. The interest rate on the Mortgage Payable is 8%. Interest expense was last updated and recorded on 12/31/19. h) i) 2. Update the Adjusted Trial Balance columns in the worksheet. Make sure you carry the correct debit/credit columns across. Use cell references and formulas to create the adjusted balances. 3. Carry over the applicable balances to the Income Statement and Balance Sheet columns. Remember the difference in debits/credits will be the Net Income - which should be added to the bottom of the worksheet columns for each on the line provided. 4. Use the other provided blank worksheets to prepare, in proper format, the Income Statement, Statement of Retained Earnings, and classified Balance Sheet for the period ending. Formatting and labeling should be appropriate, consistent, and user-friendly. (USE Spellcheck for each worksheet) Please refer to examples in the book if you question titles and classifications. 5 Note that $8,000 of the Mortgage Payable is due December 1, 2020. Students - For this application assignment, you are going to complete adjusting journal entries, a partial Worksheet, Income Statement, Statement of Retained Earnings, and Balance Sheet. You are to use the worksheet to present the adjusting entries (and their impact on the Trial Balance) and organize the statement information. Use cell references, formulas, and summation functions where applicable and appropriate. Do not hard enter amounts in cells that should be calculated amounts. Specific instructions are outlined below. Instructions: 1. Journalize the following adjusting entries for 6/30/20 in the Journal (see tab) and then transfer to the worksheet in the appropriate Adjusting Entries column. Provide descriptions of all journal entries written up for a complete journal entry. a) The company estimates uncollectible accounts using the '% of receivables' allowance method. As of June 30th, the company estimates that 5% of the accounts receivable balance is uncollectible. (do not forget to account for the current balance in Allowance for Doubtful Accounts) b) Supplies on hand are determined to be $ 2,800 70% of the Prepaid Insurance balance has expired as of June 30th. d) The Prepaid Rent balance represents 6 months of rent expense. As of June 30, three of those months have passed. Depreciation of assets is recognized as follows: Buildings - $8,200 Equipment - $7,600 f) Invoices for utilities expenses of $1,450 have been received, but not entered, related to June. e) g) Employees working the last 6 days of June will be paid in July. The daily expense for employee wages is $950. (Ignore payroll tax expenses) 25% of the unearned revenue has been earned as of June 30. The interest rate on the Mortgage Payable is 8%. Interest expense was last updated and recorded on 12/31/19. h) i) 2. Update the Adjusted Trial Balance columns in the worksheet. Make sure you carry the correct debit/credit columns across. Use cell references and formulas to create the adjusted balances. 3. Carry over the applicable balances to the Income Statement and Balance Sheet columns. Remember the difference in debits/credits will be the Net Income - which should be added to the bottom of the worksheet columns for each on the line provided. 4. Use the other provided blank worksheets to prepare, in proper format, the Income Statement, Statement of Retained Earnings, and classified Balance Sheet for the period ending. Formatting and labeling should be appropriate, consistent, and user-friendly. (USE Spellcheck for each worksheet) Please refer to examples in the book if you question titles and classifications. 5 Note that $8,000 of the Mortgage Payable is due December 1, 2020