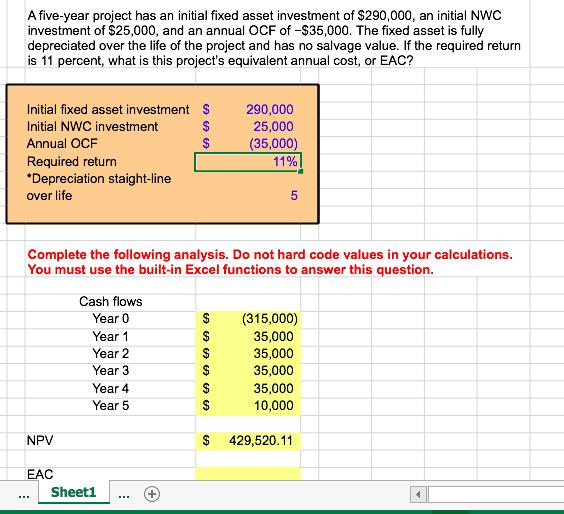

A five-year project has an initial fixed asset investment of $290,000, an initial NWC investment of $25,000, and an annual OCF of -$35,000. The

A five-year project has an initial fixed asset investment of $290,000, an initial NWC investment of $25,000, and an annual OCF of -$35,000. The fixed asset is fully depreciated over the life of the project and has no salvage value. If the required return is 11 percent, what is this project's equivalent annual cost, or EAC? Initial fixed asset investment Initial NWC investment Annual OCF Required return *Depreciation staight-line over life NPV EAC Cash flows Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 $ Sheet1 67 67 97 $ Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel functions to answer this question. $ 67 67 67 66 6 $ $ $ $ 290,000 25,000 (35,000) 11% $ 5 (315,000) 35,000 35,000 35,000 35,000 10,000 $ 429,520.11

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer NOTE Calculate the free cash flows Particulars 2 Initial invest...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started