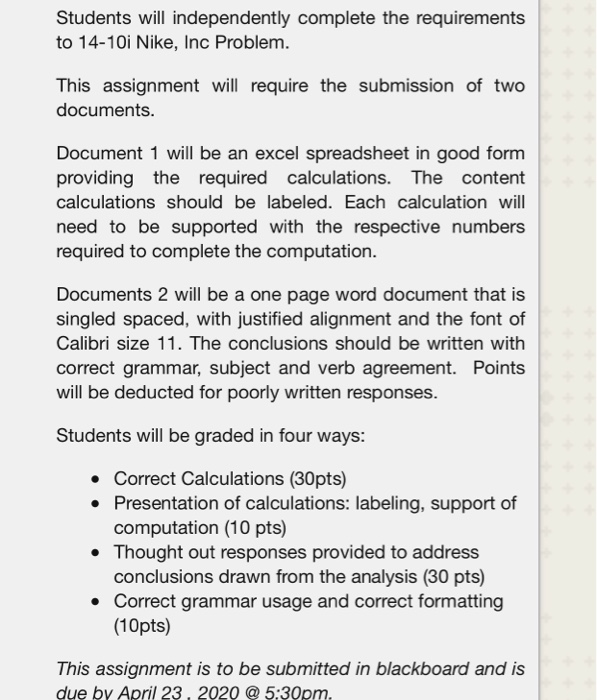

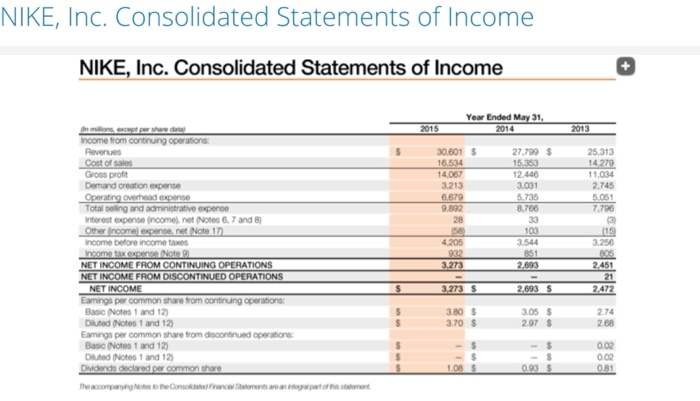

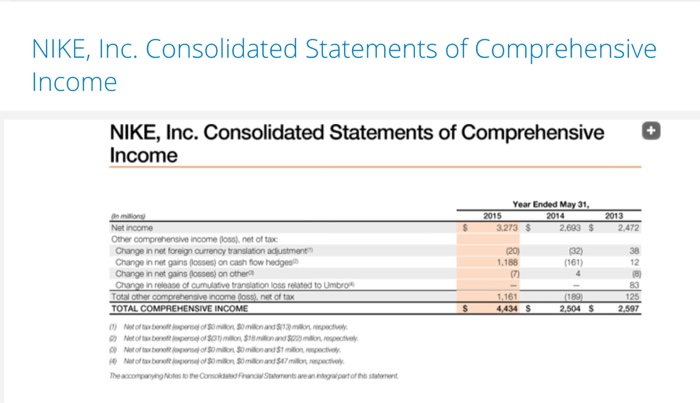

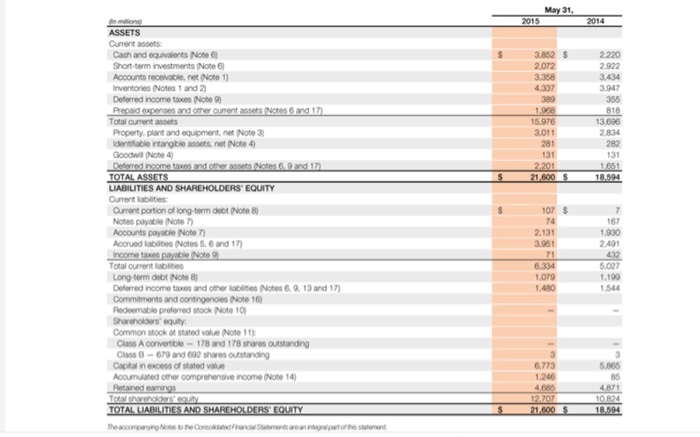

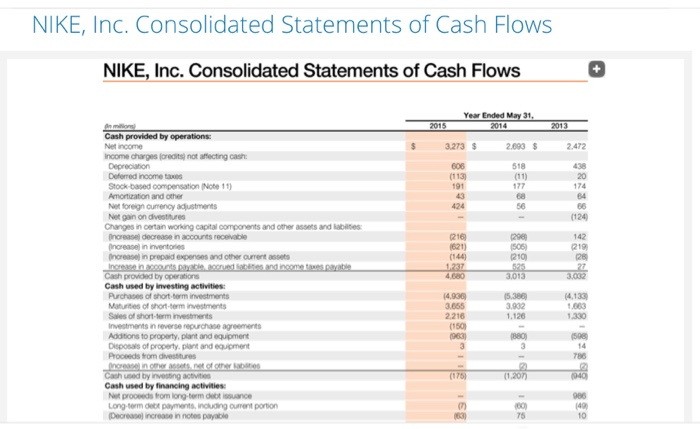

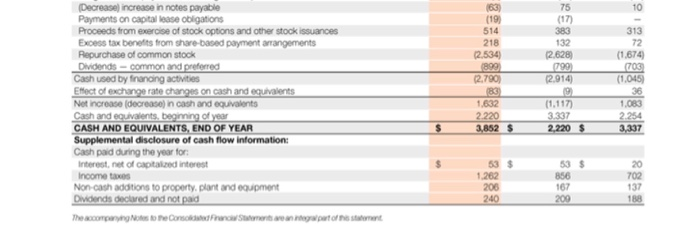

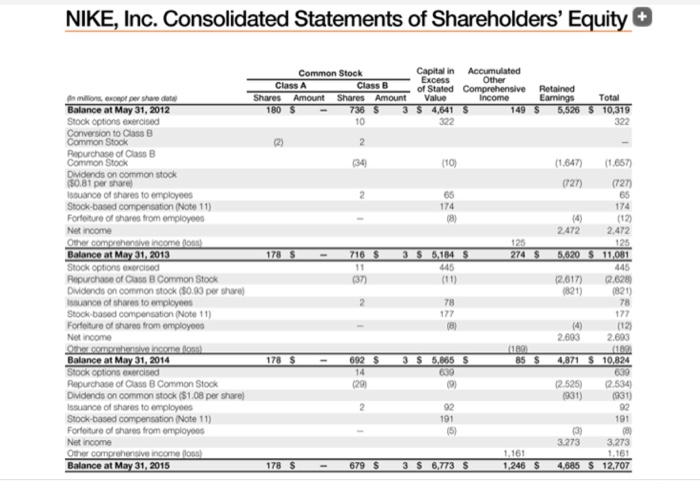

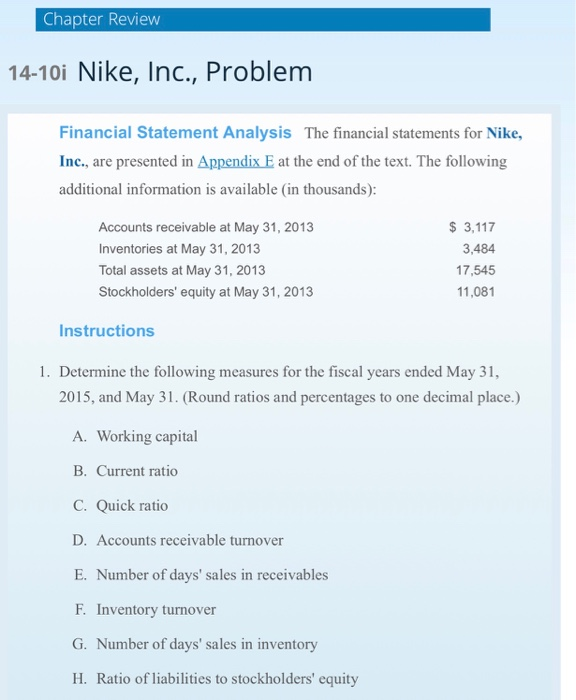

Students will independently complete the requirements to 14-10i Nike, Inc Problem. This assignment will require the submission of two documents. Document 1 will be an excel spreadsheet in good form providing the required calculations. The content calculations should be labeled. Each calculation will need to be supported with the respective numbers required to complete the computation. Documents 2 will be a one page word document that is singled spaced, with justified alignment and the font of Calibri size 11. The conclusions should be written with correct grammar, subject and verb agreement. Points will be deducted for poorly written responses. Students will be graded in four ways: Correct Calculations (30pts) Presentation of calculations: labeling, support of computation (10 pts) Thought out responses provided to address conclusions drawn from the analysis (30 pts) Correct grammar usage and correct formatting (10pts) This assignment is to be submitted in blackboard and is due by April 23, 2020 @ 5:30pm. NIKE, Inc. Consolidated Statements of Income NIKE, Inc. Consolidated Statements of Income Year Ended May 31, 2014 2015 2013 $ 30.601 $ 16.534 14.067 3.213 6.679 9892 27.799 15.353 12.446 3.031 5.735 8.786 25,313 14 279 11.034 2.745 5,061 7.796 103 105 3.256 milions of persona Income from continuing operations Revenues Cost of Gross profit Demand creation expense Operating Overhead expense Total selling and administrative expense Interest expense Income.net Notes 6, 7 and 8) Other Income expense.net Note 17 Income before income to Incom p ense Note NET INCOME FROM CONTINUING OPERATIONS NET INCOME FROM DISCONTINUED OPERATIONS NET INCOME Earings per common share from continuing operations: Basic Notes 1 and 12) Diluted Notes 1 and 12) Earings per common share from discontinued operations: Basic Notes 1 and 12 Diluted Notes 1 and 12) Didends declared per common share 4.205 902 3.544 851 2,693 3.273 2.451 3.273 $ 2.693 S 2472 3.80 3.70 $ $ 2.74 3.06 $ 2.97 $ 28 $ 0.02 0.02 0.81 0.93 $ The accompagne Conso l es w oment NIKE, Inc. Consolidated Statements of Comprehensive Income NIKE, Inc. Consolidated Statements of Comprehensive Income Year Ended May 31, 2015 2014 3.273 $ 2.693 $ 2013 20 20 ming Net Income Other comprehensive income (los), net of tac Change in net foreign currency translation adjustment Change in not gains 600) on cash flow hedge Change in not goins ) on other Change in rase of cumulative translations r ed to move Total other comprehensive income foss), net of tax TOTAL COMPREHENSIVE INCOME (32) (161) 1.188 12 1,161 4,434 $ $ 83 125 2,597 (189) 2,504 $ Netofan of Somon Omonand more Nebent pense of min Simon and more Newb minando poco Not of bonell profilon Somonand more The accomparing the Cow Sh o wer May 31, 2015 2014 3,852 $ 2.072 3258 2.220 2922 3434 3.947 355 399 818 15.976 3.011 13.696 2834 281 282 131 2.201 21.600S 1651 18,594 $ ASSETS Current assets Cash and equivalents Note 6 Short-term investments Note 6) Accounts receivable.net Note 1) Inventories Notes 1 and 2 Deferred income tax Note 9) Prepaid expenses and other current Notes and 17 Total current assets Property, plant and equipment, net Note 3 Identifiable intangible t s, net Note 4 Goodwil Note 4 Deferred income taxes and other assets Notes 6.9 and 17 TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current abilities Current portion of long term debt Note 8 Notes payable Note 7) Accounts payable Note 7) Accrued abilities Notes 5. 6 and 17) Income tax payable Note Total currenties Long-term debt Note 8) Deferred income taxes and other abilities Notes 6. 9. 13 and 17 Commitments and contingencies Note 16 Redeemable preferred stock Note 10) Shareholders' equity Common stock at started Note 11) Class A convertible-178 and 178 shares outstanding C -679 and 602 shares outstanding Capital in excess of stated value Accumulated other comprehensive income Note 14) Retained wings Total se g uit TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 107 74 2,131 3051 167 1.930 2.491 432 6.334 1019 5.027 1.199 1.544 5.805 35 6,773 1.246 4.685 12.707 21.600S 4871 10024 18.594 The accompanying So o n NIKE, Inc. Consolidated Statements of Cash Flows NIKE, Inc. Consolidated Statements of Cash Flows Year Ended May 31, 2014 2015 3.273 $ 2.000 $ 2.472 008 518 (11) 424 (124 2216 621) (144 (290 505) (210) 142 2192 28 Cash provided by operations: Net income Income charges foredits not affecting cash Depreciation Deferred income Stock-based compensation Note 11) Amortation and other Net foreign currency adjustments Net ganon divestres Changes in certain working capital components and other assets and tables Increase decrease in accounts receivable Increase in inventores Increase in prepaid expenses and other current Ingrescencounts pay dingen Cash provided by operations Cash used by Investing activities: Purchases of short-term investments Maurities of short-term investments Sales of short-term investments Investments in reverse repurchase agreements Additions to property, plant and equipment Disposal of property, plant and equipment Proceeds from divestitures in n etof other Cash Used by inviting activities Cash used by financing activities: Net proces from long-term d isance Long term payments, including current portion Decrease increase in notes payable 4.680 3,013 3702 14.90 3.655 2216 (150 1963) 3.002 1.126 14,133 1.063 1.330 1880 50 786 5. (1.207 163) 75 (17) (19 383 313 (1.674 132 (2.628) (799) (2.914) 702 514 218 2534 899 12.790 83 1.632 2.220 3,852 $ (Decrease increase in notes payable Payments on capital lease obligations Proceeds from exercise of stock options and other stock issuances Excess tax benefits from share-based payment arrangements Repurchase of common stock Dividends - common and preferred Cash used by financing activities Emoct of exchange rate changes on cash and equivalents Not increase (decrease in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for: Interest, net of capitalized interest Income taxes Non-cash additions to property, plant and equipment Dividends declared and not paid (1.045 (1.117) 3337 2,220 1.083 2254 3,337 $ $ 53 856 53 $ 1.262 206 240 702 167 137 188 209 The accompanying to the Cons u mer rangtom t NIKE, Inc. Consolidated Statements of Shareholders' Equity + Common Stock - Class A Class B Shares Amount Shares Amount 1805 736 3 Capital in Excess of Stated Value 5 4.641 322 Accumulated Other Comprehensive Income S 149 Retained Earnings $ 5,526 $ Total 10,319 322 (10) (1.647) (1.657) 65 174 (727) (727) 65 174 (4) (12 2.472 2.472 125 5.620S 11.081 445 (2.617) 2.628 (821) 820) 716 $ 3 $ 2 74 A millions of per share data Balance at May 31, 2012 Stock options exercised Conversion to Class B Common Stock Repurchase of Class B Common Stock Dividends on common stock $0.81 per share Issuance of shares to employees Stock-based compensation (Note 11) Forfeiture of shares from employees Net income Other comprehensive income osa) Balance at May 31, 2013 Stock options exercised Repurchase of Class B Common Stock Didends on common stock ($0.93 per share) Issuance of shares to employees Stock-based compensation (Note 11) Forfeiture of shares from employees Net income Othm ansininen Balance at May 31, 2014 Stock options exercised Repurchase of Class B Common Stock Dividends on common stock ($1.08 per share) Issuance of shares to employees Stock-based compensation (Note 11) Forfeiture of shares from employees Net income Other comprehensive income loss) Balance at May 31, 2015 S 5,184 S 445 (11) 78 78 177 8) 177 (4) 2.693 (12) 2.693 178 $ - 692 $ 3 $ $ (189) 85 $ 4,871 $ 5,865 639 (9) 10.824 639 2.534) 1931) (2.525) 1931) 92 92 191 191 3.273 1.161 3.273 1.161 178 S - 679 S 3 $ 6,773 $ 1,246 $ 4,686 $ 12,707 Chapter Review 14-10i Nike, Inc., Problem Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix E at the end of the text. The following additional information is available in thousands): Accounts receivable at May 31, 2013 Inventories at May 31, 2013 Total assets at May 31, 2013 Stockholders' equity at May 31, 2013 $ 3,117 3,484 17,545 11,081 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2015, and May 31. (Round ratios and percentages to one decimal place.) A. Working capital B. Current ratio C. Quick ratio D. Accounts receivable turnover E. Number of days' sales in receivables F. Inventory turnover G. Number of days' sales in inventory H. Ratio of liabilities to stockholders' equity H. Ratio of liabilities to stockholders' equity I. Asset turnover J. Return on total assets, assuming interest expense is $28 million for the year ending May 31, 2015, and $24 million for the year ending May 31, 2014 K. Return on common stockholders' equity L. Price-earnings ratio, assuming that the market price was $101.67 per share on May 29, 2015, and $76.91 per share on May 30, 2014 M. Percentage relationship of net income to sales What conclusions can be drawn from these analyses