Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Studio Limited is a company located in St. John's NL. The company manufactures and sells Louis Vuitton (LV) merchandise made from authenticated LV canvas

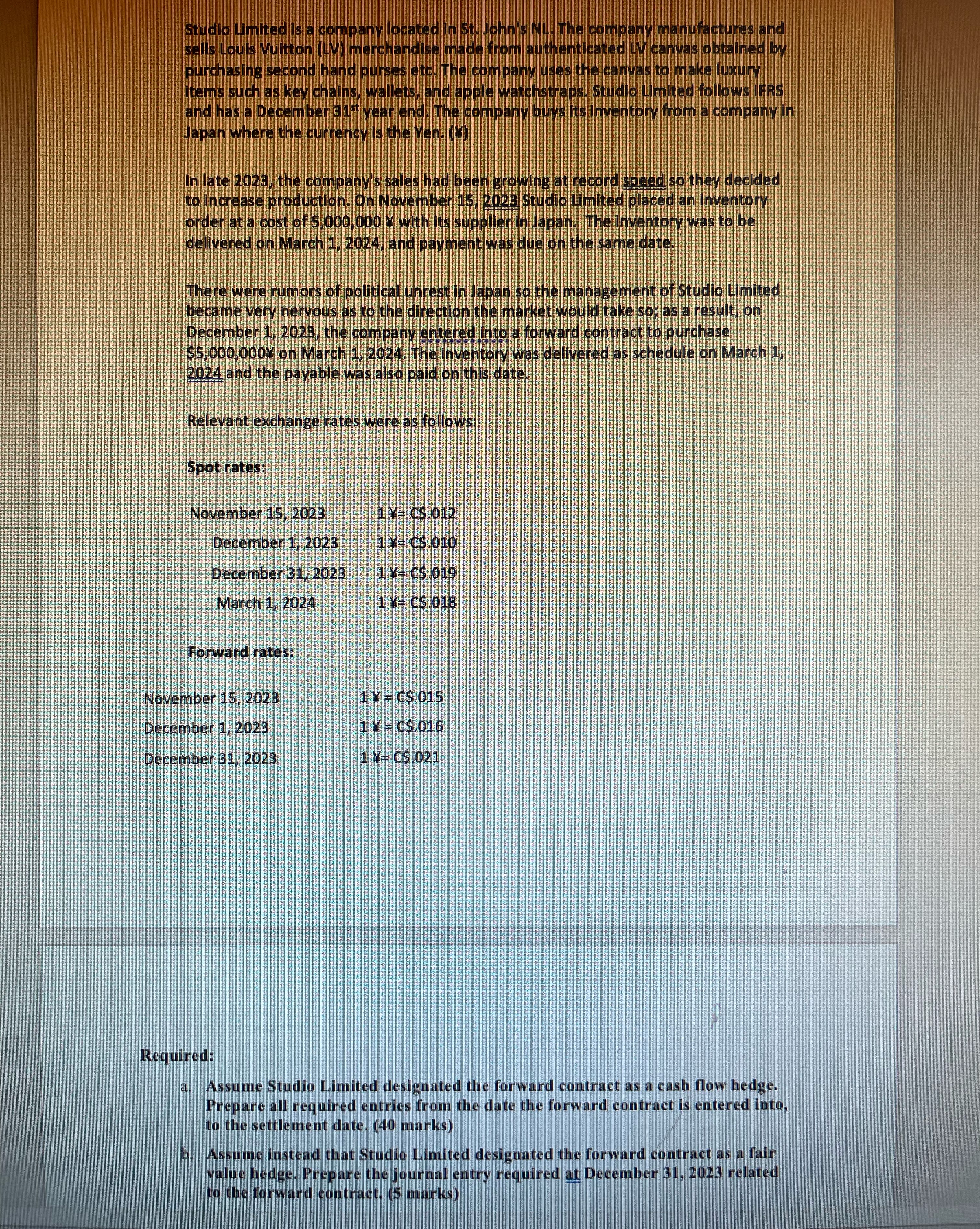

Studio Limited is a company located in St. John's NL. The company manufactures and sells Louis Vuitton (LV) merchandise made from authenticated LV canvas obtained by purchasing second hand purses etc. The company uses the canvas to make luxury items such as key chains, wallets, and apple watchstraps. Studio Limited follows IFRS and has a December 31st year end. The company buys its Inventory from a company in Japan where the currency is the Yen. (Y) In late 2023, the company's sales had been growing at record speed so they decided to Increase production. On November 15, 2023 Studio Limited placed an Inventory order at a cost of 5,000,000 X with its supplier in Japan. The Inventory was to be delivered on March 1, 2024, and payment was due on the same date. There were rumors of political unrest in Japan so the management of Studio Limited became very nervous as to the direction the market would take so; as a result, on December 1, 2023, the company entered into a forward contract to purchase $5,000,000% on March 1, 2024. The inventory was delivered as schedule on March 1, 2024 and the payable was also paid on this date. Relevant exchange rates were as follows: Spot rates: November 15, 2023 1 X= CS.012 December 1, 2023 1 X= C$.010 December 31, 2023 March 1, 2024 1 Y= CS.019 1 Y= CS.018 Forward rates: November 15, 2023 1 Y = C$.015 December 1, 2023 1 Y = C$.016 December 31, 2023 1 Y= CS.021 Required: Assume Studio Limited designated the forward contract as a cash flow hedge. Prepare all required entries from the date the forward contract is entered into, to the settlement date. (40 marks) b. Assume instead that Studio Limited designated the forward contract as a fair value hedge. Prepare the journal entry required at December 31, 2023 related to the forward contract. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided the company has been following a growth pattern since 2010 and a r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started