Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Managerial accounting information is generally prepared for A) regulatory agencies. B) investors. C) managers. D) stockholders. 2. Which one of the following is

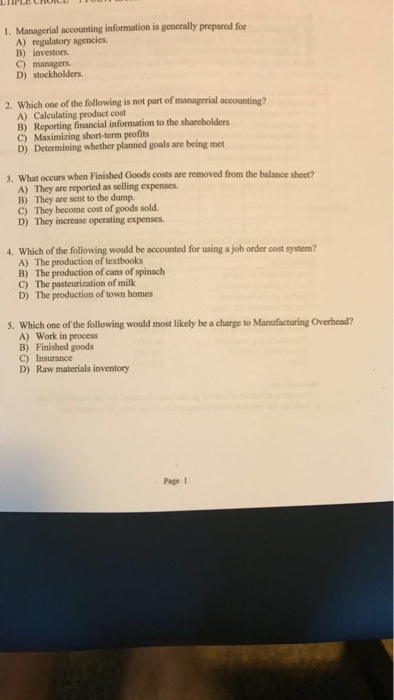

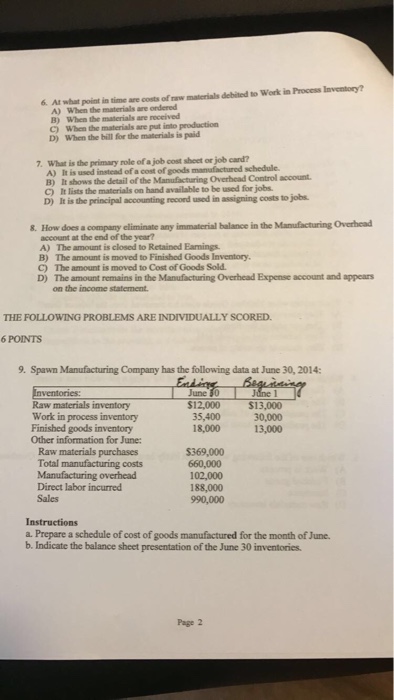

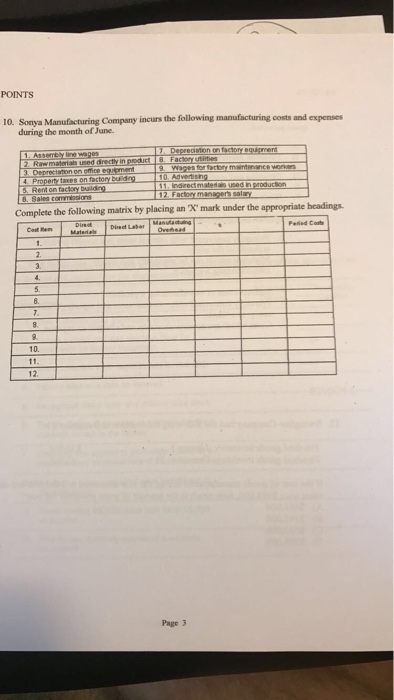

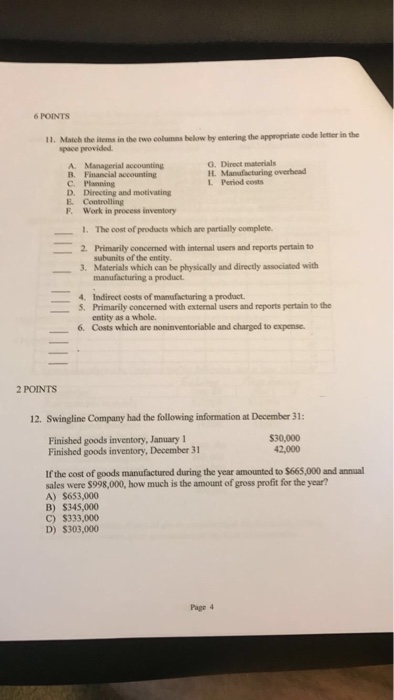

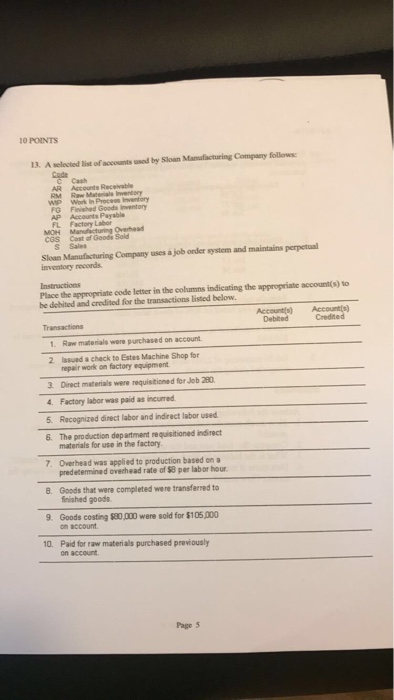

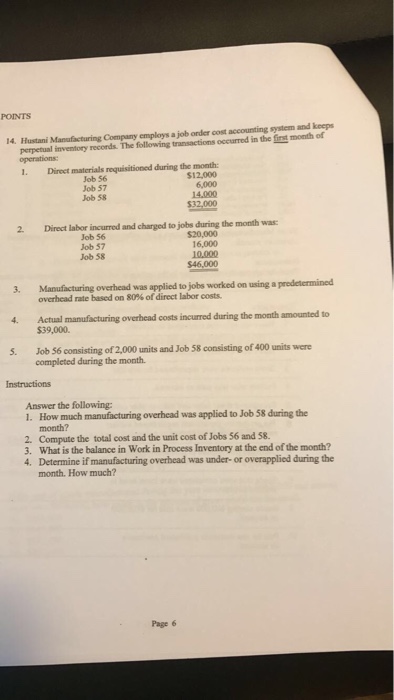

1. Managerial accounting information is generally prepared for A) regulatory agencies. B) investors. C) managers. D) stockholders. 2. Which one of the following is not part of managerial accounting? A) Calculating product cost B) Reporting financial information to the shareholders C) Maximizing short-term profits D) Determining whether planned goals are being met 3. What occurs when Finished Goods costs are removed from the balance sheet? A) They are reported as selling expenses. B) They are sent to the dump. C) They become cost of goods sold. D) They increase operating expenses. 4. Which of the following would be accounted for using a job order cost system? A) The production of textbooks B) The production of cans of spinach C) The pasteurization of milk D) The production of town homes 5. Which one of the following would most likely be a charge to Manufacturing Overhead? A) Work in process B) Finished goods C) Insurance D) Raw materials inventory Page 1 6. At what point in time are costs of raw materials debited to Work in Process Inventory? A) When the materials are ordered B) When the materials are received C) When the materials are put into production D) When the bill for the materials is paid 7. What is the primary role of a job cost sheet or job card? A) It is used instead of a cost of goods manufactured schedule. B) It shows the detail of the Manufacturing Overhead Control account. C) It lists the materials on hand available to be used for jobs. D) It is the principal accounting record used in assigning costs to jobs. 8. How does a company eliminate any immaterial balance in the Manufacturing Overhead account at the end of the year? A) The amount is closed to Retained Earnings. B) The amount is moved to Finished Goods Inventory. C) The amount is moved to Cost of Goods Sold. D) The amount remains in the Manufacturing Overhead Expense account and appears on the income statement. THE FOLLOWING PROBLEMS ARE INDIVIDUALLY SCORED. 6 POINTS 9. Spawn Manufacturing Company has the following data at June 30, 2014: Ending June 50 Inventories: Raw materials inventory Work in process inventory Finished goods inventory Other information for June: Raw materials purchases Total manufacturing costs Manufacturing overhead Direct labor incurred Sales $12,000 35,400 18,000 $369,000 660,000 102,000 188,000 990,000 June 1 $13,000 30,000 13,000 Instructions a. Prepare a schedule of cost of goods manufactured for the month of June. b. Indicate the balance sheet presentation of the June 30 inventories. Page 2 POINTS 10. Sonya Manufacturing Company incurs the following manufacturing costs and expenses during the month of June. 1. Assembly line wages 7. Depreciation on factory equipment 8. Factory utilities 2. Raw materials used directly in product 3. Depreciation on office equipment 9. Wages for factory maintenance workers 10. Advertising 4. Property taxes on factory building 5. Rent on factory building 11. Indirect materials used in production 12. Factory managers salary 6. Sales commissions Complete the following matrix by placing an 'X' mark under the appropriate headings. Did Laber Period Cos Cost 1. 2. 3. 4. 5. 6. 7. 8. 9 10. 11. 12. Dire Materials Manufacturing Overhead Page 3 "S 6 POINTS 11. Match the items in the two columns below by entering the appropriate code letter in the space provided. 2 POINTS A. Managerial accounting B. Financial accounting C. Planning D. Directing and motivating E. Controlling F. Work in process inventory 1. The cost of products which are partially complete. 2. Primarily concerned with internal users and reports pertain to subunits of the entity. 3. Materials which can be physically and directly associated with manufacturing a product. G. Direct materials H. Manufacturing overhead I Period costs 4. Indirect costs of manufacturing a product. 5. Primarily concerned with external users and reports pertain to the entity as a whole. 6. Costs which are noninventoriable and charged to expense. 12. Swingline Company had the following information at December 31: Finished goods inventory, January 1 Finished goods inventory, December 31 B) $345,000 C) $333,000 D) $303,000 If the cost of goods manufactured during the year amounted to $665,000 and annual sales were $998,000, how much is the amount of gross profit for the year? A) $653,000 $30,000 42,000 Page 4 10 POINTS 13. A selected list of accounts used by Sloan Manufacturing Company follows: Code C AR RM WP FG AP FL Cash Accounts Receivable Raw Materiale Inventory Work In Process Inventory Finished Goods Inventory Accounts Payable Factory Labor Manufacturing Overhead MOH COS Cost of Goods Sold S Sales Sloan Manufacturing Company uses a job order system and maintains perpetual inventory records. Instructions Place the appropriate code letter in the columns indicating the appropriate account(s) to be debited and credited for the transactions listed below. Transactions 1. Raw materials were purchased on account. 2. Issued a check to Estes Machine Shop for repair work on factory equipment. 3. Direct materials were requisitioned for Job 290. 4. Factory labor was paid as incurred. 5. Recognized direct labor and indirect labor used. 6. The production department requisitioned indirect materials for use in the factory. 7. Overhead was applied to production based on a predetermined overhead rate of $8 per labor hour. 8. Goods that were completed were transferred to finished goods 9. Goods costing $80,000 were sold for $105,000 on account. 10. Paid for raw materials purchased previously on account. Page 5 Account(s) Debited Account(s) Credited POINTS 14. Hustani Manufacturing Company employs a job order cost accounting system and keeps perpetual inventory records. The following transactions occurred in the first month of operations: 1. 2. 3. 4. 5. Direct materials requisitioned during the month: Job 56 $12,000 Job 57 Job 58 Direct labor incurred and charged to jobs during the month was: Job 56 $20,000 Job 57 Job 58 16,000 6,000 14,000 $32,000 Manufacturing overhead was applied to jobs worked on using a predetermined overhead rate based on 80% of direct labor costs. 10,000 $46,000 Actual manufacturing overhead costs incurred during the month amounted to $39,000. Instructions Job 56 consisting of 2,000 units and Job 58 consisting of 400 units were completed during the month. Page 6 Answer the following: 1. How much manufacturing overhead was applied to Job 58 during the month? 2. Compute the total cost and the unit cost of Jobs 56 and 58. 3. What is the balance in Work in Process Inventory at the end of the month? 4. Determine if manufacturing overhead was under- or overapplied during the month. How much?

Step by Step Solution

★★★★★

3.53 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers of managerial accounting questions 1 C managers Managerial accounting inform...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started