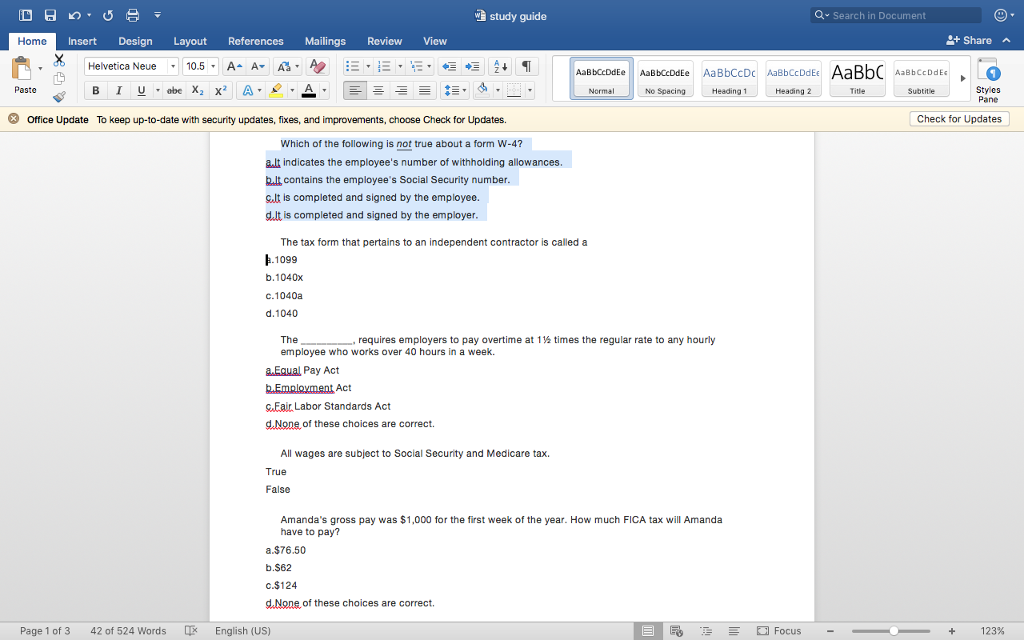

study guide Q Search in Document Home InsertDesign Layout References Mailings Revicw View +Share Helvetica Neue , 10.5, A-A, A--..:, T AaB bCcDdEe AaBbCcDd AaBbCcDdEe AaBbCcD AaBbCcDdE Paste Styles Pane No Heading1 Heading2 Title Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates he payroll register for the week ended June 20 for Sweet Treats Co. showed gross wages of $11,475.38 and deductions of $4,235.91. Wages and salaries expense would a.be debited for $15,711.29 b.be debited for $4,235.91 .be credited for $11,475.38 d.be debited for $11,475.38. The main advantage of using an electronic versus a manual payroll record-keeping system is a.that a manual system can be audited easier for errors and fraud b.that a manual system is more reliable and accurate. that in an electronic system only the employee number and hours worked need to be entered into a computer each pay period. dthat a manual system is prepared by hand and the same information would be recorded several times. An electronic payroll system involves information boutout input dAll of these choices are correct. Page 3 of 3 42 of 524 Words English (US) EFocus- 123% study guide Q Search in Document Home InsertDesign Layout References Mailings Revicw View +Share Helvetica Neue , 10.5, A A- , , , T AaB bCcDdEe AaBbCcDd AaBbCcDdEe AaBbCcD AaBbCcDdE Paste Styles Pane No Heading1 Heading2 Title Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates The account that should be credited for the total income tax withheld from employee's earnings is a Emplovee Federal Income Tax Payable FICA Tax Expense e,Employee Income Tax Expense dEICA Tax Payable The outputs from a manual or an electronic payroll accounting system include all the following except aSocial Security reports. emplovee eanings records. snavroll registers. d.payroll checks. Below is the payroll data forexinga Co. for the payroll period ended on December 18: Gross earnings $3,200.75 Deductions: Federal income tax $549.00 Social Security tax $484.25 Medicare tax $53.21 Health insurance premiums $107.00 Employee Credit Union Savings Plans $140.00 Net amount of payroll $1,867.29 The journal entry Brewings Co. will need to make to record the above payroll information includes: a.a debit to each individual deduction as an expense for its corresponding amount. adebit to Wages and Salaries Expense for $3,200.75 c.a credit to Cash for $3,200.75 debit to wages and Salaries Expense for $1,867.29 Page 2 of 3 42 of 524 Words English (US) Focus 123% study guide Q Search in Document Home InsertDesign Layout References Mailings Revicw View +Share Helvetica Neue , 10.5, A A- , -..:, T AaB bCcDdEe AaBbCcDd AaBbCcDdEe AaBbCcD AaBbCcDdE Paste Styles Pane No Heading1 Heading2 Title Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates Lindsay's current gross pay is $3,000. Her cumulative earnings before her current pay totaled $116,500. How much of her current gross pay is subject to Social Security Tax a.$0 b.$1,000 c.$2,000. d.$3,000 A separate record of each employee's earnings is called a pavroll check. bpayroll ledger c.amployee earnings record dnayroll register Which of the following is some of the information that should be provided on employce payroll records? mount of taxes and other items withheld. Gros amount of earnings accumulated for the year ross amount of earnings for each pay period dAll of these choices are correct. Page 1 of 3 42 of 524 Words English (US) Focus 123% study guide Q Search in Document Home InsertDesign Layout References Mailings Revicw View +Share Helvetica Neue , 10.5, A-A, A--..:, T AaB bCcDdEe AaBbCcDd AaBbCcDdEe AaBbCcD AaBbCcDdE Paste Styles Pane No Heading1 Heading2 Title Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates Which of the following is not true about a form W-4? alt indicates the employee's number of withholding allowances. ltcontains the employee's Social Security number Slt is completed and signed by the employee. dlt is completed and signed by the employer The tax form that pertains to an independent contractor is called a .1099 b.1040x c.1040a d.1040 Therequires employers to pay overtime at 1 times the regular rate to any hourly employee who works over 40 hours in a week. a Equal Pay Act c.Fair Labor Standards Act d.None of these choices are correct All wages are subject to Social Security and Medicare tax. True False Amanda's gross pay was $1,000 for the first week of the year. How much FICA tax will Amanda have to pay? a.$76.50 b.S62 C.$124 d None of these choices are correct. Page 1 of 3 42 of 524 Words English (US) Focus 123%