Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Study the following abstract and answer the questions that follow: Simbongile Limited Simbongile Limited (Simbongile or the company), is a company that manufactures devices

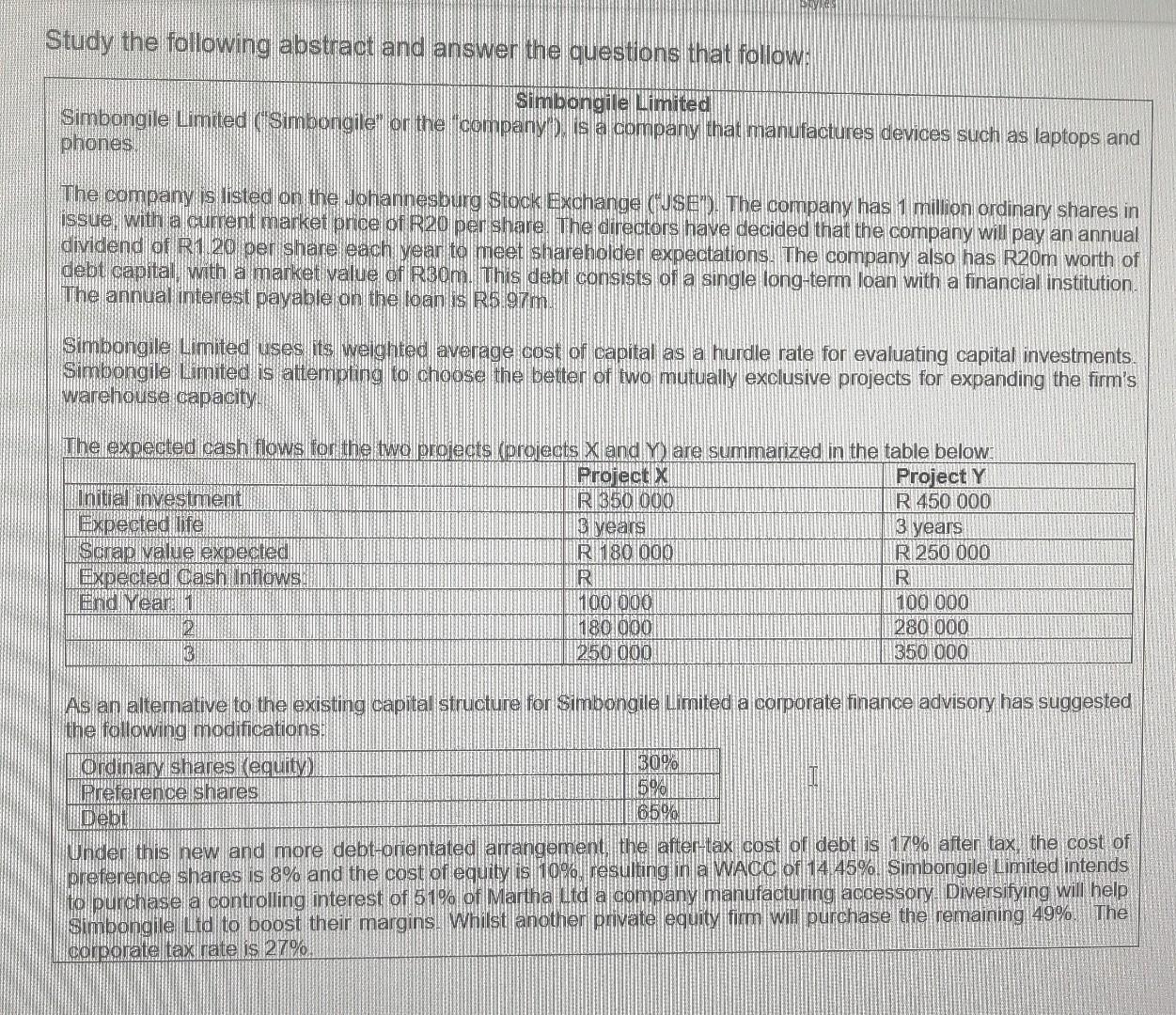

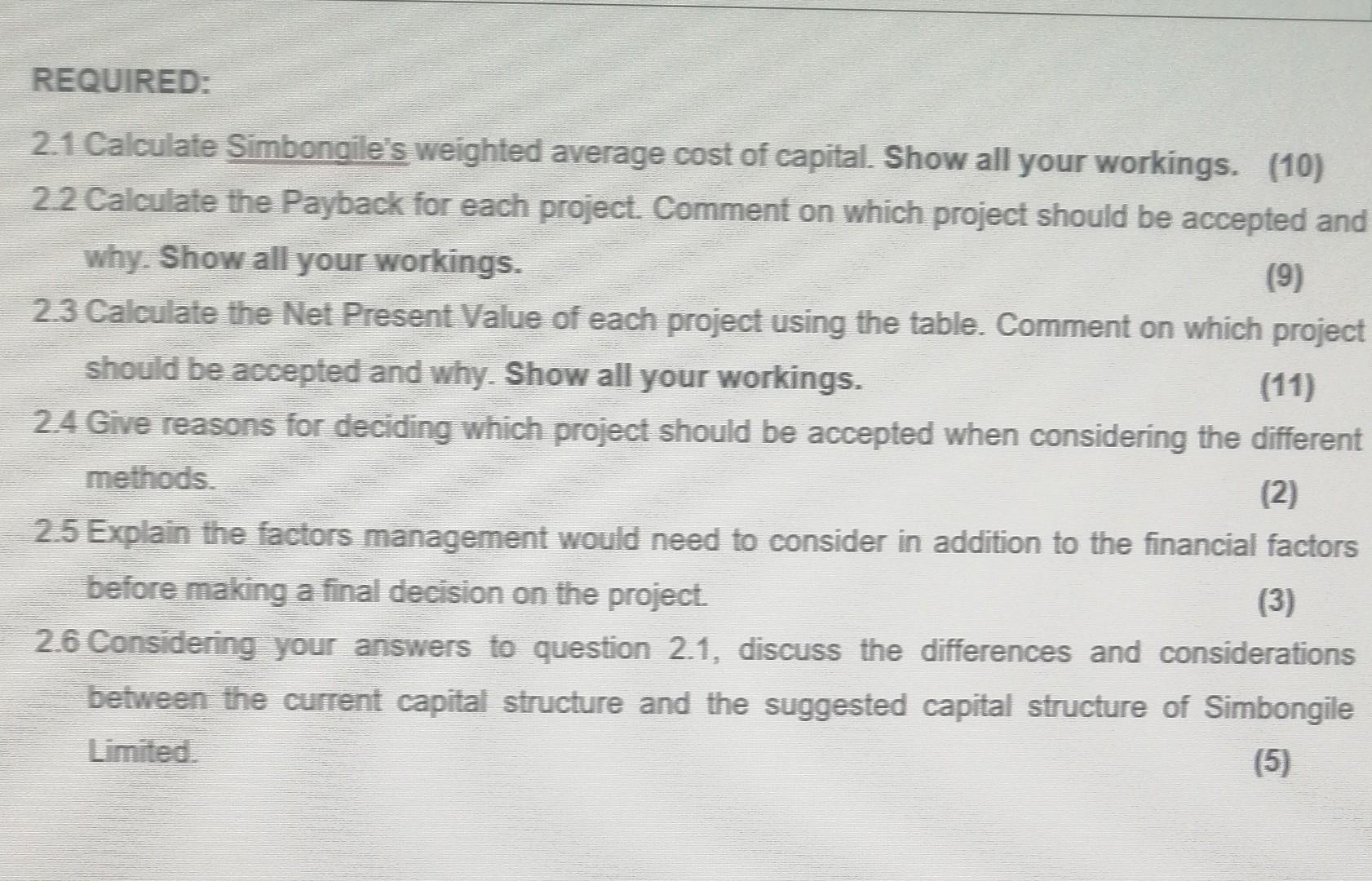

Study the following abstract and answer the questions that follow: Simbongile Limited Simbongile Limited ("Simbongile" or the "company"), is a company that manufactures devices such as laptops and phones The company is listed on the Johannesburg Stock Exchange ("JSE"). The company has 1 million ordinary shares in issue, with a current market price of R20 per share. The directors have decided that the company will pay an annual dividend of R1.20 per share each year to meet shareholder expectations. The company also has R20m worth of debt capital, with a market value of R30m. This debt consists of a single long-term loan with a financial institution. The annual interest payable on the loan is R5.97m. Simbongile Limited uses its weighted average cost of capital as a hurdle rate for evaluating capital investments. Simbongile Limited is attempting to choose the better of two mutually exclusive projects for expanding the firm's warehouse capacity. The expected cash flows for the two projects (projects X and Y) are summarized in the table below: Project X R 350 000 Initial investment Expected life Scrap value expected Expected Cash Inflows. End Year 1 3 years R 180 000 R Ordinary shares (equity) Preference shares 100 000 180 000 250 000 Project Y R 450 000 3 As an alternative to the existing capital structure for Simbongile Limited a corporate finance advisory has suggested the following modifications. 30% 5% 65% 3 years R 250 000 R 100 000 280 000 350 000 Debt Under this new and more debt-orientated arrangement, the after-tax cost of debt is 17% after tax, the cost of preference shares is 8% and the cost of equity is 10%, resulting in a WACC of 14.45%. Simbongile Limited intends to purchase a controlling interest of 51% of Martha Ltd a company manufacturing accessory. Diversifying will help Simbongile Ltd to boost their margins. Whilst another private equity firm will purchase the remaining 49%. The corporate tax rate is 27%. REQUIRED: 2.1 Calculate Simbongile's weighted average cost of capital. Show all your workings. (10) 2.2 Calculate the Payback for each project. Comment on which project should be accepted and why. Show all your workings. (9) 2.3 Calculate the Net Present Value of each project using the table. Comment on which project should be accepted and why. Show all your workings. (11) 2.4 Give reasons for deciding which project should be accepted when considering the different methods. (2) 2.5 Explain the factors management would need to consider in addition to the financial factors before making a final decision on the project. (3) 2.6 Considering your answers to question 2.1, discuss the differences and considerations between the current capital structure and the suggested capital structure of Simbongile Limited. (5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

21 Calculate Simbongiles Weighted Average Cost of Capital WACC WACCEVRe PVRp DVRd 1Tc Where E Market value of equity P Market value of preference shares D Market value of debt V Total market value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started