Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Style Limited obtained a licence from the Customs and Excise department on 15 December 2021 to manufacture leather jackets for export. The company commenced

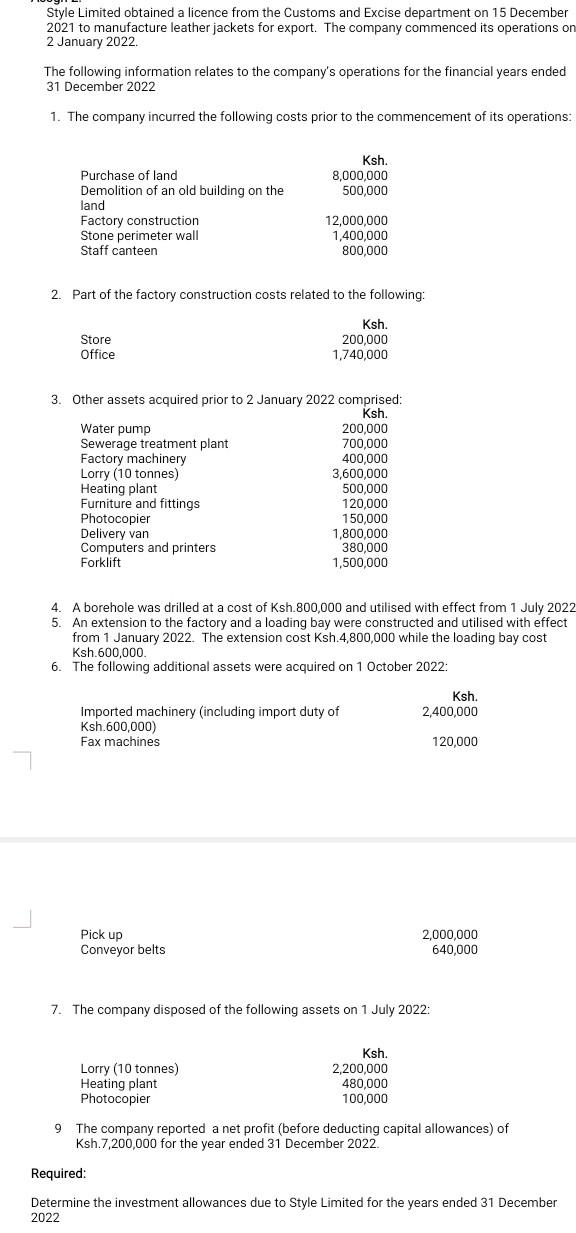

Style Limited obtained a licence from the Customs and Excise department on 15 December 2021 to manufacture leather jackets for export. The company commenced its operations on 2 January 2022. The following information relates to the company's operations for the financial years ended 31 December 2022 1. The company incurred the following costs prior to the commencement of its operations: Purchase of land Demolition of an old building on the land Factory construction Stone perimeter wall Staff canteen Store Office 2. Part of the factory construction costs related to the following: Water pump Sewerage treatment plant Factory machinery Lorry (10 tonnes) Heating plant Furniture and fittings Photocopier Delivery van Computers and printers Forklift Ksh. 8,000,000 500,000 3. Other assets acquired prior to 2 January 2022 comprised: Ksh. 12,000,000 1,400,000 800,000 Pick up Conveyor belts Ksh. 200,000 1,740,000 Lorry (10 tonnes) Heating plant Photocopier 200,000 700,000 400,000 3,600,000 4. A borehole was drilled at a cost of Ksh.800,000 and utilised with effect from 1 July 2022 5. An extension to the factory and a loading bay were constructed and utilised with effect from 1 January 2022. The extension cost Ksh.4,800,000 while the loading bay cost Ksh.600,000. 6. The following additional assets were acquired on 1 October 2022: 500,000 120,000 150,000 1,800,000 380,000 1,500,000 Imported machinery (including import duty of Ksh.600,000) Fax machines Ksh. 2,400,000 7. The company disposed of the following assets on 1 July 2022: Ksh. 2,200,000 480,000 100,000 120,000 2,000,000 640,000 9 The company reported a net profit (before deducting capital allowances) of Ksh.7,200,000 for the year ended 31 December 2022. Required: Determine the investment allowances due to Style Limited for the years ended 31 December 2022

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the investment allowances due to Style Limited for the year ended 31 December 2022 we need to calculate the capital allowances for the qualifying assets acquired and utilized dur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started