Question

Subject 1 (40%) A. As a business valuation expert, you have been allotted with the project to estimate the cost of equity for Alton Holdings.

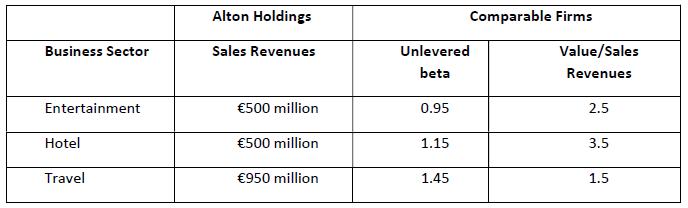

Subject 1 (40%) A. As a business valuation expert, you have been allotted with the project to estimate the cost of equity for Alton Holdings. Alton Holdings operates in three different business sectors - Entertainment, Hotels, and Travel Services. The table beneath gives the information you collected both for the firm and for other comparable firms in each business sector.

i. Estimate the (bottom-up) unlevered beta for Alton Holdings. (10 marks)

ii. Assume that Alton Holdings has no market-traded debt but €1.3 billion in book debt, an interest expense of €75 million per year, maturity 5 years and corporate bonds with the same credit rating as Alton Holdings yield 7.5%. Estimate the market value of debt of Alton Holdings. (5 marks)

iii. Assume next that Alton Holdings has 100 million shares trading at €12 per share. The tax rate is 40%. Estimate the (bottom up) levered beta for the Alton Holdings. (5 marks)

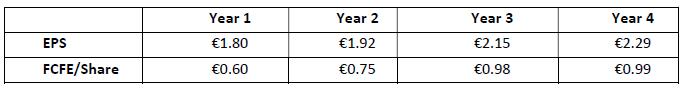

B. As a business valuation expert, you have been also assigned the project to value Enter music Company, a manufacturer of guitars, other musical instruments, and consumer and professional electronics. The table that follows gives the firm’s estimated free cash flows to

equity (FCFE) and the earnings per share (EPS) for the next 4 years.

Enter music has no debt or working capital needs. The current beta of the firm is 1.6 but it is expected to drop to 1.2 after Year 4. The firm expects its earnings per share and its net capital expenditures to grow 5% per year after Year 4. The debt ratio will remain 0%, the T-bond rate is constant at 7% for the period and the market risk premium is 5%.

i. Estimate the terminal value of equity per share at Year 4. (5 marks)

ii. Estimate the value per share today. (5 marks)

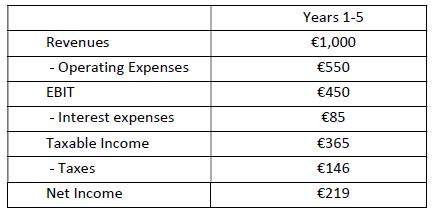

C. You have been assigned to check the valuation of Info Systems, a software firm, done by a colleague of you. Info systems has an expected life 5 years, constant cash flows over this period, and zero salvage value. The income statement of the Info systems is given as follows:

Info systems has no capital expenditures, depreciation or working capital needs, i.e. the earnings are the cash flows to the firm. The cost of capital is 10%

i. Estimate the value of Infosystems. (5 marks)

ii. Assume that the value derived in (i) is the one also estimated by your colleague. How would you change your calculations if you are given that the cash flows are real cash flows and the cost of capital is the nominal cost of capital. The expected inflation rate is 2% annually. Comment on your answer. (5 marks)

Business Sector Entertainment Hotel Travel Alton Holdings Sales Revenues 500 million 500 million 950 million Unlevered beta 0.95 1.15 Comparable Firms 1.45 Value/Sales Revenues 2.5 3.5 1.5

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information here is a breakdown of the cash flows for years 1 to 5 Year 1 Revenues 1000 Operating Expenses 550 EBIT 450 Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started