Answered step by step

Verified Expert Solution

Question

1 Approved Answer

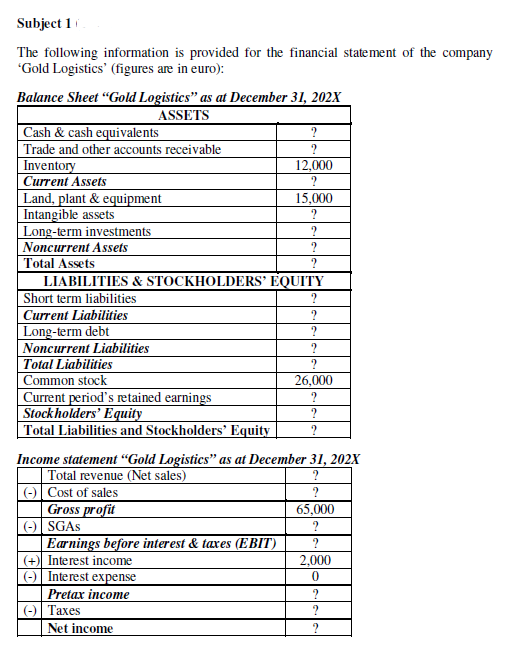

Subject 1 The following information is provided for the financial statement of the company 'Gold Logistics' (figures are in euro): Balance Sheet Gold Logistics as

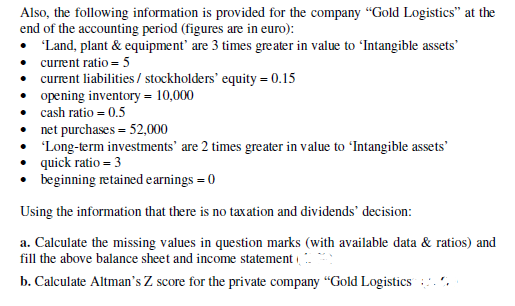

Subject 1 The following information is provided for the financial statement of the company 'Gold Logistics' (figures are in euro): Balance Sheet "Gold Logistics as at December 31, 202X ASSETS Cash & cash equivalents Trade and other accounts receivable ? Inventory 12,000 Current Assets ? Land, plant & equipment 15,000 Intangible assets Long-term investments Noncurrent Assets ? Total Assets LIABILITIES & STOCKHOLDERS' EQUITY Short term liabilities Current Liabilities ? Long-term debt Noncurrent Liabilities ? Total Liabilities Common stock 26,000 Current period's retained earnings Stockholders' Equity Total Liabilities and Stockholders' Equity ? Income statement "Gold Logistics" as at December 31, 202X Total revenue (Net sales) ? Cost of sales ? Gross profit 65,000 - SGAS ? Earnings before interest & taxes (EBIT) ? (+) Interest income 2,000 Interest expense 0 Pretax income ? - Taxes ? Net income 2 Also, the following information is provided for the company "Gold Logistics at the end of the accounting period (figures are in euro): 'Land, plant & equipment are 3 times greater in value to 'Intangible assets' current ratio = 5 current liabilities / stockholders' equity = 0.15 opening inventory = 10,000 cash ratio = 0.5 net purchases = 52,000 'Long-term investments' are 2 times greater in value to 'Intangible assets' quick ratio = 3 beginning retained earnings = 0 Using the information that there is no taxation and dividends' decision: a. Calculate the missing values in question marks (with available data & ratios) and fill the above balance sheet and income statement :- b. Calculate Altman's Z score for the private company "Gold Logistics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started