Subject: Auditing and Assurance

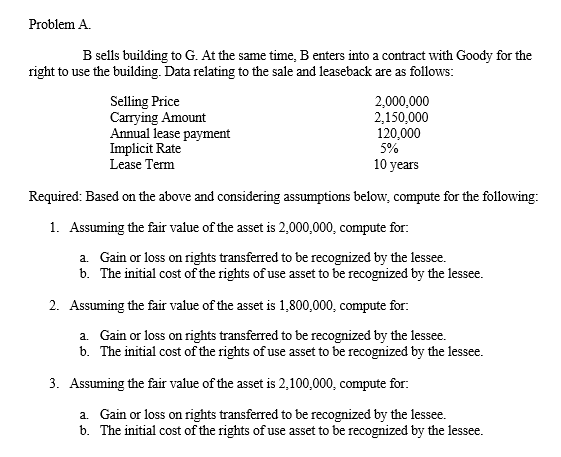

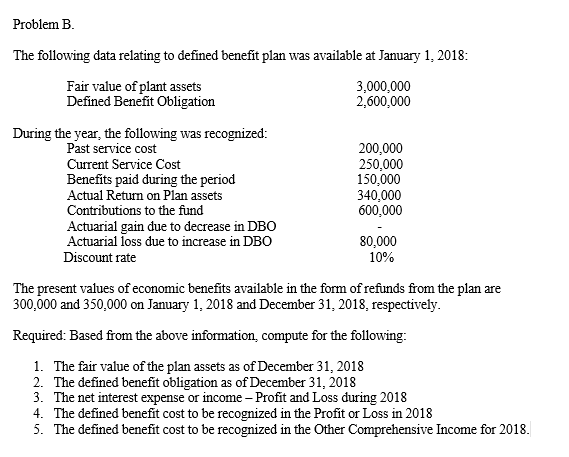

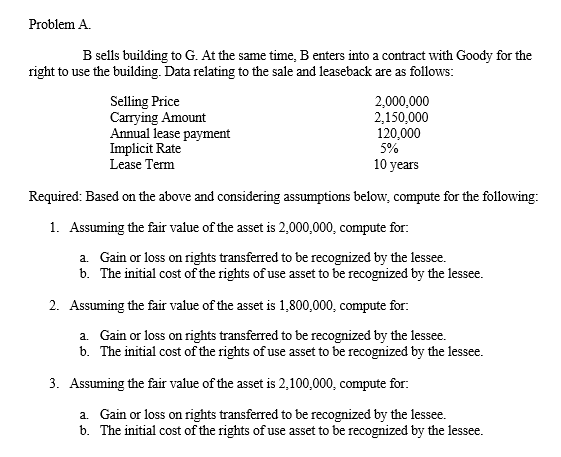

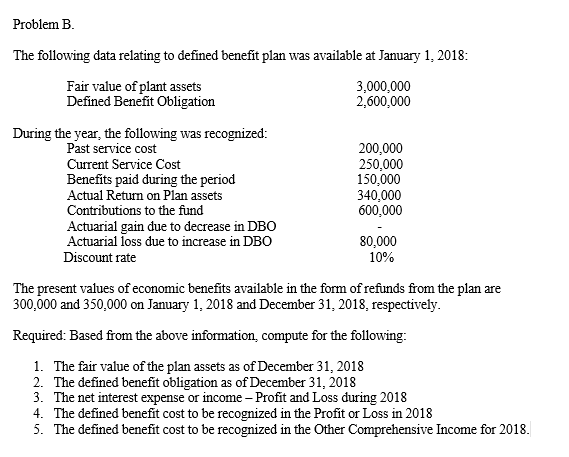

Problem A. 5% B sells building to G. At the same time, B enters into a contract with Goody for the right to use the building. Data relating to the sale and leaseback are as follows: Selling Price 2,000,000 Carrying Amount 2,150,000 Annual lease payment 120,000 Implicit Rate Lease Term 10 years Required: Based on the above and considering assumptions below, compute for the following: 1. Assuming the fair value of the asset is 2,000,000, compute for: a. Gain or loss on rights transferred to be recognized by the lessee. b. The initial cost of the rights of use asset to be recognized by the lessee. 2. Assuming the fair value of the asset is 1.800.000, compute for: a. Gain or loss on rights transferred to be recognized by the lessee. b. The initial cost of the rights of use asset to be recognized by the lessee. 3. Assuming the fair value of the asset is 2,100,000, compute for: a. Gain or loss on rights transferred to be recognized by the lessee. b. The initial cost of the rights of use asset to be recognized by the lessee. Problem B. The following data relating to defined benefit plan was available at January 1, 2018: Fair value of plant assets 3,000,000 Defined Benefit Obligation 2,600,000 During the year, the following was recognized: Past service cost 200,000 Current Service Cost 250,000 Benefits paid during the period 150,000 Actual Return on Plan assets 340,000 Contributions to the fund 600,000 Actuarial gain due to decrease in DBO Actuarial loss due to increase in DBO 80,000 Discount rate 10% The present values of economic benefits available in the form of refunds from the plan are 300,000 and 350,000 on January 1, 2018 and December 31, 2018, respectively. Required: Based from the above information, compute for the following: 1. The fair value of the plan assets as of December 31, 2018 2. The defined benefit obligation as of December 31, 2018 3. The net interest expense or income - Profit and Loss during 2018 4. The defined benefit cost to be recognized in the Profit or Loss in 2018 5. The defined benefit cost to be recognized in the Other Comprehensive Income for 2018. Problem A. 5% B sells building to G. At the same time, B enters into a contract with Goody for the right to use the building. Data relating to the sale and leaseback are as follows: Selling Price 2,000,000 Carrying Amount 2,150,000 Annual lease payment 120,000 Implicit Rate Lease Term 10 years Required: Based on the above and considering assumptions below, compute for the following: 1. Assuming the fair value of the asset is 2,000,000, compute for: a. Gain or loss on rights transferred to be recognized by the lessee. b. The initial cost of the rights of use asset to be recognized by the lessee. 2. Assuming the fair value of the asset is 1.800.000, compute for: a. Gain or loss on rights transferred to be recognized by the lessee. b. The initial cost of the rights of use asset to be recognized by the lessee. 3. Assuming the fair value of the asset is 2,100,000, compute for: a. Gain or loss on rights transferred to be recognized by the lessee. b. The initial cost of the rights of use asset to be recognized by the lessee. Problem B. The following data relating to defined benefit plan was available at January 1, 2018: Fair value of plant assets 3,000,000 Defined Benefit Obligation 2,600,000 During the year, the following was recognized: Past service cost 200,000 Current Service Cost 250,000 Benefits paid during the period 150,000 Actual Return on Plan assets 340,000 Contributions to the fund 600,000 Actuarial gain due to decrease in DBO Actuarial loss due to increase in DBO 80,000 Discount rate 10% The present values of economic benefits available in the form of refunds from the plan are 300,000 and 350,000 on January 1, 2018 and December 31, 2018, respectively. Required: Based from the above information, compute for the following: 1. The fair value of the plan assets as of December 31, 2018 2. The defined benefit obligation as of December 31, 2018 3. The net interest expense or income - Profit and Loss during 2018 4. The defined benefit cost to be recognized in the Profit or Loss in 2018 5. The defined benefit cost to be recognized in the Other Comprehensive Income for 2018