Answered step by step

Verified Expert Solution

Question

1 Approved Answer

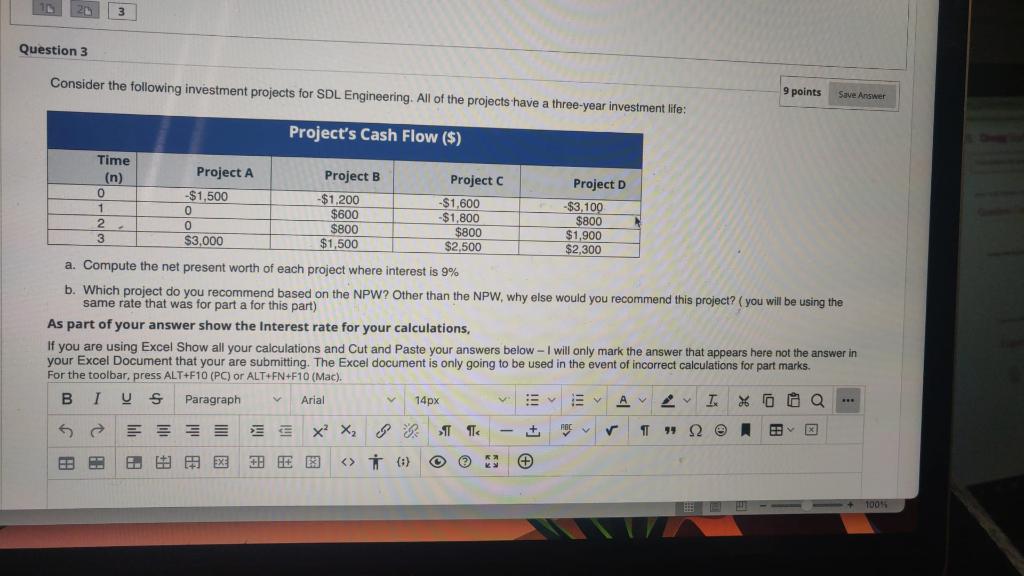

Subject : Business FInance (Engineering Economics) 3 Question 3 Consider the following investment projects for SDL Engineering. All of the projects have a three-year investment

Subject : Business FInance (Engineering Economics)

3 Question 3 Consider the following investment projects for SDL Engineering. All of the projects have a three-year investment life: 9 points Save Answer Project's Cash Flow ($) Time Project A Project B Project C Project D 0 -$1,500 -$1,200 -$1,600 1 -$3,100 0 $600 -$1,800 $800 22 0 $800 $800 3 $1,900 $3,000 $1,500 $2,500 $2,300 a. Compute the net present worth of each project where interest is 9% b. Which project do you recommend based on the NPW? Other than the NPW, why else would you recommend this project? (you will be using the same rate that was for part a for this part) As part of your answer show the Interest rate for your calculations, If you are using Excel Show all your calculations and Cut and paste your answers below - I will only mark the answer that appears here not the answer in your Excel Document that your are submitting. The Excel document is only going to be used in the event of incorrect calculations for part marks. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 14px E A2 % da SS T The TT x 94 92 E. EF E 13 + 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started