Answered step by step

Verified Expert Solution

Question

1 Approved Answer

subject : corporate finance Your solutions must delineate how you reach the final answer. I need answers a) thru g) got answers a thru e

subject : corporate finance

Your solutions must delineate how you reach the final answer.

I need answers a) thru g)

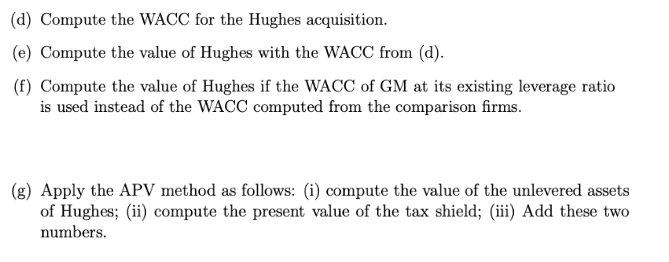

got answers a thru e but i m not sure these are correct or not...

could you give me how to solve f and g ? and also tell me if a) thru e) answers are right or wrong

need answers for the final in next month (practicing problems for the final but do not have official answers in the book...)

these are the answers that i got ....help please

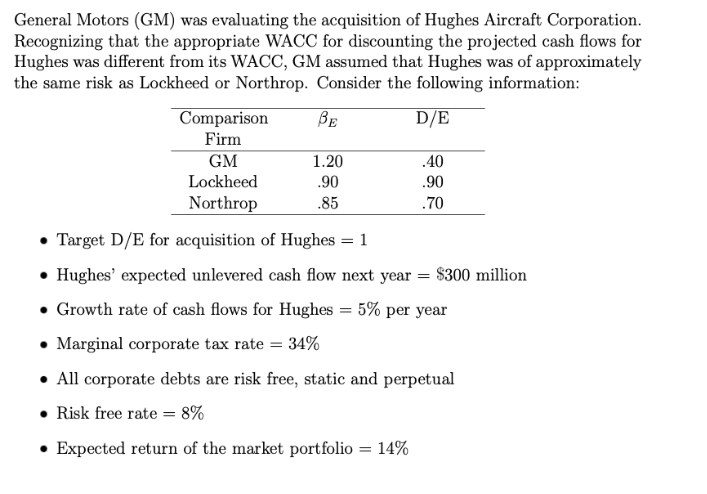

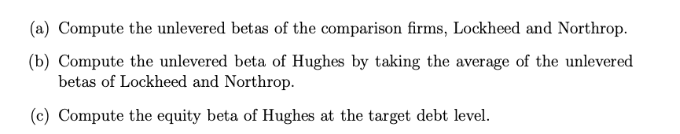

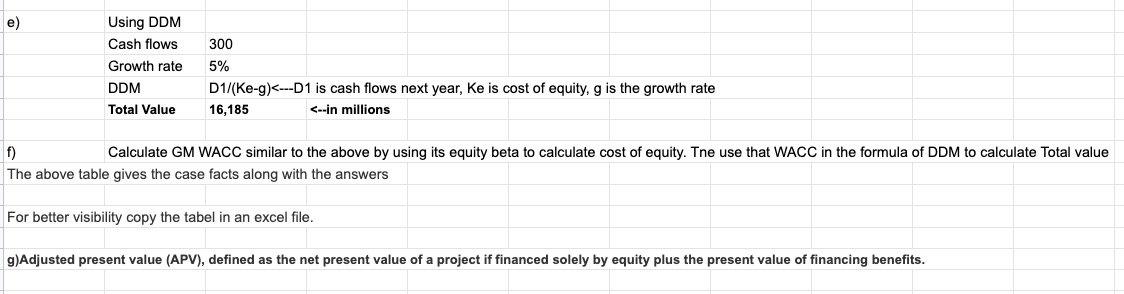

General Motors (GM) was evaluating the acquisition of Hughes Aircraft Corporation. Recognizing that the appropriate WACC for discounting the projected cash flows for Hughes was different from its WACC, GM assumed that Hughes was of approximately the same risk as Lockheed or Northrop. Consider the following information: Comparison BE D/E Firm GM 1.20 .40 Lockheed .90 .90 Northrop .85 .70 Target D/E for acquisition of Hughes = 1 Hughes' expected unlevered cash flow next year = $300 million Growth rate of cash flows for Hughes = 5% per year Marginal corporate tax rate = 34% All corporate debts are risk free, static and perpetual Risk free rate = 8% Expected return of the market portfolio 14% (a) Compute the unlevered betas of the comparison firms, Lockheed and Northrop. (b) Compute the unlevered beta of Hughes by taking the average of the unlevered betas of Lockheed and Northrop. (c) Compute the equity beta of Hughes at the target debt level. (d) Compute the WACC for the Hughes acquisition. (e) Compute the value of Hughes with the WACC from (d). (f) Compute the value of Hughes if the WACC of GM at its existing leverage ratio is used instead of the WACC computed from the comparison firms. (g) Apply the APV method as follows: (i) compute the value of the unlevered assets of Hughes; (ii) compute the present value of the tax shield; (iii) Add these two numbers. Unleverd Beta 0.4 Beta (Equity) D/E GM 1.2 Lockheed 0.9 Northrop 0.85 0.9 0.95 0.56 0.58

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started