Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subject :- CREDIT & RISK MANAGEMENT Total Marks: 10 SEMESTER FALL 2021 CREDIT & RISK MANAGEMENT (FIN625) Assignment 2 - Due Date: February 22, 2022

Subject :- CREDIT & RISK MANAGEMENT

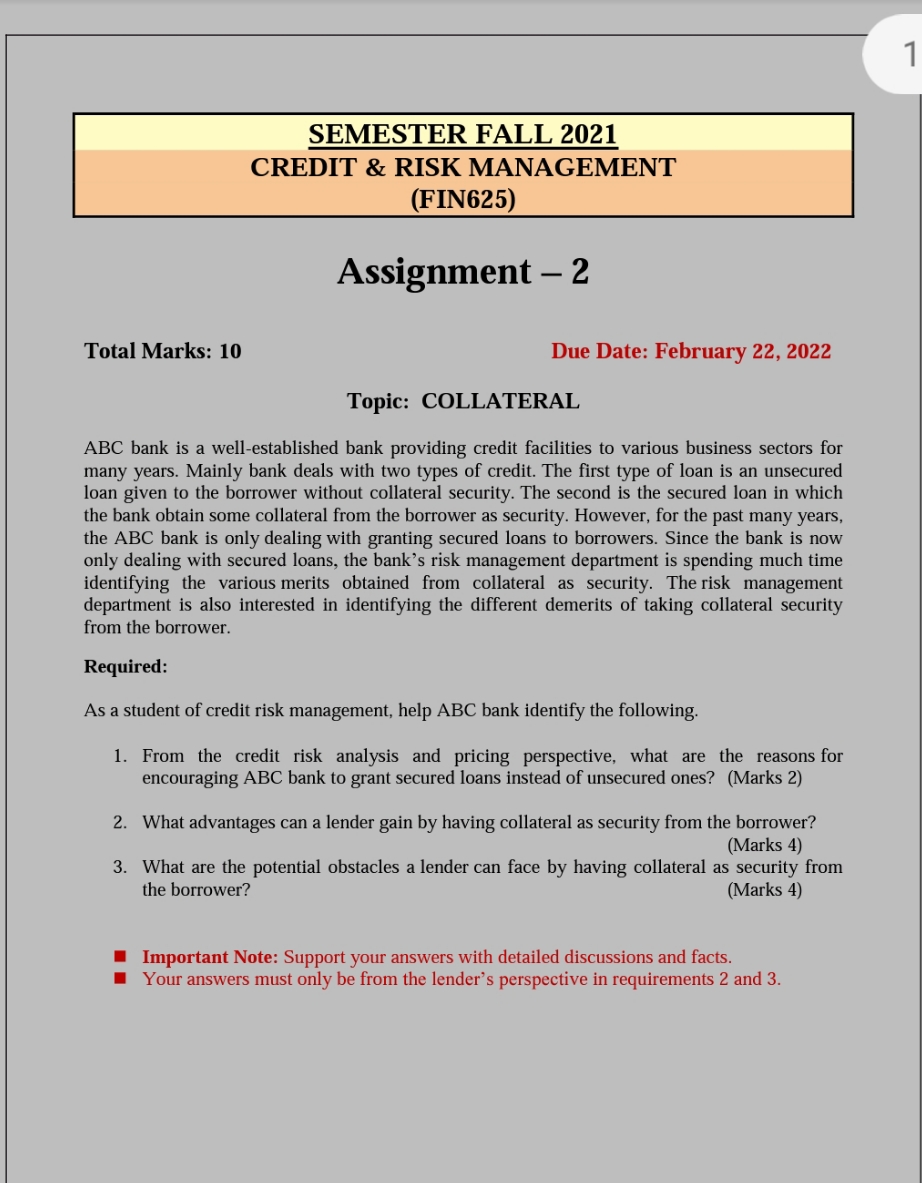

Total Marks: 10 SEMESTER FALL 2021 CREDIT & RISK MANAGEMENT (FIN625) Assignment 2 - Due Date: February 22, 2022 Topic: COLLATERAL ABC bank is a well-established bank providing credit facilities to various business sectors for many years. Mainly bank deals with two types of credit. The first type of loan is an unsecured loan given to the borrower without collateral security. The second is the secured loan in which the bank obtain some collateral from the borrower as security. However, for the past many years, the ABC bank is only dealing with granting secured loans to borrowers. Since the bank is now only dealing with secured loans, the bank's risk management department is spending much time identifying the various merits obtained from collateral as security. The risk management department is also interested in identifying the different demerits of taking collateral security from the borrower. Required: As a student of credit risk management, help ABC bank identify the following. 1. From the credit risk analysis and pricing perspective, what are the reasons for encouraging ABC bank to grant secured loans instead of unsecured ones? (Marks 2) 2. What advantages can a lender gain by having collateral as security from the borrower? (Marks 4) 3. What are the potential obstacles a lender can face by having collateral as security from the borrower? (Marks 4) Important Note: Support your answers with detailed discussions and facts. Your answers must only be from the lender's perspective in requirements 2 and 3. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Reasons for Encouraging Secured Loans Over Unsecured Ones From a credit risk analysis and pricing perspective encouraging secured loans over unsecured ones offers several benefits Reduced Credit Ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started