Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subject: FIN444 - International Financial Management Critical Thinking Question Thank you sir. Swarovski is an Austrian producer of premium jewelry and fashion accessories. One of

Subject: FIN444 - International Financial Management

Critical Thinking Question

Thank you sir.

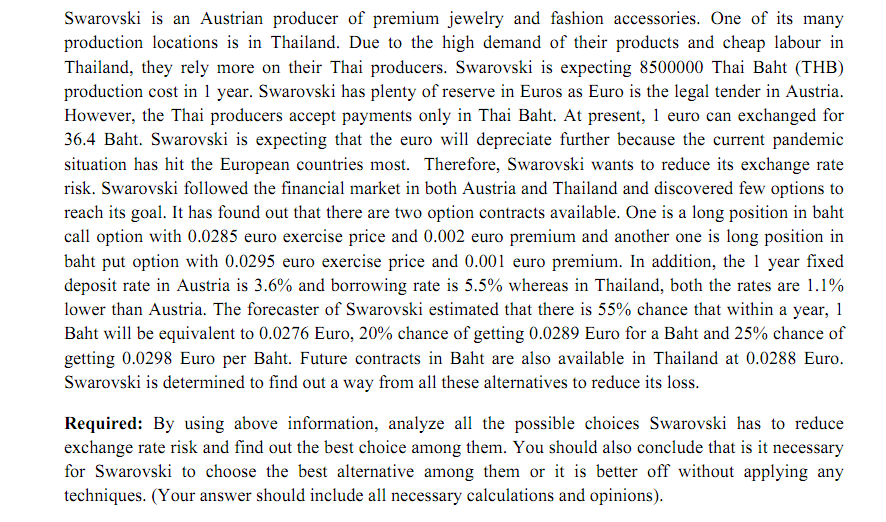

Swarovski is an Austrian producer of premium jewelry and fashion accessories. One of its many production locations is in Thailand. Due to the high demand of their products and cheap labour in Thailand, they rely more on their Thai producers. Swarovski is expecting 8500000 Thai Baht (THB) production cost in 1 year. Swarovski has plenty of reserve in Euros as Euro is the legal tender in Austria. However, the Thai producers accept payments only in Thai Baht. At present, 1 euro can exchanged for 36.4 Baht. Swarovski is expecting that the euro will depreciate further because the current pandemic situation has hit the European countries most. Therefore, Swarovski wants to reduce its exchange rate risk. Swarovski followed the financial market in both Austria and Thailand and discovered few options to reach its goal. It has found out that there are two option contracts available. One is a long position in baht call option with 0.0285 euro exercise price and 0.002 euro premium and another one is long position in baht put option with 0.0295 euro exercise price and 0.001 euro premium. In addition, the 1 year fixed deposit rate in Austria is 3.6% and borrowing rate is 5.5% whereas in Thailand, both the rates are 1.1% lower than Austria. The forecaster of Swarovski estimated that there is 55% chance that within a year, 1 Baht will be equivalent to 0.0276 Euro, 20% chance of getting 0.0289 Euro for a Baht and 25% chance of getting 0.0298 Euro per Baht. Future contracts in Baht are also available in Thailand at 0.0288 Euro. Swarovski is determined to find out a way from all these alternatives to reduce its loss. Required: By using above information, analyze all the possible choices Swarovski has to reduce exchange rate risk and find out the best choice among them. You should also conclude that is it necessary for Swarovski to choose the best alternative among them or it is better off without applying any techniques. (Your answer should include all necessary calculations and opinions). Swarovski is an Austrian producer of premium jewelry and fashion accessories. One of its many production locations is in Thailand. Due to the high demand of their products and cheap labour in Thailand, they rely more on their Thai producers. Swarovski is expecting 8500000 Thai Baht (THB) production cost in 1 year. Swarovski has plenty of reserve in Euros as Euro is the legal tender in Austria. However, the Thai producers accept payments only in Thai Baht. At present, 1 euro can exchanged for 36.4 Baht. Swarovski is expecting that the euro will depreciate further because the current pandemic situation has hit the European countries most. Therefore, Swarovski wants to reduce its exchange rate risk. Swarovski followed the financial market in both Austria and Thailand and discovered few options to reach its goal. It has found out that there are two option contracts available. One is a long position in baht call option with 0.0285 euro exercise price and 0.002 euro premium and another one is long position in baht put option with 0.0295 euro exercise price and 0.001 euro premium. In addition, the 1 year fixed deposit rate in Austria is 3.6% and borrowing rate is 5.5% whereas in Thailand, both the rates are 1.1% lower than Austria. The forecaster of Swarovski estimated that there is 55% chance that within a year, 1 Baht will be equivalent to 0.0276 Euro, 20% chance of getting 0.0289 Euro for a Baht and 25% chance of getting 0.0298 Euro per Baht. Future contracts in Baht are also available in Thailand at 0.0288 Euro. Swarovski is determined to find out a way from all these alternatives to reduce its loss. Required: By using above information, analyze all the possible choices Swarovski has to reduce exchange rate risk and find out the best choice among them. You should also conclude that is it necessary for Swarovski to choose the best alternative among them or it is better off without applying any techniques. (Your answer should include all necessary calculations and opinions)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started