Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SUBJECT: FINANCE FOR SUPPLY CHAIN MANAGERS Illustration 2 The financial controller of ABC Co. Ltd., Mr. Osei Antwi-Boasiako is gathering data to prepare a cash

SUBJECT: FINANCE FOR SUPPLY CHAIN MANAGERS

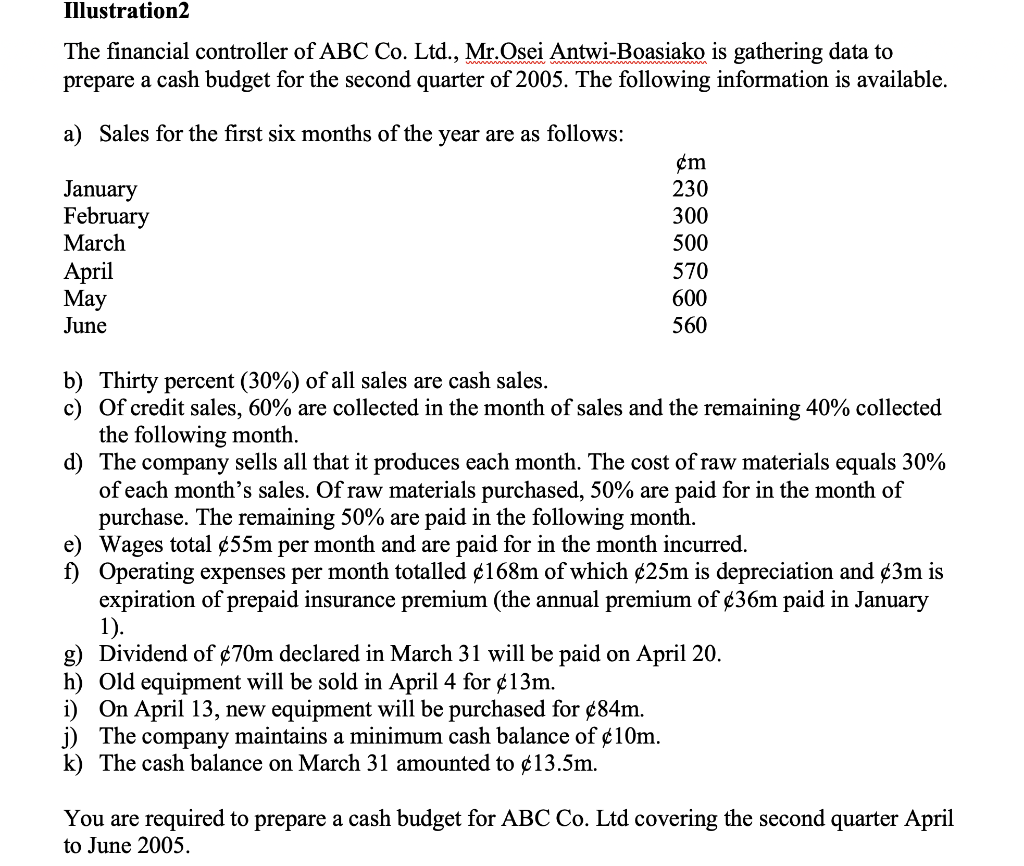

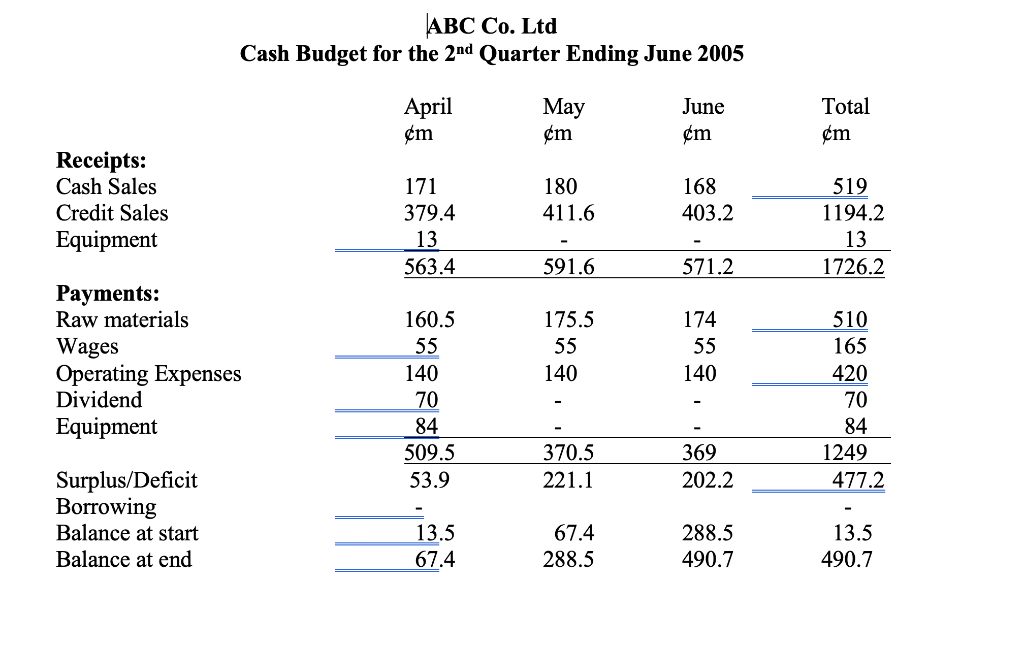

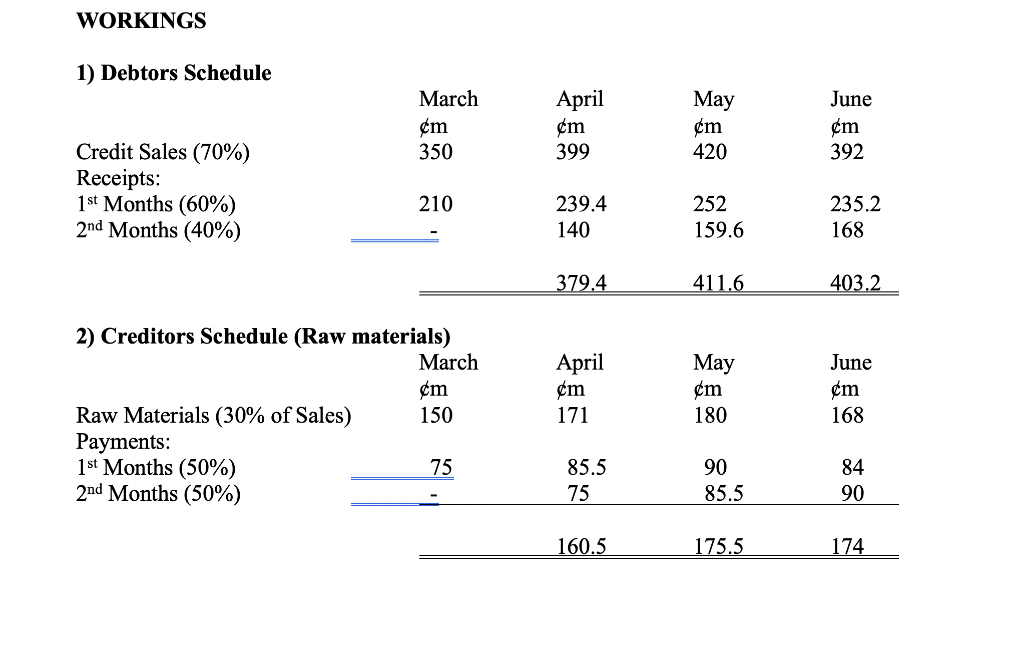

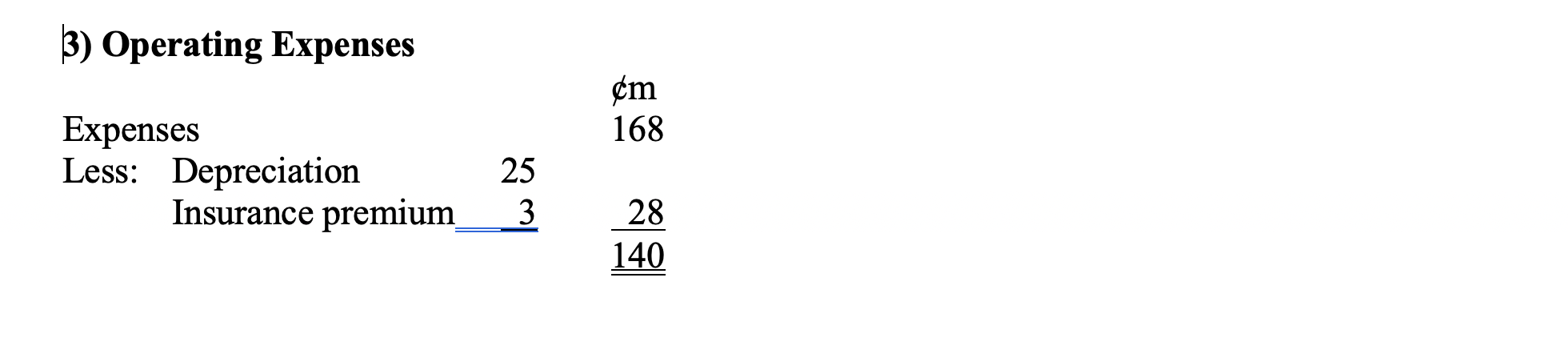

Illustration 2 The financial controller of ABC Co. Ltd., Mr. Osei Antwi-Boasiako is gathering data to prepare a cash budget for the second quarter of 2005. The following information is available. a) Sales for the first six months of the year are as follows: m 230 300 January February March April May June 500 570 600 560 b) Thirty percent (30%) of all sales are cash sales. c) Of credit sales, 60% are collected in the month of sales and the remaining 40% collected the following month. d) The company sells all that it produces each month. The cost of raw materials equals 30% of each month's sales. Of raw materials purchased, 50% are paid for in the month of purchase. The remaining 50% are paid in the following month. e) Wages total $55m per month and are paid for in the month incurred. f) Operating expenses per month totalled 168m of which 25m is depreciation and 3m is expiration of prepaid insurance premium (the annual premium of 36m paid in January 1). g) Dividend of 70m declared in March 31 will be paid on April 20. h) Old equipment will be sold in April 4 for $13m. i) On April 13, new equipment will be purchased for 84m. j) The company maintains a minimum cash balance of 10m. k) The cash balance on March 31 amounted to $13.5m. You are required to prepare a cash budget for ABC Co. Ltd covering the second quarter April to June 2005. ABC Co. Ltd Cash Budget for the 2nd Quarter Ending June 2005 April m May em June em Total m Receipts: Cash Sales Credit Sales Equipment 180 411.6 168 403.2 171 379.4 13 563.4 519 1194.2 13 1726.2 591.6 571.2 Payments: Raw materials Wages Operating Expenses Dividend Equipment 175.5 55 140 174 55 140 160.5 55 140 70 84 509.5 53.9 510 165 420 70 84 1249 477.2 370.5 221.1 369 202.2 Surplus/Deficit Borrowing Balance at start Balance at end 13.5 67.4 67.4 288.5 288.5 490.7 13.5 490.7 WORKINGS 1) Debtors Schedule May March m 350 April em 399 m 420 June m 392 Credit Sales (70%) Receipts: 1st Months (60%) 2nd Months (40%) 210 239.4 140 252 159.6 235.2 168 379.4 411.6 403.2 2) Creditors Schedule (Raw materials) March m Raw Materials (30% of Sales) 150 Payments: 1st Months (50%) 75 2nd Months (50%) April m 171 May m 180 June m 168 85.5 75 90 85.5 84 90 160.5 175.5 174 b) Operating Expenses m 168 Expenses Less: Depreciation Insurance premium 25 3 28 140 Illustration 2 The financial controller of ABC Co. Ltd., Mr. Osei Antwi-Boasiako is gathering data to prepare a cash budget for the second quarter of 2005. The following information is available. a) Sales for the first six months of the year are as follows: m 230 300 January February March April May June 500 570 600 560 b) Thirty percent (30%) of all sales are cash sales. c) Of credit sales, 60% are collected in the month of sales and the remaining 40% collected the following month. d) The company sells all that it produces each month. The cost of raw materials equals 30% of each month's sales. Of raw materials purchased, 50% are paid for in the month of purchase. The remaining 50% are paid in the following month. e) Wages total $55m per month and are paid for in the month incurred. f) Operating expenses per month totalled 168m of which 25m is depreciation and 3m is expiration of prepaid insurance premium (the annual premium of 36m paid in January 1). g) Dividend of 70m declared in March 31 will be paid on April 20. h) Old equipment will be sold in April 4 for $13m. i) On April 13, new equipment will be purchased for 84m. j) The company maintains a minimum cash balance of 10m. k) The cash balance on March 31 amounted to $13.5m. You are required to prepare a cash budget for ABC Co. Ltd covering the second quarter April to June 2005. ABC Co. Ltd Cash Budget for the 2nd Quarter Ending June 2005 April m May em June em Total m Receipts: Cash Sales Credit Sales Equipment 180 411.6 168 403.2 171 379.4 13 563.4 519 1194.2 13 1726.2 591.6 571.2 Payments: Raw materials Wages Operating Expenses Dividend Equipment 175.5 55 140 174 55 140 160.5 55 140 70 84 509.5 53.9 510 165 420 70 84 1249 477.2 370.5 221.1 369 202.2 Surplus/Deficit Borrowing Balance at start Balance at end 13.5 67.4 67.4 288.5 288.5 490.7 13.5 490.7 WORKINGS 1) Debtors Schedule May March m 350 April em 399 m 420 June m 392 Credit Sales (70%) Receipts: 1st Months (60%) 2nd Months (40%) 210 239.4 140 252 159.6 235.2 168 379.4 411.6 403.2 2) Creditors Schedule (Raw materials) March m Raw Materials (30% of Sales) 150 Payments: 1st Months (50%) 75 2nd Months (50%) April m 171 May m 180 June m 168 85.5 75 90 85.5 84 90 160.5 175.5 174 b) Operating Expenses m 168 Expenses Less: Depreciation Insurance premium 25 3 28 140Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started