Answered step by step

Verified Expert Solution

Question

1 Approved Answer

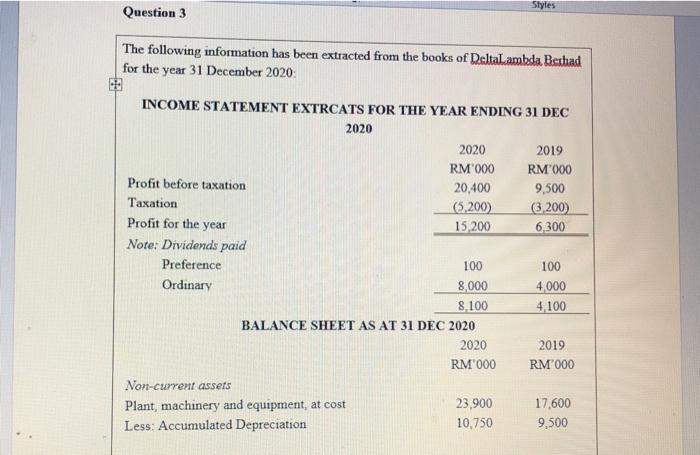

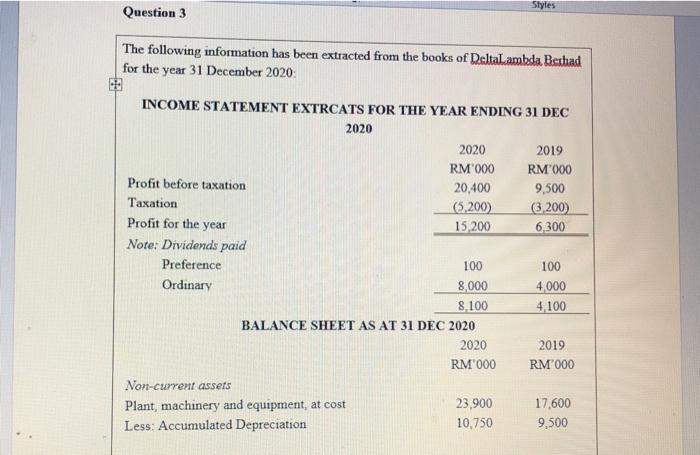

subject financial accounting 2 course accounting and finance Q3 Styles Question 3 The following information has been extracted from the books of DeltaLambda Berhad for

subject financial accounting 2

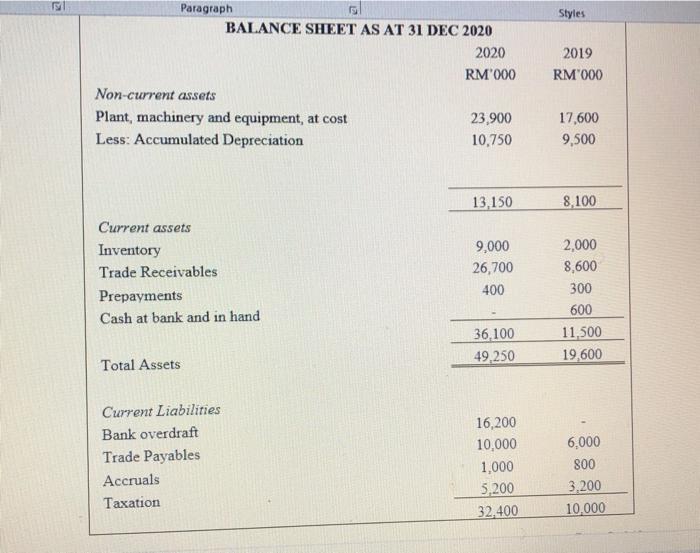

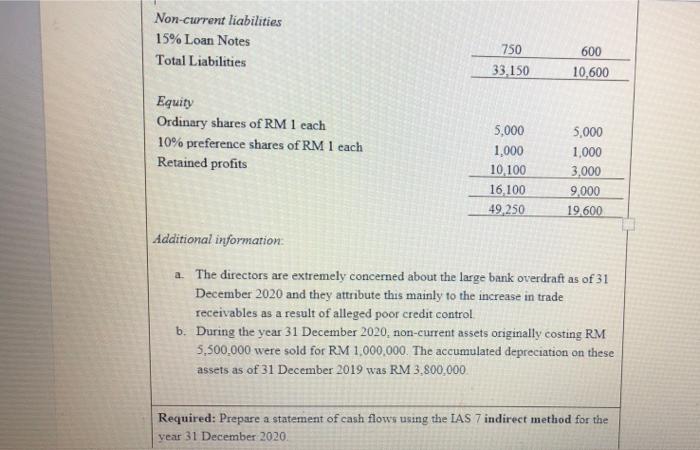

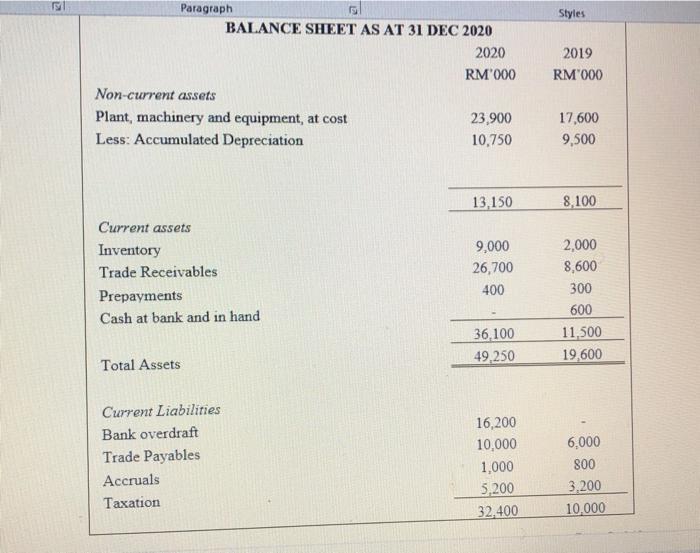

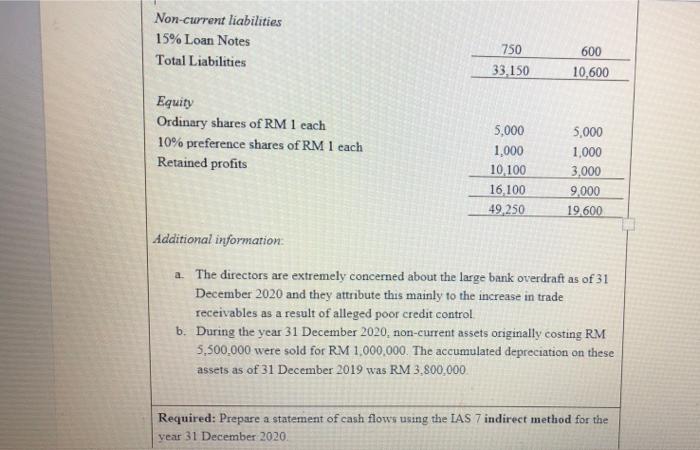

Styles Question 3 The following information has been extracted from the books of DeltaLambda Berhad for the year 31 December 2020: INCOME STATEMENT EXTRCATS FOR THE YEAR ENDING 31 DEC 2020 2020 2019 RM 000 RM 000 Profit before taxation 20,400 9,500 Taxation (5,200) (3,200) Profit for the year 15,200 6,300 Note: Dividends paid Preference 100 100 Ordinary 8,000 4,000 8 100 4,100 BALANCE SHEET AS AT 31 DEC 2020 2020 2019 RM 000 RM 000 Non-current assets Plant, machinery and equipment, at cost 23,900 17,600 Less: Accumulated Depreciation 10.750 9.500 Styles Paragraph BALANCE SHEET AS AT 31 DEC 2020 2020 RM'000 Non-current assets Plant, machinery and equipment, at cost 23,900 Less: Accumulated Depreciation 10,750 2019 RM'000 17,600 9,500 13,150 8.100 Current assets Inventory Trade Receivables Prepayments Cash at bank and in hand 9,000 26,700 400 2,000 8,600 300 600 11.500 19,600 36.100 49,250 Total Assets Current Liabilities Bank overdraft Trade Payables Accruals Taxation 16,200 10,000 1,000 5.200 32,400 6,000 800 3,200 10,000 Non-current liabilities 15% Loan Notes Total Liabilities 750 33.150 600 10,600 Equity Ordinary shares of RM 1 each 10% preference shares of RM 1 each Retained profits 5,000 1,000 10.100 16 100 49,250 5,000 1,000 3,000 9,000 19.600 Additional information a. The directors are extremely concerned about the large bank overdraft as of 31 December 2020 and they attribute this mainly to the increase in trade receivables as a result of alleged poor credit control b. During the year 31 December 2020, non-current assets originally costing RM 5.500.000 were sold for RM 1,000,000. The accumulated depreciation on these assets as of 31 December 2019 was RM 3.800,000 Required: Prepare a statement of cash flows using the IAS 7 indirect method for the vear 31 December 2020 course accounting and finance

Q3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started