Answered step by step

Verified Expert Solution

Question

1 Approved Answer

subject financial accounting 2 course accounting & finance q4 Question 4 The following is a list of assets of Pfizer Sdn Bhd at 1 April

subject financial accounting 2

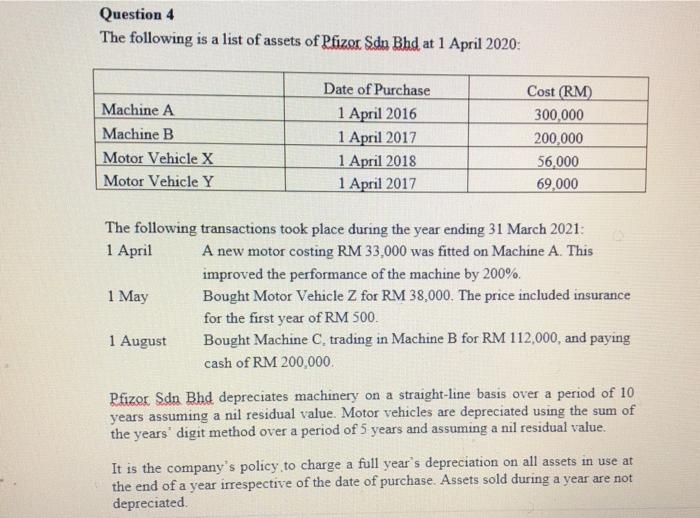

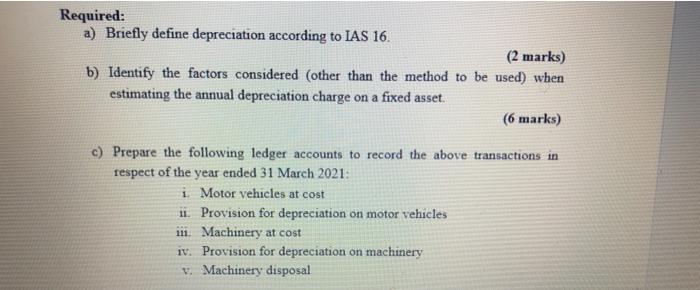

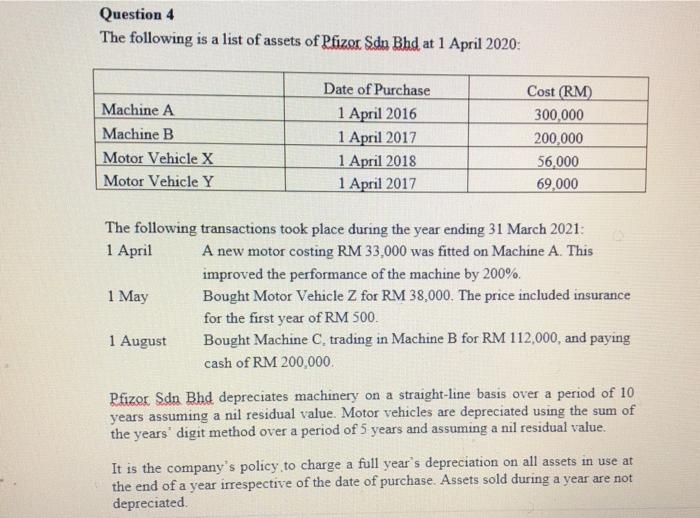

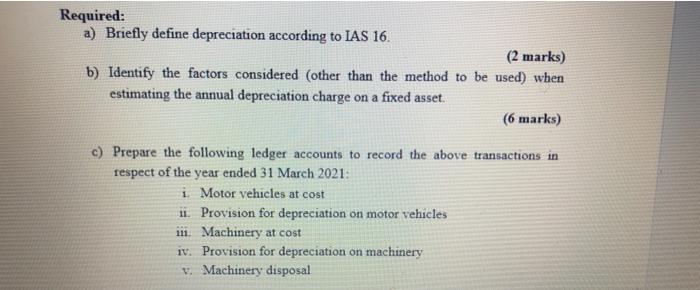

Question 4 The following is a list of assets of Pfizer Sdn Bhd at 1 April 2020: Machine A Machine B Motor Vehicle X Motor Vehicle Y Date of Purchase 1 April 2016 1 April 2017 1 April 2018 1 April 2017 Cost (RM) 300,000 200,000 56,000 69,000 The following transactions took place during the year ending 31 March 2021 1 April A new motor costing RM 33,000 was fitted on Machine A. This improved the performance of the machine by 200%. 1 May Bought Motor Vehicle Z for RM 38.000. The price included insurance for the first year of RM 500. 1 August Bought Machine C. trading in Machine B for RM 112,000, and paying cash of RM 200,000 Pfizer Sdn Bhd depreciates machinery on a straight-line basis over a period of 10 years assuming a nil residual value. Motor vehicles are depreciated using the sum of the years' digit method over a period of 5 years and assuming a nil residual value. It is the company's policy to charge a full year's depreciation on all assets in use at the end of a year irrespective of the date of purchase. Assets sold during a year are not depreciated. Required: a) Briefly define depreciation according to IAS 16. (2 marks) b) Identify the factors considered (other than the method to be used) when estimating the annual depreciation charge on a fixed asset. (6 marks) c) Prepare the following ledger accounts to record the above transactions in respect of the year ended 31 March 2021: i Motor vehicles at cost 11. Provision for depreciation on motor vehicles 11. Machinery at cost iv. Provision for depreciation on machinery 1. Machinery disposal course accounting & finance q4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started