Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subject: Financial Modeling - You must show how you do your solutions and all the steps. You also need to show the formulas you use.

Subject: Financial Modeling

- You must show how you do your solutions and all the steps. You also need to show the formulas you use. You are expected to interpret the results obtained

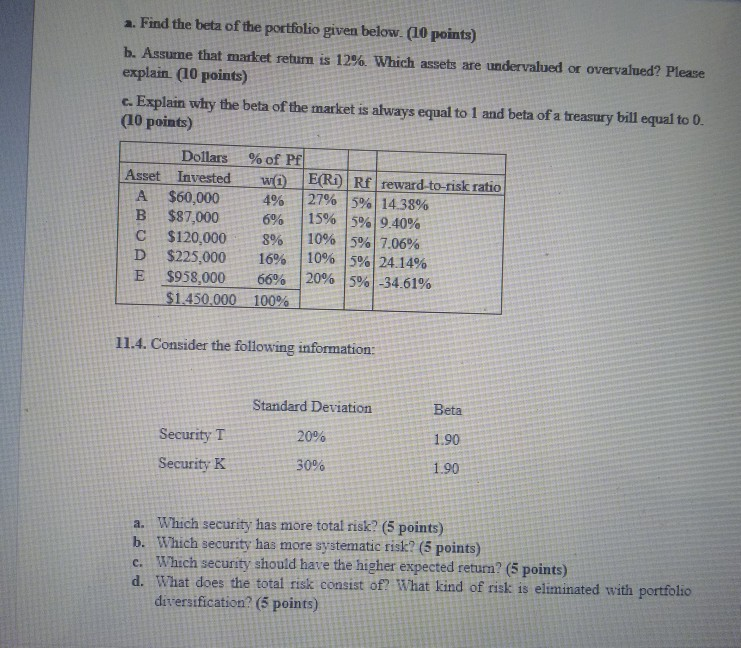

a. Find the beta of the portfolio given below. (10 points) b. Assume that market return is 12%. Which assets are undervalued or overvalued? Please explain (10 points) c. Explain why the beta of the market is always equal to 1 and beta of a treasury bill equal to 0. (10 points) Dollars % of PE Asset Invested wi) E(R) Rf reward-to-risk ratio $60,000 4% 27% 5% 14.38% B $87,000 6% 15% 5% 9.40% $120,000 8% 10% 5% 7.06% D $225,000 16% 10% 5%24.14% E $958,000 66% 20% 5% -34,61% $1.450.000 100% 11.4. Consider the following information: Standard Deviation Beta 20% 1.90 Security I Security K 30% 1.90 a. Which security has more total risk? (5 points) b. Which security has more systematic risk? (5 points) c. Which security should have the higher expected retum? (5 points) d. What does the total risk consist of? What kind of risk is eliminated with portfolio diversification? 6 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started