Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subject: International Finance Management Thank you sir. 1. Which of the following factors will lead to an inflow of portfolio investment into a country? a)

Subject: International Finance Management

Thank you sir.

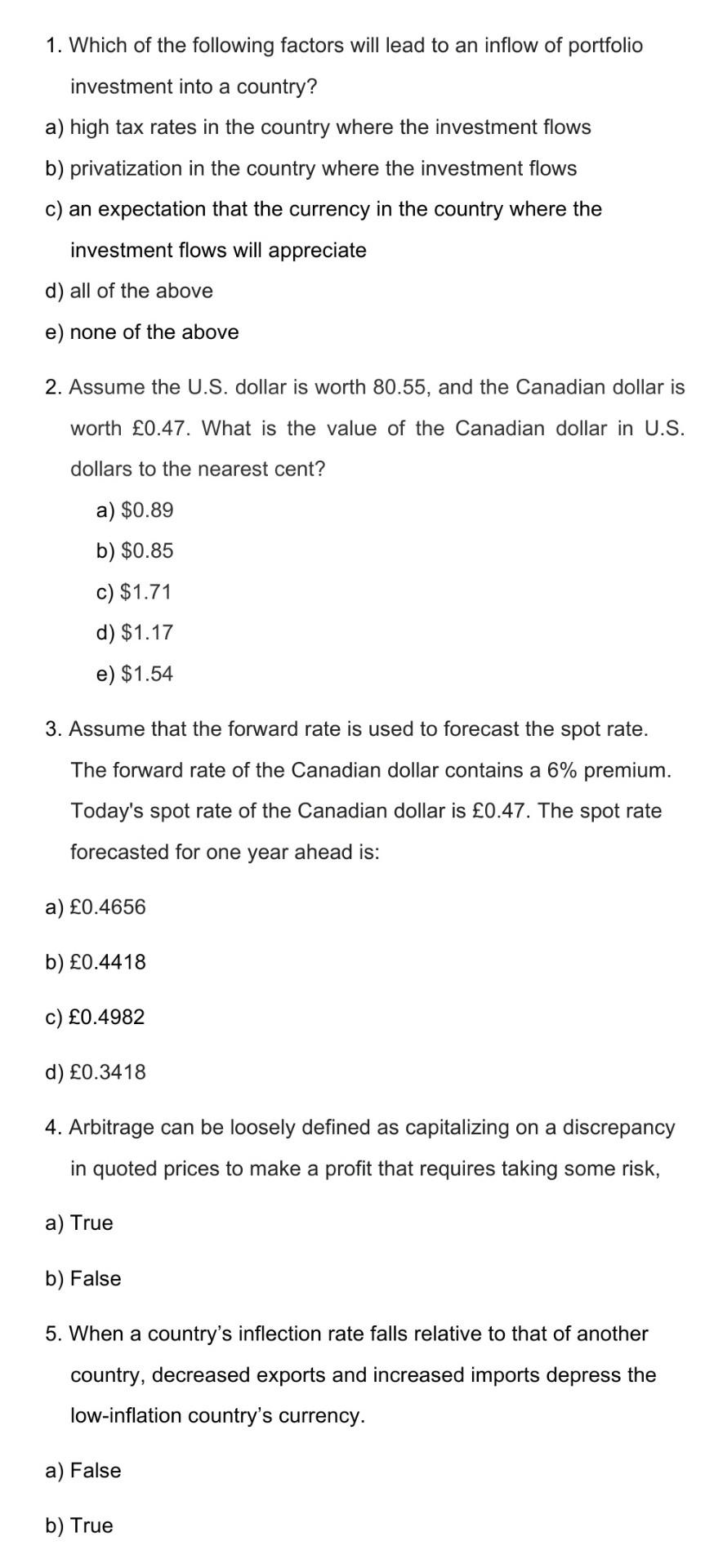

1. Which of the following factors will lead to an inflow of portfolio investment into a country? a) high tax rates in the country where the investment flows b) privatization in the country where the investment flows c) an expectation that the currency in the country where the investment flows will appreciate d) all of the above e) none of the above 2. Assume the U.S. dollar is worth 80.55, and the Canadian dollar is worth 0.47. What is the value of the Canadian dollar in U.S. dollars to the nearest cent? a) $0.89 b) $0.85 c) $1.71 d) $1.17 e) $1.54 3. Assume that the forward rate is used to forecast the spot rate. The forward rate of the Canadian dollar contains a 6% premium. Today's spot rate of the Canadian dollar is 0.47. The spot rate forecasted for one year ahead is: a) 0.4656 b) 0.4418 c) 0.4982 d) 0.3418 4. Arbitrage can be loosely defined as capitalizing on a discrepancy in quoted prices to make a profit that requires taking some risk, a) True b) False 5. When a country's inflection rate falls relative to that of another country, decreased exports and increased imports depress the low-inflation country's currency. a) False b) TrueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started