Question

Subject name: Accounting & Finance Decision-Making Mangers The below problem is a Differential Analysis problem, including *****Keep or Drop type problem*** Please utilize differential analysis

Subject name: Accounting & Finance Decision-Making Mangers

The below problem is a Differential Analysis problem, including *****Keep or Drop type problem***

Please utilize differential analysis to solve the problems. Please show all work and responses in the answer with an explanation...

Question:

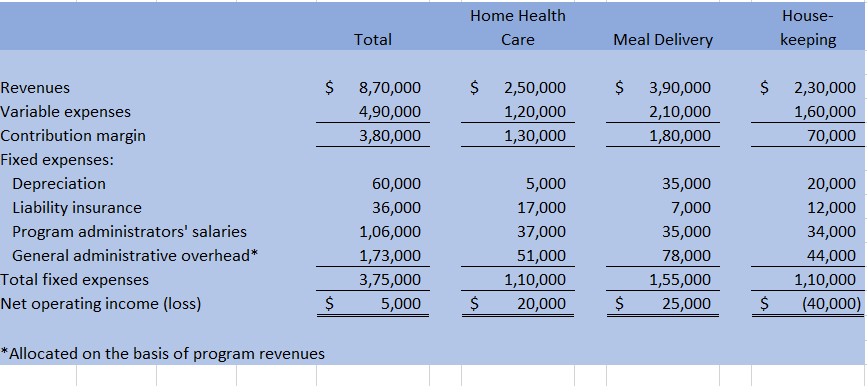

"Adams County Area on Aging is a nonprofit organization that helps its senior residents live in their own homes by providing three essential services. These services are home health care, meal delivery, and housekeeping. In the home health care program, trained aides visit seniors on a regular basis to provide companionship, meal preparation, and some health care. The meal delivery program provides daily delivery of a hot meal. The housekeeping service provides weekly house cleaning services. Data on revenue and expenses for the past year is shown below:

The director of the Adams County Area on Aging is concerned about the organizations finances. Last years results were similar to the results for previous years and are representative of what would be expected in the future. The director believes the net operating income of $5,000 last year is too small for the organization to be sustainable in the face of anticipated rising costs and an upcoming recession. The director has asked for more information about the financial advisability of discontinuing the housekeeping program.

The depreciation in housekeeping is for a small van that is used to carry the housekeepers and their equipment from job to job. If the program were discontinued, the van would be donated to a charitable organization. Depreciation charges assume zero residual value. The liability insurance and the salary of the program administrator would be avoided if the housekeeping program were dropped, however, the general administrative overhead would not be avoided.

1. Should the housekeeping program be discontinued? Your answer should be fully explained with computations to support your answer.

2. Recast the above data in a format that would be more useful to management in assessing the long-run financial viability of the various services.

| Total | Home Health Care | Meal Delivery | House-keeping | |||||||

| Revenues | $8,70,000 | $2,50,000 | $3,90,000 | $2,30,000 | ||||||

| Variable expenses | 4,90,000 | 1,20,000 | 2,10,000 | 1,60,000 | ||||||

| Contribution margin | 3,80,000 | 1,30,000 | 1,80,000 | 70,000 | ||||||

| Fixed expenses: | ||||||||||

| Depreciation | 60,000 | 5,000 | 35,000 | 20,000 | ||||||

| Liability insurance | 36,000 | 17,000 | 7,000 | 12,000 | ||||||

| Program administrators' salaries | 1,06,000 | 37,000 | 35,000 | 34,000 | ||||||

| General administrative overhead* | 1,73,000 | 51,000 | 78,000 | 44,000 | ||||||

| Total fixed expenses | 3,75,000 | 1,10,000 | 1,55,000 | 1,10,000 | ||||||

| Net operating income (loss) | $5,000 | $20,000 | $25,000 | $(40,000) | ||||||

| *Allocated on the basis of program revenues | ||||||||||

Again uploaded as an image. Now can you check and complete it please and I had posted the full question, Can you answer ASAP with all formulas on the excel sheet

Home Health Care House- keeping Total Meal Delivery $ $ $ $ 8,70,000 4,90,000 3,80,000 2,50,000 1,20,000 1,30,000 3,90,000 2,10,000 1,80,000 2,30,000 1,60,000 70,000 Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance Program administrators' salaries General administrative overhead* Total fixed expenses Net operating income (loss) 60,000 36,000 1,06,000 1,73,000 3,75,000 5,000 5,000 17,000 37,000 51,000 1,10,000 20,000 35,000 7,000 35,000 78,000 1,55,000 25,000 20,000 12,000 34,000 44,000 1,10,000 (40,000) $ $ $ $ Allocated on the basis of program revenuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started