Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subject name : finance2 Project Description . This projects designed to apply the task idreturn we learn it can companies in the real world It

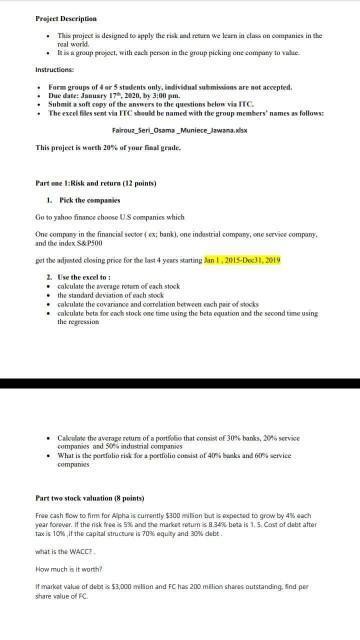

Subject name : finance2

Project Description . This projects designed to apply the task idreturn we learn it can companies in the real world It is a group project, with each person in the group picking one company to value. Instructions: Form groups of 4 or 5 students only, individual submissions are not accepted Due date: January 17, 2020, by 3:00 pm. Submit a soft copy of the answers to the questions helen via ITC The excel files sent in IT should be named with the group members' names as follows: Fairouz_Ser_Osama_Muniece Jawani This project is worth 20% of your finalul Parte 1: Risk and return (12 points) 1. Pick the companies Go to yahoo firme choose US companies which One company in the financial sex bank), one industrial company, one service company and the index S&P500 put the sented closing price for the last years starting Man 2015 Dec.2019 2. Use the excel to cakulate the average rotum of each stock the standard deviation of each stock calculate the covariance and correlation between each pair of stocks cakulte beta for each stock one time using the beta equation and the second time using the regression Calone the average retum of a portfoo that consist of 30% banks, service cupons and of industrial companies What is the portfolio risk for a portfolio consist of busks and 60% service companies Part two stock valuation points) Free cash flow to fim for Alpha is currently $200 million but is spected to grow by 4 wach year forever. If the risk free 5% and the market ratum 34 bota is 1.5. Cost of debt after Tadas 10% if the capital structure is 70% equity and 30% debt what is the WACC How much as it worth of market value of debt $3,000 million and FC Has 200 milion shares outstanding. Sind per share value of FC Project Description . This projects designed to apply the task idreturn we learn it can companies in the real world It is a group project, with each person in the group picking one company to value. Instructions: Form groups of 4 or 5 students only, individual submissions are not accepted Due date: January 17, 2020, by 3:00 pm. Submit a soft copy of the answers to the questions helen via ITC The excel files sent in IT should be named with the group members' names as follows: Fairouz_Ser_Osama_Muniece Jawani This project is worth 20% of your finalul Parte 1: Risk and return (12 points) 1. Pick the companies Go to yahoo firme choose US companies which One company in the financial sex bank), one industrial company, one service company and the index S&P500 put the sented closing price for the last years starting Man 2015 Dec.2019 2. Use the excel to cakulate the average rotum of each stock the standard deviation of each stock calculate the covariance and correlation between each pair of stocks cakulte beta for each stock one time using the beta equation and the second time using the regression Calone the average retum of a portfoo that consist of 30% banks, service cupons and of industrial companies What is the portfolio risk for a portfolio consist of busks and 60% service companies Part two stock valuation points) Free cash flow to fim for Alpha is currently $200 million but is spected to grow by 4 wach year forever. If the risk free 5% and the market ratum 34 bota is 1.5. Cost of debt after Tadas 10% if the capital structure is 70% equity and 30% debt what is the WACC How much as it worth of market value of debt $3,000 million and FC Has 200 milion shares outstanding. Sind per share value of FC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started