SUBJECT: PERSONAL TAXATION

PLEASE SOLVE THE QUESTION WITH A PROPER EXPLANATION.

THANK YOU FOR YOUR HARD WORK.

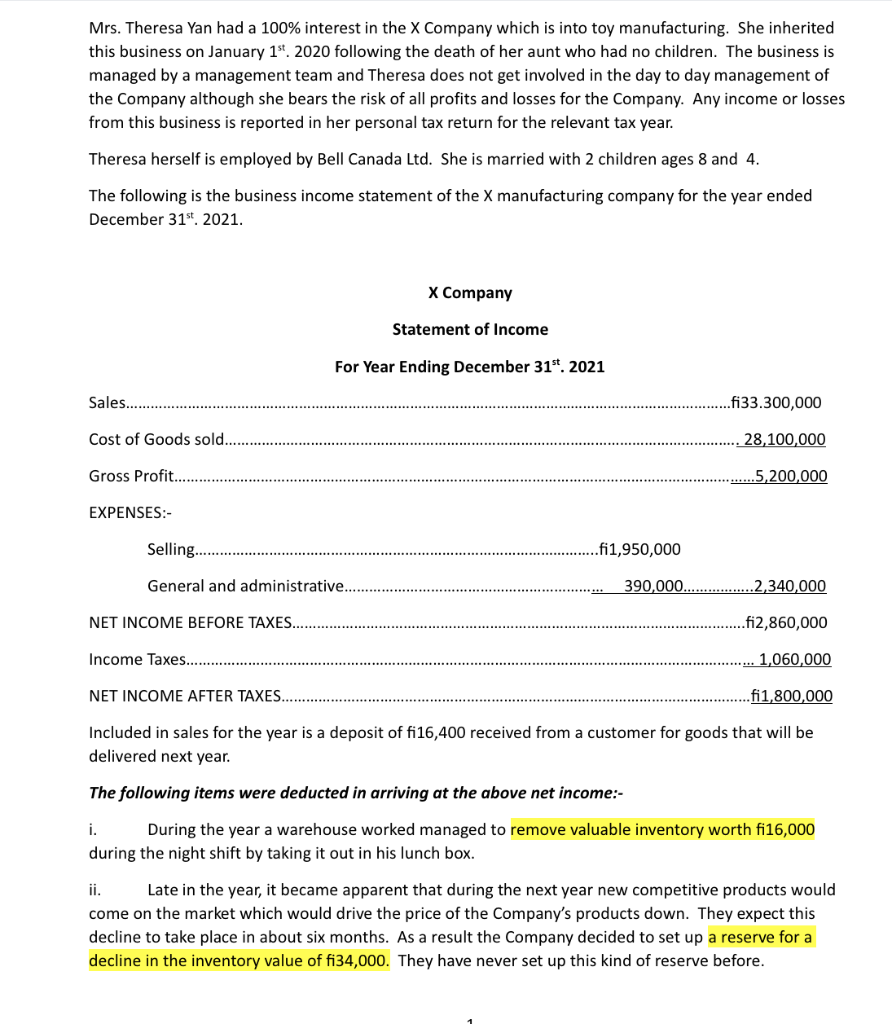

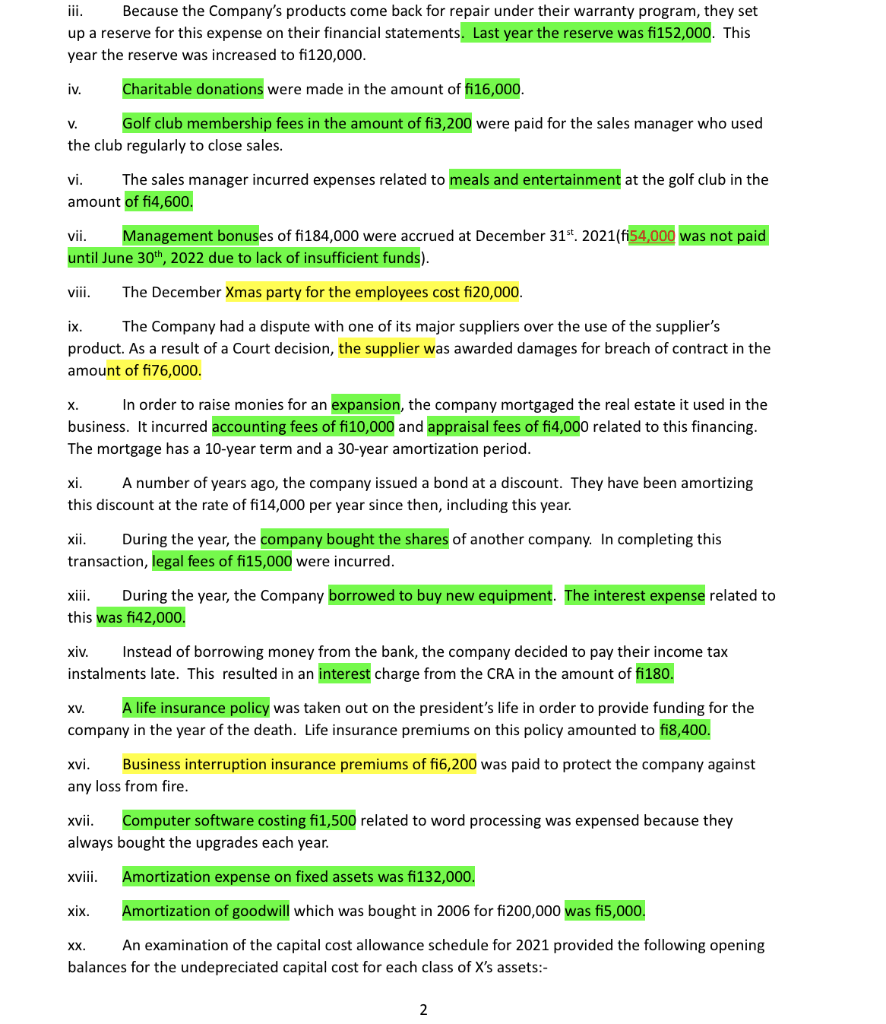

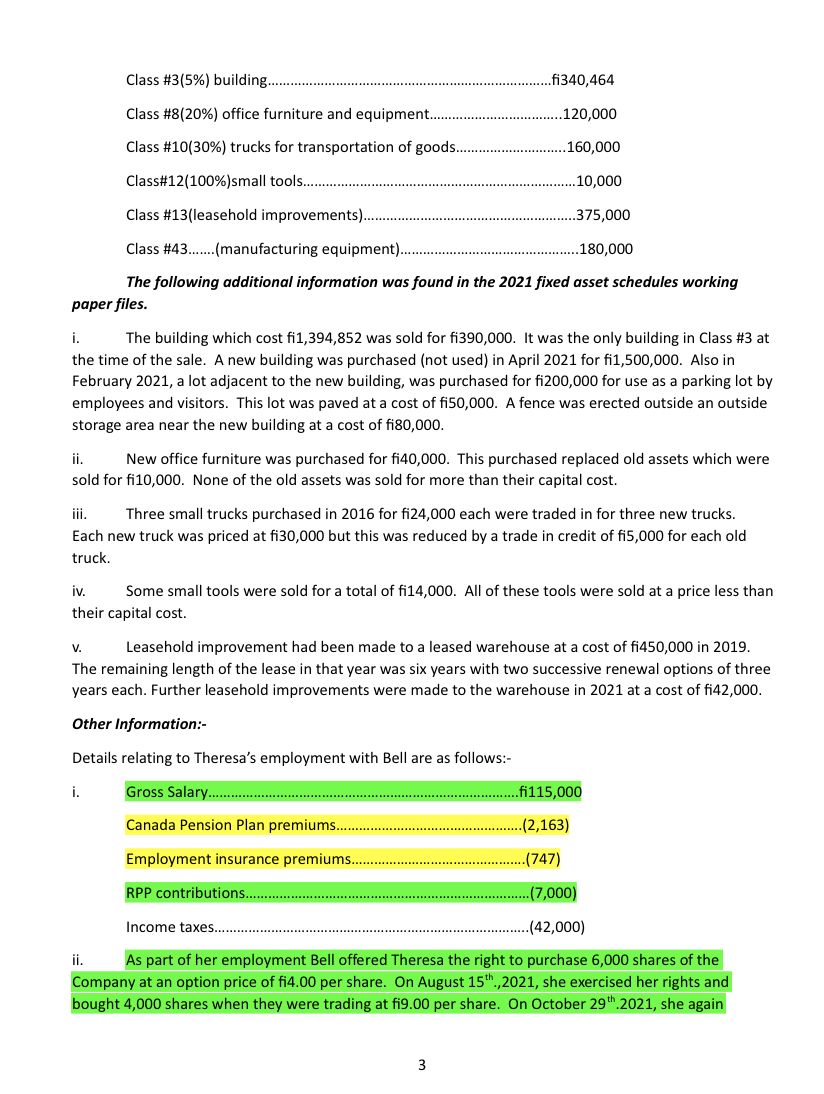

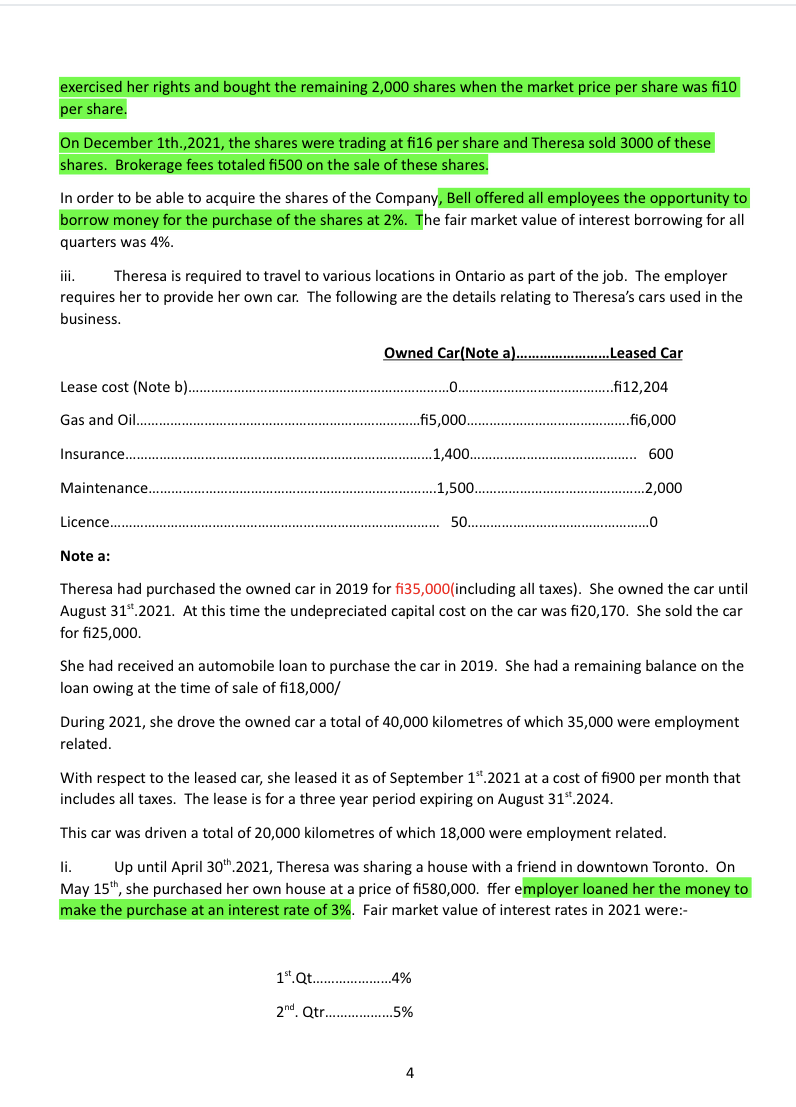

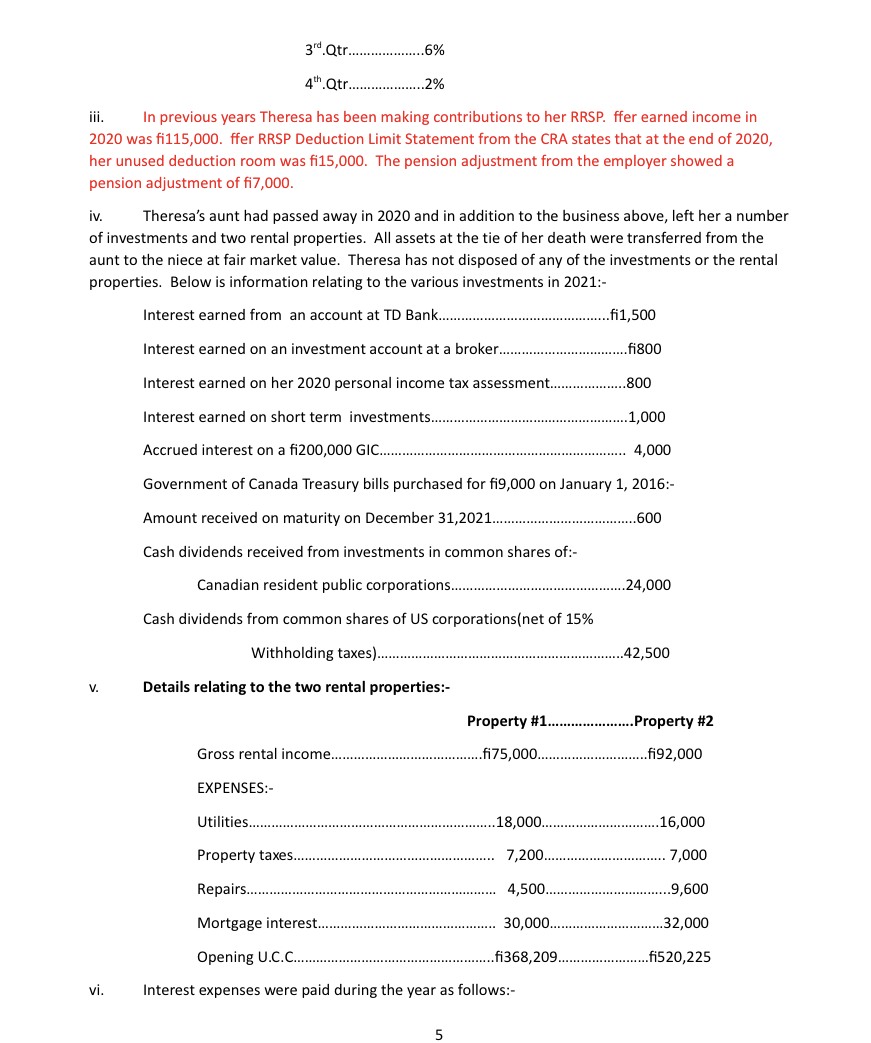

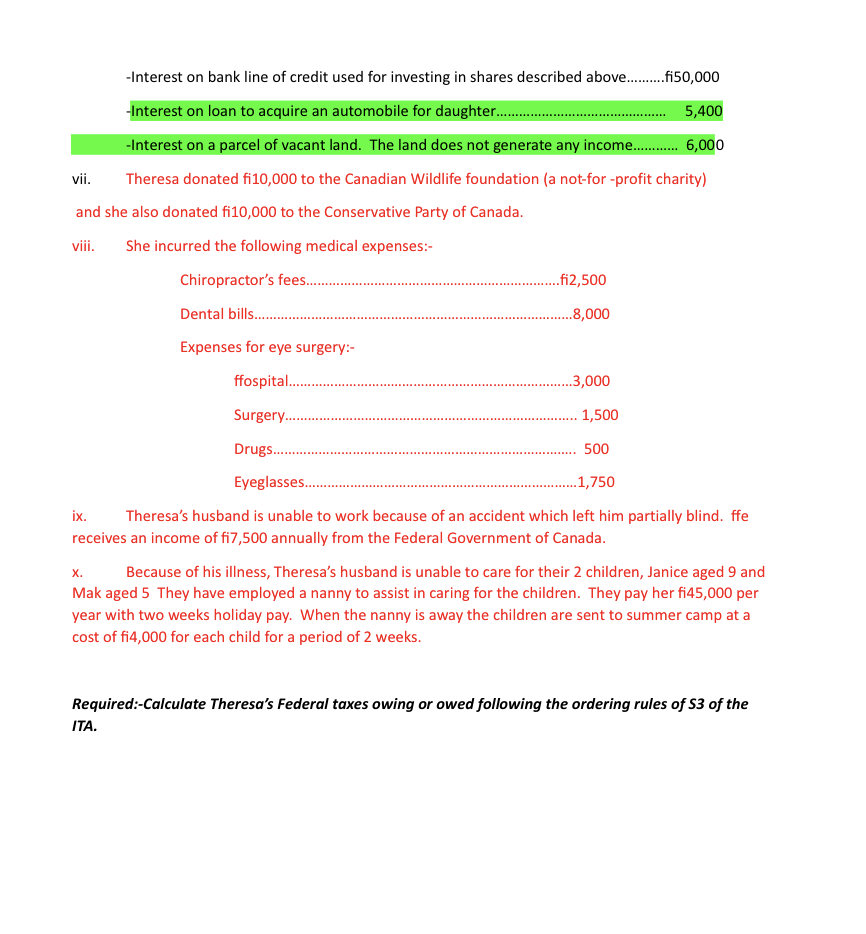

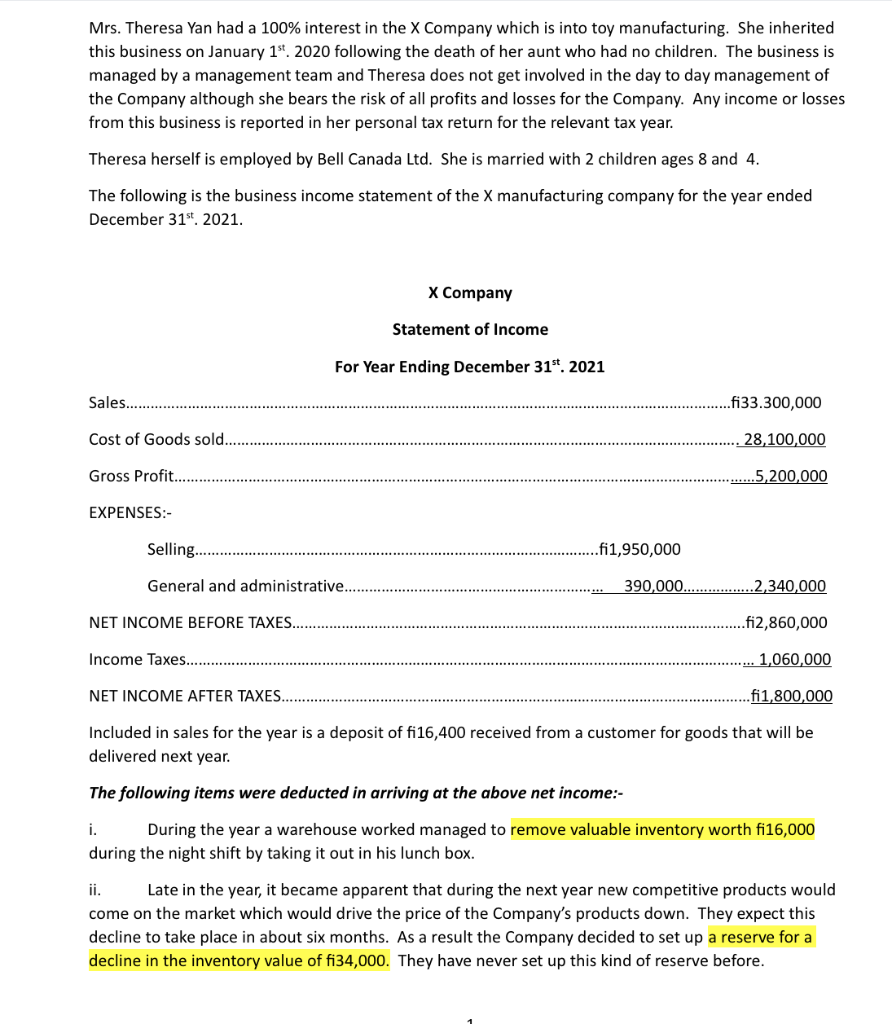

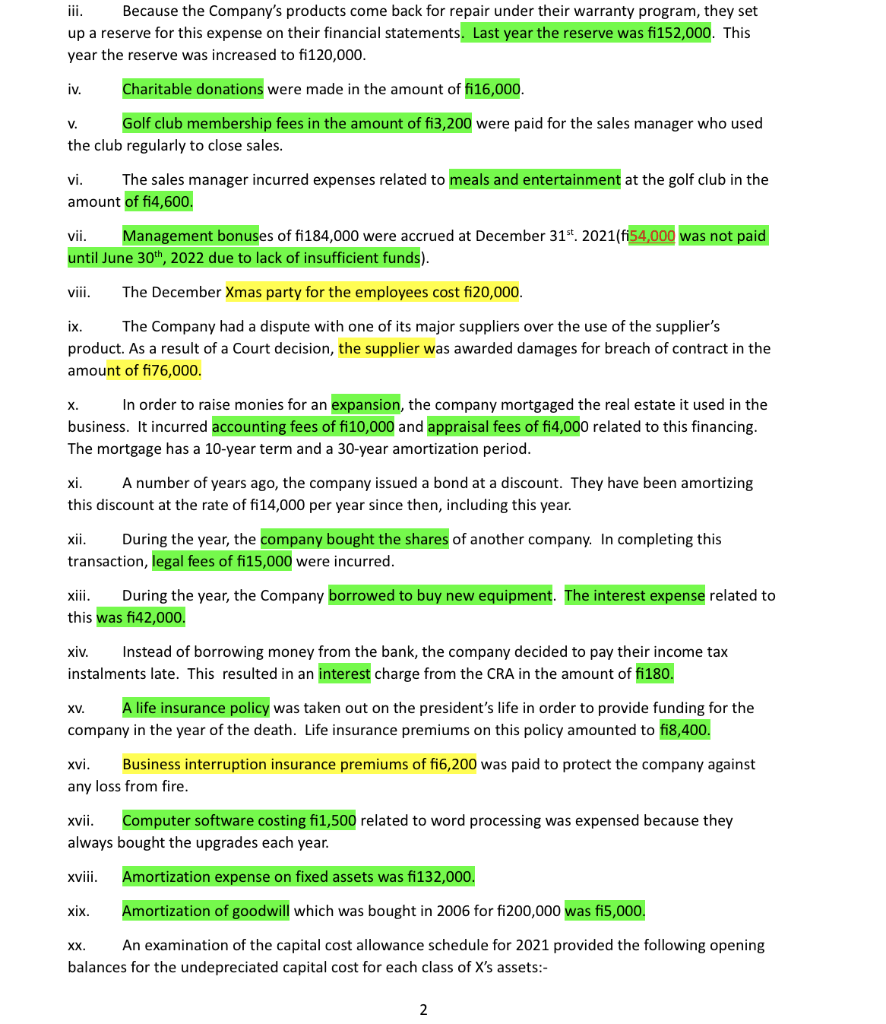

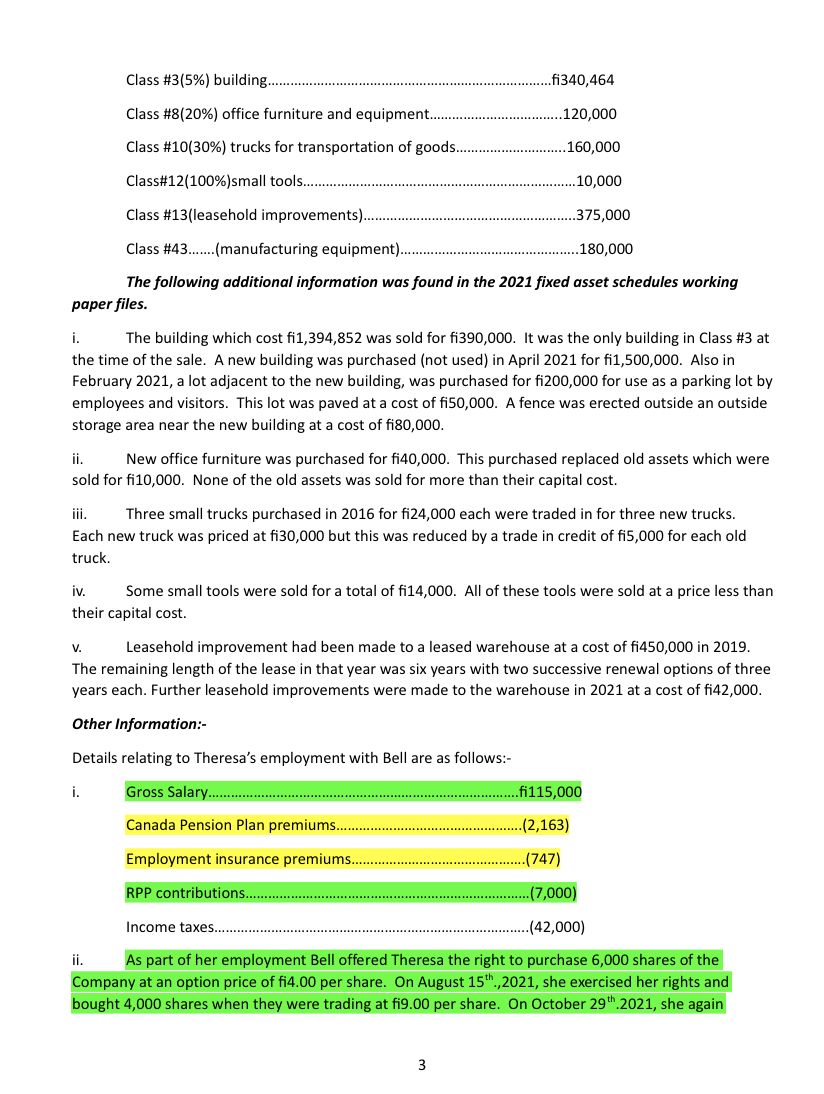

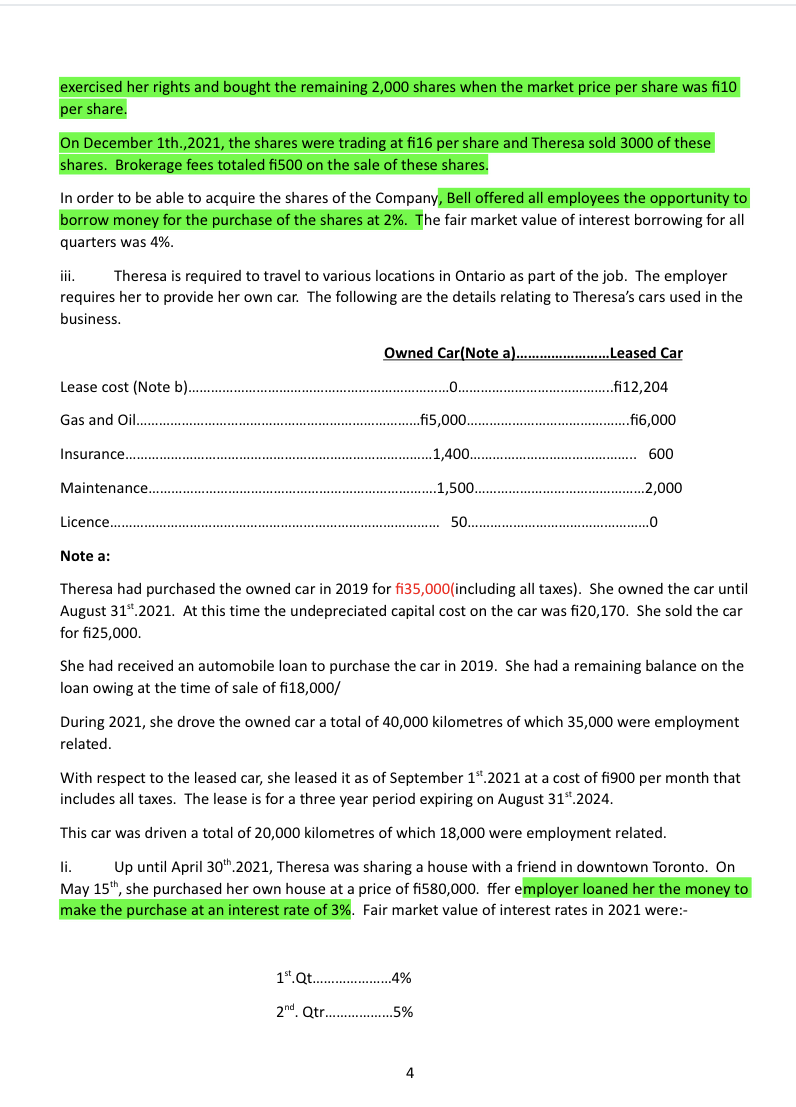

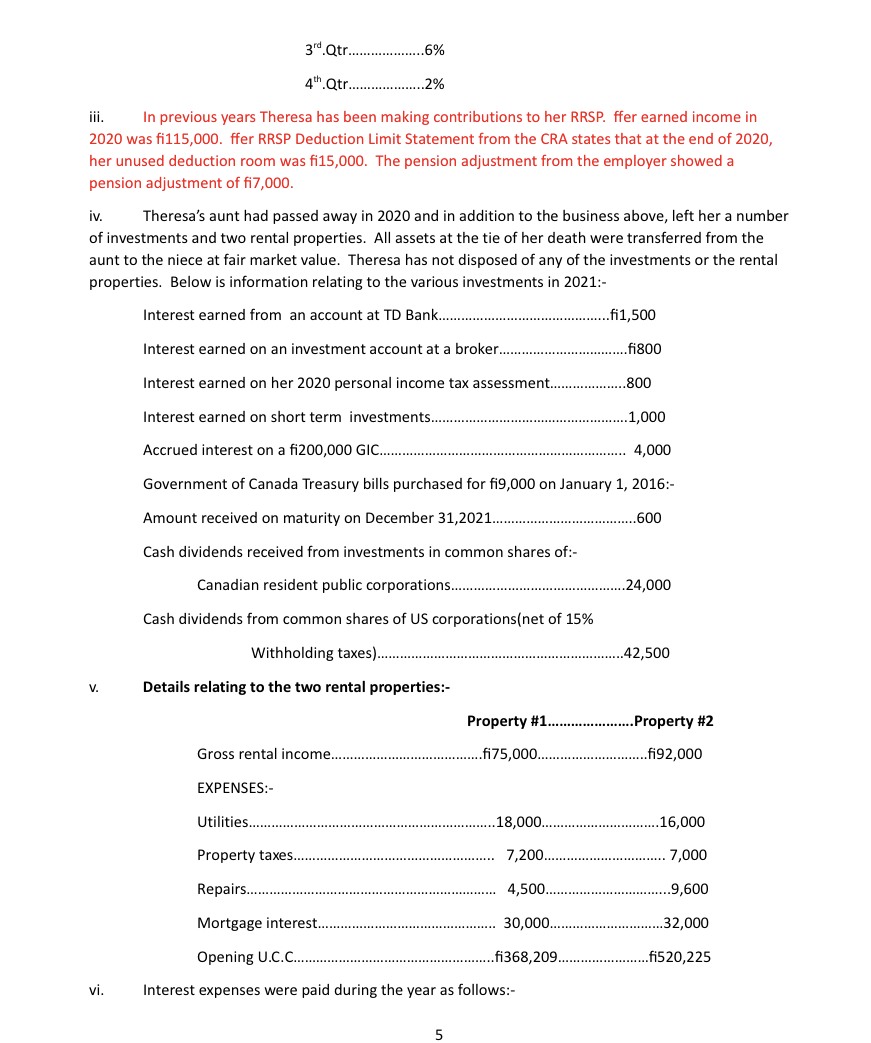

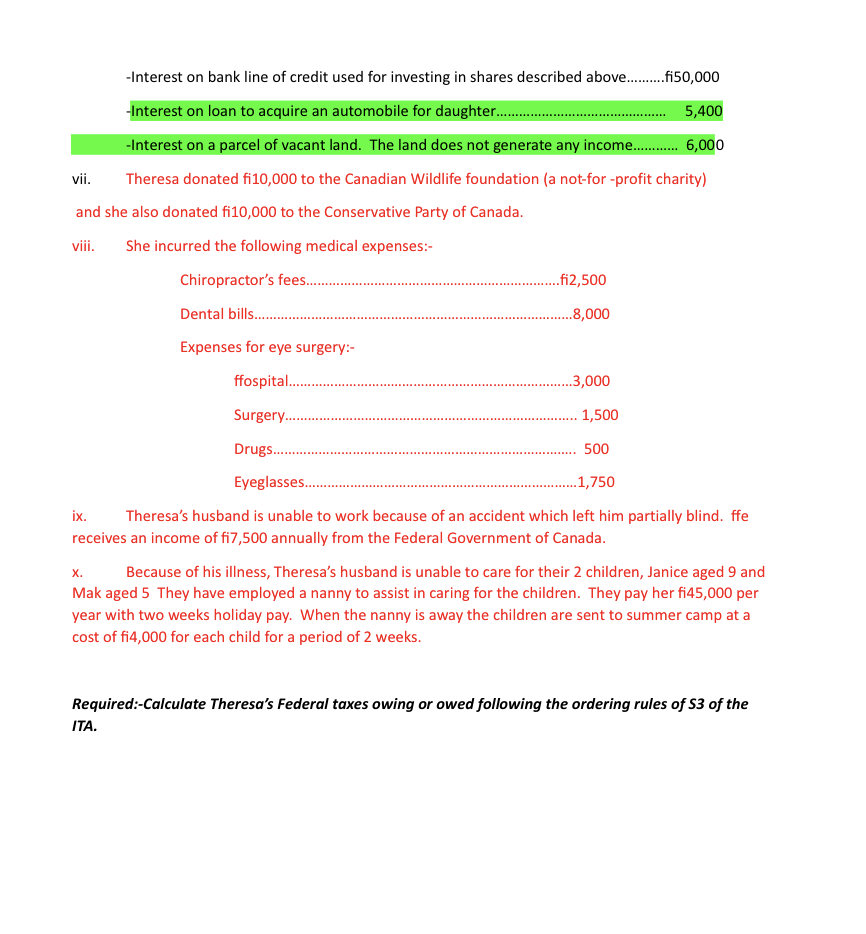

Mrs. Theresa Yan had a 100% interest in the X Company which is into toy manufacturing. She inherited this business on January 1st..2020 following the death of her aunt who had no children. The business is managed by a management team and Theresa does not get involved in the day to day management of the Companv although she bears the risk of all profits and losses for the Companv. Anv income or losses iii. Because the Company's products come back for repair under their warranty program, they set up a reserve for this expense on their financial statements. Last year the reserve was firmis year the reserve was increased to fire,000. iv. Charitable donations were made in the amount of fi16,000. v. Golf club membership fees in the amount of fi3,200 were paid for the sales manager who used the club regularly to close sales. vi. The sales manager incurred expenses related to meals and entertainment at the golf club in the amount of fi4,600. vii. Management bonuses of fi184,000 were accrued at December until June 30th,2022 due to lack of insufficient funds). viii. The December Xmas party for the employees cost fi20,000. ix. The Company had a dispute with one of its major suppliers over the use of the supplier's product. As a result of a Court decision, the supplier was awarded damages for breach of contract in the amount of fi76,000. x. In order to raise monies for an expansion, the company mortgaged the real estate it used in the business. It incurred accounting fees of fi10,000 and appraisal fees of fi4,000 related to this financing. The mortgage has a 10 -year term and a 30 -year amortization period. xi. A number of years ago, the company issued a bond at a discount. They have been amortizing this discount at the rate of fi14,000 per year since then, including this year. xii. During the year, the company bought the shares of another company. In completing this transaction, legal fees of fi15,000 were incurred. xiii. During the year, the Company borrowed to buy new equipment. this xiv. Instead of borrowing money from the bank, the company decided to pay their income tax instalments late. This resulted in an interest charge from the CRA in the amount of xv. Was taken out on the president's life in order to provide funding for the company in the year of the death. Life insurance premiums on this policy amounted to fi8,400. xvi. Business interruption insurance premiums of fi6,200 was paid to protect the company against any loss from fire. xvii. Computer software costing fi1,500 related to word processing was expensed because they always bought the upgrades each year. xviii. Amortization expense on fixed assets was fi132,000. xix. Amortization of goodwill which was bought in 2006 for fi200,000 was fi5,000. xx. An examination of the capital cost allowance schedule for 2021 provided the following opening balances for the undepreciated capital cost for each class of X s assets:- 5 The following additional information was found in the 2021 fixed asset schedules working paper files. i. The building which cost fi1,394,852 was sold for fi390,000. It was the only building in Class #3 at the time of the sale. A new building was purchased (not used) in April 2021 for fi1,500,000. Also in February 2021, a lot adjacent to the new building, was purchased for fi200,000 for use as a parking lot by employees and visitors. This lot was paved at a cost of fi50,000. A fence was erected outside an outside storage area near the new building at a cost of fi80,000. ii. New office furniture was purchased for fi40,000. This purchased replaced old assets which were sold for fi10,000. None of the old assets was sold for more than their capital cost. iii. Three small trucks purchased in 2016 for fi24,000 each were traded in for three new trucks. Each new truck was priced at fi30,000 but this was reduced by a trade in credit of fi5,000 for each old truck. iv. Some small tools were sold for a total of fi14,000. All of these tools were sold at a price less than their capital cost. v. Leasehold improvement had been made to a leased warehouse at a cost of fi450,000 in 2019. The remaining length of the lease in that year was six years with two successive renewal options of three years each. Further leasehold improvements were made to the warehouse in 2021 at a cost of fi42,000. Other Information:- Details relating to Theresa's employment with Bell are as follows:- i. Gross Salary................................................................................fi115,000 Canada Pension Plan premiums.................................................(2,163) Employment insurance premiums..............................................(747) RPP contributions..............................................................................(7,000) Income taxes....................................................................................(42,000) ii. As part of her employment Bell offered Theresa the right to purchase 6,000 shares of the Company at an option price of fi4.00 per share. On August 15th.,2021, she exercised her rights and bought 4,000 shares when they were trading at fig.00 per share. On October 29th.2021, she again exercised her rights and bought the remaining 2,000 shares when the market price per share was fi10 per share. On December 1th.,2021, the shares were trading at fi16 per share and Theresa sold 3000 of these shares. Brokerage fees totaled fi500 on the sale of these shares. In order to be able to acquire the shares of the Company, Bell offered all employees the opportunity to borrow money for the purchase of the shares at 2%. The fair market value of interest borrowing for all quarters was 4% iii. Theresa is required to travel to various locations in Ontario as part of the job. The employer requires her to provide her own car. The following are the details relating to Theresa's cars used in the business. Note a: Theresa had purchased the owned car in 2019 for fi35,000(including all taxes). She owned the car until August 31st.2021. At this time the undepreciated capital cost on the car was fi20,170. She sold the car for fi25,000. She had received an automobile loan to purchase the car in 2019. She had a remaining balance on the loan owing at the time of sale of fi18,000/ During 2021, she drove the owned car a total of 40,000 kilometres of which 35,000 were employment related. With respect to the leased car, she leased it as of September 1st.2021 at a cost of fi900 per month that includes all taxes. The lease is for a three year period expiring on August 31st.2024. This car was driven a total of 20,000 kilometres of which 18,000 were employment related. li. Up until April 30th.2021, Theresa was sharing a house with a friend in downtown Toronto. On May 15th, she purchased her own house at a price of fi580,000. ffer employer loaned her the money to make the purchase at an interest rate of 3%. Fair market value of interest rates in 2021 were:- 3rd Qtr..................6\% 4th Qtr...................2\% iii. In previous years Theresa has been making contributions to her RRSP. ffer earned income in 2020 was fi115,000. ffer RRSP Deduction Limit Statement from the CRA states that at the end of 2020 , her unused deduction room was fi15,000. The pension adjustment from the employer showed a pension adjustment of fi7,000. iv. Theresa's aunt had passed away in 2020 and in addition to the business above, left her a number of investments and two rental properties. All assets at the tie of her death were transferred from the aunt to the niece at fair market value. Theresa has not disposed of any of the investments or the rental properties. Below is information relating to the various investments in 2021:- vi. Interest expenses were paid during the year as follows:- ix. Theresa's husband is unable to work because of an accident which left him partially blind. ffe receives an income of fi7,500 annually from the Federal Government of Canada. x. Because of his illness, Theresa's husband is unable to care for their 2 children, Janice aged 9 and Mak aged 5 They have employed a nanny to assist in caring for the children. They pay her fi45,000 per year with two weeks holiday pay. When the nanny is away the children are sent to summer camp at a cost of fi4,000 for each child for a period of 2 weeks. Required:-Calculate Theresa's Federal taxes owing or owed following the ordering rules of S3 of ITA. Mrs. Theresa Yan had a 100% interest in the X Company which is into toy manufacturing. She inherited this business on January 1st..2020 following the death of her aunt who had no children. The business is managed by a management team and Theresa does not get involved in the day to day management of the Companv although she bears the risk of all profits and losses for the Companv. Anv income or losses iii. Because the Company's products come back for repair under their warranty program, they set up a reserve for this expense on their financial statements. Last year the reserve was firmis year the reserve was increased to fire,000. iv. Charitable donations were made in the amount of fi16,000. v. Golf club membership fees in the amount of fi3,200 were paid for the sales manager who used the club regularly to close sales. vi. The sales manager incurred expenses related to meals and entertainment at the golf club in the amount of fi4,600. vii. Management bonuses of fi184,000 were accrued at December until June 30th,2022 due to lack of insufficient funds). viii. The December Xmas party for the employees cost fi20,000. ix. The Company had a dispute with one of its major suppliers over the use of the supplier's product. As a result of a Court decision, the supplier was awarded damages for breach of contract in the amount of fi76,000. x. In order to raise monies for an expansion, the company mortgaged the real estate it used in the business. It incurred accounting fees of fi10,000 and appraisal fees of fi4,000 related to this financing. The mortgage has a 10 -year term and a 30 -year amortization period. xi. A number of years ago, the company issued a bond at a discount. They have been amortizing this discount at the rate of fi14,000 per year since then, including this year. xii. During the year, the company bought the shares of another company. In completing this transaction, legal fees of fi15,000 were incurred. xiii. During the year, the Company borrowed to buy new equipment. this xiv. Instead of borrowing money from the bank, the company decided to pay their income tax instalments late. This resulted in an interest charge from the CRA in the amount of xv. Was taken out on the president's life in order to provide funding for the company in the year of the death. Life insurance premiums on this policy amounted to fi8,400. xvi. Business interruption insurance premiums of fi6,200 was paid to protect the company against any loss from fire. xvii. Computer software costing fi1,500 related to word processing was expensed because they always bought the upgrades each year. xviii. Amortization expense on fixed assets was fi132,000. xix. Amortization of goodwill which was bought in 2006 for fi200,000 was fi5,000. xx. An examination of the capital cost allowance schedule for 2021 provided the following opening balances for the undepreciated capital cost for each class of X s assets:- 5 The following additional information was found in the 2021 fixed asset schedules working paper files. i. The building which cost fi1,394,852 was sold for fi390,000. It was the only building in Class #3 at the time of the sale. A new building was purchased (not used) in April 2021 for fi1,500,000. Also in February 2021, a lot adjacent to the new building, was purchased for fi200,000 for use as a parking lot by employees and visitors. This lot was paved at a cost of fi50,000. A fence was erected outside an outside storage area near the new building at a cost of fi80,000. ii. New office furniture was purchased for fi40,000. This purchased replaced old assets which were sold for fi10,000. None of the old assets was sold for more than their capital cost. iii. Three small trucks purchased in 2016 for fi24,000 each were traded in for three new trucks. Each new truck was priced at fi30,000 but this was reduced by a trade in credit of fi5,000 for each old truck. iv. Some small tools were sold for a total of fi14,000. All of these tools were sold at a price less than their capital cost. v. Leasehold improvement had been made to a leased warehouse at a cost of fi450,000 in 2019. The remaining length of the lease in that year was six years with two successive renewal options of three years each. Further leasehold improvements were made to the warehouse in 2021 at a cost of fi42,000. Other Information:- Details relating to Theresa's employment with Bell are as follows:- i. Gross Salary................................................................................fi115,000 Canada Pension Plan premiums.................................................(2,163) Employment insurance premiums..............................................(747) RPP contributions..............................................................................(7,000) Income taxes....................................................................................(42,000) ii. As part of her employment Bell offered Theresa the right to purchase 6,000 shares of the Company at an option price of fi4.00 per share. On August 15th.,2021, she exercised her rights and bought 4,000 shares when they were trading at fig.00 per share. On October 29th.2021, she again exercised her rights and bought the remaining 2,000 shares when the market price per share was fi10 per share. On December 1th.,2021, the shares were trading at fi16 per share and Theresa sold 3000 of these shares. Brokerage fees totaled fi500 on the sale of these shares. In order to be able to acquire the shares of the Company, Bell offered all employees the opportunity to borrow money for the purchase of the shares at 2%. The fair market value of interest borrowing for all quarters was 4% iii. Theresa is required to travel to various locations in Ontario as part of the job. The employer requires her to provide her own car. The following are the details relating to Theresa's cars used in the business. Note a: Theresa had purchased the owned car in 2019 for fi35,000(including all taxes). She owned the car until August 31st.2021. At this time the undepreciated capital cost on the car was fi20,170. She sold the car for fi25,000. She had received an automobile loan to purchase the car in 2019. She had a remaining balance on the loan owing at the time of sale of fi18,000/ During 2021, she drove the owned car a total of 40,000 kilometres of which 35,000 were employment related. With respect to the leased car, she leased it as of September 1st.2021 at a cost of fi900 per month that includes all taxes. The lease is for a three year period expiring on August 31st.2024. This car was driven a total of 20,000 kilometres of which 18,000 were employment related. li. Up until April 30th.2021, Theresa was sharing a house with a friend in downtown Toronto. On May 15th, she purchased her own house at a price of fi580,000. ffer employer loaned her the money to make the purchase at an interest rate of 3%. Fair market value of interest rates in 2021 were:- 3rd Qtr..................6\% 4th Qtr...................2\% iii. In previous years Theresa has been making contributions to her RRSP. ffer earned income in 2020 was fi115,000. ffer RRSP Deduction Limit Statement from the CRA states that at the end of 2020 , her unused deduction room was fi15,000. The pension adjustment from the employer showed a pension adjustment of fi7,000. iv. Theresa's aunt had passed away in 2020 and in addition to the business above, left her a number of investments and two rental properties. All assets at the tie of her death were transferred from the aunt to the niece at fair market value. Theresa has not disposed of any of the investments or the rental properties. Below is information relating to the various investments in 2021:- vi. Interest expenses were paid during the year as follows:- ix. Theresa's husband is unable to work because of an accident which left him partially blind. ffe receives an income of fi7,500 annually from the Federal Government of Canada. x. Because of his illness, Theresa's husband is unable to care for their 2 children, Janice aged 9 and Mak aged 5 They have employed a nanny to assist in caring for the children. They pay her fi45,000 per year with two weeks holiday pay. When the nanny is away the children are sent to summer camp at a cost of fi4,000 for each child for a period of 2 weeks. Required:-Calculate Theresa's Federal taxes owing or owed following the ordering rules of S3 of ITA