Question

Subject: Strategic Marketing Assignment. The aims of this activity are: To provide an opportunity to practice and develop your ability to think on strategic marketing

Subject: Strategic Marketing

Assignment.

The aims of this activity are: To provide an opportunity to practice and develop your ability to think on strategic marketing case studies. To generate insight into connections by encouraging you to reflect on strategic marketing course content. To encourage reflective reading on strategic marketing practices.

Read the COCA-COLA CASE STUDY AND ANSWER THE FOUR QUESTIONS.

No. 2: COCA-COLA CO. Discussion questions for No 2. case study: 1. What are some of the advantages and disadvantages that diversification can bring to a company like Coke? (10 marks) 2. How was Coke able to achieve an impressive growth record from 1990 to 1997? What changes have caused Coke to stumble since then? (10 marks) 3. Critics have said Cokes recent advertising campaigns have been unsuccessful, yet Coke continues to be one of the most recognizable brands in the world. How does Coke keep its brand so strong? (10 marks)

4. Why is Coke wary of a transformative acquisition? (10 marks)

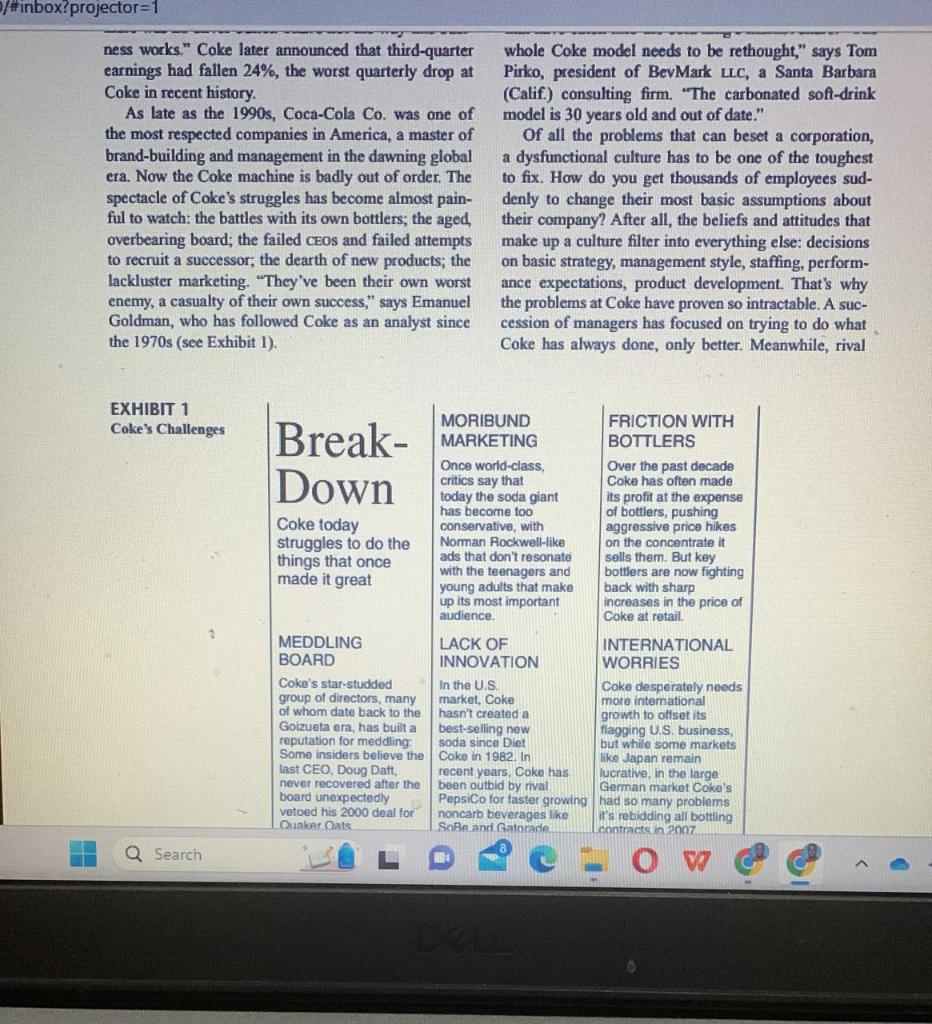

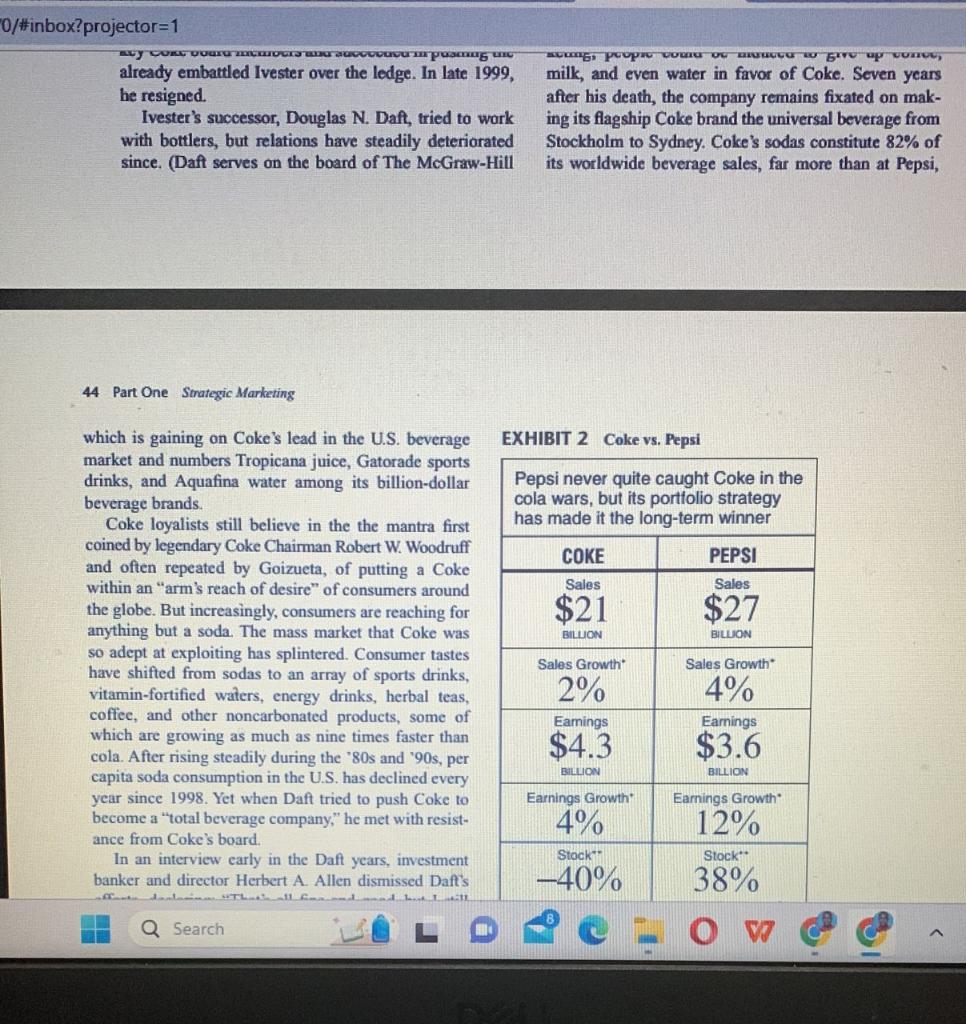

founder of Wired and other magazines and Web sites. Case 1-3 stint as head of a large European Coke bottler. "The reporter at the time. "There's still opportunity for both Coca-Cola and the other brands." When former Coca-Cola co. executive E. Neville Isdell All it took was a tour of Coke's operations in India, agreed last May to come out of retirement and become China, and 14 other key markets this summer for Isdell chief executive of the beleaguered soda giant, he to see a different reality: Coca-Cola was a troubled brimmed with confidence. No Coke newcomer, Isdell company. Things looked so bad that just 100 days into had spent 35 years inside the vast Coke system as the his new job the 61-year-old Irishman interrupted his Atlanta company built itself into the world's most rec- fact-finding mission to deliver a surprise warning to ognized global brand, retiring in 2001 after a three-year Wall Street. Coke, which had been struggling since the death in 1997 of its revered CEO, Roberto C. Goizueta, Yet as grave as those problems are, they only hint had made little progress in its efforts to meet the ris- at the real dimensions of Coke's woes. The Coca-Cola ing challenges of noncarbonated drinks. The soda giant organization is stuck in a mind-set formed during its would fall short of the meager 3% growth in earnings heyday in the 1980 s and ' 90 s, when Goizueta made that analysts were resigned to for the third and fourth Coke into a growth story that captivated the world. An quarters. Moreover, Isdell was clearly prepping Wall unwillingness to tamper with the structures and beliefs Street for perhaps another year-or longer-of under- formed during those glory years has left the company performance. "We've got a long way to go," a chas- unable to adapt to consumer demands for new kinds tened lsdell told analysts. "The last time I checked of beverages, from New Age teas to gourmet coffees, there was no silver bullet. That's not the way this busi- that have eaten into the cola king's market share. "The ness works." Coke later announced that third-quarter whole Coke model needs to be rethought," says Tom earnings had fallen 24%, the worst quarterly drop at Pirko, president of BevMark LLC, a Santa Barbara Coke in mecent histary (Califi consultino firm "The carhonated onfl-drink founder of Wired and other magazines and Web sites. Case 1-3 stint as head of a large European Coke bottler. "The reporter at the time. "There's still opportunity for both Coca-Cola and the other brands." When former Coca-Cola co. executive E. Neville Isdell All it took was a tour of Coke's operations in India, agreed last May to come out of retirement and become China, and 14 other key markets this summer for Isdell chief executive of the beleaguered soda giant, he to see a different reality: Coca-Cola was a troubled brimmed with confidence. No Coke newcomer, Isdell company. Things looked so bad that just 100 days into had spent 35 years inside the vast Coke system as the his new job the 61-year-old Irishman interrupted his Atlanta company built itself into the world's most rec- fact-finding mission to deliver a surprise warning to ognized global brand, retiring in 2001 after a three-year Wall Street. Coke, which had been struggling since the death in 1997 of its revered CEO, Roberto C. Goizueta, Yet as grave as those problems are, they only hint had made little progress in its efforts to meet the ris- at the real dimensions of Coke's woes. The Coca-Cola ing challenges of noncarbonated drinks. The soda giant organization is stuck in a mind-set formed during its would fall short of the meager 3% growth in earnings heyday in the 1980 s and ' 90 s, when Goizueta made that analysts were resigned to for the third and fourth Coke into a growth story that captivated the world. An quarters. Moreover, Isdell was clearly prepping Wall unwillingness to tamper with the structures and beliefs Street for perhaps another year-or longer-of under- formed during those glory years has left the company performance. "We've got a long way to go," a chas- unable to adapt to consumer demands for new kinds tened lsdell told analysts. "The last time I checked of beverages, from New Age teas to gourmet coffees, there was no silver bullet. That's not the way this busi- that have eaten into the cola king's market share. "The ness works." Coke later announced that third-quarter whole Coke model needs to be rethought," says Tom earnings had fallen 24%, the worst quarterly drop at Pirko, president of BevMark LLC, a Santa Barbara Coke in mecent histary (Califi consultino firm "The carhonated onfl-drink ness works." Coke later announced that third-quarter whole Coke model needs to be rethought," says Tom earnings had fallen 24%, the worst quarterly drop at Pirko, president of BevMark LLC, a Santa Barbara Coke in recent history. (Calif) consulting firm. "The carbonated soft-drink As late as the 1990s, Coca-Cola Co. was one of model is 30 years old and out of date." the most respected companies in America, a master of Of all the problems that can beset a corporation, brand-building and management in the dawning global a dysfunctional culture has to be one of the toughest era. Now the Coke machine is badly out of order. The to fix. How do you get thousands of employees sudspectacle of Coke's struggles has become almost pain- denly to change their most basic assumptions about ful to watch: the battles with its own bottlers; the aged their company? After all, the beliefs and attitudes that overbearing board; the failed cEos and failed attempts make up a culture filter into everything else: decisions to recruit a successor; the dearth of new products; the on basic strategy, management style, staffing, performlackluster marketing. "They've been their own worst ance expectations, product development. That's why enemy, a casualty of their own success," says Emanuel the problems at Coke have proven so intractable. A sucGoldman, who has followed Coke as an analyst since cession of managers has focused on trying to do what the 1970s (see Exhibit 1). Coke has always done, only better. Meanwhile, rival EXHIBIT 1 Coke's Challenges RreA MORIBUNDMARKETINGFRICTIONWITHBOTTLERS PepsiCo Inc. has a much different view of its mission 4%. Shares have fallen hard, currently trading at less (hint: it's not just about soda pop)-one that has helped than half their 1998 peak as more and more investors it adapt far more successfully to a changing market- conclude that Coke's best days may be behind it. "At place. Until Coke can lay the ghost of Goizueta to rest Coke," says Brian Holland, research director at Boyd and let go of some long-cherished beliefs, it's unlikely Watterson Asset Management LLC, a Cleveland money to fix its problems. manager that has cut its Coke holdings by 84% since Frozen in Time last December, "there's a lot to fix, and there's no shortterm solution." In the absence of a clear vision, Coke's desire to cling Is the latest Coke CEO capable of leading Coke out of to its past is not hard to understand. After all, in Coke the valley? It's too early in Isdell's tenure to say for Classic, the company is blessed with a flagship prodsure, but the early signs are not promising. Although uct that remains, for all of the management missteps he earned a reputation for bold decision-making as a of the past decade, one of the most powerful brands in young executive, Isdell seems to have fallen into lock- the world. And despite the company's problems, it is step with the reigning Coke orthodoxy. He says the still a cash cow. Helped by the dollar's decline against company's salvation lies in simply tuning up the soda other major currencies, Coke is expected to generate operations and capitalizing on existing brands. "We are roughly $5 billion in operating profits this year, far not talking about radical change in strategy," he told beyond such companies as Nike, Colgate-Palmolive, Wall Street analysts in November. "We are talking and McDonald's that have similar global ambitions. about a dramatic change in execution." Indeed, part of Coke's paralysis is a fear that nothing That was more or less the playbook used by Roberto else the company enters will ever match the extraordiGoizueta, a charismatic CEO. The Cuban-born executive nary margins of soda concentrate. sold off ancillary businesses and refocused the company on what it did best: selling carbonated soft drinks. "Smoke and Mirrors" At the same time he engaged in some sophisticated reengineering of the company's financial structures. In Goizueta's most ingenious contribution to Coke, the 1986 , Coke spun off a 51% stake in its U.S. bottling ingredient that added rocket fuel to the stock price, was operations, a shrewd bit of financial alchemy that let it a bit of creative though perfectly legal balance-sheet dump billions of dollars of bottling-related debt off its rejiggering that in some ways prefigured the Enron Corp. balance sheet while allowing it to continue pulling the machinations. Known inside the company as the "49\% strings at the spin-off. Thanks to near-constant buying solution," it was the brainchild of then-Chief Financial and selling of small bottling operations, the deal also Officer M. Douglas lvester. It worked like this: Coke helped Coke achieve consistent profit gains, turning the spun off its U.S. bottling operations in late 1986 into once-stodgy company into-shazam! - a growth stock. a new company known as Coca-Cola Enterprises Ine., Meanwhile, Coke was able to ride the global boom retaining a 49% stake for itself. That was enough to exert like few other companies, rushing into once-closed de facto control but a hair below the 50% threshold that once-stodgy company into-sazam:-a growth stock, a new company known as Coca-Cola Enterprises inc., Meanwhile, Coke was able to ride the global boom retaining a 49% stake for itself. That was enough to exert like few other companies, rushing into once-closed de facto control but a hair below the 50% threshold that economies such as China, East Germany, and the Soviet requires companies to consolidate results of subsidiaries Union and sating their pent-up demand for a taste of in their financials. At a stroke, Coke erased $2.4 billion America. The result: Coke stock soared 3,500\% during of debt from its balance sheet. Just as important, it was Goizueta's 16-year reign, helping to make him one of able to command six board seats at oCE, which it packed the first supercompensated ceos and the first profes- with current or former Coke executives, including thensional manager to break the \$1 billion pay barrier. After Coke President Donald R. Keough. With effective conhis death from lung cancer in October, 1997, Goizueta trol, Coke for years could ensure that cCE was run to was all but deified, his financial structures, his cola- Coke's benefit. "Coke was creating a special-purpose centric philosophy, and even his board of directors fro- entity, like Chewbacca from Enron," marvels one Wall zen in place ever since. Street analyst, referring to Enron's Chewco Investments The ensuing years have seen a long and painful limited partnership. Coke disputes any comparison to descent. After generating average annual earnings Enron and says the spin-off was simply a way "to levgrowth of 18% between 1990 and 1997 , Coke's net erage substantial efficiencies and adapt more rapidly to income in recent years has grown an average of just the changing trade landscape in the U.S." Case 1-3 Coca-Cola Co(A)43 Its behind-the-scenes control of CCE allowed Coke Cos., which publishes BusinessWeek.) In a sign of disuto extract a series of advantages, from pricing to decid- nity that would have been unthinkable in the Goizueta ing how many vending machines CCE purchased. Coke era, some bottlers are beginning to push back with had tacit control over how much its largest customer- price hikes that could boost their own profits-at CCE-paid for the concentrate Coke sold it, as well as Coke's expense. how much CCE charged retailers for the actual soda. While those hikes could dampen sales-and thus Thus the escalating price wars between Coke and Pepsi reduce the amount of concentrate bottlers need to purcame much more out of CCE's margins than Coke's, chase from Coke-the bottlers are clearly banking on especially since Coke also required CCE to shoulder a the belief that they will come out ahead, even if Coke growing portion of its brands' marketing costs. doesn't. At the same time, many bottlers have refused to But that was just one aspect of this unusual relation-_ carry some of the company's new noncarbonated niche especially since Coke also required CCz to shoulder a the belief that they will come out ahead, even if Coke growing portion of its brands' marketing casts. doesn't. At the same time, many bottlers have refused to But that was just one aspect of this unusual relation- carry some of the company's new noncarbonated niche ship. In the ' 80 s and '90s a generation that ran small, offerings that Coke acquired, such as Mad River teas family-owned bottlers was looking to retire. Coke had and Planet Java coffee, forcing the company to bury been snapping up these operations as a way to assure both products last year. While cCE executives mainquality and to keep them from falling into the hands tain that relations have improved under Isdell, Trevor of leveraged-buyout artists, who would likely bleed Messinger, a Coke bottler in Rapid City, S.D., readily them for their cash flow. In CCE it had another so- admits relations between Coke and some bottlers are called anchor bottler, one of roughly a dozen around contentious. "I don't think everybody is on the same the world, from which it could exact ever-higher profits page of the playbook," he says. as it resold these smaller bottlers to the anchors. There If the friction between Coke and its bottlers worsens, were so many such deals that Coke was able to con- some analysts believe that Isdell will have no choice vince analysts the resulting profits should be consid- but to resort to radical measures to defend Coke's ered part of normal operations and not extraordinary interests-such as reacquiring the 62% of cce it doesn't income. own. (Coke's stake has declined to 38% because of For a time, this flurry of dealmaking masked the dilution.) If CCE continues to raise prices, then reabproblems building in Coke's international business. But sorbing the bottler could be the only means left for by the end of the '90s, Coke simply ran out of assets to Coke to ensure that it maintains its share of the pie, resell, and its largest bottlers began to sink fast under reasons Morgan Stanley analyst William P. Pecoriello. all the debt-financed acquisitions they had made at Another scenario swirling inside the Coke system Coke's behest. The result: Coke's profits stalled, with would have Isdell reacquiring CCE and then breaking operating income falling from $5 billion in 1997 to up its assets and territories for resale to smaller bottlers as low as $3.69 billion in 2000 . "In hindsight, a lot of or even major U.S. beer distributors - which as private what Coke was doing was smoke and mirrors, stuff companies may be content to work on lower margins that wouldn't pass the accounting standards of today," than publicly traded CCE. But for now, Coke shows notes Douglas C. Lane, a private fund manager who little willingness to tamper with this vestige of the now holds 400,000 Coke shares. "And at the time it Goizueta era. "I think that there are a number of things created expectations of growth that weren't real." Coke that we can do together without having to consider notes that all such transactions were fully disclosed at changing the model," Isdell said in an interview. the time. Nowhere is the Goizueta orthodoxy more apparent The next move was inevitable: Coke imposed a than in the company's unwavering focus on its aging crushing 7.6\% price hike on its bottlers in the late '90s group of soda-pop brands, especially the hallowed as Ivester, now CEO, desperately tried to sustain four: Coca-Cola, Diet Coke, Sprite, and Fanta. Goizueta Goizueta's profit streak. Coke's U.S. bottlers, livid over was fond of discussing Coke's market share in terms the price increase, burned up the phone lines to some of "share of stomach," as though, with the right markey Coke board members and succeeded in pushing the keting, people could be induced to give up coffee, already embattled Ivester over the ledge. In late 1999, milk, and even water in favor of Coke. Seven years he resigned. after his death, the company remains fixated on mak- which is gaining on Coke's lead in the U.S. beverage market and numbers Tropicana juice, Gatorade sports drinks, and Aquafina water among its billion-dollar beverage brands. Coke loyalists still believe in the the mantra first coined by legendary Coke Chairman Robert W. Woodruff and often repeated by Goizueta, of putting a Coke within an "arm's reach of desire" of consumers around the globe. But increasingly, consumers are reaching for anything but a soda. The mass market that Coke was so adept at exploiting has splintered. Consumer tastes have shifted from sodas to an array of sports drinks, vitamin-fortified waters, energy drinks, herbal teas, coffee, and other noncarbonated products, some of which are growing as much as nine times faster than cola. After rising steadily during the ' 80 s and 90s, per capita soda consumption in the U.S. has declined every year since 1998. Yet when Daft tried to push Coke to become a "total beverage company", he met with resistance from Coke's board. In an interview early in the Daft years, investment banker and director Herbert A. Allen dismissed Daft's In an interview early in the Daft years, investment banker and director Herbert A. Allen dismissed Daft's efforts, declaring: "That's all fine and good, but I still believe that getting the four core [soda] brands right is 85% of the equation." That attitude still seems to dominate. One director, speaking on the condition he not be named, recently dismissed bottled water as "something I guess we have to carry. But the fact is we're still the kings of carbonation-always have been, always will be." Coke's cultural resistance to diversification has become an enormous liability. South Beach Beverage Co., for example, negotiated with Coke for two years before the soda giant decided against acquiring the New Age juice company. It took Pepsi just two weeks to make an offer. Is SoBe a huge brand? No, but it gives Pepsi access and insight into a market that its drinks, competitively we would be disadvantaged in soda pop completely bypasses. If you think of yourself many ways," says PepsiCo CEo Steven S. Reinemund. as a beverage-and-snack company, as Pepsi does, that's "Being outside carbonated [soft drinks] makes sure valuable. If you think of yourself as a soda company, as we're growing in the areas where there is growth." Coke does, it's not. Isdell has said he'll explore new beverage catego- Pepsi Generation ries. If so, he'll be starting well behind Pepsi. Pepsi got a two-year jump on Coke in bottled water and later Its portfolio of beverages and its faster-growing snack outmaneuvered Big Red to acquire both SoBe and foods give Pepsi enormous clout with retailers (see share of the fast-growing sports-drink segment in the Exhibit 2). Pepsi boasts that it has become the second- U.S., vs. 81% for PepsiCo's Gatorade brand. And after largest generator of revenues, after Kraft Foods Inc., for garnering just a 2.8% share of the popular energy-drink its largest grocer customers. Pepsi isn't shy about using category - vs. 58.5% for independent rival Red Bullthat clout to try to wrest shelf space from Coke and Coke plans to try again with a second energy drink, other rivals. "If we were only playing in carbonated soft Full Throttle, in January. But in reaching into new categories, Coke may result, says one former marketing executive, is an erohave to figure out how to get these beverages to mar- sion of Coke's perceived value as a brand: "Starbucks ket using food brokers, since its dedicated bottlers have can charge $2 for a cup of coffee, and they can barely been loath to handle new products that don't approach sell a 12-pack of Cokes for $2." the high volumes of soda. Here, too, Pepsi has a head In recent years, Coke showed signs of regaining its start. Gatorade is already distributed through a well- footing on the marketing front, thanks in large part established system of brokers. Coke also may have to Heyer. But Heyer's departure in June after he was to reduce its profit expectations, since the margins on passed over for the top job was viewed as a big loss and noncarbonated drinks are generally lower. "Even with is likely to lead to an exodus of the talent he brought to premium price, they cannot achieve those [soda] mar- Coke during his three-year tenure. His successor, longgins in the New Age category," warns Lance Collins, time Coke exec Charles B. "Chuck" Fruit, contends founder of New Jersey-based Fuze Beverage LLC, that Coke is producing good ads but has been hurt by whose products include a diet pomegranate white tea. a propensity to careen from campaign to campaign. The one area at Coke where the thinking has "We've suffered from an impatience that we're going changed since the height of the Goizueta era, though to have to overcome," he says. "When we change camnot necessarily for the better, is marketing. At his paigns and have 11 different looks to a brand at any one Atlanta funeral, Goizueta was eulogized to the strains time, we're swimming upstream." of Id Like To Teach the World To Sing from Coke's syrupy but unforgettable commercials of the '70s. At "Simple Little Things" the height of its powers, the Coke marketing machine could turn even disaster into triumph, as it did when To really break out, Coke could make a transformative Coke tampered with its historic concentrate formula acquisition, as Pepsi did in the 1970s when it bought in 1985. The sweeter new concoction backfired, but Frito-Lay Inc. But Isdell is downplaying the notion Coke seized th opportunity to build intense loyalty for of a big, audacious fix for Coke's troubles. In fact, he Coca-Cola Classic. readily admits that during one of his European tours he The marketing magic at Coke had begun to fade passed on the chance to acquire Red Bull-the indeeven before Goizueta's death. In the late ' 90 s, Ivester pendently owned, market-leading energy drink. Rather began shifting resources away from advertising and into than a gaudy acquisition, Isdell maintains that Coke's blanketing the world with as many vending machines, redemption will come from its ability to better perform refrigerated coolers, and delivery trucks as Coke and the "millions of simple little things" that Coke employits bottlers could muster. The goal was simple ubiq- ees do around the globe each day. And Isdell is adauity, while the niceties of brand-building were ignored. mant that there's still growth in carbonated soft drinks. "There was no vision, no marketing," recalls one former The reason goes back to the bottom line: He says there executive. "It was all growth through distribution." just aren't many businesses for sale that produce the uity, while the niceties of brand-building were ignored. mant that there's still growth in carbonated soft drinks. "There was no vision, no marketing" recalls one former The reason goes back to the bottom line: He says there executive. "It was all growth through distribution." just aren't many businesses for sale that produce the This proved to be a costly shift. For one, vending lush margins-around 30%, some analysts estimatemachines that were put into unconventional locations that Coke makes from selling its proprietary concensuch as auto-parts stores didn't always pay off. Coke's trate to bottlers. In the end, Isdell has come around to lackluster advertising didn't help, either. Ivester, who the view that there's plenty of growth left in soda pop. had a deep distrust of Madison Avenue, tended to "Regardless of what the skeptics may think, I know starve the ad budget, believing that the iconic Coke that carbonated soft drinks can grow," he told analysts brand was powerful enough to sell itself. That began in mid-September. to change under Daft, who hired Steven J. Heyer, a That's a remarkably conservative strategy for a man former ad exec, and promoted him to president. Then, who made his name as a change agent at the soda giant. to evade the stifling Atlanta bureaucracy, he and Heyer During his years of helping Coke crack emerging marpushed decision-making out into the field. But the kets in Africa, Asia, and Eastern Europe-assignments move went wrong when Coke's local marketers, sud- that earned him the reputation as the "Indiana Jones denly unshackled, began producing racy ads, includ- of Coke" - the gregarious former rugby player made ing an Italian spot featuring a couple skinny-dipping. his mark as the revolutionary who was always willThat prompted Coke headquarters to reclaim control ing to challenge the corporate dogma. As a European and revert to bland Norman Rockwell-type ads. The executive in the late 1980s, Isdell pushed the company 46 Part One Strategieg Marketing into bottled water-a full decade before the cola- So notorious is the Coke board that many blame it for centric managers did the same back in the U.S. "He got the humiliating rejections Coke received from a string an awful lot of grief from headquarters," recalls Gavin of CEO candidates the board courted before anointDarby, a former Coke executive. ing Isdell. Even Buffett's prestige were not enough to And when Coke was poised to reenter India in 1993 persuade James M. "Jim" Kilts, head of Gillette Co., after a 17-year absence, Isdell allowed his local manag- where Buffett was a director for years. Like Robert ers to establish a beachhead by purchasing the leading A. Eckert of Mattel Inc. and Carlos M. Gutierrez of India soda maker, Parle, even though Coke had long Kellogg Co., Kilts passed on the opportunity to head frmwned on acmuirino rival soda makers Cokek former the world's most nowerful hrand fIndeed one execu- uity, while the niceties of brand-building were ignored. mant that there's still growth in carbonated soft drinks. "There was no vision, no marketing" recalls one former The reason goes back to the bottom line: He says there executive. "It was all growth through distribution." just aren't many businesses for sale that produce the This proved to be a costly shift. For one, vending lush margins-around 30%, some analysts estimatemachines that were put into unconventional locations that Coke makes from selling its proprietary concensuch as auto-parts stores didn't always pay off. Coke's trate to bottlers. In the end, Isdell has come around to lackluster advertising didn't help, either. Ivester, who the view that there's plenty of growth left in soda pop. had a deep distrust of Madison Avenue, tended to "Regardless of what the skeptics may think, I know starve the ad budget, believing that the iconic Coke that carbonated soft drinks can grow," he told analysts brand was powerful enough to sell itself. That began in mid-September. to change under Daft, who hired Steven J. Heyer, a That's a remarkably conservative strategy for a man former ad exec, and promoted him to president. Then, who made his name as a change agent at the soda giant. to evade the stifling Atlanta bureaucracy, he and Heyer During his years of helping Coke crack emerging marpushed decision-making out into the field. But the kets in Africa, Asia, and Eastern Europe-assignments move went wrong when Coke's local marketers, sud- that earned him the reputation as the "Indiana Jones denly unshackled, began producing racy ads, includ- of Coke" - the gregarious former rugby player made ing an Italian spot featuring a couple skinny-dipping. his mark as the revolutionary who was always willThat prompted Coke headquarters to reclaim control ing to challenge the corporate dogma. As a European and revert to bland Norman Rockwell-type ads. The executive in the late 1980s, Isdell pushed the company 46 Part One Strategieg Marketing into bottled water-a full decade before the cola- So notorious is the Coke board that many blame it for centric managers did the same back in the U.S. "He got the humiliating rejections Coke received from a string an awful lot of grief from headquarters," recalls Gavin of CEO candidates the board courted before anointDarby, a former Coke executive. ing Isdell. Even Buffett's prestige were not enough to And when Coke was poised to reenter India in 1993 persuade James M. "Jim" Kilts, head of Gillette Co., after a 17-year absence, Isdell allowed his local manag- where Buffett was a director for years. Like Robert ers to establish a beachhead by purchasing the leading A. Eckert of Mattel Inc. and Carlos M. Gutierrez of India soda maker, Parle, even though Coke had long Kellogg Co., Kilts passed on the opportunity to head frmwned on acmuirino rival soda makers Cokek former the world's most nowerful hrand fIndeed one execu- ers to establish a beachhead by purchasing the leading A. Eckert of Mattel Inc. and Carlos M. Gutierrez of India soda maker, Parle, even though Coke had long Kellogg Co., Kilts passed on the opportunity to head frowned on acquiring rival soda makers. Coke's former the world's most powerful brand. (Indeed, one execuIndia chief, Jay Raja, recalls Isdell telling him to go for tive that Coke approached for the job was rankled by it: "We agreed that we would ask for forgiveness instead the way Coke's board leaked the names of people it was of permission." Isdell's instincts were proven right: At pursuing. "It was like the search was playing out on a later board meeting, Goizueta hailed Isdell's move, CNN," he says. "One of the greatest legacies that [Isdell] which gave Coke 60% of the Indian soda market almost can leave behind is a reshaped board.") overnight, as "the deal of the decade," recalls Raja. Board members have made clear their opposition to product diversification, as well as their belief that Notorious Board mergers aren't what's needed. At times they've even involved themselves in operations. Keough rankled Perhaps the biggest impediment Isdell faces, outsiders some marketing staffers when earlier this year he persay, is Coke's board. More than anyone else, the direc- sonally killed an edgy TV ad-in which a teen wipes tors, especially the powerful triumvirate of Warren E. a Coke can under his armpit before handing it to an Buffett, Herbert A. Allen, and Donald Keough, are the unwitting friend - that he deemed in poor taste. Isdell keepers of the flame at Coke. Over the years they have maintains that he'll be able to stand his ground with strictly enforced obedience to the Goizueta Way. This Coke's board. Sonya H. Soutus, a Coke spokeswoman, politburo of the Goizueta era (of 14 directors, 10 date says it is "presumptuous and unfair" to criticize Coke's back to the late CEO) has chewed through two CEOs in the board members, who she says have substantial stockpast five years. Three directors are over the age of 70 , holdings, bring a wealth of experience, and have taken but don't look for any departures soon. Earlier this year steps to address Coke's problems. the board waived Coke's mandatory retirement age, 74, Can Isdell return Coke to greatness? In some ways, to allow Buffett to remain and Keough to rejoin. the clock is working against him. At 61, he may be This is a group that believes in getting involved- only a transitional CEO. Still, long-timers can somevery involved - in company affairs. Many Coke insid- times bring special skills to rejuvenating a tired corpoers feel that Daft, Isdell's predecessor who abruptly rate culture. "A.G. Lafley was a product of Procter \& announced his retirement last February, never recov- Gamble, and William Johnson was a product of [ HJ.] ered from Buffett's 11th-hour veto of his attempt to Heinz," notes Gary M. Stibel, a management guru-at steal Quaker Oats Co. from Pepsi in November, 2000. Westport (Conn.)-based New England Consulting The deal was quashed when the legendary financier Group. "They remembered what it was like when their declared at a special board meeting that Quaker and companies were great, and they returned them to that its powerful Gatorade brand weren't worth giving up greatness." There are plenty of other examples, though, 10.5% of the Coca-Cola Co. Daft declined to speak for such as Eastman Kodak Co., where a succession of this article except to say he retired for health reasons. CEOs was unable to break from the past and continued "The board has to challenge management's plan but to ride outdated models and product lineups nearly into should not challenge its authority. The Coke board was oblivion. As two cEos have already discovered at Coke, micro-managing," says John M. Nash, a board consult- it isn't casy following in the footsteps of a legend. ant and former president of the National Association of Source: Dean Foust, "Cone flat," BusinessWeek, December 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started