submission consist of:

can you help me how to A NEW MS WORD FILE WITH a One-page report comparing HEMI to its competitor (Wajax Corporation).

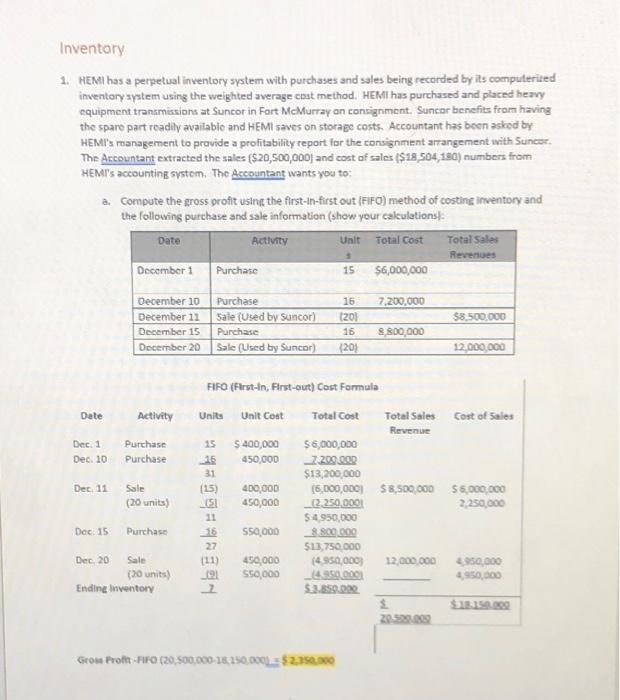

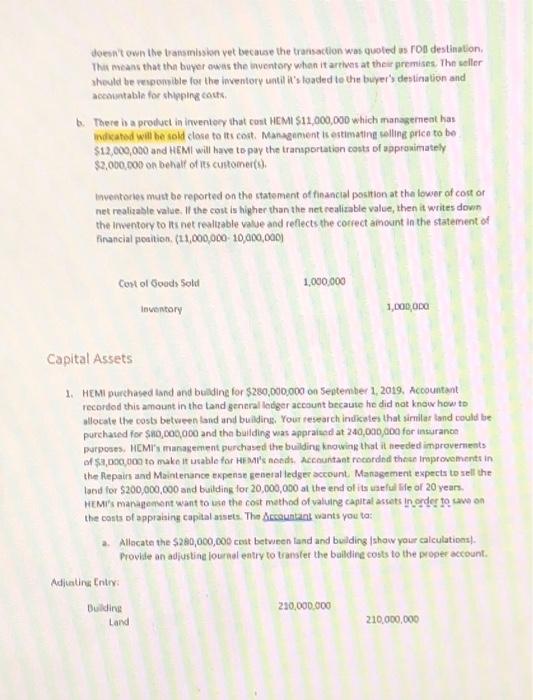

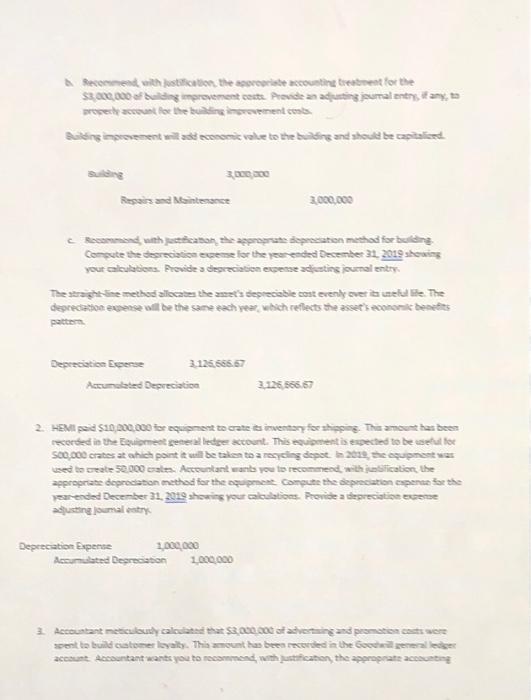

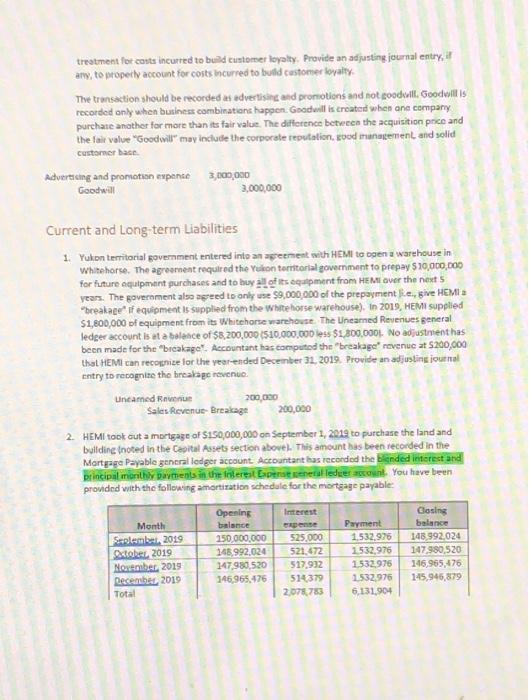

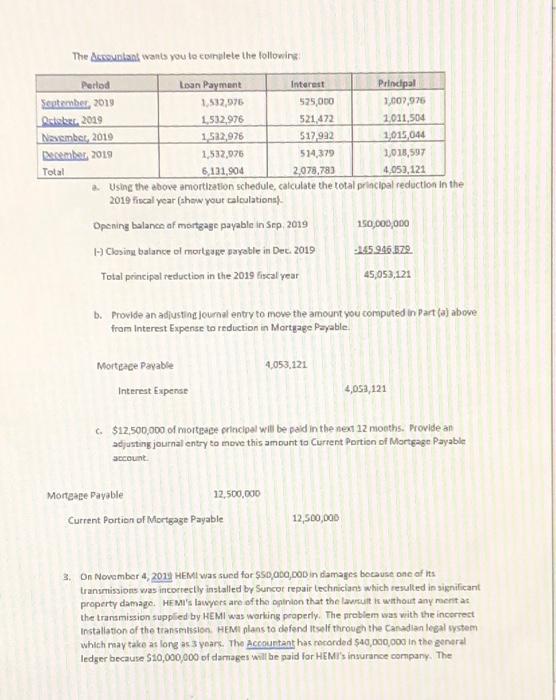

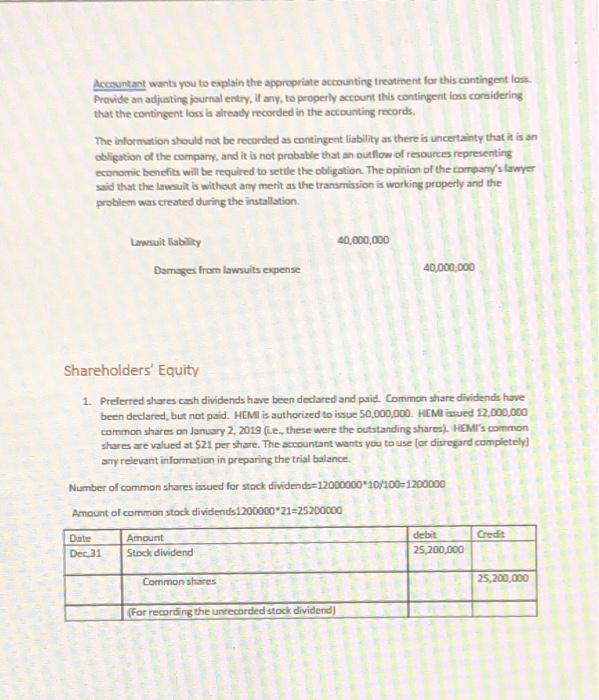

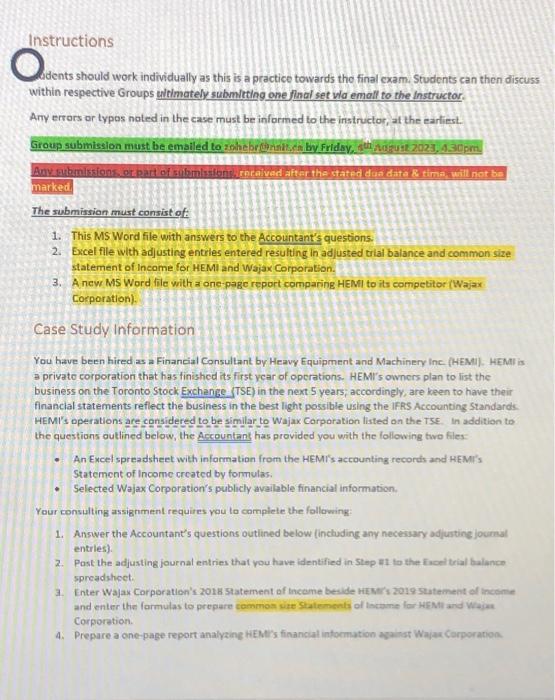

b. Explain why the gross profit is higher under one method when compared to the other method. Under the FIFO (First-in-First-Out) cost method, the cost of goods sold is based on the earliest inventory purchases, while the ending inventory is valued using the cost of the most recent purchases. When prices rise, using FiFO results in lower costs of goods sold since the older, lower-priced items are matched with current revenues, leading to a higher gross profit as revenues are offset by lower costs. In contrast, the Weighted Average Method calculates the cost of zoods sold and endine inventory based on the weighted average cost of all units available for sale during the accounting period. These cost fluctuations result in higher costs of goods sold and lower gross profit than FiFO when prices rise, as higher costs match current revenues. 2. HEMI's management is cost conscious and does not spend money unless the benefits exceed the amount spent. The accountant understands that a physical inventory count is good internal control practice; howvever, he wants you to explain the benefit of a physical inventory count when HEMI has a perpetual inventory system and the inventory is physically protected. Conducting periodic physical inventary counts, even with a perpetual inventory system in place, offers numerous valuable benefits for companies like HEMI. Firstly, it allows verification of the perpetual system's accuracy, identifying end rectifying any discrepancies between physical counts and records. Secondly, hidden, or systematic errors that may not be evident throuzh routine eperations can be detected, cosuring data integrity. Thirdly, it serves as an internal control layer, reducing the risk of fraud or mismanagement. Moreover, the process can lead to process improwements, optimixing imventory management procedures. It also helps prevent stockouts and overslocking, improving cash flow management. For compliance and external assurance, a physical count assures stakeholders of accurate inventory records. Additionally, it enhances confidence in financial reportinE, avoiding misstatements in financial statements related to inventory valuation. Lastly, by identifying inventory shrinkage, cost savings, and better inventory control can be achieved. 3. Accountant wants you to evaluate the following major transactions and provide adjusting journal entries, if necessary. For each item, explain why you are (or are not) adjusting HEMr's current account balances and provide supporting calculations for adjustments: a. On December 21 , HEMI ordered 25 transmissions for a total cost of $15,000,000 which were shipped on December 27 with the terms fob Destination. This inventory was not recelved at year end and has not been recorded in HEMr's accounting records. There's no need for an adjusting entry for this transaction since the inventory wasn't received by the year-end. It's appropriate not to include it in the accounting records. HEMI Accountant wants you to explain the appropriate accounting treatrnent for this contingent loss-Provide an adjusting journal entry, if any, to properly account this contingent loss considering that the contingent loss ba already recorded in the accounting records. The informotion should not be recorded as contingent liability as there is uncertainty that it is an obligation of the compary, and it is not probable that an outfow of resources representing economic bencfits will be required to settle the obligation. The opinion of the corrporry/s lawyer said that the lawsit is without any merit as the transmission is working properly and the probiem was crested during the installation. Lawait kabing Damses from lawsuits expense 40,000,000 40,000,000 Shareholders' Equity 1. Prelerred shares cash dividends have been declared and paid. Common share dividends have been dedared, but not paid. HEM is authorized to issue 50,000,000. HEMe anued 12,000,060 common shares an January 2, 2019 (i.e, these were the outstanding share), FaMtr's common shares are valued at \$21 per share. The accountant wants you to use [or disregard completely) ary relevant information in preparing the trial balance. Number of common shares isued for stack dividends =1200000010/100=1200000 Amount of cornmon stock dividends 120000021=25,200000 treatment for cants incurred to build customer loyplty. Provide an adjusting journal entry, if atw, to properlv account for costs incurred to buld castomer bevaity. The transaktion should be recorded at edvertisine and promotions and not coodvill, Goodwill is recorded only when business combinations happen. Goodvill is created when ane cempary purchate another for more than its fair value. The difference betveeen the acquisition prien and the fair value "Goodivill" may include the corporate reputation, sood manakement and sodid customer bace. kduerticing and promotion expanse Goodwill 3,000,000 3,000,000 Current and Long-term Liabilities 1. Yukon territorial govemment entered into an ageenent with HEM to ogen a warehouse in Whitehorke. The agreernent requiled the Vulon terrtiorial government to prepay $10,000,000 for future equipmant purchases and to buy all of its equpment from HEMI over the next 5 vears. The goverament also aesed to only use $9,000,000 of the prepayment k.e., give HEM a 'breakace' if equipment is supplied from the white horse warehouse), in 2019, HElWi supplied $1,800,000 of equipment from its Whitehorse warchouse. The Uneamed Revenues general ledger account is at a balasce of $8,200,000 (\$\$10,000,000 less $1,300,0001. No adjustnent has been made for the "breakage", Accountant has computod the "breakage" rovenuc at $200,000 that HEMI can recopnize lor the vear-ended December 31, 2019. Provide an adjustins ioutmal entry to recognite the breakec revenue. Uneamed Rnweriue 200,050 Sales Revenue-Breakage 200,000 2. HEMI took cut a mortgage of $150,000,000 on September 1, 2019 to purchase the land and bulldine tnoted in the Capital Assets section abovel. This amcunt bas been recorded in the Mortpage Payable general ledecr account Accountant has reconded the Biended ieterest and prouded with the follewing amortiration schedale for the morgage payable: doesn't own the bansmisisn vet becase the transaction was quoled as rOb destination, This means that tha buyor owas the inyentory whan it arewes at their premises. The seller sheuld be respomible for the inventory until il's loaded to the buyer's destination and acemuntable for shlpping couk. b. Toere is a product in irventery that cont HCMI $11,000,000 which managemeat has indzatod wal he sold close to tts cout. Managenient is estimating welling price to bo $12,000,020 and HEMI will have to pay the transportation costs of appronimately $2,000,000 on behalf of its cutomer(s). inventories must be reported on the statement of financial position at tha lewer of cost or net realizable value. 11 the cout is higher than the net realizable value, then it writes down the imentory to its net realzable valye and reflects the correct amount in the statement of financial peaition. (11,000,00010,000,000) Cost ol Goods Sold 1,000,000 inwentory 1,000,0Da Capital Assets 1. HEM purchased land and buldine for $280,000,000 on september 1, 2019. Accountant recordod this amount in the tand gennral lodger account becaute he did not know how to allocate the cosb between land and buildins, Your research indiketes that sirnilar tand could be purchased for $n0,000,000 and tha building was appraised at 240,000,000 for insuranoe purposes. MCMr's manazement purchased the buildins knowing that it needed improvernents the Repains and Maintenance ekpenae geaeral ledger account. Management expects to sell the land for $200,000,000 and building for 20,000,000 at the end of its uraful bie of 20 year. HeMi's managoqsent want to use the cost method of valuing capital assets in erder to uwo on the conts of appraising capital assets. The Accountant wants you ta: a. Allacate the $280,000,000 cest between fand and building (show your calculations). Provide an adjustine lournal entry to transter the baildine costs to the proper account. Aditatine Entir: Bulding: Land 210,000,000 210,000,000 Instructions bdents should work individually as this is a practice towards tho final exam. Students can then discuss within respective Groups ultimately submiting one final set vla emaff to the instructor. Any errors or typos noted in the case must be informed to the instructor, at the earliest. marked The submission must consist of: 1. This MS Word file with answers to the Accountant's questions. 2. Excel file with adjusting entries entered resulting in adjusted trial balance and common size statement of Income for HEMI and Wajax Corporation. 3. A new MS Word file with a one-page report comparing HEMl to its competitor (Wajax Corporation). Case Study Information You have been hired as a Financial Consultant by Heavy Equipment and Machinery inc. (HEMI). HEMII is a privato corporation that has finished its first vear of operations. HEMI's owners plan to list the business on the Toronto Stock Exchange. (TSE) in the next 5 years; accordingly, are keen to have their financlal statements reflect the business in the best light possible using the IFRS Accounting standards. HEMI's operations are considered to be similar to Wajax Corporation listed on the TSE. in addition to the questions outlined below, the Accountant has provided you writh the following two files: - An Excel spreadsheet with information from the HEMI's accounting records and HEMI's Statement of Income crcated by formulas: - Selected Wajax Corporation's publicly available financial information. Your consulting assignment requires you to complete the following: 1. Answer the Accountant's questions outlined below linchuding any necessary adjusting jocimal entries). 2. Past the adjusting journal entries that vou have identified in Step it to the fiscel trial balance spreadshoet. 3. Enter Wajax Corporation's 2018 Statement of Incame beside HEMr's 2019 statement of income and enter the farmulas to prepare common size Statements of lactame lor HEMT and Whias Corporation. 4. Prepare a one-page report analyzine HEMT's financial informution asainst Wajas Corporation Inventory 1. HEMI has a perpetual inventory system with purchases and sales being recorded by its compulerited inventory system using the weighted average cost method. HEMI has purchased and placed heary equipment transmissions at Suncor in Fart MeMurray on consignment. Suncor benefits from having the spare part readily available and HEMl saves on storage costs. Accountant has been asked by HEMr's management to provide a profitability report for the consignment arrangement with Suncor. The Accountant extracted the sales ($20,500,000) and coat of sales ($18,504,190) numbers from HEMT's accounting system. The Accountant ivants you to: a. Compute the gross grofit using the first-in-first out (FIFO) method of costing inventory and the following purchase and sale information (show your calculations): FIFO (First-in, First-out) Cost Formula Gros Fofh-Fro (20,500,00018,230,000)=$2.35000 sulaing 3,000,000 Rrowirs and Mtainteanse 3,000,000 your ealulations. Provide a desreciation ewense adjuting journal entry. pattera Depreciotice Eeperse 3.125665 .67 Acrumolated Depreciation 3,126,866.60 2. HEMl peid $10,000,00 tor equipnent to cate to inventary for ahipgive. Thir amouns has been used to veate 50000 crates. Accountant wants you to recomenend with jublication, the adpeting joumal vatry The Ascounlans wants vou to complete the following: a. Using the above amortization schedule, calculate the total priacipal reduction in the 2019 fiscal year (shew yout calculations)- Opening bulance of mortgage payable in Sep, 2019 1-) Closing balance of mortsake payable in Dec. 2019 Total principol reduction in the 2019 fiscal year 150,000,000 155946.572. 45,053,121 b. Frowde an adiusting journal entry to move the amount you computed in part (a) above from interest Expense to reduction in Mortgape Payable. Morteace Parable Interest Expense 4,053,121 4,053,121 c. \$12,500,000 of mortgace orincipal will be paid in the neat 12 mooths. Provide an adjusting journal entry to meve this amount to Current Portion of Morterge Payable secount. Morteage Payable 12,500,000 Current Portion of Morteage Payable 12,500,000 3. On Nowember 4, 2019 HEMI was sued for $S0,0c0,000 in damages bocavse one of its transmissions was incorrectly installed by Suncot repair technicians which resulked in significant property damago. HEMI's lawyers are of the oginion that the laweult is without any ment at the transmission suppled by HEMI was working peaperly. The problem was with the incerrect installation of the transmission. HEMI plans to defend Itself throuch the Canadian leeal wystem which may take as lone as 3 years. The Accountant has merorded $40,000,000 in the general ledger because $10,000,000 of darmages will be paid for HEMI's insurance company. The b. Explain why the gross profit is higher under one method when compared to the other method. Under the FIFO (First-in-First-Out) cost method, the cost of goods sold is based on the earliest inventory purchases, while the ending inventory is valued using the cost of the most recent purchases. When prices rise, using FiFO results in lower costs of goods sold since the older, lower-priced items are matched with current revenues, leading to a higher gross profit as revenues are offset by lower costs. In contrast, the Weighted Average Method calculates the cost of zoods sold and endine inventory based on the weighted average cost of all units available for sale during the accounting period. These cost fluctuations result in higher costs of goods sold and lower gross profit than FiFO when prices rise, as higher costs match current revenues. 2. HEMI's management is cost conscious and does not spend money unless the benefits exceed the amount spent. The accountant understands that a physical inventory count is good internal control practice; howvever, he wants you to explain the benefit of a physical inventory count when HEMI has a perpetual inventory system and the inventory is physically protected. Conducting periodic physical inventary counts, even with a perpetual inventory system in place, offers numerous valuable benefits for companies like HEMI. Firstly, it allows verification of the perpetual system's accuracy, identifying end rectifying any discrepancies between physical counts and records. Secondly, hidden, or systematic errors that may not be evident throuzh routine eperations can be detected, cosuring data integrity. Thirdly, it serves as an internal control layer, reducing the risk of fraud or mismanagement. Moreover, the process can lead to process improwements, optimixing imventory management procedures. It also helps prevent stockouts and overslocking, improving cash flow management. For compliance and external assurance, a physical count assures stakeholders of accurate inventory records. Additionally, it enhances confidence in financial reportinE, avoiding misstatements in financial statements related to inventory valuation. Lastly, by identifying inventory shrinkage, cost savings, and better inventory control can be achieved. 3. Accountant wants you to evaluate the following major transactions and provide adjusting journal entries, if necessary. For each item, explain why you are (or are not) adjusting HEMr's current account balances and provide supporting calculations for adjustments: a. On December 21 , HEMI ordered 25 transmissions for a total cost of $15,000,000 which were shipped on December 27 with the terms fob Destination. This inventory was not recelved at year end and has not been recorded in HEMr's accounting records. There's no need for an adjusting entry for this transaction since the inventory wasn't received by the year-end. It's appropriate not to include it in the accounting records. HEMI Accountant wants you to explain the appropriate accounting treatrnent for this contingent loss-Provide an adjusting journal entry, if any, to properly account this contingent loss considering that the contingent loss ba already recorded in the accounting records. The informotion should not be recorded as contingent liability as there is uncertainty that it is an obligation of the compary, and it is not probable that an outfow of resources representing economic bencfits will be required to settle the obligation. The opinion of the corrporry/s lawyer said that the lawsit is without any merit as the transmission is working properly and the probiem was crested during the installation. Lawait kabing Damses from lawsuits expense 40,000,000 40,000,000 Shareholders' Equity 1. Prelerred shares cash dividends have been declared and paid. Common share dividends have been dedared, but not paid. HEM is authorized to issue 50,000,000. HEMe anued 12,000,060 common shares an January 2, 2019 (i.e, these were the outstanding share), FaMtr's common shares are valued at \$21 per share. The accountant wants you to use [or disregard completely) ary relevant information in preparing the trial balance. Number of common shares isued for stack dividends =1200000010/100=1200000 Amount of cornmon stock dividends 120000021=25,200000 treatment for cants incurred to build customer loyplty. Provide an adjusting journal entry, if atw, to properlv account for costs incurred to buld castomer bevaity. The transaktion should be recorded at edvertisine and promotions and not coodvill, Goodwill is recorded only when business combinations happen. Goodvill is created when ane cempary purchate another for more than its fair value. The difference betveeen the acquisition prien and the fair value "Goodivill" may include the corporate reputation, sood manakement and sodid customer bace. kduerticing and promotion expanse Goodwill 3,000,000 3,000,000 Current and Long-term Liabilities 1. Yukon territorial govemment entered into an ageenent with HEM to ogen a warehouse in Whitehorke. The agreernent requiled the Vulon terrtiorial government to prepay $10,000,000 for future equipmant purchases and to buy all of its equpment from HEMI over the next 5 vears. The goverament also aesed to only use $9,000,000 of the prepayment k.e., give HEM a 'breakace' if equipment is supplied from the white horse warehouse), in 2019, HElWi supplied $1,800,000 of equipment from its Whitehorse warchouse. The Uneamed Revenues general ledger account is at a balasce of $8,200,000 (\$\$10,000,000 less $1,300,0001. No adjustnent has been made for the "breakage", Accountant has computod the "breakage" rovenuc at $200,000 that HEMI can recopnize lor the vear-ended December 31, 2019. Provide an adjustins ioutmal entry to recognite the breakec revenue. Uneamed Rnweriue 200,050 Sales Revenue-Breakage 200,000 2. HEMI took cut a mortgage of $150,000,000 on September 1, 2019 to purchase the land and bulldine tnoted in the Capital Assets section abovel. This amcunt bas been recorded in the Mortpage Payable general ledecr account Accountant has reconded the Biended ieterest and prouded with the follewing amortiration schedale for the morgage payable: doesn't own the bansmisisn vet becase the transaction was quoled as rOb destination, This means that tha buyor owas the inyentory whan it arewes at their premises. The seller sheuld be respomible for the inventory until il's loaded to the buyer's destination and acemuntable for shlpping couk. b. Toere is a product in irventery that cont HCMI $11,000,000 which managemeat has indzatod wal he sold close to tts cout. Managenient is estimating welling price to bo $12,000,020 and HEMI will have to pay the transportation costs of appronimately $2,000,000 on behalf of its cutomer(s). inventories must be reported on the statement of financial position at tha lewer of cost or net realizable value. 11 the cout is higher than the net realizable value, then it writes down the imentory to its net realzable valye and reflects the correct amount in the statement of financial peaition. (11,000,00010,000,000) Cost ol Goods Sold 1,000,000 inwentory 1,000,0Da Capital Assets 1. HEM purchased land and buldine for $280,000,000 on september 1, 2019. Accountant recordod this amount in the tand gennral lodger account becaute he did not know how to allocate the cosb between land and buildins, Your research indiketes that sirnilar tand could be purchased for $n0,000,000 and tha building was appraised at 240,000,000 for insuranoe purposes. MCMr's manazement purchased the buildins knowing that it needed improvernents the Repains and Maintenance ekpenae geaeral ledger account. Management expects to sell the land for $200,000,000 and building for 20,000,000 at the end of its uraful bie of 20 year. HeMi's managoqsent want to use the cost method of valuing capital assets in erder to uwo on the conts of appraising capital assets. The Accountant wants you ta: a. Allacate the $280,000,000 cest between fand and building (show your calculations). Provide an adjustine lournal entry to transter the baildine costs to the proper account. Aditatine Entir: Bulding: Land 210,000,000 210,000,000 Instructions bdents should work individually as this is a practice towards tho final exam. Students can then discuss within respective Groups ultimately submiting one final set vla emaff to the instructor. Any errors or typos noted in the case must be informed to the instructor, at the earliest. marked The submission must consist of: 1. This MS Word file with answers to the Accountant's questions. 2. Excel file with adjusting entries entered resulting in adjusted trial balance and common size statement of Income for HEMI and Wajax Corporation. 3. A new MS Word file with a one-page report comparing HEMl to its competitor (Wajax Corporation). Case Study Information You have been hired as a Financial Consultant by Heavy Equipment and Machinery inc. (HEMI). HEMII is a privato corporation that has finished its first vear of operations. HEMI's owners plan to list the business on the Toronto Stock Exchange. (TSE) in the next 5 years; accordingly, are keen to have their financlal statements reflect the business in the best light possible using the IFRS Accounting standards. HEMI's operations are considered to be similar to Wajax Corporation listed on the TSE. in addition to the questions outlined below, the Accountant has provided you writh the following two files: - An Excel spreadsheet with information from the HEMI's accounting records and HEMI's Statement of Income crcated by formulas: - Selected Wajax Corporation's publicly available financial information. Your consulting assignment requires you to complete the following: 1. Answer the Accountant's questions outlined below linchuding any necessary adjusting jocimal entries). 2. Past the adjusting journal entries that vou have identified in Step it to the fiscel trial balance spreadshoet. 3. Enter Wajax Corporation's 2018 Statement of Incame beside HEMr's 2019 statement of income and enter the farmulas to prepare common size Statements of lactame lor HEMT and Whias Corporation. 4. Prepare a one-page report analyzine HEMT's financial informution asainst Wajas Corporation Inventory 1. HEMI has a perpetual inventory system with purchases and sales being recorded by its compulerited inventory system using the weighted average cost method. HEMI has purchased and placed heary equipment transmissions at Suncor in Fart MeMurray on consignment. Suncor benefits from having the spare part readily available and HEMl saves on storage costs. Accountant has been asked by HEMr's management to provide a profitability report for the consignment arrangement with Suncor. The Accountant extracted the sales ($20,500,000) and coat of sales ($18,504,190) numbers from HEMT's accounting system. The Accountant ivants you to: a. Compute the gross grofit using the first-in-first out (FIFO) method of costing inventory and the following purchase and sale information (show your calculations): FIFO (First-in, First-out) Cost Formula Gros Fofh-Fro (20,500,00018,230,000)=$2.35000 sulaing 3,000,000 Rrowirs and Mtainteanse 3,000,000 your ealulations. Provide a desreciation ewense adjuting journal entry. pattera Depreciotice Eeperse 3.125665 .67 Acrumolated Depreciation 3,126,866.60 2. HEMl peid $10,000,00 tor equipnent to cate to inventary for ahipgive. Thir amouns has been used to veate 50000 crates. Accountant wants you to recomenend with jublication, the adpeting joumal vatry The Ascounlans wants vou to complete the following: a. Using the above amortization schedule, calculate the total priacipal reduction in the 2019 fiscal year (shew yout calculations)- Opening bulance of mortgage payable in Sep, 2019 1-) Closing balance of mortsake payable in Dec. 2019 Total principol reduction in the 2019 fiscal year 150,000,000 155946.572. 45,053,121 b. Frowde an adiusting journal entry to move the amount you computed in part (a) above from interest Expense to reduction in Mortgape Payable. Morteace Parable Interest Expense 4,053,121 4,053,121 c. \$12,500,000 of mortgace orincipal will be paid in the neat 12 mooths. Provide an adjusting journal entry to meve this amount to Current Portion of Morterge Payable secount. Morteage Payable 12,500,000 Current Portion of Morteage Payable 12,500,000 3. On Nowember 4, 2019 HEMI was sued for $S0,0c0,000 in damages bocavse one of its transmissions was incorrectly installed by Suncot repair technicians which resulked in significant property damago. HEMI's lawyers are of the oginion that the laweult is without any ment at the transmission suppled by HEMI was working peaperly. The problem was with the incerrect installation of the transmission. HEMI plans to defend Itself throuch the Canadian leeal wystem which may take as lone as 3 years. The Accountant has merorded $40,000,000 in the general ledger because $10,000,000 of darmages will be paid for HEMI's insurance company. The