Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Submit a one pager outlining what went wrong of a financial statement manipulation case you found online based on the following themes assigned: Assigned work

Submit a one pager outlining "what went wrong" of a financial statement manipulation case you found online based on the following themes assigned:

Assigned work (income statement manipulation, specifically expense manipulation)

Need in 1 hr

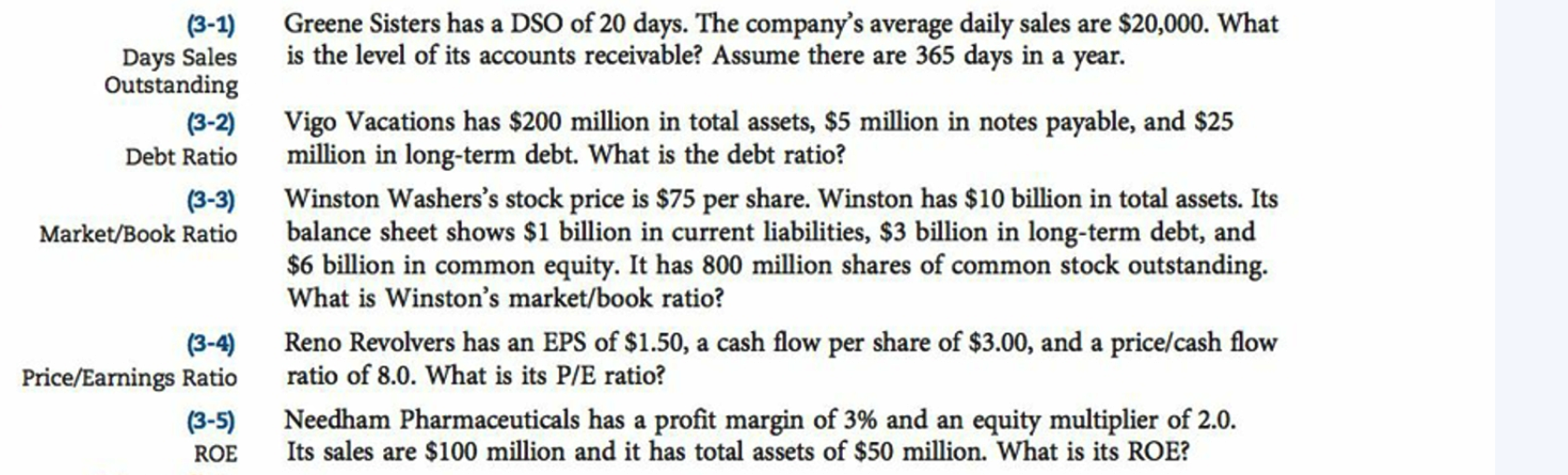

(3-1) Greene Sisters has a DSO of 20 days. The company's average daily sales are $20,000. What Days Sales is the level of its accounts receivable? Assume there are 365 days in a year. Outstanding (3-2) Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 Debt Ratio million in long-term debt. What is the debt ratio? (3-3) Winston Washers's stock price is $75 per share. Winston has $10 billion in total assets. Its Market/Book Ratio balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock outstanding. What is Winston's market/book ratio? (3-4) Reno Revolvers has an EPS of $1.50, a cash flow per share of $3.00, and a price/cash flow Price/Earnings Ratio ratio of 8.0. What is its P/E ratio? (3-5) Needham Pharmaceuticals has a profit margin of 3\% and an equity multiplier of 2.0. ROE Its sales are $100 million and it has total assets of $50 million. What is its ROE? (3-1) Greene Sisters has a DSO of 20 days. The company's average daily sales are $20,000. What Days Sales is the level of its accounts receivable? Assume there are 365 days in a year. Outstanding (3-2) Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 Debt Ratio million in long-term debt. What is the debt ratio? (3-3) Winston Washers's stock price is $75 per share. Winston has $10 billion in total assets. Its Market/Book Ratio balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock outstanding. What is Winston's market/book ratio? (3-4) Reno Revolvers has an EPS of $1.50, a cash flow per share of $3.00, and a price/cash flow Price/Earnings Ratio ratio of 8.0. What is its P/E ratio? (3-5) Needham Pharmaceuticals has a profit margin of 3\% and an equity multiplier of 2.0. ROE Its sales are $100 million and it has total assets of $50 million. What is its ROEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started