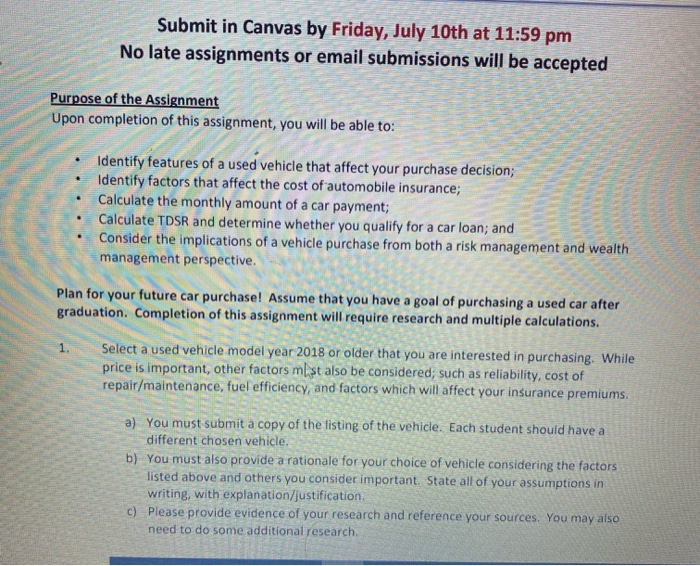

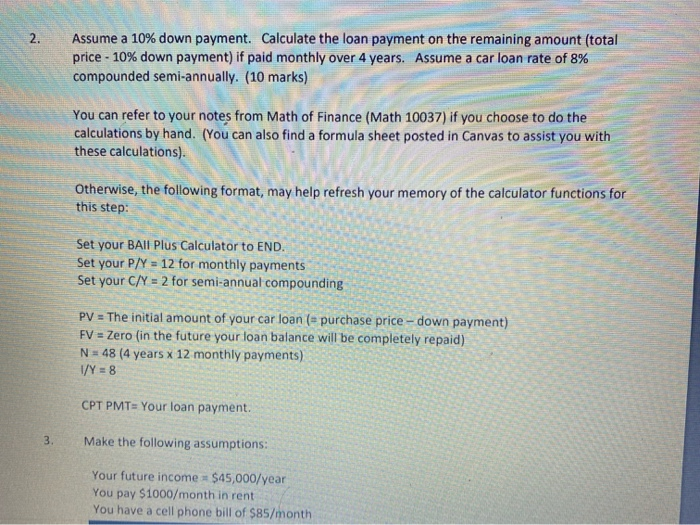

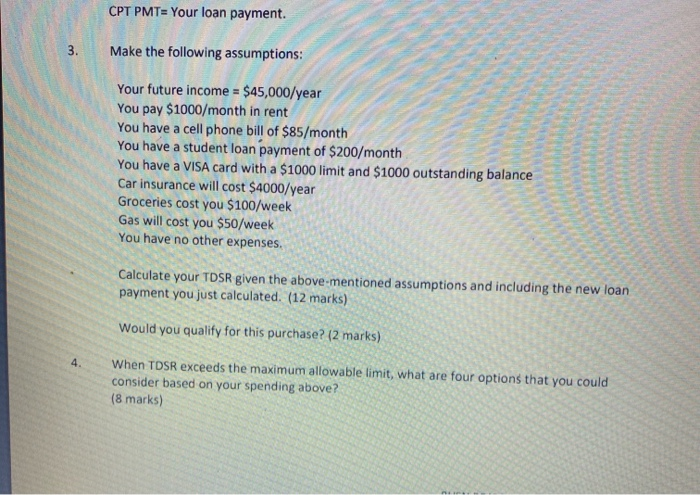

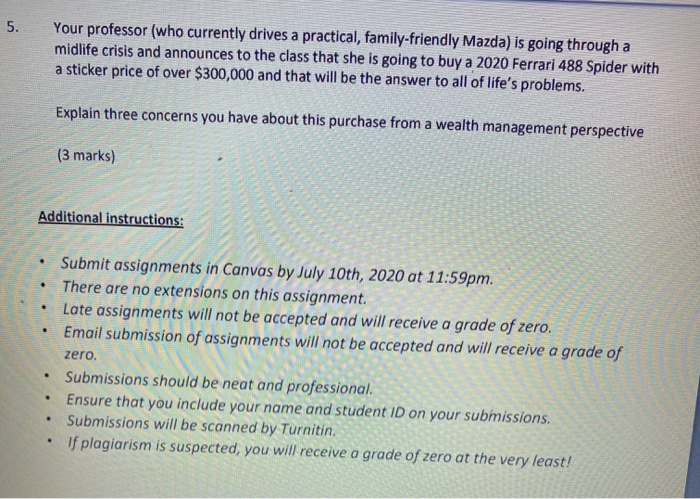

Submit in Canvas by Friday, July 10th at 11:59 pm No late assignments or email submissions will be accepted Purpose of the Assignment Upon completion of this assignment, you will be able to: . Identify features of a used vehicle that affect your purchase decision; Identify factors that affect the cost of automobile insurance; Calculate the monthly amount of a car payment; Calculate TDSR and determine whether you qualify for a car loan; and Consider the implications of a vehicle purchase from both a risk management and wealth management perspective. Plan for your future car purchase! Assume that you have a goal of purchasing a used car after graduation. Completion of this assignment will require research and multiple calculations. 1. Select a used vehicle model year 2018 or older that you are interested in purchasing. While price is important, other factors mst also be considered; such as reliability, cost of repair/maintenance, fuel efficiency, and factors which will affect your insurance premiums. a) You must submit a copy of the listing of the vehicle. Each student should have a different chosen vehicle. b) You must also provide a rationale for your choice of vehicle considering the factors listed above and others you consider important. State all of your assumptions in writing, with explanation/justification c) Please provide evidence of your research and reference your sources. You may also need to do some additional research. 2. Assume a 10% down payment. Calculate the loan payment on the remaining amount (total price - 10% down payment) if paid monthly over 4 years. Assume a car loan rate of 8% compounded semi-annually. (10 marks) You can refer to your notes from Math of Finance (Math 10037) if you choose to do the calculations by hand. (You can also find a formula sheet posted in Canvas to assist you with these calculations). Otherwise, the following format, may help refresh your memory of the calculator functions for this step: Set your BAll Plus Calculator to END. Set your P/Y = 12 for monthly payments Set your C/Y = 2 for semi-annual compounding PV = The initial amount of your car loan (= purchase price - down payment) FV = Zero (in the future your loan balance will be completely repaid) N = 48 (4 years x 12 monthly payments) 1/Y = 8 CPT PMT=Your loan payment. 3 Make the following assumptions: Your future income $45,000/year You pay $1000/month in rent You have a cell phone bill of $85/month CPT PMT= Your loan payment. 3. Make the following assumptions: Your future income = $45,000/year You pay $1000/month in rent You have a cell phone bill of $85/month You have a student loan payment of $200/month You have a VISA card with a $1000 limit and $1000 outstanding balance Car insurance will cost $4000/year Groceries cost you $100/week Gas will cost you $50/week You have no other expenses. Calculate your TDSR given the above-mentioned assumptions and including the new loan payment you just calculated. (12 marks) Would you qualify for this purchase? (2 marks) 4. When TDSR exceeds the maximum allowable limit, what are four options that you could consider based on your spending above? (8 marks) 5. Your professor (who currently drives a practical, family-friendly Mazda) is going through a midlife crisis and announces to the class that she is going to buy a 2020 Ferrari 488 Spider with a sticker price of over $300,000 and that will be the answer to all of life's problems. Explain three concerns you have about this purchase from a wealth management perspective (3 marks) Additional instructions: . Submit assignments in Canvas by July 10th, 2020 at 11:59pm. There are no extensions on this assignment. Late assignments will not be accepted and will receive a grade of zero. Email submission of assignments will not be accepted and will receive a grade of . O zero. . . Submissions should be neat and professional. Ensure that you include your name and student ID on your submissions. Submissions will be scanned by Turnitin. If plagiarism is suspected, you will receive a grade of zero at the very least! Submit in Canvas by Friday, July 10th at 11:59 pm No late assignments or email submissions will be accepted Purpose of the Assignment Upon completion of this assignment, you will be able to: . Identify features of a used vehicle that affect your purchase decision; Identify factors that affect the cost of automobile insurance; Calculate the monthly amount of a car payment; Calculate TDSR and determine whether you qualify for a car loan; and Consider the implications of a vehicle purchase from both a risk management and wealth management perspective. Plan for your future car purchase! Assume that you have a goal of purchasing a used car after graduation. Completion of this assignment will require research and multiple calculations. 1. Select a used vehicle model year 2018 or older that you are interested in purchasing. While price is important, other factors mst also be considered; such as reliability, cost of repair/maintenance, fuel efficiency, and factors which will affect your insurance premiums. a) You must submit a copy of the listing of the vehicle. Each student should have a different chosen vehicle. b) You must also provide a rationale for your choice of vehicle considering the factors listed above and others you consider important. State all of your assumptions in writing, with explanation/justification c) Please provide evidence of your research and reference your sources. You may also need to do some additional research. 2. Assume a 10% down payment. Calculate the loan payment on the remaining amount (total price - 10% down payment) if paid monthly over 4 years. Assume a car loan rate of 8% compounded semi-annually. (10 marks) You can refer to your notes from Math of Finance (Math 10037) if you choose to do the calculations by hand. (You can also find a formula sheet posted in Canvas to assist you with these calculations). Otherwise, the following format, may help refresh your memory of the calculator functions for this step: Set your BAll Plus Calculator to END. Set your P/Y = 12 for monthly payments Set your C/Y = 2 for semi-annual compounding PV = The initial amount of your car loan (= purchase price - down payment) FV = Zero (in the future your loan balance will be completely repaid) N = 48 (4 years x 12 monthly payments) 1/Y = 8 CPT PMT=Your loan payment. 3 Make the following assumptions: Your future income $45,000/year You pay $1000/month in rent You have a cell phone bill of $85/month CPT PMT= Your loan payment. 3. Make the following assumptions: Your future income = $45,000/year You pay $1000/month in rent You have a cell phone bill of $85/month You have a student loan payment of $200/month You have a VISA card with a $1000 limit and $1000 outstanding balance Car insurance will cost $4000/year Groceries cost you $100/week Gas will cost you $50/week You have no other expenses. Calculate your TDSR given the above-mentioned assumptions and including the new loan payment you just calculated. (12 marks) Would you qualify for this purchase? (2 marks) 4. When TDSR exceeds the maximum allowable limit, what are four options that you could consider based on your spending above? (8 marks) 5. Your professor (who currently drives a practical, family-friendly Mazda) is going through a midlife crisis and announces to the class that she is going to buy a 2020 Ferrari 488 Spider with a sticker price of over $300,000 and that will be the answer to all of life's problems. Explain three concerns you have about this purchase from a wealth management perspective (3 marks) Additional instructions: . Submit assignments in Canvas by July 10th, 2020 at 11:59pm. There are no extensions on this assignment. Late assignments will not be accepted and will receive a grade of zero. Email submission of assignments will not be accepted and will receive a grade of . O zero. . . Submissions should be neat and professional. Ensure that you include your name and student ID on your submissions. Submissions will be scanned by Turnitin. If plagiarism is suspected, you will receive a grade of zero at the very least