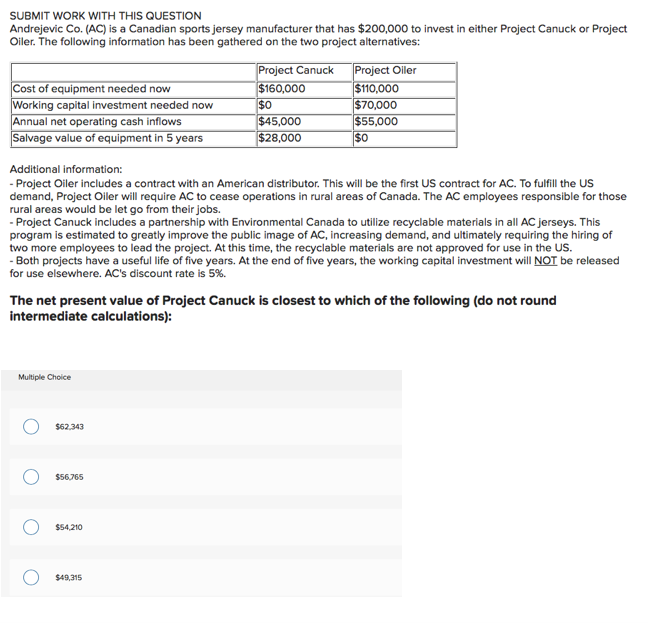

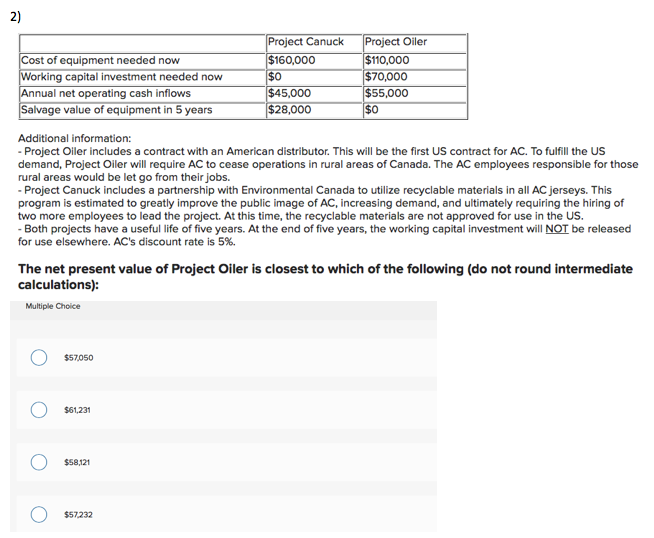

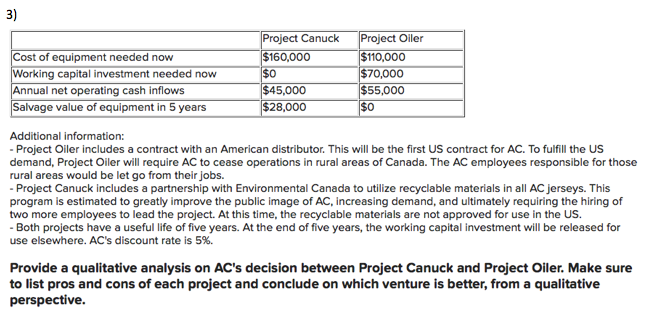

SUBMIT WORK WITH THIS QUESTION Andrejevic Co. (AC) is a Canadian sports jersey manufacturer that has $200,000 to invest in either Project Canuck or Project Oiler. The following information has been gathered on the two project alternatives: Project Canuck Project Oiler Cost of equipment needed now $160,000 $110,000 Working capital investment needed now $0 $70,000 Annual net operating cash inflows $45,000 $55,000 Salvage value of equipment in 5 years $28,000 SO Additional information: - Project Oiler includes a contract with an American distributor. This will be the first US contract for AC. To fulfill the US demand, Project Oiler will require AC to cease operations in rural areas of Canada. The AC employees responsible for those rural areas would be let go from their jobs. Project Canuck includes a partnership with Environmental Canada to utilize recyclable materials in all AC jerseys. This program is estimated to greatly improve the public image of AC, increasing demand, and ultimately requiring the hiring of two more employees to lead the project. At this time, the recyclable materials are not approved for use in the US. -Both projects have a useful life of five years. At the end of five years, the working capital investment will NOT be released for use elsewhere. AC's discount rate is 5%. The net present value of Project Canuck is closest to which of the following (do not round intermediate calculations): Multiple Choice O $62.343 O $56.765 O $54,210 O $49,3152) Project Canuck Project Oiler Cost of equipment needed now $160,000 $110,000 Working capital investment needed now $70,000 Annual net operating cash inflows $45,000 $55,000 Salvage value of equipment in 5 years $28,000 $0 Additional information: Project Oiler includes a contract with an American distributor. This will be the first US contract for AC. To fulfill the US demand, Project Oiler will require AC to cease operations in rural areas of Canada. The AC employees responsible for those rural areas would be let go from their jobs. - Project Canuck includes a partnership with Environmental Canada to utilize recyclable materials in all AC jerseys. This program is estimated to greatly improve the public image of AC, increasing demand, and ultimately requiring the hiring of two more employees to lead the project. At this time, the recyclable materials are not approved for use in the US. Both projects have a useful life of five years. At the end of five years, the working capital investment will NOT be released for use elsewhere. AC's discount rate is 5%. The net present value of Project Oiler is closest to which of the following (do not round intermediate calculations): Multiple Choice O $57.050 $61,231 O $58,121 O $572323) Project Canuck Project Oller Cost of equipment needed now $160,000 $110,000 Working capital investment needed now $70,000 Annual net operating cash inflows $45,000 $55,000 Salvage value of equipment in 5 years $28,000 $0 Additional information: - Project Oller includes a contract with an American distributor. This will be the first US contract for AC. To fulfill the US demand, Project Oiler will require AC to cease operations in rural areas of Canada. The AC employees responsible for those rural areas would be let go from their jobs. - Project Canuck includes a partnership with Environmental Canada to utilize recyclable materials in all AC jerseys. This program is estimated to greatly improve the public image of AC, increasing demand, and ultimately requiring the hiring of two more employees to lead the project. At this time, the recyclable materials are not approved for use in the US. - Both projects have a useful life of five years. At the end of five years, the working capital investment will be released for use elsewhere. AC's discount rate is 5%. Provide a qualitative analysis on AC's decision between Project Canuck and Project Oiler. Make sure to list pros and cons of each project and conclude on which venture is better, from a qualitative perspective