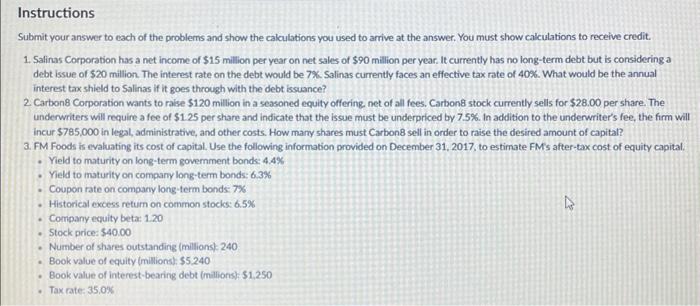

Submit your answer to each of the problems and show the calculations you used to arrive at the answer. You must show calculations to receive credit. 1. Salinas Corporation has a net income of $15 million per year on net sales of $90 million per year. It currently has no long-term debt but is considering a debt issue of $20 million. The interest rate on the debt would be 7%. Salinas currently faces an effective tax rate of 40%. What would be the annual interest tax shield to Salinas if it goes through with the debt issuance? 2 Carbon 8 Corporation wants to raise $120 million in a seasoned equity offering net of all fees, Carbon stock currently sells for $28.00 per share. The underwriters will require a fee of $1.25 per share and indicate that the issue must be underpriced by 7.5%. In addition to the underwriter's fee, the firm will incur $785,000 in legal, administrative, and other costs. How many shares must Carbon 8 sell in order to raise the desired amount of capital? 3. FM Foods is evaluating its cost of capital. Use the following information provided on December 31,2017 , to estimate FMs after-tax cost of equity capital. - Yield to maturity on long-term government bondk: 4.4% - Yield to maturity on company long-term bonds: 6.3% - Coupon rate on company long-term bonds: 7% - Historical excess retum on common stocks: 6.5% - Company equity beta: 1.20 - Stock price: $40.00 - Number of shares outstanding (millions) 240 - Book value of equity (millionst:\$5.240 - Book value of interest-bearing debt (millions) $1.250 - Tax rate: 35.0% Submit your answer to each of the problems and show the calculations you used to arrive at the answer. You must show calculations to receive credit. 1. Salinas Corporation has a net income of $15 million per year on net sales of $90 million per year. It currently has no long-term debt but is considering a debt issue of $20 million. The interest rate on the debt would be 7%. Salinas currently faces an effective tax rate of 40%. What would be the annual interest tax shield to Salinas if it goes through with the debt issuance? 2 Carbon 8 Corporation wants to raise $120 million in a seasoned equity offering net of all fees, Carbon stock currently sells for $28.00 per share. The underwriters will require a fee of $1.25 per share and indicate that the issue must be underpriced by 7.5%. In addition to the underwriter's fee, the firm will incur $785,000 in legal, administrative, and other costs. How many shares must Carbon 8 sell in order to raise the desired amount of capital? 3. FM Foods is evaluating its cost of capital. Use the following information provided on December 31,2017 , to estimate FMs after-tax cost of equity capital. - Yield to maturity on long-term government bondk: 4.4% - Yield to maturity on company long-term bonds: 6.3% - Coupon rate on company long-term bonds: 7% - Historical excess retum on common stocks: 6.5% - Company equity beta: 1.20 - Stock price: $40.00 - Number of shares outstanding (millions) 240 - Book value of equity (millionst:\$5.240 - Book value of interest-bearing debt (millions) $1.250 - Tax rate: 35.0%