Answered step by step

Verified Expert Solution

Question

1 Approved Answer

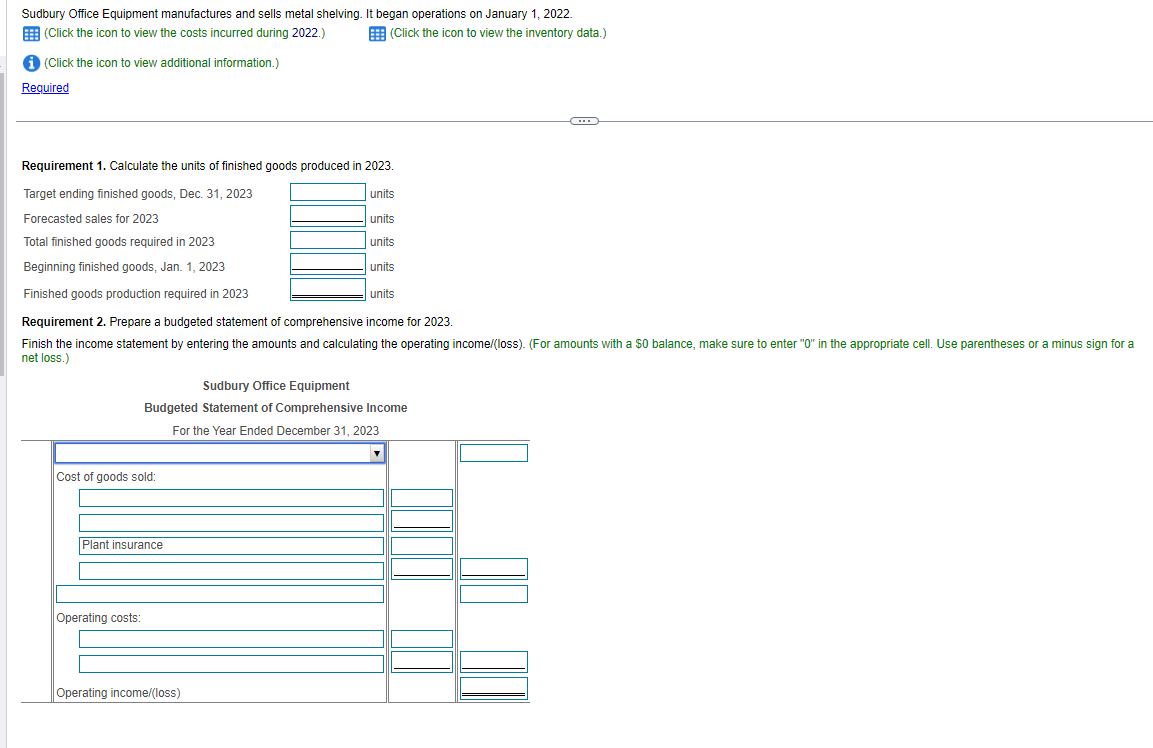

Sudbury Office Equipment manufactures and sells metal shelving. It began operations on January 1, 2022. (Click the icon to view the inventory data.) (Click

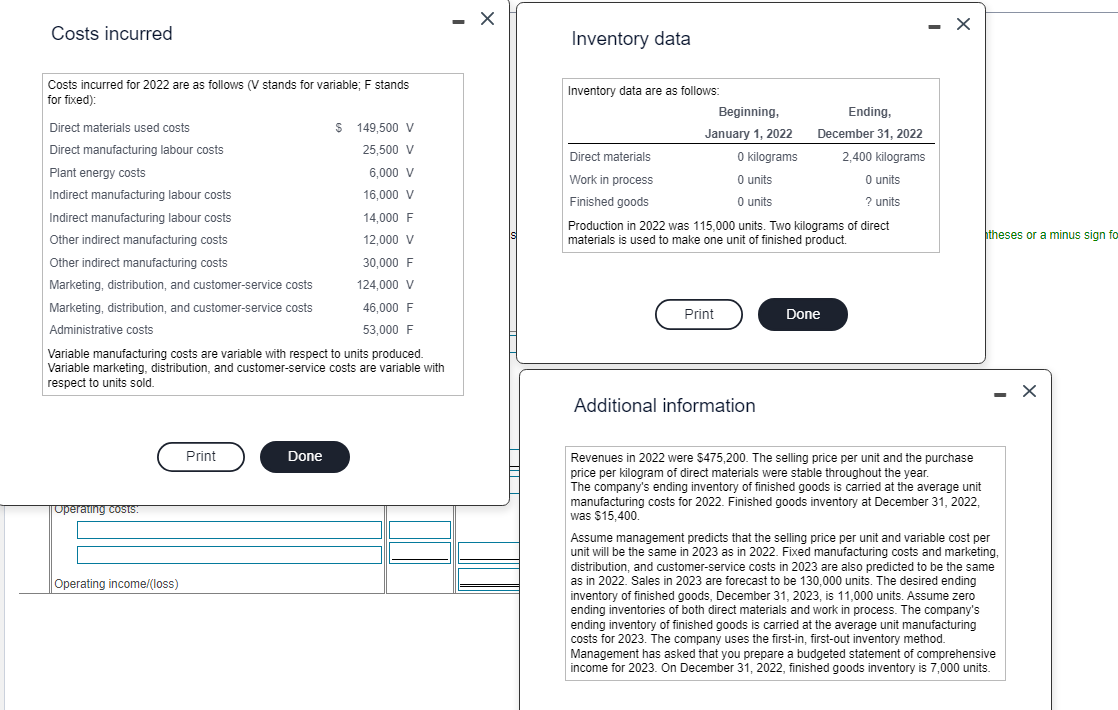

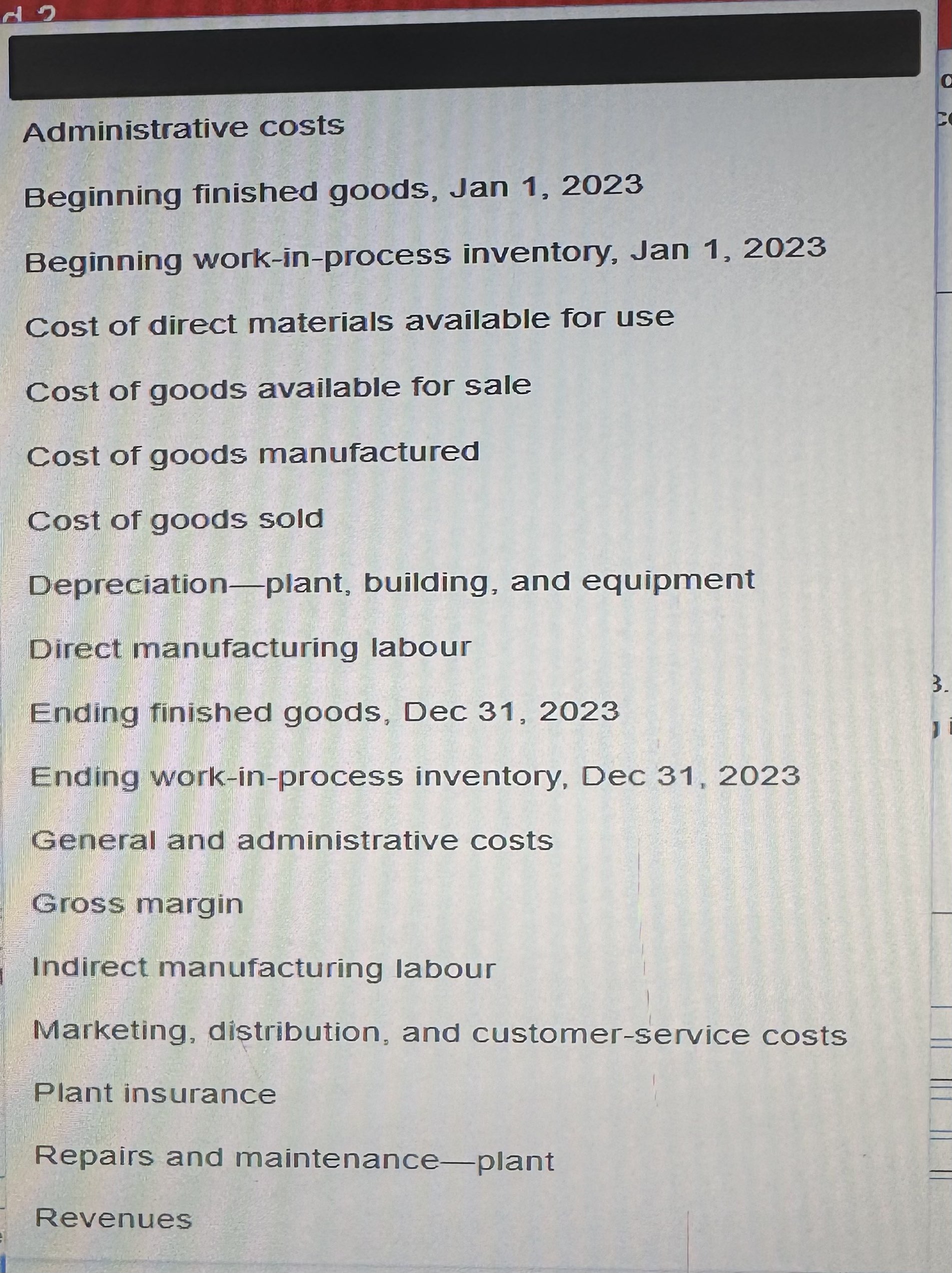

Sudbury Office Equipment manufactures and sells metal shelving. It began operations on January 1, 2022. (Click the icon to view the inventory data.) (Click the icon to view the costs incurred during 2022.) i (Click the icon to view additional information.) Required Requirement 1. Calculate the units of finished goods produced in 2023. Target ending finished goods, Dec. 31, 2023 units Forecasted sales for 2023 units Total finished goods required in 2023 units Beginning finished goods, Jan. 1, 2023 units Finished goods production required in 2023 units Requirement 2. Prepare a budgeted statement of comprehensive income for 2023. Finish the income statement by entering the amounts and calculating the operating income/(loss). (For amounts with a $0 balance, make sure to enter "0" in the appropriate cell. Use parentheses or a minus sign for a net loss.) Sudbury Office Equipment Budgeted Statement of Comprehensive Income For the Year Ended December 31, 2023 Cost of goods sold: Plant insurance Operating costs: Operating income/(loss) Costs incurred Costs incurred for 2022 are as follows (V stands for variable; F stands for fixed): Direct materials used costs Direct manufacturing labour costs Plant energy costs Indirect manufacturing labour costs Indirect manufacturing labour costs Other indirect manufacturing costs Other indirect manufacturing costs Marketing, distribution, and customer-service costs Marketing, distribution, and customer-service costs Administrative costs Operating costs. Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer-service costs are variable with respect to units sold. Operating income/(loss) Print $ 149,500 V 25,500 V 6,000 V 16,000 V Done 14,000 F 12,000 V 30,000 F 124,000 V 46,000 F 53,000 F Inventory data Inventory data are as follows: Ending, December 31, 2022 2,400 kilograms 0 units ? units Production in 2022 was 115,000 units. Two kilograms of direct materials is used to make one unit of finished product. Direct materials Work in process Finished goods Beginning, January 1, 2022 Print 0 kilograms 0 units 0 units Additional information Done Revenues in 2022 were $475,200. The selling price per unit and the purchase price per kilogram of direct materials were stable throughout the year. The company's ending inventory of finished goods is carried at the average unit manufacturing costs for 2022. Finished goods inventory at December 31, 2022, was $15,400. theses or a minus sign fo Assume management predicts that the selling price per unit and variable cost per unit will be the same in 2023 as in 2022. Fixed manufacturing costs and marketing, distribution, and customer-service costs in 2023 are also predicted to be the same as in 2022. Sales in 2023 are forecast to be 130,000 units. The desired ending inventory of finished goods, December 31, 2023, is 11,000 units. Assume zero ending inventories of both direct materials and work in process. The company's ending inventory of finished goods is carried at the average unit manufacturing costs for 2023. The company uses the first-in, first-out inventory method. Management has asked that you prepare a budgeted statement of comprehensive income for 2023. On December 31, 2022, finished goods inventory is 7,000 units. 12 Administrative costs Beginning finished goods, Jan 1, 2023 Beginning work-in-process inventory, Jan 1, 2023 Cost of direct materials available for use Cost of goods available for sale Cost of goods manufactured Cost of goods sold Depreciation-plant, building, and equipment Direct manufacturing labour Ending finished goods, Dec 31, 2023 Ending work-in-process inventory, Dec 31, 2023 General and administrative costs Gross margin Indirect manufacturing labour Marketing, distribution, and customer-service costs Plant insurance Repairs and maintenance-plant Revenues O 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started