Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sudden Ltd. is formed as a Canada Business Corporation. It pays an incorporation fee of $20,000 and pays legal fees of $15,020 to do

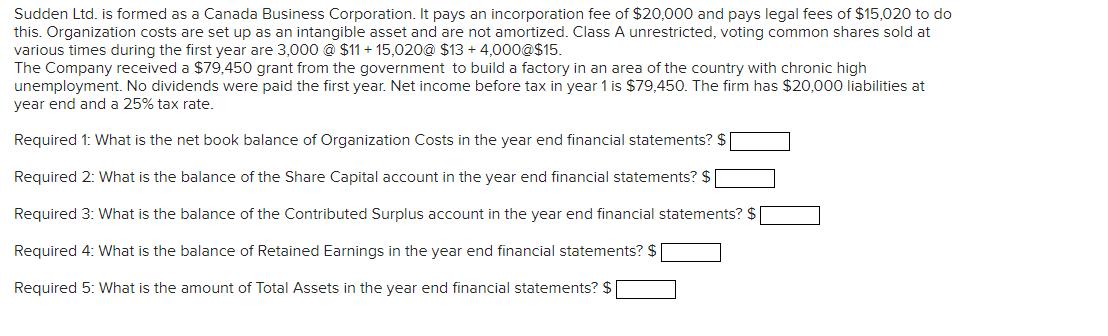

Sudden Ltd. is formed as a Canada Business Corporation. It pays an incorporation fee of $20,000 and pays legal fees of $15,020 to do this. Organization costs are set up as an intangible asset and are not amortized. Class A unrestricted, voting common shares sold at various times during the first year are 3,000 @ $11+ 15,020@ $13+ 4,000@$15. The Company received a $79,450 grant from the government to build a factory in an area of the country with chronic high unemployment. No dividends were paid the first year. Net income before tax in year 1 is $79,450. The firm has $20,000 liabilities at year end and a 25% tax rate. Required 1: What is the net book balance of Organization Costs in the year end financial statements? $ Required 2: What is the balance of the Share Capital account in the year end financial statements? $ Required 3: What is the balance of the Contributed Surplus account in the year end financial statements? $ Required 4: What is the balance of Retained Earnings in the year end financial statements? $ Required 5: What is the amount of Total Assets in the year end financial statements? $

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answers to Sudden Ltds Financial Statements 1 Net Book Balance of Organization Costs 34040 Organizat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started