Answered step by step

Verified Expert Solution

Question

1 Approved Answer

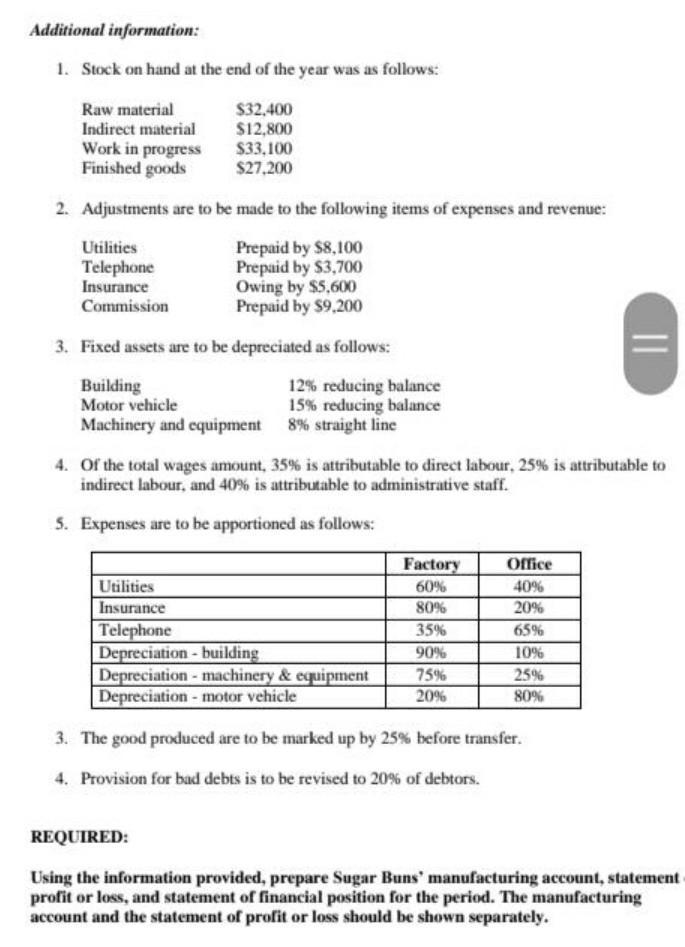

Additional information: 1. Stock on hand at the end of the year was as follows: Raw material $32,400 Indirect material $12,800 Work in progress

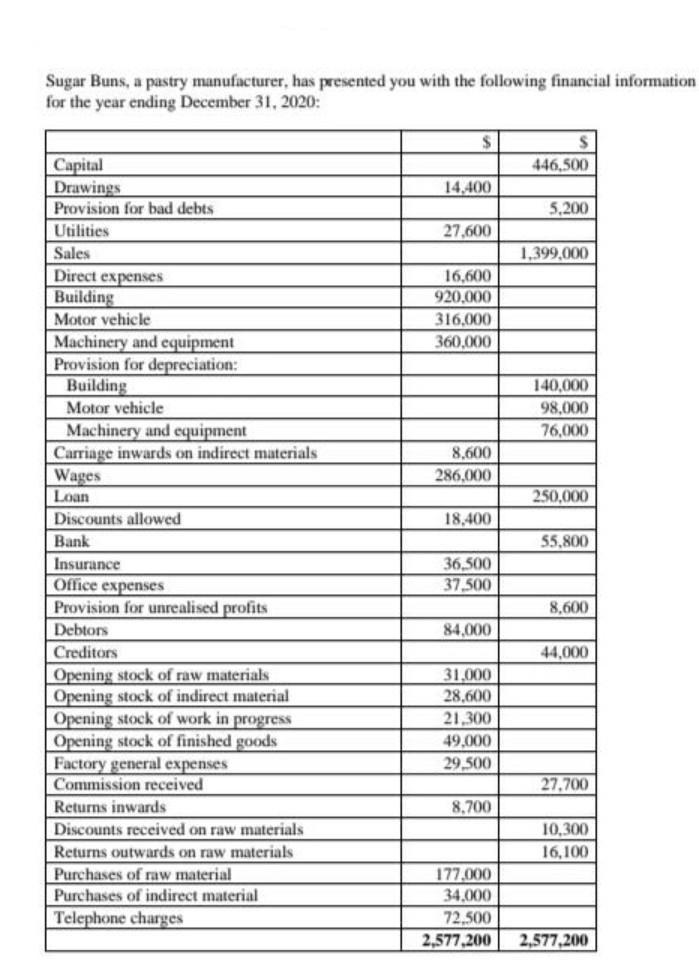

Additional information: 1. Stock on hand at the end of the year was as follows: Raw material $32,400 Indirect material $12,800 Work in progress $33,100 Finished goods $27,200 2. Adjustments are to be made to the following items of expenses and revenue: Prepaid by $8,100 Prepaid by $3,700 Utilities Telephone Insurance Commission Owing by $5,600 Prepaid by $9,200 3. Fixed assets are to be depreciated as follows: Building Motor vehicle Machinery and equipment 12% reducing balance 15% reducing balance 8% straight line 4. Of the total wages amount, 35% is attributable to direct labour, 25% is attributable to indirect labour, and 40% is attributable to administrative staff. 5. Expenses are to be apportioned as follows: Factory 60% 80% 35% 90% 75% 20% Office 40% 20% 65% 10% 25% 80% || Utilities Insurance Telephone Depreciation - building Depreciation - machinery & equipment Depreciation - motor vehicle 3. The good produced are to be marked up by 25% before transfer. 4. Provision for bad debts is to be revised to 20% of debtors. REQUIRED: Using the information provided, prepare Sugar Buns' manufacturing account, statement profit or loss, and statement of financial position for the period. The manufacturing account and the statement of profit or loss should be shown separately. Sugar Buns, a pastry manufacturer, has presented you with the following financial information for the year ending December 31, 2020: Capital Drawings Provision for bad debts Utilities Sales Direct expenses Building Motor vehicle Machinery and equipment Provision for depreciation: Building Motor vehicle Machinery and equipment Carriage inwards on indirect materials Wages Loan Discounts allowed Bank Insurance Office expenses Provision for unrealised profits Debtors Creditors Opening stock of raw materials Opening stock of indirect material Opening stock of work in progress Opening stock of finished goods Factory general expenses Commission received Returns inwards Discounts received on raw materials Returns outwards on raw materials chase f raw material Purchases of indirect material Telephone charges S 14,400 27,600 16,600 920,000 316,000 360,000 8,600 286,000 18,400 36,500 37.500 84,000 31,000 28,600 21,300 49,000 29,500 8,700 S 446,500 5,200 1,399,000 140,000 98,000 76,000 250,000 55,800 8,600 44,000 27.700 10,300 16,100 177,000 34,000 72,500 2,577,200 2,577,200

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To prepare the manufacturing account we need to calculate the cost of goods manufactured duri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started