Question

Sugar Skull Corporation uses no debt (it is unleveraged or unlevered). The weighted average cost of capital is 4.8 percent. If the current market

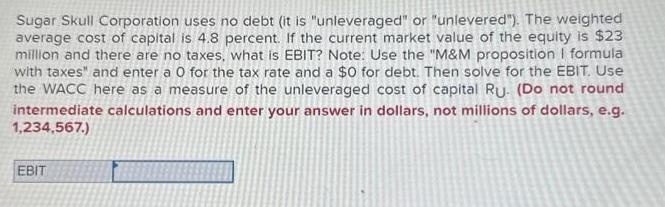

Sugar Skull Corporation uses no debt (it is "unleveraged" or "unlevered"). The weighted average cost of capital is 4.8 percent. If the current market value of the equity is $23 million and there are no taxes, what is EBIT? Note: Use the "M&M proposition I formula with taxes" and enter a 0 for the tax rate and a $0 for debt. Then solve for the EBIT. Use the WACC here as a measure of the unleveraged cost of capital Ru. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) EBIT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to calculate EBIT for Sugar Skull Corporation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F Brigham, Phillip R Daves

14th Edition

0357516664, 978-0357516669

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App