Answered step by step

Verified Expert Solution

Question

1 Approved Answer

suggestions Answer all questions 1. a) Explain the relationship between strike prices and implied volatilities under a price jump scenario. Total [5 Marks] b) How

suggestions

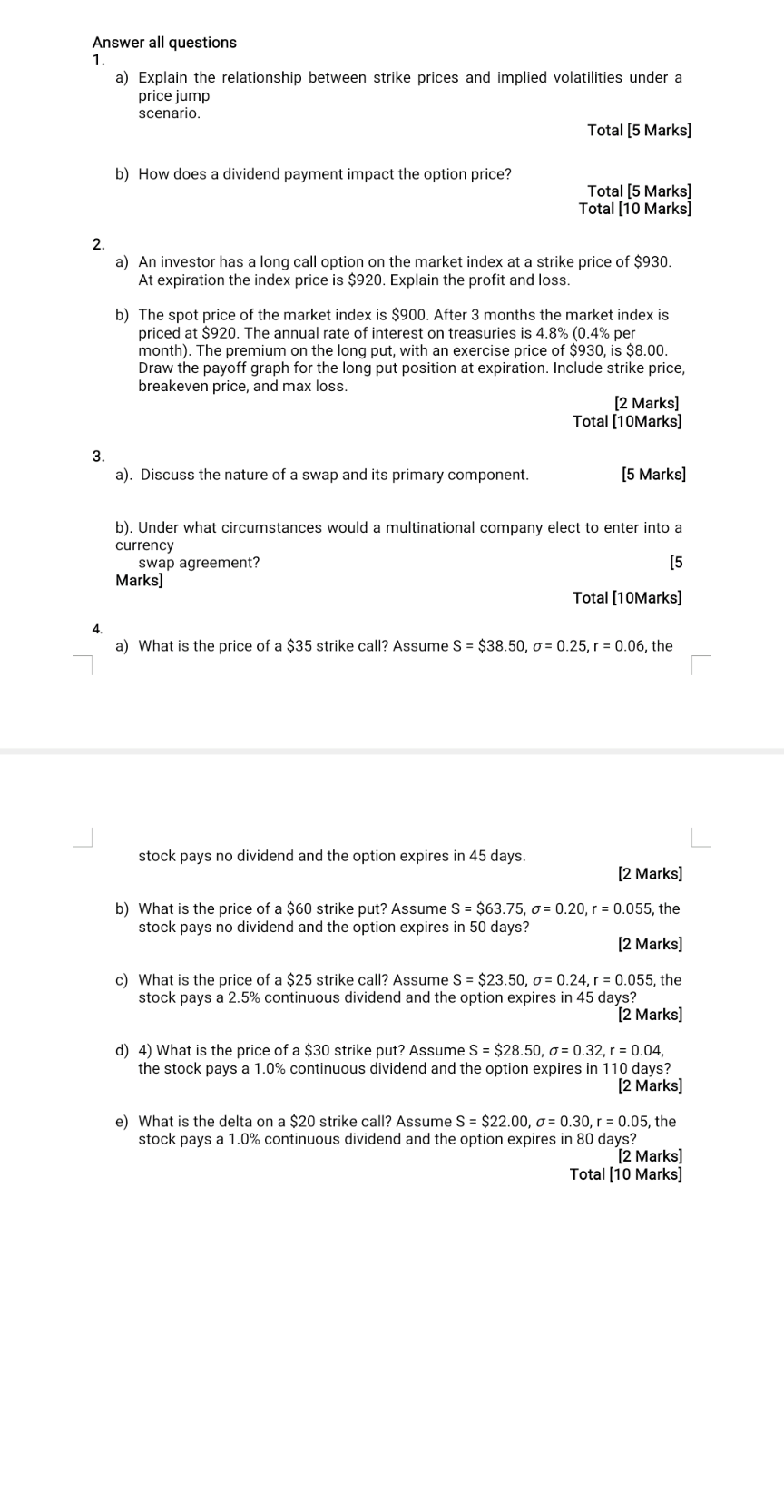

Answer all questions 1. a) Explain the relationship between strike prices and implied volatilities under a price jump scenario. Total [5 Marks] b) How does a dividend payment impact the option price? Total [5 Marks] Total [10 Marks] 2. a) An investor has a long call option on the market index at a strike price of $930. At expiration the index price is $920. Explain the profit and loss. b) The spot price of the market index is $900. After 3 months the market index is priced at $920. The annual rate of interest on treasuries is 4.8%(0.4% per month). The premium on the long put, with an exercise price of $930, is $8.00. Draw the payoff graph for the long put position at expiration. Include strike price, breakeven price, and max loss. 3. a). Discuss the nature of a swap and its primary component. [5 Marks] b). Under what circumstances would a multinational company elect to enter into a currency swap agreement? [5 Marks] Total [10Marks] 4. a) What is the price of a $35 strike call? Assume S=$38.50,=0.25,r=0.06, the stock pays no dividend and the option expires in 45 days. [2 Marks] b) What is the price of a $60 strike put? Assume S=$63.75,=0.20,r=0.055, the stock pays no dividend and the option expires in 50 days? [2 Marks] c) What is the price of a $25 strike call? Assume S=$23.50,=0.24,r=0.055, the stock pays a 2.5% continuous dividend and the option expires in 45 days? [2 Marks] d) 4) What is the price of a $30 strike put? Assume S=$28.50,=0.32,r=0.04, the stock pays a 1.0% continuous dividend and the option expires in 110 days? [2 Marks] e) What is the delta on a $20 strike call? Assume S=$22.00,=0.30,r=0.05, the stock pays a 1.0% continuous dividend and the option expires in 80 days? [2 Marks] Total [10 Marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started