Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sullivan ranch corporation has purchased a new tractor on Jan 1, year 1 paying 10% of the purchase price in cash and signing a 2

Sullivan ranch corporation has purchased a new tractor on Jan 1, year 1 paying 10% of the purchase price in cash and signing a 2 year note for the balance. The following information is given:

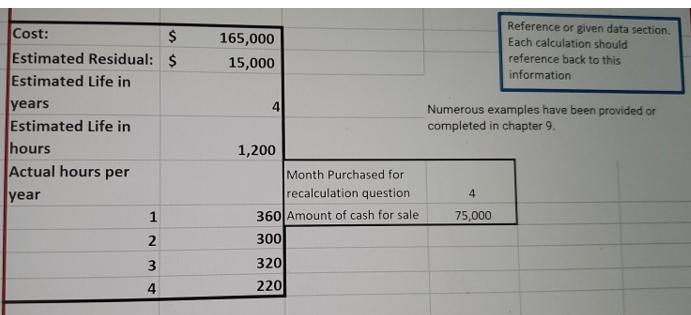

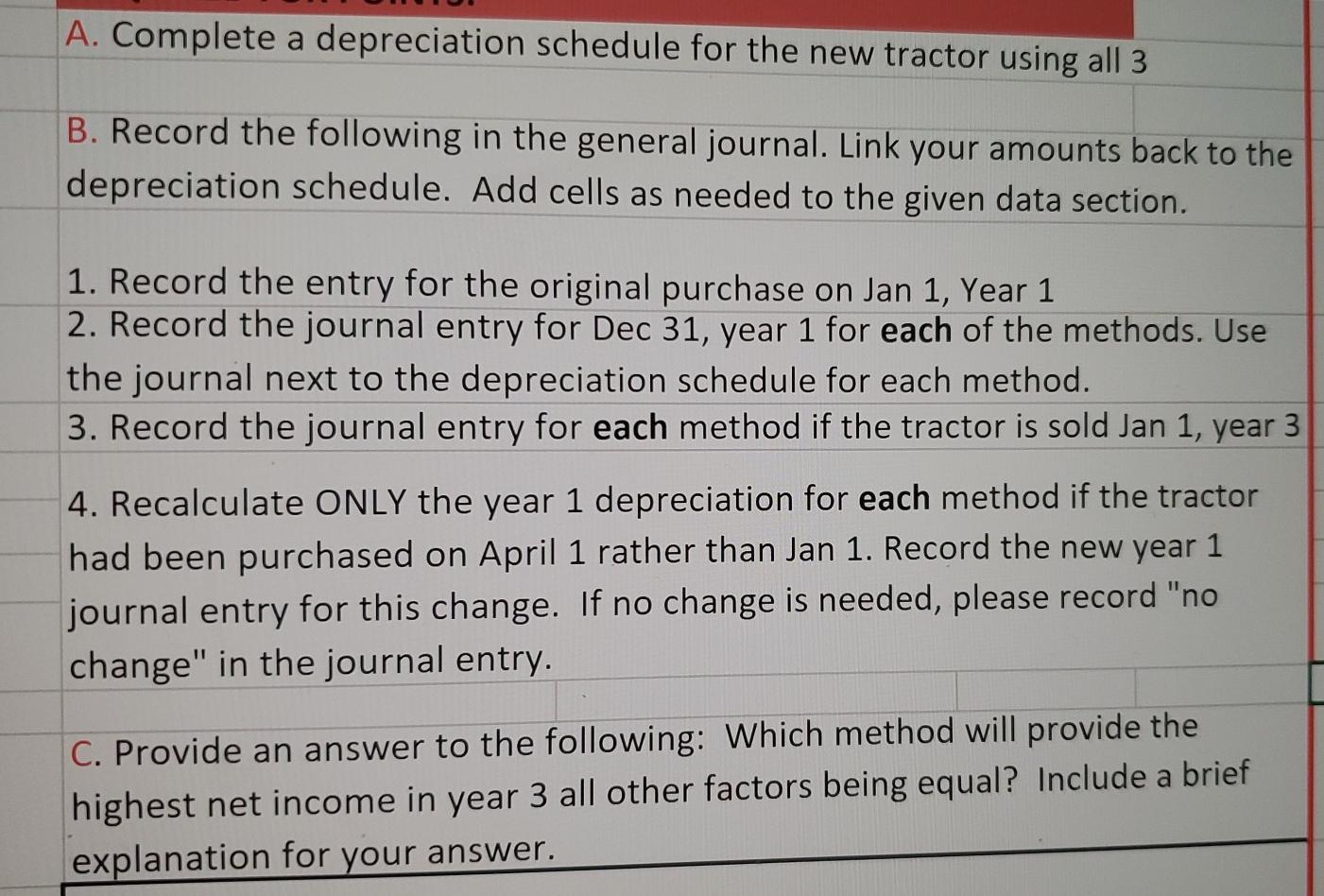

Cost: Estimated Residual: $ Estimated Life in years Estimated Life in hours Actual hours per year 1 2 3 4 165,000 15,000 4 1,200 Month Purchased for recalculation question 360 Amount of cash for sale 300 320 220 Reference or given data section. Each calculation should reference back to this information Numerous examples have been provided or completed in chapter 9. 4 75,000 A. Complete a depreciation schedule for the new tractor using all 3 B. Record the following in the general journal. Link your amounts back to the depreciation schedule. Add cells as needed to the given data section. 1. Record the entry for the original purchase on Jan 1, Year 1 2. Record the journal entry for Dec 31, year 1 for each of the methods. Use the journal next to the depreciation schedule for each method. 3. Record the journal entry for each method if the tractor is sold Jan 1, year 3 4. Recalculate ONLY the year 1 depreciation for each method if the tractor had been purchased on April 1 rather than Jan 1. Record the new year 1 journal entry for this change. If no change is needed, please record no change in the journal entry. C. Provide an answer to the following: Which method will provide the highest net income in year 3 all other factors being equal? Include a brief explanation for your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6361c5a392e9e_235985.pdf

180 KBs PDF File

6361c5a392e9e_235985.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started