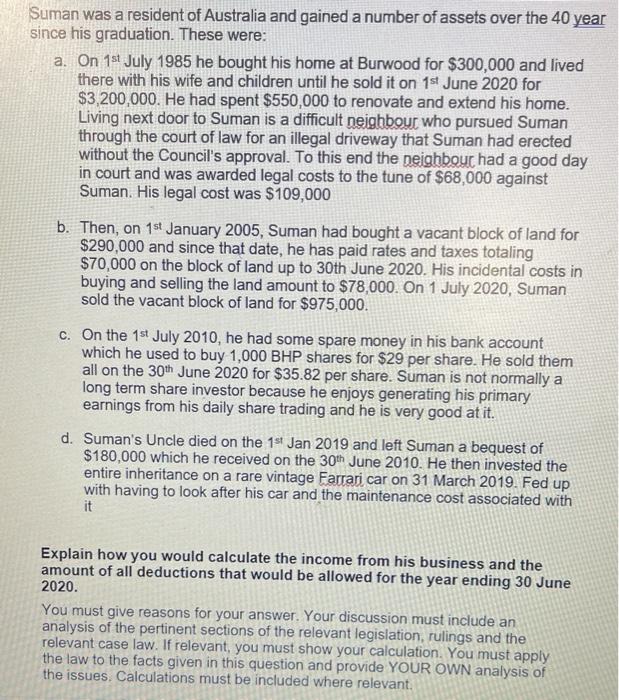

Suman was a resident of Australia and gained a number of assets over the 40 year since his graduation. These were: a. On 1st July 1985 he bought his home at Burwood for $300,000 and lived there with his wife and children until he sold it on 1st June 2020 for $3,200,000. He had spent $550,000 to renovate and extend his home. Living next door to Suman is a difficult neighbour who pursued Suman through the court of law for an illegal driveway that Suman had erected without the Council's approval. To this end the neighbour had a good day in court and was awarded legal costs to the tune of $68,000 against Suman. His legal cost was $109,000 b. Then, on 1st January 2005, Suman had bought a vacant block of land for $290,000 and since that date, he has paid rates and taxes totaling $70,000 on the block of land up to 30th June 2020. His incidental costs in buying and selling the land amount to $78,000. On 1 July 2020, Suman sold the vacant block of land for $975,000. c. On the 1st July 2010, he had some spare money in his bank account which he used to buy 1,000 BHP shares for $29 per share. He sold them all on the 30th June 2020 for $35.82 per share. Suman is not normally a long term share investor because he enjoys generating his primary earnings from his daily share trading and he is very good at it. d. Suman's Uncle died on the 1st Jan 2019 and left Suman a bequest of $180,000 which he received on the 30th June 2010. He then invested the entire inheritance on a rare vintage Farrari car on 31 March 2019. Fed up with having to look after his car and the maintenance cost associated with it Explain how you would calculate the income from his business and the amount of all deductions that would be allowed for the year ending 30 June 2020. You must give reasons for your answer. Your discussion must include an analysis of the pertinent sections of the relevant legislation, rulings and the relevant case law. If relevant, you must show your calculation. You must apply the law to the facts given in this question and provide YOUR OWN analysis of the issues. Calculations must be included where relevant