Answered step by step

Verified Expert Solution

Question

1 Approved Answer

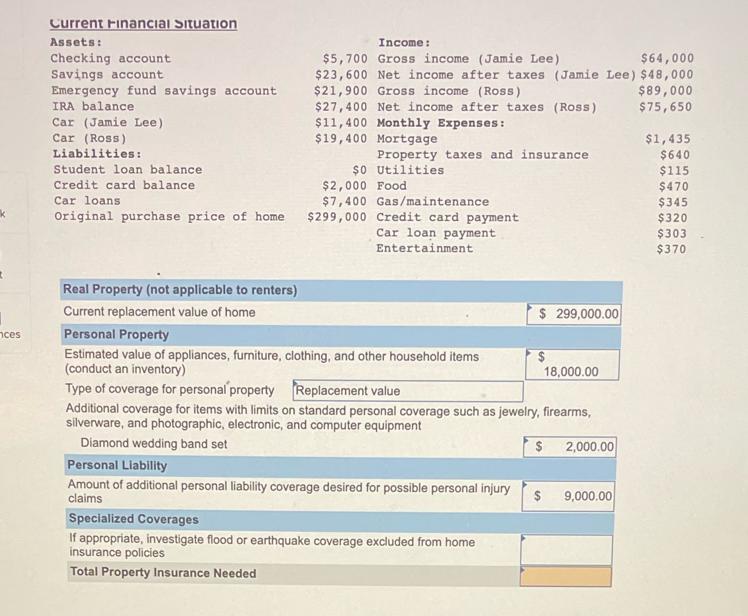

ces Current Financial Situation Assets: Checking account Savings account Emergency fund savings acc IRA balance. Car (Jamie Lee) Car (Ross) Liabilities: account Student loan

ces Current Financial Situation Assets: Checking account Savings account Emergency fund savings acc IRA balance. Car (Jamie Lee) Car (Ross) Liabilities: account Student loan balance Credit card balance Car loans Original purchase price of home Real Property (not applicable to renters) Current replacement value of home Income: $5,700 Gross income (Jamie Lee) $64,000 $23,600 Net income after taxes (Jamie Lee) $48,000 $21,900 Gross income (Ross) $89,000 $27,400 Net income after taxes (Ross) $75,650 $11,400 Monthly Expenses: $19,400 Mortgage Property taxes and insurance. $0 Utilities $2,000 Food $7,400 Gas/maintenance $299,000 Credit card payment Car loan payment Entertainment Personal Property Estimated value of appliances, furniture, clothing, and other household items (conduct an inventory) Personal Liability Amount of additional personal liability coverage desired for possible personal injury claims $ 299,000.00 Specialized Coverages If appropriate, investigate flood or earthquake coverage excluded from home insurance policies Total Property Insurance Needed $ Type of coverage for personal property Replacement value Additional coverage for items with limits on standard personal coverage such as jewelry, firearms, silverware, and photographic, electronic, and computer equipment Diamond wedding band set 18,000.00 $ 2,000.00 9,000.00 $1,435 $640 $115 $470 $345 $320 $303 $370 *

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Home Insurance The replacement value of the home is 299000 Total Home Insurance 299000 2 Per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started