Answered step by step

Verified Expert Solution

Question

1 Approved Answer

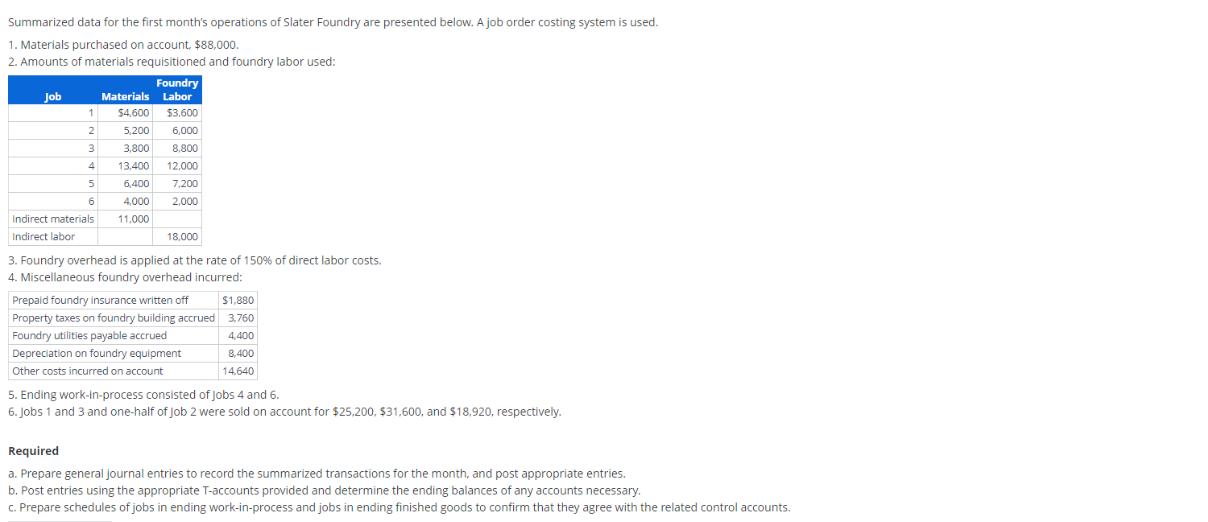

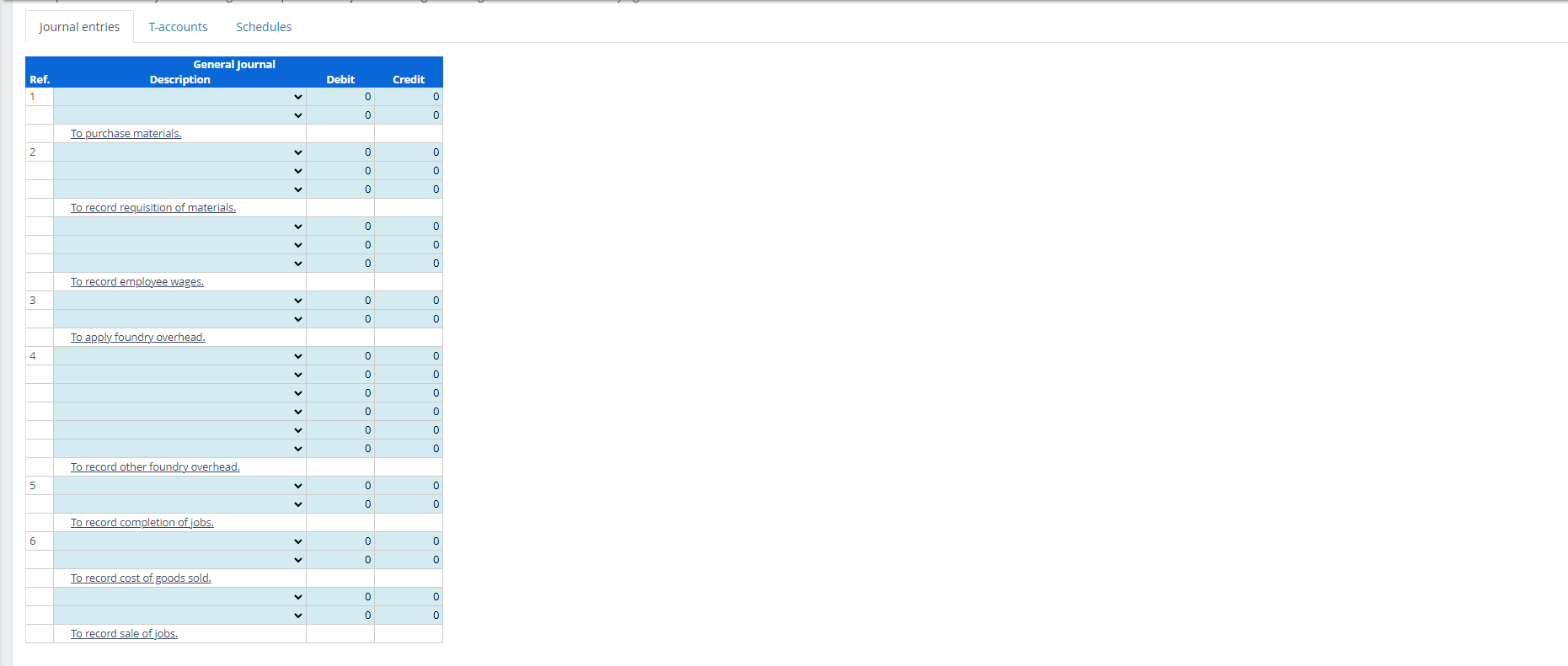

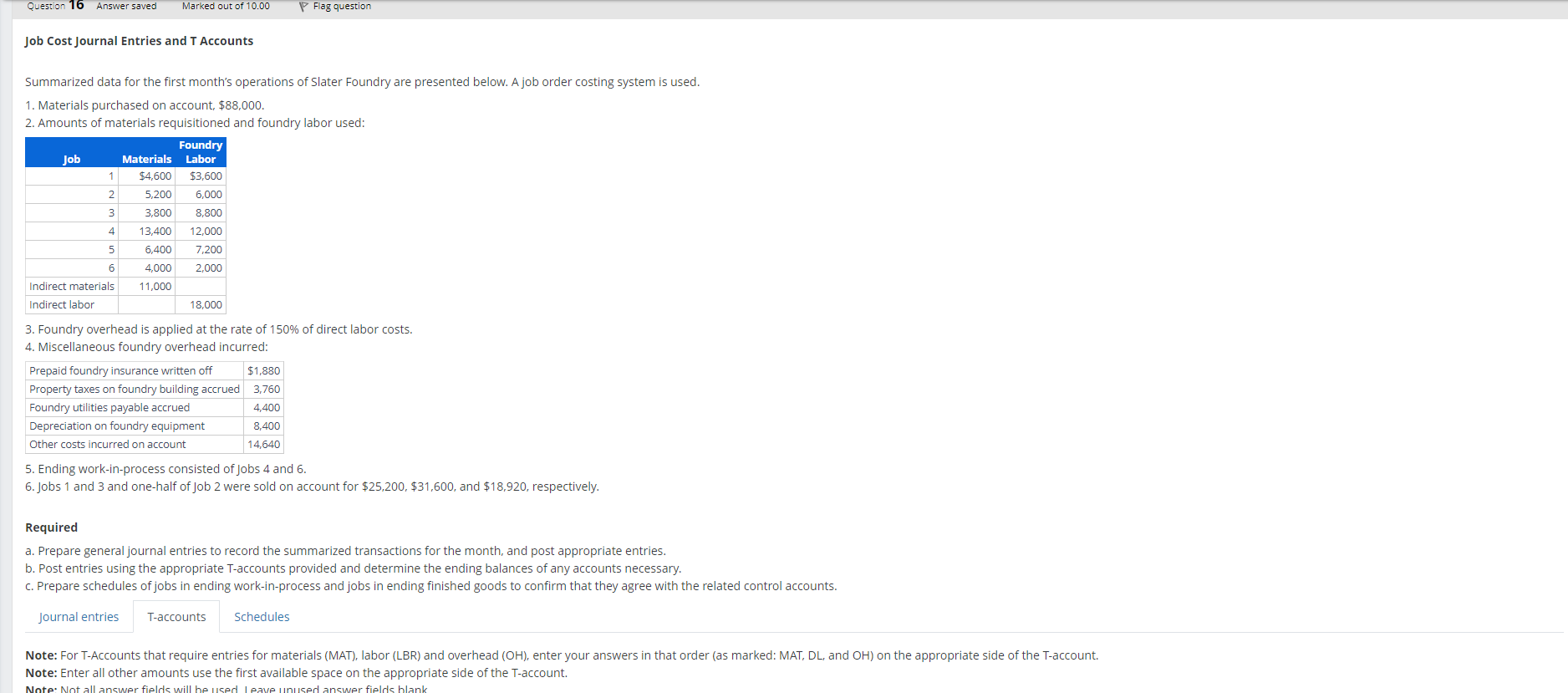

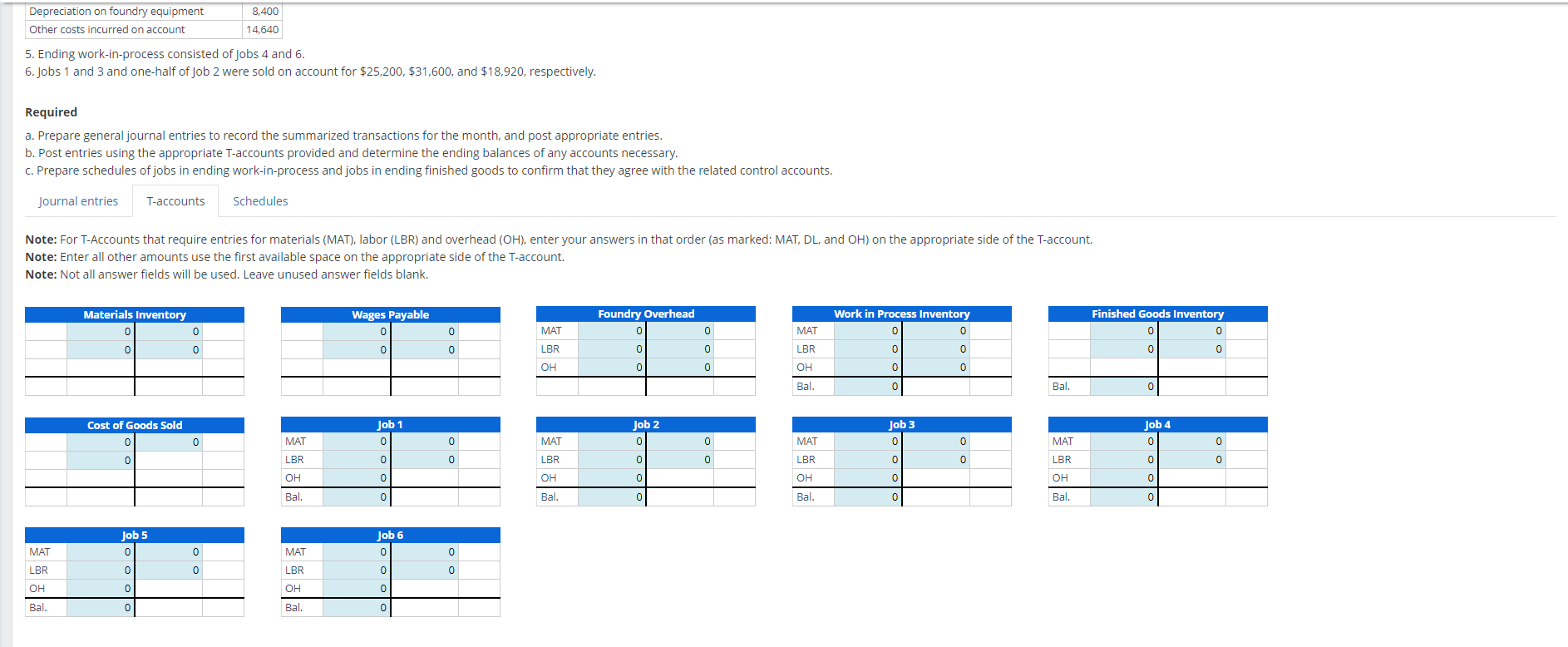

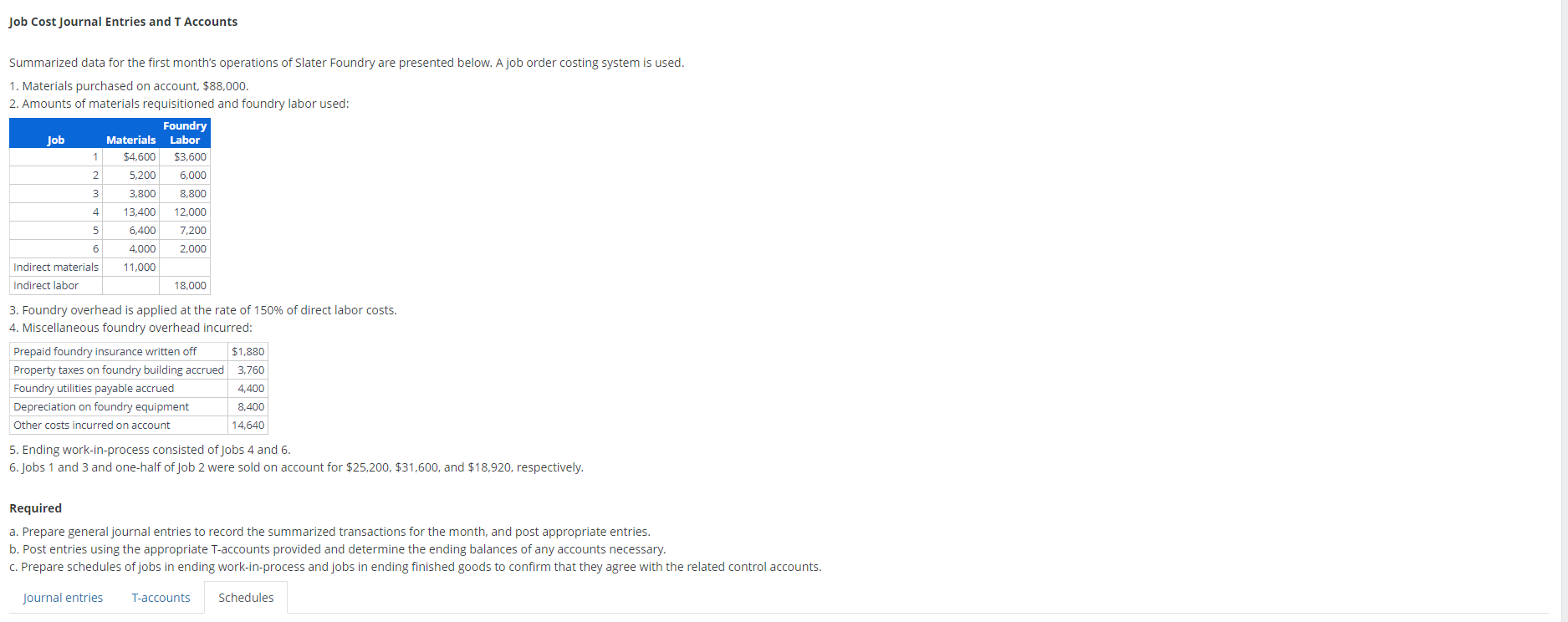

Summarized data for the first month's operations of Slater Foundry are presented below. A job order costing system is used. 1. Materials purchased on

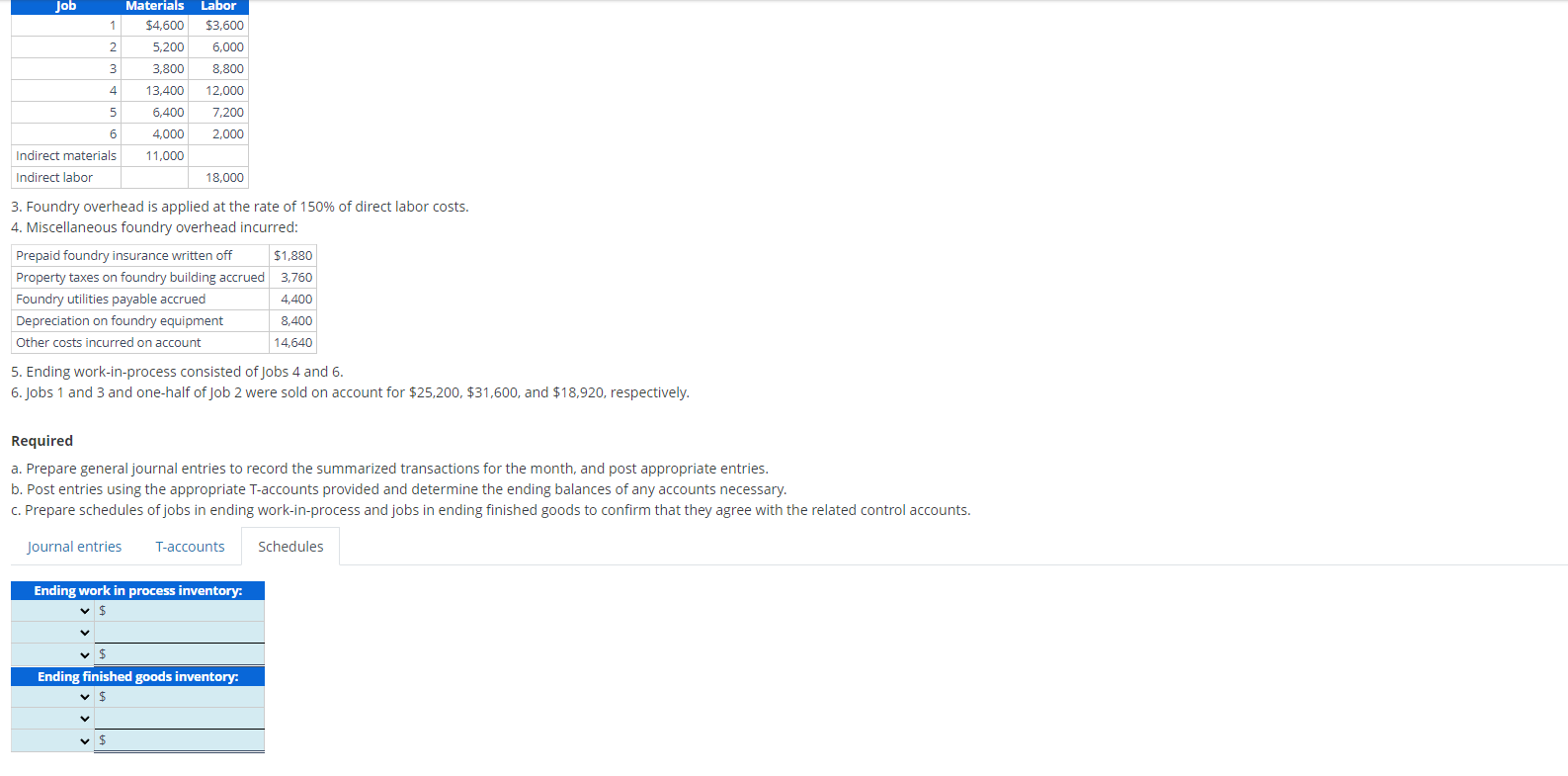

Summarized data for the first month's operations of Slater Foundry are presented below. A job order costing system is used. 1. Materials purchased on account, $88,000. 2. Amounts of materials requisitioned and foundry labor used: Foundry Materials Labor $4,600 $3,600 5,200 6,000 3,800 8,800 13,400 12,000 6,400 7,200 4,000 2,000 Indirect materials 11.000 Indirect labor Job 1 2 3 4 5 6 18,000 3. Foundry overhead is applied at the rate of 150% of direct labor costs. 4. Miscellaneous foundry overhead incurred: Prepaid foundry insurance written off Property taxes on foundry building accrued Foundry utilities payable accrued Depreciation on foundry equipment Other costs incurred on account $1,880 3,760 4,400 8,400 14,640 5. Ending work-in-process consisted of jobs 4 and 6. 6. Jobs 1 and 3 and one-half of job 2 were sold on account for $25,200, $31,600, and $18,920, respectively. Required a. Prepare general journal entries to record the summarized transactions for the month, and post appropriate entries. b. Post entries using the appropriate T-accounts provided and determine the ending balances of any accounts necessary. c. Prepare schedules of jobs in ending work-in-process and jobs in ending finished goods to confirm that they agree with the related control accounts. Ref. 1 2 3 4 5 Journal entries 6 T-accounts Schedules Description To purchase materials. General Journal To record requisition of materials. To record employee wages. To apply foundry overhead. To record other foundry overhead. To record completion of jobs. To record cost of goods sold. To record sale of jobs. Debit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Credit O O O 0 0 OOO 0 0 0 0 oooooo 0 0 o o 0 0 0 0 Question 16 Answer saved Job Cost Journal Entries and T Accounts Job Summarized data for the first month's operations of Slater Foundry are presented below. A job order costing system is used. 1. Materials purchased on account, $88,000. 2. Amounts of materials requisitioned and foundry labor used: 1 2 Marked out of 10.00 3 4 5 6 Foundry Materials Labor $4,600 $3,600 5,200 6,000 3,800 8,800 13,400 12,000 6,400 7,200 2,000 4,000 Indirect materials 11,000 Indirect labor 18,000 3. Foundry overhead is applied at the rate of 150% of direct labor costs. 4. Miscellaneous foundry overhead incurred: Prepaid foundry insurance written off Property taxes on foundry building accrued Foundry utilities payable accrued Depreciation on foundry equipment Other costs incurred on account Flag question $1,880 3,760 4,400 8,400 14,640 5. Ending work-in-process consisted of jobs 4 and 6. 6. Jobs 1 and 3 and one-half of Job 2 were sold on account for $25,200, $31,600, and $18,920, respectively. T-accounts Required a. Prepare general journal entries to record the summarized transactions for the month, and post appropriate entries. b. Post entries using the appropriate T-accounts provided and determine the ending balances of any accounts necessary. c. Prepare schedules of jobs in ending work-in-process and jobs in ending finished goods to confirm that they agree with the related control accounts. Journal entries Schedules Note: For T-Accounts that require entries for materials (MAT), labor (LBR) and overhead (OH), enter your answers in that order (as marked: MAT, DL, and OH) on the appropriate side of the T-account. Note: Enter all other amounts use the first available space on the appropriate side of the T-account. Note: Not all answer fields will be used. Leave unused answer fields blank Depreciation on foundry equipment Other costs incurred on account 5. Ending work-in-process consisted of Jobs 4 and 6. 6. Jobs 1 and 3 and one-half of Job 2 were sold on account for $25,200, $31,600, and $18,920, respectively. Required a. Prepare general journal entries to record the summarized transactions for the month, and post appropriate entries. b. Post entries using the appropriate T-accounts provided and determine the ending balances of any accounts necessary. c. Prepare schedules of jobs in ending work-in-process and jobs in ending finished goods to confirm that they agree with the related control accounts. Journal entries MAT LBR OH Bal. T-accounts Note: For T-Accounts that require entries for materials (MAT), labor (LBR) and overhead (OH), enter your answers in that order (as marked: MAT, DL, and OH) on the appropriate side of the T-account. Note: Enter all other amounts use the first available space on the appropriate side of the T-account. Note: Not all answer fields will be used. Leave unused answer fields blank. Materials Inventory 0 Cost of Goods Sold 0 0 Job 5 0 0 0 0 0 0 8,400 14,640 0 0 0 Schedules MAT LBR OH Bal. MAT LBR OH Bal. Wages Payable 0 0 Job 1 0 0 0 0 Job 6 0 0 0 0 0 0 0 0 0 0 MAT LBR OH MAT LBR OH Bal. Foundry Overhead 0 0 0 Job 2 0 0 0 0 0 0 0 0 0 MAT LBR OH Bal. MAT LBR OH Bal. Work in Process Inventory 0 0 0 0 Job 3 0 0 0 0 0 0 0 0 0 Bal. MAT LBR OH Bal. Finished Goods Inventory 0 0 0 Job 4 0 0 0 0 0 0 0 0 Job Cost Journal Entries and T Accounts Summarized data for the first month's operations of Slater Foundry are presented below. A job order costing system is used. 1. Materials purchased on account, $88,000. 2. Amounts of materials requisitioned and foundry labor used: Job 1 2 3 4 5 6 Foundry Materials Labor $4,600 $3,600 5,200 6,000 3,800 8,800 13,400 12,000 6,400 7,200 4,000 2,000 Indirect materials 11,000 Indirect labor 18,000 3. Foundry overhead is applied at the rate of 150% of direct labor costs. 4. Miscellaneous foundry overhead incurred: Prepaid foundry insurance written off Property taxes on foundry building accrued Foundry utilities payable accrued Depreciation on foundry equipment Other costs incurred on account $1,880 3,760 4,400 8,400 14,640 5. Ending work-in-process consisted of Jobs 4 and 6. 6. Jobs 1 and 3 and one-half of Job 2 were sold on account for $25,200, $31,600, and $18,920, respectively. Required a. Prepare general journal entries to record the summarized transactions for the month, and post appropriate entries. b. Post entries using the appropriate T-accounts provided and determine the ending balances of any accounts necessary. c. Prepare schedules of jobs in ending work-in-process and jobs in ending finished goods to confirm that they agree with the related control accounts. Journal entries T-accounts Schedules Job 1 2 3 4 5 6 Materials Labor $4,600 $3,600 5,200 6,000 3,800 8,800 13,400 12,000 6,400 7,200 2,000 4,000 Indirect materials 11,000 Indirect labor 18,000 3. Foundry overhead is applied at the rate of 150% of direct labor costs. 4. Miscellaneous foundry overhead incurred: Prepaid foundry insurance written off Property taxes on foundry building accrued Foundry utilities payable accrued Depreciation on foundry equipment Other costs incurred on account 5. Ending work-in-process consisted of Jobs 4 and 6. 6. Jobs 1 and 3 and one-half of Job 2 were sold on account for $25,200, $31,600, and $18,920, respectively. Required a. Prepare general journal entries to record the summarized transactions for the month, and post appropriate entries. b. Post entries using the appropriate T-accounts provided and determine the ending balances of any accounts necessary. c. Prepare schedules of jobs in ending work-in-process and jobs in ending finished goods to confirm that they agree with the related control accounts. Journal entries $ T-accounts Ending work in process inventory: $ $1,880 3,760 4,400 8,400 14,640 $ Ending finished goods inventory: $ Schedules

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Materials purchased on account 88000 Materials Inventory 1 88000 Accounts Payable 88000 b Amounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started