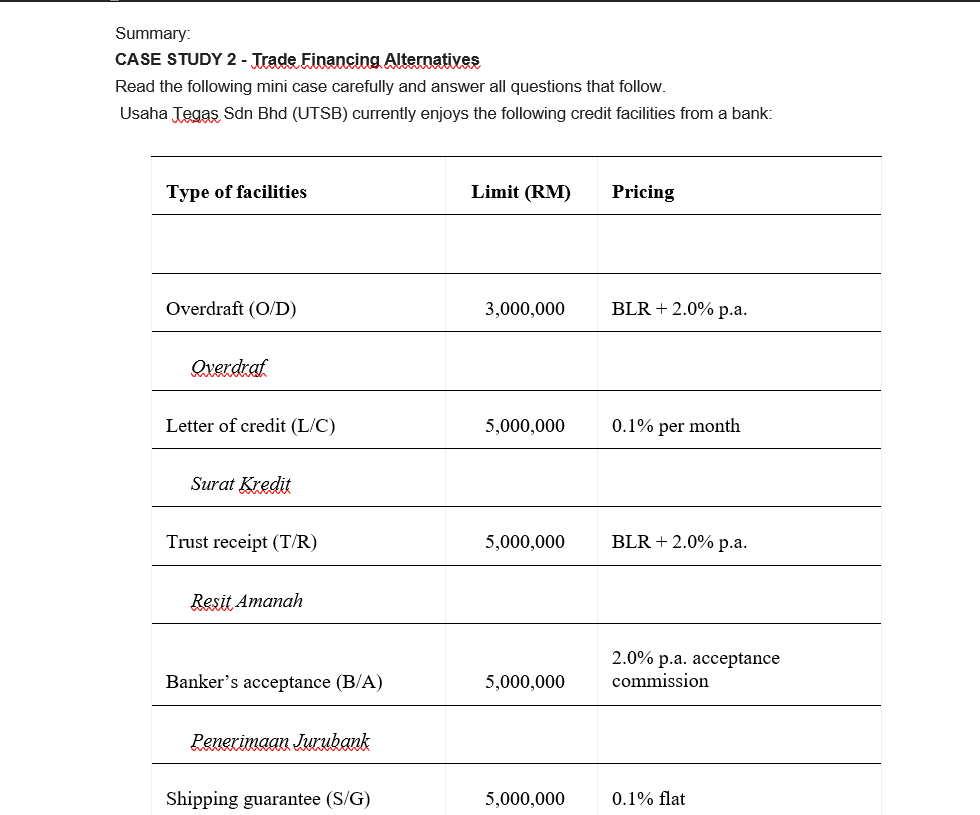

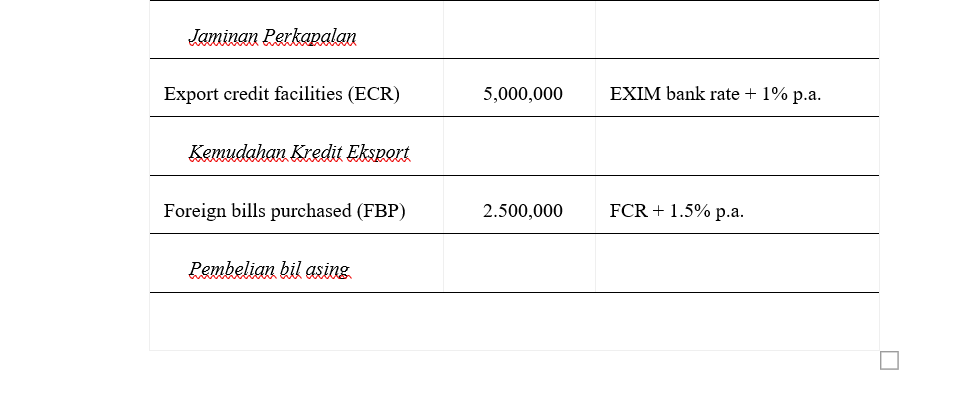

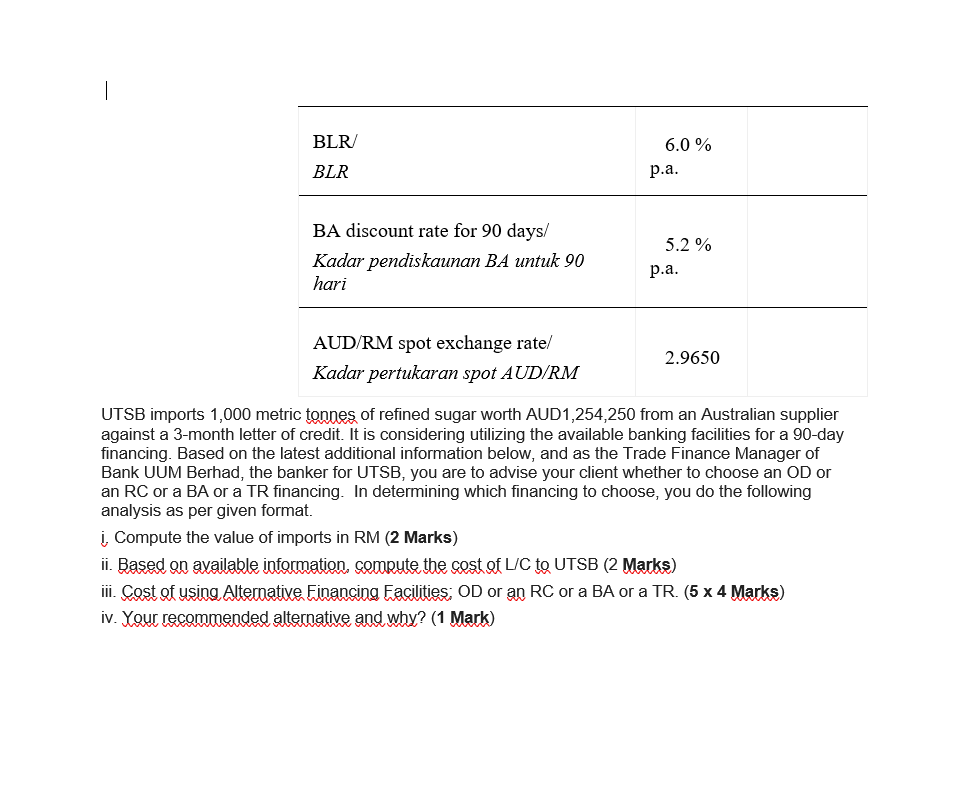

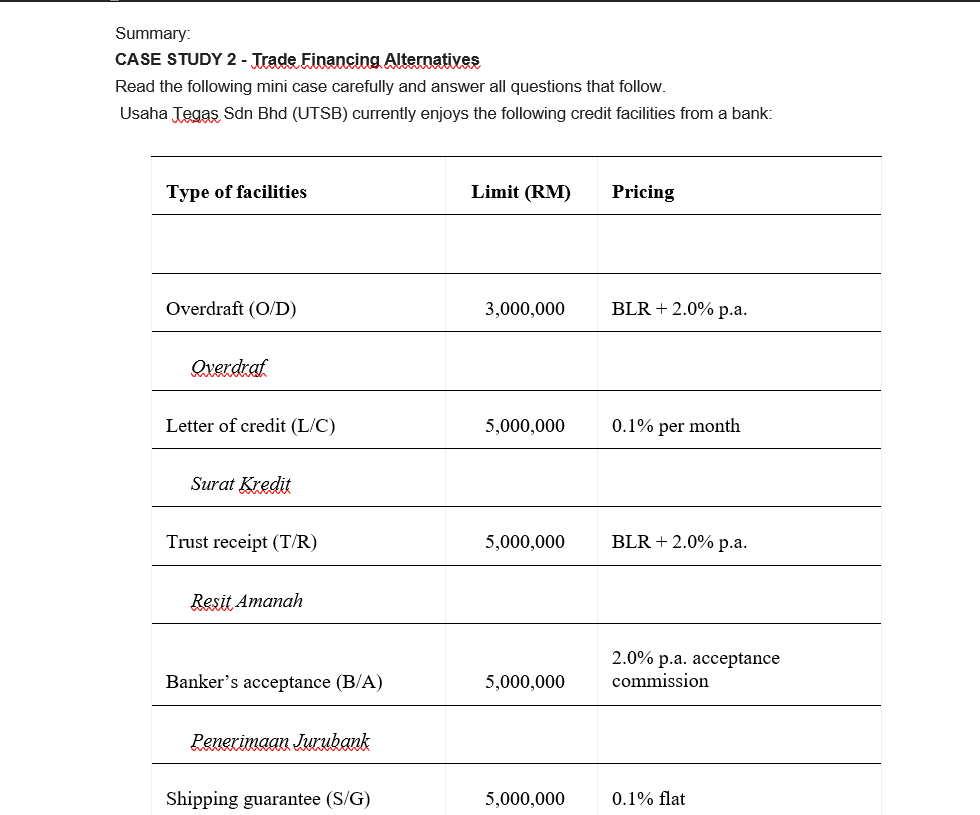

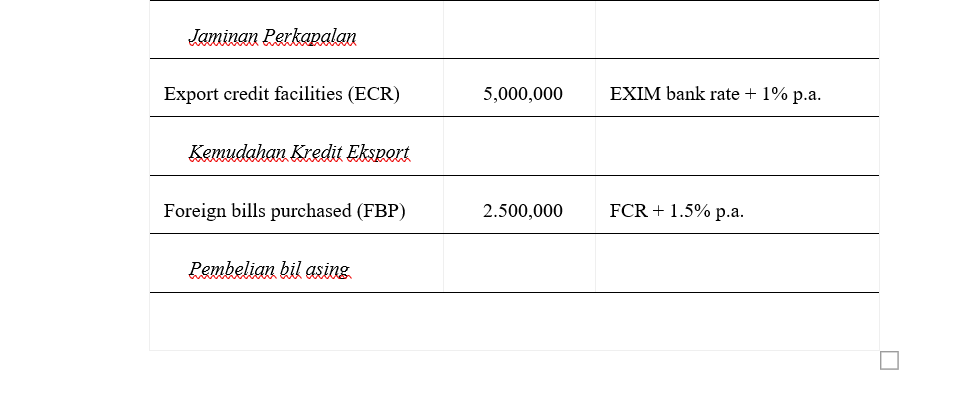

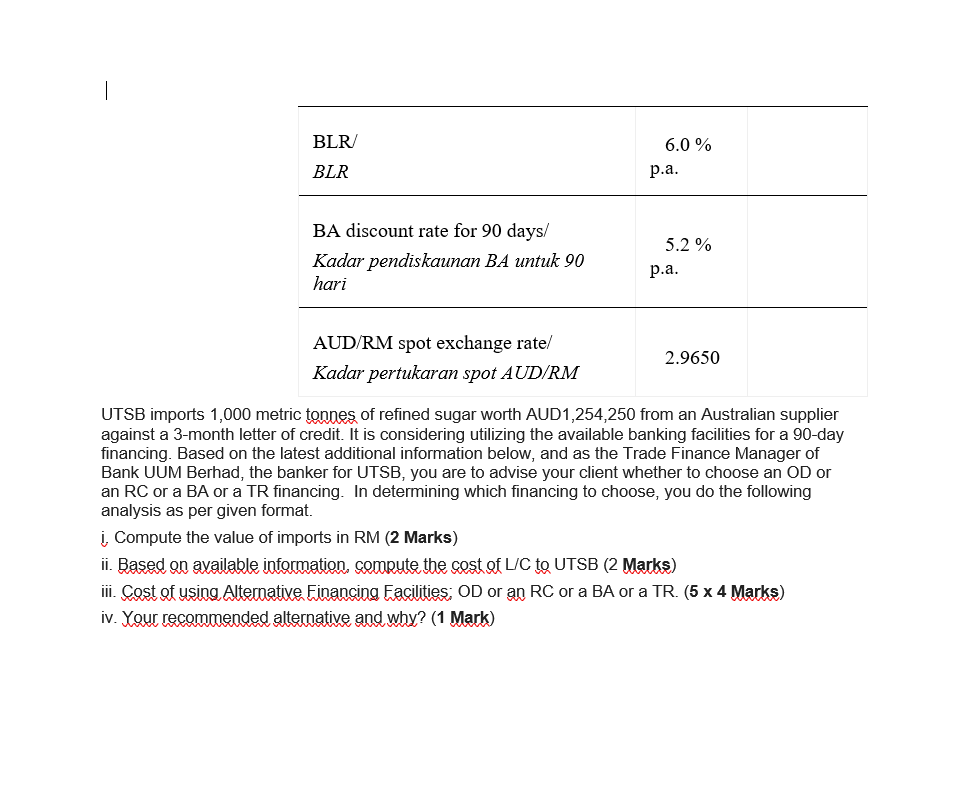

Summary CASE STUDY 2 - Trade Financing Alternatives Read the following mini case carefully and answer all questions that follow. Usaha Tegas Sdn Bhd (UTSB) currently enjoys the following credit facilities from a bank: Type of facilities Limit (RM) Pricing Overdraft (O/D) 3,000,000 BLR + 2.0% p.a. Overdraf Letter of credit (L/C) 5,000,000 0.1% per month Surat Kredit Trust receipt (T/R) 5,000,000 BLR + 2.0% p.a. Resit Amanah 2.0% p.a. acceptance commission Banker's acceptance (B/A) 5,000,000 Penerimaan Jurubank Shipping guarantee (S/G) 5,000,000 0.1% flat Jaminan Perkapalan Export credit facilities (ECR) 5,000,000 EXIM bank rate + 1% p.a. Kemudahan Kredit Eksport Foreign bills purchased (FBP) 2.500,000 FCR + 1.5% p.a. Pembelian bil asing BLR 6.0 % p.a. BLR BA discount rate for 90 days/ Kadar pendiskaunan BA untuk 90 hari 5.2 % p.a. AUD/RM spot exchange rate/ Kadar pertukaran spot AUD/RM 2.9650 UTSB imports 1,000 metric tonnes of refined sugar worth AUD1,254,250 from an Australian supplier against a 3-month letter of credit. It is considering utilizing the available banking facilities for a 90-day financing. Based on the latest additional information below, and as the Trade Finance Manager of Bank UUM Berhad, the banker for UTSB, you are to advise your client whether to choose an OD or an RC or a BA or a TR financing. In determining which financing to choose, you do the following analysis as per given format. i Compute the value of imports in RM (2 Marks) ii. Based on available information, compute the cost of L/C to UTSB (2 Marks) iii. Cost of using Alternative Financing Facilities, OD or an RC or a BA or a TR. (5 x 4 Marks) iv. Your recommended alternative and why? (1 Mark) Summary CASE STUDY 2 - Trade Financing Alternatives Read the following mini case carefully and answer all questions that follow. Usaha Tegas Sdn Bhd (UTSB) currently enjoys the following credit facilities from a bank: Type of facilities Limit (RM) Pricing Overdraft (O/D) 3,000,000 BLR + 2.0% p.a. Overdraf Letter of credit (L/C) 5,000,000 0.1% per month Surat Kredit Trust receipt (T/R) 5,000,000 BLR + 2.0% p.a. Resit Amanah 2.0% p.a. acceptance commission Banker's acceptance (B/A) 5,000,000 Penerimaan Jurubank Shipping guarantee (S/G) 5,000,000 0.1% flat Jaminan Perkapalan Export credit facilities (ECR) 5,000,000 EXIM bank rate + 1% p.a. Kemudahan Kredit Eksport Foreign bills purchased (FBP) 2.500,000 FCR + 1.5% p.a. Pembelian bil asing BLR 6.0 % p.a. BLR BA discount rate for 90 days/ Kadar pendiskaunan BA untuk 90 hari 5.2 % p.a. AUD/RM spot exchange rate/ Kadar pertukaran spot AUD/RM 2.9650 UTSB imports 1,000 metric tonnes of refined sugar worth AUD1,254,250 from an Australian supplier against a 3-month letter of credit. It is considering utilizing the available banking facilities for a 90-day financing. Based on the latest additional information below, and as the Trade Finance Manager of Bank UUM Berhad, the banker for UTSB, you are to advise your client whether to choose an OD or an RC or a BA or a TR financing. In determining which financing to choose, you do the following analysis as per given format. i Compute the value of imports in RM (2 Marks) ii. Based on available information, compute the cost of L/C to UTSB (2 Marks) iii. Cost of using Alternative Financing Facilities, OD or an RC or a BA or a TR. (5 x 4 Marks) iv. Your recommended alternative and why? (1 Mark)