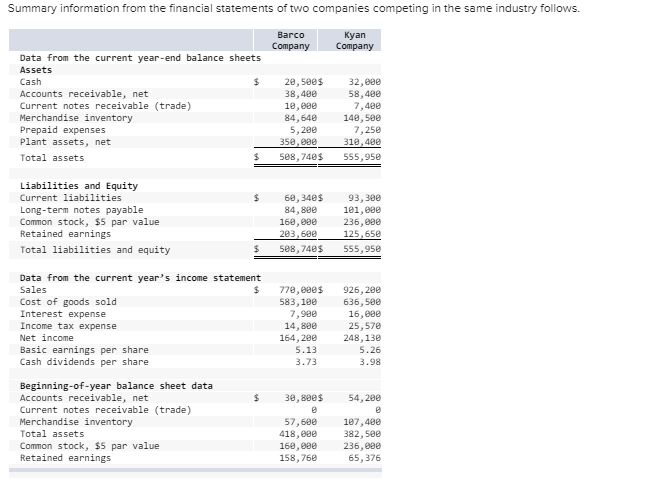

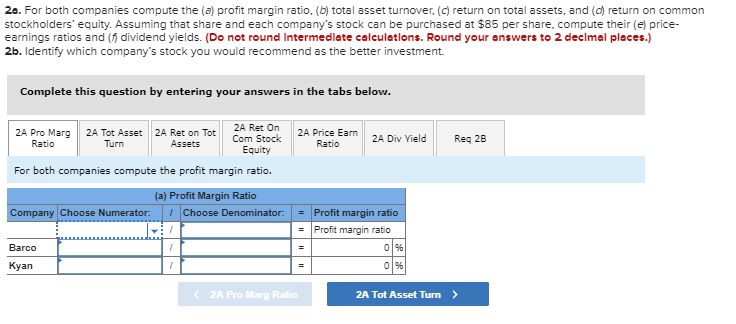

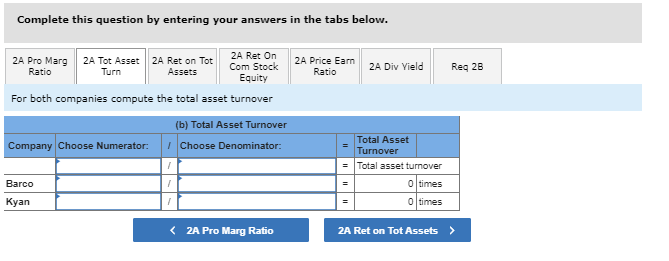

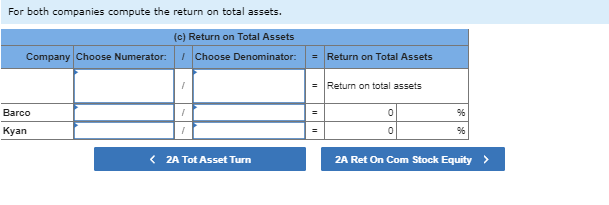

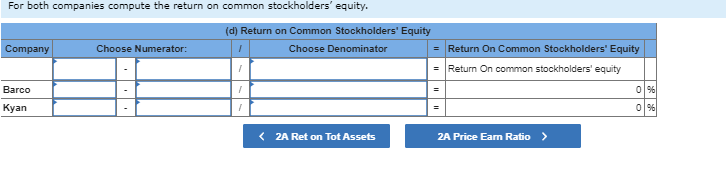

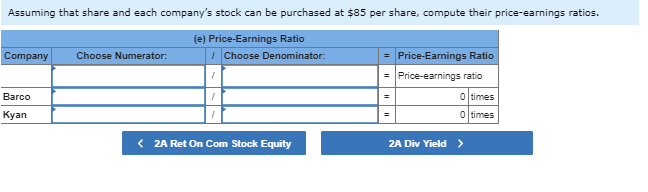

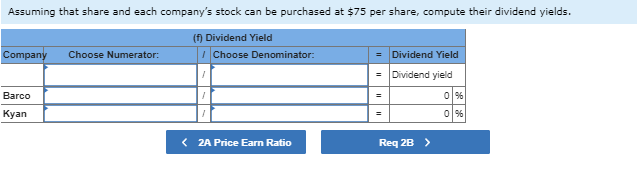

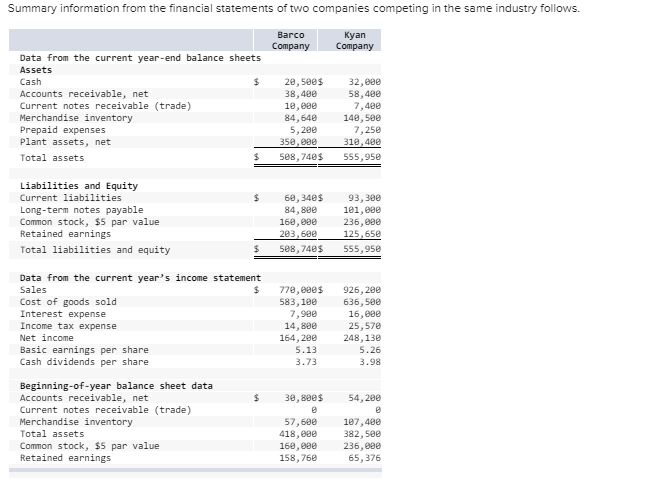

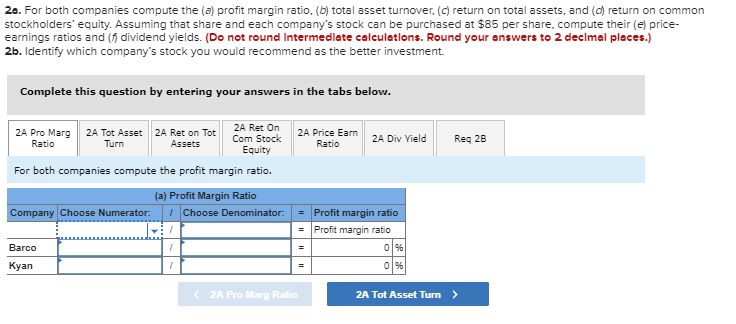

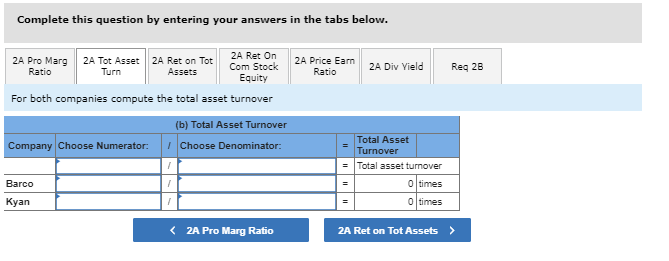

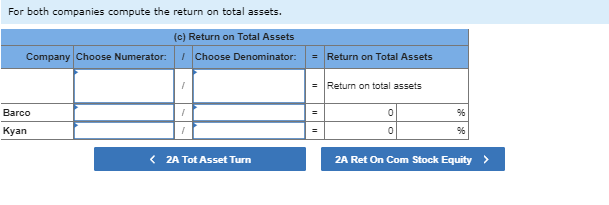

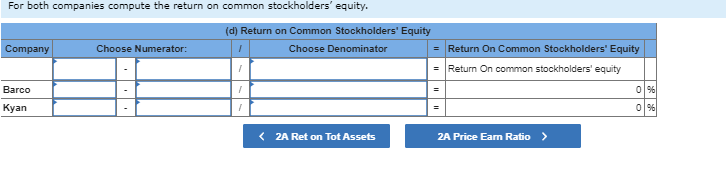

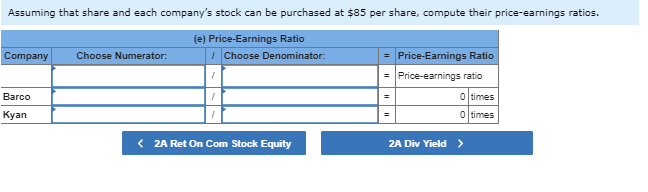

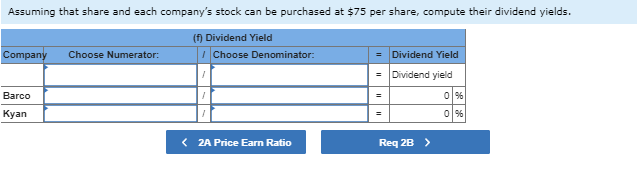

Summary information from the financial statements of two companies competing in the same industry follows. Kyan Company Company Data from the current Assets Cash Accounts receivable, net Current notes receivable (trade) Merchandise inventory Prepaid expenses Plant assets, net Total assets year-end balance sheets 28,58es 38,488 18,88e 84,648 5,28e 358,88e 32,88e 58,48e 7,488 148, 58e 7,25e $ 588,748 555,95e Liabilities and Equity Current liabilities Long-term notes payab Common stock, $5 par value Retained earnings 93,38e 1e1,eae 236,880 125,658 $ 588,748 555,95e 68, 3485 84,88e 168,e8e 283, 688 le Total liabilities and equity Data from the current year's income statement Sales Cost of goods sold Interest expense Income tax expense Net income Basic earnings per share Cash dividends per share $ 77, 583,188 7,98e 14,888 164,288 5.13 3.73 926,28e 636,58e 16,888 25,57e 248,13e 5.26 3.98 Beginning-of-year balance sheet data Accounts receivable, net Current notes receivable (trade) Merchandise inventory Total assets Common stock, $5 par value Retained earnings 38,88e 54,288 57,688 418,888 168,e8e 158,76e 382,58e 236,880 65, 376 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (c) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $85 per share, compute their (e) price- earnings ratios anddividend yields. (D not r und Intermediate calculations. Round your answers t 2 decimal places.) 2b. ldentify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below 2A Pro Marg 2A Tot Asset 2A Ret on Tot Turn 2A Ret On 2A Price Eam 2A Div Vield Com Stock Req 2B Ratio Assets Ratio Equity For both companies compute the profit margin ratio. ) Profit Margin Ratio - Profit margin ratio Barco 01% Kyan 01% 2A Pro Marg Ratio 2A Tot Asset Turn> Complete this question by entering your answers in the tabs below. 2A Ret On 2A Price Eam 2A Div Vield Ratio 2A Pro Marg 2A Tot Asset 2A Ret on Tot 2 Com Stock Equity Req 28 Ratio Turn Assets For both companies compute the total asset turnover (b) Total Asset Turnover Total Asset Turnover Total asset turnover Company Choose Numerato Choose Denominator Barco 0 times 0 times Kyan 2A Pro Marg Ratio 2A Ret on Tot Assets> For both companies compute the return on total assets. (c) Return on Total Assets Company Choose Numerator: Choose Denominator: Return on Total Assets Return on total assets Barco Kyan For both companies compute the return on common stockholders' equity. (d) Return on Common Stockholders' Equity Company Choose Numerator Choose Denominator - Return On Common Stockholders' Equity Return On common stockholders' equity Barco Kyan