Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER FMA400 FINANCIAL MANAGEMENT IV Question 3 [10] You are the accountant of Isilumko (Pty) Ltd. The operating director wants

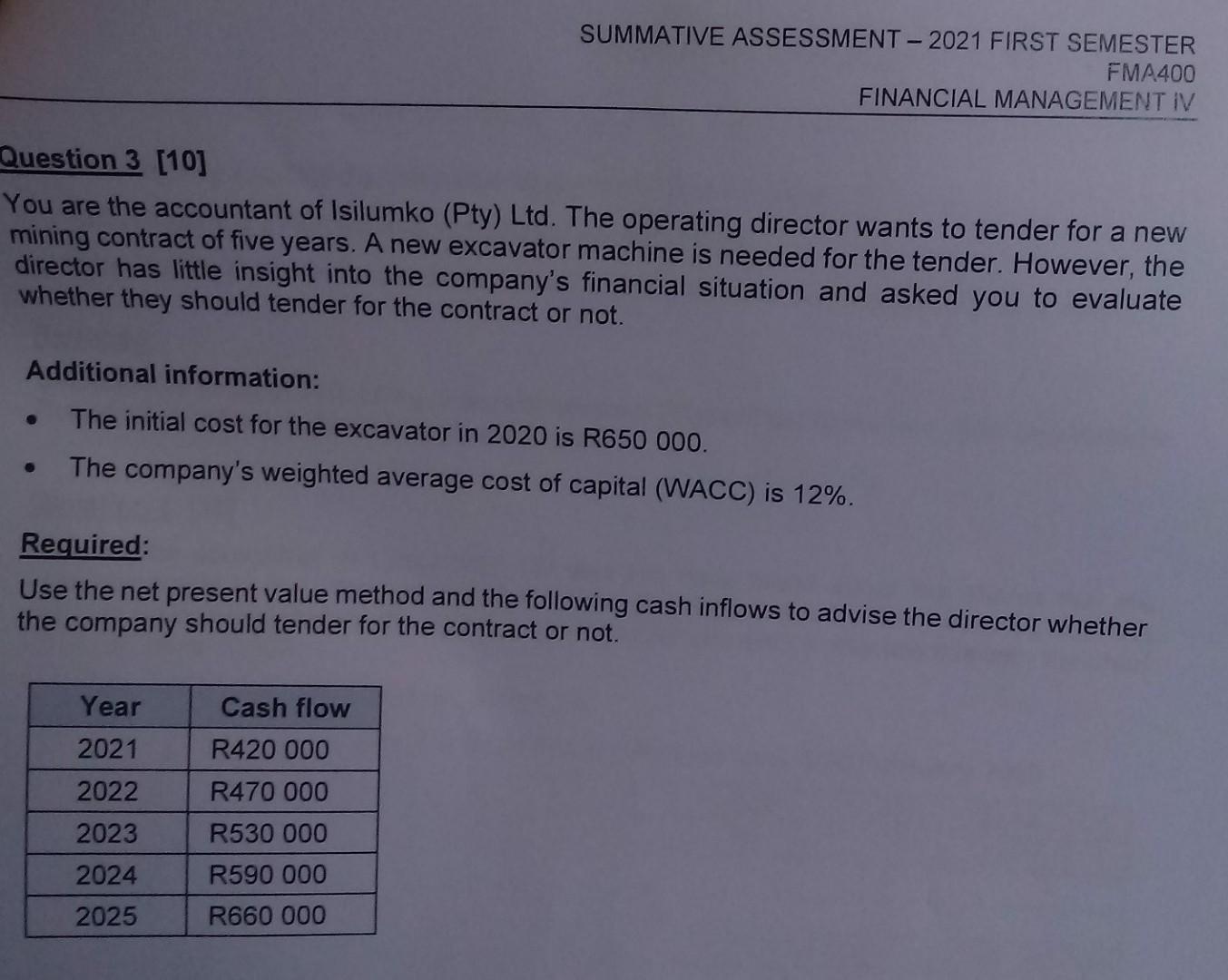

SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER FMA400 FINANCIAL MANAGEMENT IV Question 3 [10] You are the accountant of Isilumko (Pty) Ltd. The operating director wants to tender for a new mining contract of five years. A new excavator machine is needed for the tender. However, the director has little insight into the company's financial situation and asked you to evaluate whether they should tender for the contract or not. Additional information: The initial cost for the excavator in 2020 is R650 000. The company's weighted average cost of capital (WACC) is 12%. Required: Use the net present value method and the following cash inflows to advise the director whether the company should tender for the contract or not. Year Cash flow 2021 R420 000 2022 R470 000 2023 R530 000 2024 R590 000 2025 R660 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started